The building and construction sector represents a significant segment of the plastic pipe market, where plastic pipes are widely utilized in various applications ranging from water supply and drainage to gas distribution and electrical conduit systems. Materials such as polyvinyl chloride (PVC), high-density polyethylene (HDPE), and cross-linked polyethylene (PEX) are commonly used due to their versatility, durability, and cost-effectiveness. Therefore, the German building and construction sector market consumed 770.51 kilo tonnes of these pipes in 2023.

The Germany market dominated the Europe Plastic Pipe Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $4,062.2 million by 2031. The UK market is exhibiting to witness a CAGR of 5.3% during (2024 - 2031). Additionally, The France market would experience a CAGR of 7% during (2024 - 2031).

Polyvinyl chloride pipes are commonly used for sewage collection, wastewater transport, and drainage systems. Their smooth interior surface prevents clogging and buildup of debris, ensuring efficient flow and preventing blockages. They resist chemical corrosion and abrasion, making them suitable for chemical processing plants, manufacturing facilities, and refineries. Pipes also offer thermal insulation properties, maintaining the temperature of fluids during transport.

Additionally, Polyvinyl chloride pipes are employed in the oil and gas industry to transport crude oil, natural gas, and refined petroleum products. They are lightweight, corrosion-resistant, and cost-effective alternatives to traditional metal pipes. Polyvinyl chloride pipes are used in onshore and offshore applications, including drilling rigs, production platforms, and subsea pipelines.

As the GDP from the agriculture sector grows in Europe, governments and private investors allocate more funds towards improving agricultural infrastructure. This includes investments in irrigation systems, drainage networks, and water management facilities, all requiring pipes. As per Eurostat, the EU’s agricultural industry created an estimated gross value of €220.7 billion in 2022. Agriculture contributed 1.4 % to the EU’s GDP in 2022. Agricultural income per annual work unit is estimated to have risen for the EU in 2022 (+11.0 %) to a level 44.0 % higher than the index level in 2015. The value of the output produced by the EU’s agricultural industry was €537.5 billion in 2022. The increased investment in agricultural infrastructure drives demand for Polyvinyl chloride pipes in Europe. Hence, the expansion of the agriculture sector is propelling the market’s growth.

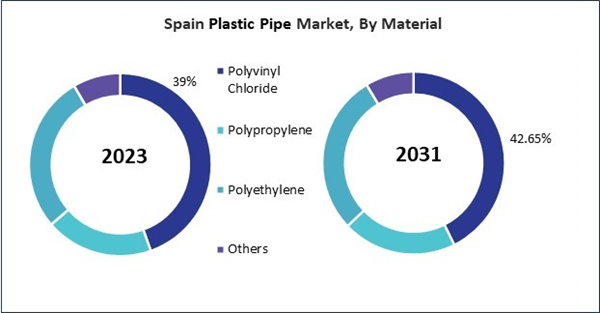

Based on Application, the market is segmented into Water Supply, Irrigation, Sewerage, Plumbing, HVAC, and Others. Based on End-use, the market is segmented into Building & Construction, Agriculture, Oil & Gas, and Others. Based on Material, the market is segmented into Polyvinyl Chloride, Polypropylene, Polyethylene, and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Chevron Phillips Chemical Company LLC

- Astral Limited

- Kubota ChemiX Co., Ltd. (KUBOTA Corporation)

- Kotec Corporation

- Tommur Industry Shanghai Co., Ltd.

- Wienerberger AG

- Aliaxis Group SA

- Finolex Industries Limited

- Geberit AG

- Georg Fischer Ltd.

Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)- Water Supply

- Irrigation

- Sewerage

- Plumbing

- HVAC

- Others

- Building & Construction

- Agriculture

- Oil & Gas

- Others

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Chevron Phillips Chemical Company LLC

- Astral Limited

- Kubota ChemiX Co., Ltd. (KUBOTA Corporation)

- Kotec Corporation

- Tommur Industry Shanghai Co., Ltd.

- Wienerberger AG

- Aliaxis Group SA

- Finolex Industries Limited

- Geberit AG

- Georg Fischer Ltd.