Speak directly to the analyst to clarify any post sales queries you may have.

EUROPE GENERATOR RENTAL MARKET INSIGHTS

- Several factors, such as increasing demand for temporary power solutions, events, and construction activities, have driven the demand for generators in the region. The market caters to a diverse range of applications, including but not limited to construction sites, events, utilities, manufacturing, and emergency backup power.

- Technological advancements in the market have further driven the market in the region. In addition, market players are focusing on investing in modern generator fleets that offer improved efficiency, reduced emissions, and advanced monitoring capabilities to meet stringent environmental regulations.

- There are several emerging trends, including the increasing adoption of hybrid and solar-powered generators reflecting a broader industry shift toward more sustainable and eco-friendly solutions. In addition, market players aim to offer comprehensive power solutions consisting of ancillary services such as fuel management, equipment maintenance, and 24/7 technical support.

- Based on the power rating, the < 75KVA market is growing at a CAGR of 5.34% during the forecast period. Generators with a capacity of less than 75KVA are versatile and well-suited for small-scale applications. They are commonly used for events, residential backup power, and smaller construction projects across Europe, providing a reliable power source for modest energy demands. Small generators in this segment are generally cost-effective to rent, making them an economical choice for users with limited budget considerations.

- Based on application, the continuous power market is showing prominent growth. Constant power generators are often deployed in industrial settings where a reliable and uninterrupted power supply is essential for continuous manufacturing. Telecommunication infrastructure relies on continuous power to maintain network connectivity. Generators are designed for continuous power supply in the oil and gas industry, where continuous power is critical for drilling operations, refineries, and extraction processes.

- The IT & data centers market segment is growing significantly, with a CAGR of 5.05% during the forecast period. Data centers require uninterrupted power to maintain the operation of servers and prevent data loss. Generator rentals provide emergency backup power, ensuring continuous data center functionality during grid outages. Emergency backup power from generator rentals safeguards data storage facilities within data centers. This is essential for preventing data corruption and ensuring the integrity of stored information during power disruptions.

- France and Italy are showing prominent growth in the market. In France, many companies invest in backup power solutions, including emergency generators, to ensure uninterrupted operations during emergencies. The French government has advised businesses to ensure their backup power generators are in working order, highlighting the critical role of load banks in meeting government recommendations. Italy faces severe energy challenges due to extreme weather conditions such as heavy snowfall, freezing temperatures, avalanches, and scorching temperatures. These conditions can disrupt electricity networks and power generators, leaving thousands without access to power.

- The Europe generator rental market's competitive scenario is intensifying, with global and domestic players offering diverse products. A few major players dominate the market in terms of market share. Some companies currently dominating the market are Aggreko, Ashtead Group, Atlas Copco, Caterpillar, Cummins, Kohler, Speedy, Himoinsa, United Rentals, and Loxam Group.

EUROPE GENERATOR RENTAL MARKET SEGMENTATION & FORECAST

Fuel Type (Revenue)

- Diesel

- Natural Gas

- Others

Power Rating (Revenue)

- < 75KVA

- 75-375KVA

- 376-1000KVA

- >1000KVA

Application (Revenue)

- Standby Power

- Continuous Power

- Peak Shaving

End-User (Revenue)

- Construction

- Retail

- Oil & Gas

- Mining

- Events

- Utilities

- IT & Data Centers

- Manufacturing

- Others

MARKET STRUCTURE

- Market Dynamics

- Competitive Landscape of Europe Generator Rental Market

- Key Vendors

- Other Prominent Vendors

VENDORS LIST

Key Vendors

- Aggreko

- United Rentals

- Ashtead Group

- Atlas Copco

- Caterpillar

- Cummins

- Kohler

- Loxam Group

- Speedy

- HIMOINSA

Other Prominent Vendors

- Generac Power Systems

- Bredenoord

- Kiloutou

- Boels Rental

- Collé Rental & Sales

- Rentaload

- SALTI

- Onis Visa

- COELMO

- Powering

- Bo-Rent

- Aksa Power Generation

- Power Electrics

- Woodlands Power

- Bells Power Group

- GAP Group

- Grupel

- GAY ELECTRICITÉ

KEY QUESTIONS ANSWERED

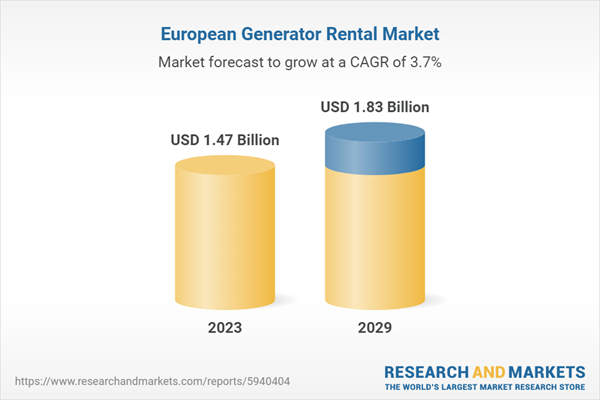

1. How big is the Europe generator rental market?2. What is the growth rate of the Europe generator rental market?

3. What are the trends in the Europe generator rental market?

4. Who are the key players in the Europe generator rental market?

Table of Contents

Companies Mentioned

- Aggreko

- United Rentals

- Ashtead Group

- Atlas Copco

- Caterpillar

- Cummins

- Kohler

- Loxam Group

- Speedy

- HIMOINSA

- Generac Power Systems

- Bredenoord

- Kiloutou

- Boels Rental

- Collé Rental & Sales

- Rentaload

- SALTI

- Onis Visa

- COELMO

- Powering

- Bo-Rent

- Aksa Power Generation

- Power Electrics

- Woodlands Power

- Bells Power Group

- GAP Group

- Grupel

- GAY ELECTRICITÉ

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.47 Billion |

| Forecasted Market Value ( USD | $ 1.83 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 28 |