Executive Summary and Market Analysis

The European market for hydrogen compressors is experiencing moderate growth, bolstered by government initiatives aimed at promoting clean hydrogen production. The European Union (EU) has committed approximately US$ 578 billion for climate-related investments from 2021 to 2027, alongside a budget of US$ 847.2 billion dedicated to renewable hydrogen production through its climate change innovation fund. Hydrogen compressors play a crucial role in the renewable energy sector, supported by these governmental initiatives.The oil and gas industry is also a significant driver of growth in the hydrogen compressor market, with numerous large-scale projects underway across Europe. Notable projects include the Johan Sverdrup and Johan Castberg oil field developments in Norway, as well as the Lochnagar and Rosebank oil and gas explorations in the UK, and the Aphrodite Gas Field in Cyprus. Additionally, several hydrogen electrolysis projects have been initiated in countries like Italy, Germany, Cyprus, and Greece, with a combined capacity of 441 MW. These compressors are essential for efficiently storing the energy generated from hydrogen electrolysis, making them a vital component in energy and power projects.

Beyond energy, sectors such as utilities, food and beverages, and chemicals are also expanding in Europe, further driving the demand for hydrogen compressors. For instance, Amazon Inc. announced a US$ 2.5 billion investment in 2022 to develop 39 new renewable energy projects across Europe, aiming to add over 1 GW of clean energy capacity to the grid. This initiative is part of a broader strategy to enhance renewable energy projects, which are expected to provide clean energy for millions of European residents. The EU Commission's plan to invest over US$ 550 billion in hydrogen production underscores the importance of hydrogen compressors in the transition to renewable, zero-emission energy sources.

Market Segmentation Analysis

The hydrogen compressor market can be segmented by type, technology, and end-user.- By Type: The market is divided into lubricated and oil-free compressors, with lubricated compressors holding a larger market share in 2023.

- By Technology: The market includes reciprocating hydrogen compressors, diaphragm hydrogen compressors, non-mechanical hydrogen compressors, and others, with reciprocating compressors dominating the market share in 2023.

- By End User: The end-user segments include power plants, oil and gas, food and beverages, petrochemical and chemical industries, hydrogen fueling stations, and hydrogen storage (Tube Trailers), with the petrochemical and chemical sectors leading in market share in 2023.

Market Outlook

The demand for oil and gas is rising in both developing and developed nations, leading to increased production activities and investments in research and development. In Europe, the oil and gas sector is witnessing a surge in investments, with Norway planning to allocate a record US$ 23.58 billion for oil and gas in 2024. This investment is part of a broader strategy to maintain production levels in the North Sea and ensure energy security. European companies are also pursuing new exploration projects, with Total Energies spearheading initiatives in the North Sea. These investments highlight Europe's commitment to energy sustainability while transitioning to greener energy sources, which is expected to drive the demand for hydrogen compressors in the coming years.Country Insights

The European hydrogen compressor market includes key countries such as Germany, France, Italy, Spain, the UK, Switzerland, Russia, Sweden, Norway, Belgium, the Netherlands, Greece, and others. Germany is the largest market in 2023, driven by high technology adoption and the presence of multinational companies. As the largest energy consumer in Europe, Germany's energy consumption is influenced by its industrial activities and population size. The country is also increasing its investments in transitioning from conventional fuels to renewable hydrogen, supported by the National Hydrogen Strategy.In March 2022, Germany announced a US$ 572 million investment to promote its hydrogen economy, which is a significant step towards adopting clean energy solutions. The government plans to invest US$ 9.6 billion to support clean hydrogen technologies. Additionally, E.ON SE, a major German energy group, has committed to investing US$ 28.5 billion by 2026 to facilitate the energy transition, including substantial investments in renewable energy and hydrogen generation capabilities. These initiatives are expected to significantly boost the demand for hydrogen compressors in Germany.

Company Profiles

Key players in the European hydrogen compressor market include Atlas Copco AB, Burckhardt Compression AG, Fluitron, Inc., Gardner Denver Nash, LLC, Howden Group, HAUG Sauer Kompressoren AG, NEUMAN & ESSER GROUP, Hydro-Pac, Inc., Lenhardt & Wagner GmbH, PDC Machines Inc., Sundyne, and Ariel Corporation. These companies are employing various strategies such as expansion, product innovation, and mergers and acquisitions to enhance their market presence and offer innovative solutions to consumers.Table of Contents

Companies Mentioned

- Atlas Copco AB

- Burckhardt Compression AG

- Fluitron, Inc.

- Gardner Denver Nash, LLC

- Howden Group

- HAUG Sauer Kompressoren AG

- NEUMAN & ESSER GROUP

- Hydro-Pac, Inc

- Lenhardt & Wagner GmbH

- PDC Machines Inc

- Sundyne

- Ariel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

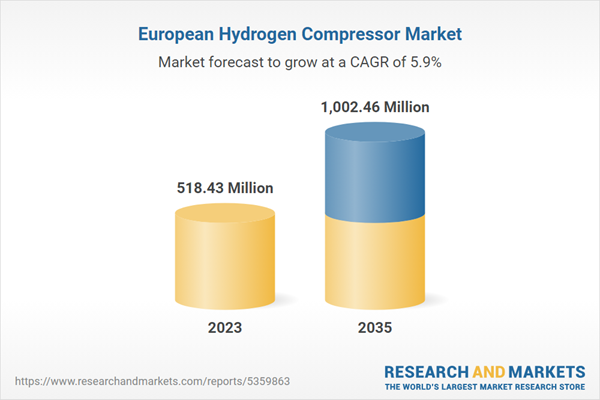

| Forecast Period | 2023 - 2035 |

| Estimated Market Value in 2023 | 518.43 Million |

| Forecasted Market Value by 2035 | 1002.46 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 12 |