In the market, the organic category holds increasing significance as consumers prioritize health and sustainability. Organic maple syrup, derived from sap collected from maple trees grown without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), appeals to health-conscious consumers seeking natural and environmentally friendly products. In terms of volume, total demand for organic maple syrup in Germany was 1,284.24 Tonnes in 2023.

The Germany market dominated the Europe Maple Syrup Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $126.7 million by 2031. The UK market is exhibiting a CAGR of 5.5% during (2024 - 2031). Additionally, The France market would experience a CAGR of 7.2% during (2024 - 2031).

Maple syrup is a crucial component of many marinades and rubs for meats, poultry, and tofu. Its natural sweetness caramelizes during cooking, creating a delicious glaze and imparting a hint of maple flavour to the dish. Vegan and vegetarian cooking and baking frequently incorporate this as a flavouring agent, owing to its plant-based composition and absence of animal products. It can be used as a substitute for honey in many recipes.

Consumers are increasingly seeking organic and natural food products, including maple syrup. Concerns about health, environmental sustainability, and a desire for transparency in food production drive this trend. These producers are exploring new flavour profiles and infusions to appeal to diverse consumer tastes. This includes flavoured syrups such as vanilla-infused, cinnamon-infused, and bourbon barrel-aged syrups, which offer unique and premium options for consumers.

As per the data released by Eurostat, in 2022, the median equivalised disposable income in the EU was 18,706 purchasing power standards (PPS) per inhabitant, increasing from 18,011 PPS recorded in 2021. At the national level, the EU countries with the highest median disposable incomes in 2022 were Luxembourg (33 214 PPS), the Netherlands (25 437 PPS), Austria (25 119 PPS), Belgium (24 142 PPS), Denmark (23 244 PPS) and Germany (23 197 PPS). Maple syrup's perception as a natural sweetener with potential nutritional benefits, such as antioxidants and vitamins, aligns with European consumers' preferences for wholesome and minimally processed ingredients. European consumers are inclined to allocate a higher budget for specialty food items of superior quality, such as maple syrup. Thus, all these factors will uplift the regional market’s expansion in the coming years.

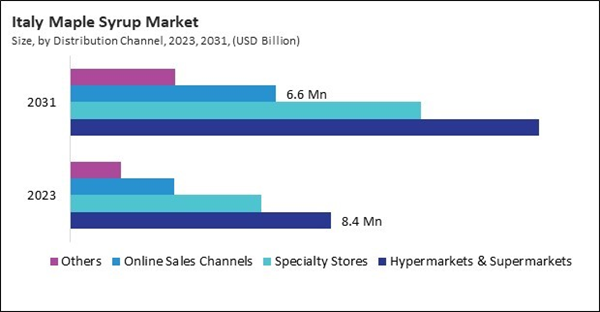

Based on Category, the market is segmented into Conventional, and Organic. Based on Distribution Channel, the market is segmented into Hypermarkets & Supermarkets, Specialty Stores, Online Sales Channels, and Others. Based on Source, the market is segmented into Sugar Maple, Black Maple, and Red Maple. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- B&G Foods, Inc.

- Vermont Pleasant Valley Maples

- Ferguson Farm Vermont Maple Syrup

- Butternut Mountain Farm

- Coombs Family Farms

- Maple Joe (Famille Michaud Apiculteurs)

- Golden Dog Farm LLC

- Judd’s Wayeeses Farms

- Anderson’s Maple Syrup, Inc.

Market Report Segmentation

By Category (Volume, Tonnes, USD Billion, 2020-2031)- Conventional

- Organic

- Hypermarkets & Supermarkets

- Specialty Stores

- Online Sales Channels

- Others

- Sugar Maple

- Black Maple

- Red Maple

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- B&G Foods, Inc.

- Vermont Pleasant Valley Maples

- Ferguson Farm Vermont Maple Syrup

- Butternut Mountain Farm

- Coombs Family Farms

- Maple Joe (Famille Michaud Apiculteurs)

- Golden Dog Farm LLC

- Judd’s Wayeeses Farms

- Anderson’s Maple Syrup, Inc.