Public investments in infrastructure and construction projects, in confluence with the implementation of stringent environmental laws, are catalyzing the demand for excavators. Governing authorities around the world are advocating for more sustainable, energy-saving equipment. These regulations encourage the adoption of new excavator technologies that meet emission standards, thereby supporting the growth in the market for advanced, eco-friendly machines. Apart from this, ongoing innovations like automated systems, global positioning systems (GPS) tracking, and better fuel efficiency are improving excavator functionalities. These advancements in technology boost productivity, lessen environmental effects, and decrease operating expenses, thereby drawing in more buyers. Furthermore, sophisticated functionalities, such as remote control and telematics, enable operators to track machine performance, increasing the appeal and competitiveness of excavators in the market.

The United States is an essential part of the market, fueled by considerable government funding in infrastructure initiatives. These initiatives encompass road building, bridge renovations, and public infrastructure, all necessitating heavy equipment. Excavators play a crucial role in activities like earthmoving, grading, and preparing sites, resulting in higher demand for these machines. Moreover, the increasing need for specialized equipment in areas, such as dredging and canal building, is encouraging advancements in the excavator sector. Machines built with longer reach, improved control mechanisms, and superior safety attributes are high in demand, allowing for heightened efficiency and accuracy in intricate and demanding construction projects. In 2024, Hitachi Construction Machinery Americas launched the ZX210LC-7H Super Long Front (SLF) excavator in the North American market. As a member of the ZAXIS-7 series, it provided more than 50 feet of reach and improved control for dredging and canal projects. Notable elements included a revamped cab, aerial camera perspective, and enhanced hydraulic systems for better performance and safety.

Excavator Market Trends:

Government Investment in Infrastructure

Governments around the world are making substantial investments in infrastructure projects, including the development of roads, bridges, and public transport systems. These large-scale projects require specialized equipment capable of navigating challenging terrains and performing heavy-duty operations. Excavators, known for their versatility and high performance, are essential for tasks such as excavation, grading, and land preparation. For instance, India’s budget for 2025-26 allocates INR 11.21 lakh crore to the infrastructure sector, underscoring the government's commitment to building a robust and sustainable infrastructure framework. This investment aligns with the broader vision of achieving a developed India by 2047, further emphasizing the necessity for efficient machinery to support such extensive development initiatives. The increasing focus of the governments on infrastructure development projects is catalyzing the demand for advanced excavators.Environmental Regulations and Sustainability Initiatives

Governing authorities are implementing tougher emission regulations, encouraging producers to create more fuel-efficient, environment-friendly equipment. Excavators now come equipped with cleaner engines, hybrid or electric power sources, and sophisticated technologies to minimize noise and dust emissions, assisting companies in complying with these regulations. With industries under pressure to reduce their carbon footprints, the need for eco-friendly excavators increases. In 2024, Volvo Construction Equipment introduced its biggest electric excavator, the EC230 Electric, in Japan. Equipped with a 264 kWh battery lasting up to five hours, this device produces zero emissions and lower noise levels, representing a notable advancement in sustainable construction. Offered for rent, it signified the larger movement towards sustainability within the construction sector. With the growing focus on sustainability, the need for cleaner, energy-efficient excavators is on the rise.Technological Integration and Smart Features

Contemporary excavators are progressively integrated with cutting-edge technologies, such as sensors, live monitoring, telematics, and data analytics, which boost performance, enhance efficiency, and lower operational expenses. These advancements give operators practical insights and facilitate predictive maintenance, reducing downtime. Automated digging systems, load sensing, and terrain navigation enhance precision, while built-in safety technologies like obstacle detection and operator alerts promote a safer workplace. The need for excavators featuring intelligent technologies is growing as sectors aim for increased efficiency and minimized risks. In 2025, KOBELCO Construction Machinery USA introduced the SK520LC-11, a 55-ton excavator equipped with an Isuzu engine and cutting-edge hydraulics, aimed at delivering both outstanding performance and fuel efficiency. This equipment also features enhanced comfort, intelligent technology, and adaptable attachment choices, showcasing the industry's transition toward more advanced, efficient machines to address the increasing needs of construction and mining endeavors.Excavator Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global excavator market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, mechanism type, power range, and application.Analysis by Product:

- Mini/Compact

- Crawler

- Wheeled

- Heavy

Analysis by Mechanism Type:

- Electric

- Hydraulic

- Hybrid

Hydraulic excavator is a crucial segment in the market owing to its superior performance, versatility, and power. It uses hydraulic fluid to generate movement and perform tasks, such as digging, lifting, and grading. Hydraulic excavator is highly efficient and capable of handling heavy-duty operations, making it the go-to choice for large-scale construction, mining, and infrastructure projects. Its widespread use is also supported by its reliability, ease of maintenance, and adaptability to different types of attachments.

Hybrid excavator combines the benefits of both diesel and electric power, offering a balance between fuel efficiency and lower emissions. It uses a combination of an internal combustion engine (ICE) and an electric motor, with the electric motor capturing and storing energy during braking or when the machine is idling, which is then used to assist with power during operation. This reduces fuel usage and enhances overall efficiency, making hybrid excavator an appealing choice for projects aiming to reduce fuel costs and environmental impact without sacrificing performance.

Analysis by Power Range:

- Upto 300 HP

- 301-500 HP

- 501 HP and Above

Excavators in the 301-500 HP power range are designed for medium to large-scale construction and infrastructure projects. These machines are well-suited for applications that demand a higher level of digging power, such as commercial building projects, road construction, and heavy lifting tasks. They provide a good balance between power and fuel efficiency, making them ideal for operations that need both productivity and cost-effectiveness.

Excavators with a power range of 501 HP and above are typically used for large-scale, high-demand construction, mining, and heavy industrial applications. These powerful machines are capable of handling the most challenging tasks, such as deep excavation, bulk material handling, and major earthmoving operations. With their high horsepower, these excavators can perform efficiently in difficult terrains, large construction sites, and mining operations where significant force and endurance are needed.

Analysis by Application:

- Mining

- Construction

- Waste Management

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Excavator Market Analysis

In North America, the market portion held by the United States with a market share of 84.80%, fueled by heightened infrastructure renewal projects in both urban and rural regions. Expenditure by the government on energy-efficient transport routes and upgrades to public infrastructure is catalyzing the demand for heavy-duty excavators. In a major announcement, the U.S. Department of Transportation revealed USD 1.32 Billion in Round 1 grants from the FY2025 Rebuilding American Infrastructure with Sustainability and Equity (RAISE) discretionary program for 109 projects, as part of a larger USD 5 Billion initiative under President Biden’s Investing in America plan. This investment is anticipated to drive the demand for sophisticated excavation equipment in various construction projects. Additionally, the increase in both residential and commercial real estate developments is further encouraging the use of compact and mid-sized excavators. Advancements in hydraulic systems and the incorporation of telematics for monitoring fleets are influencing equipment choices. The rental services trend is becoming more popular, allowing small and medium contractors to obtain advanced machinery without significant capital expenditure. The growing focus on improving productivity at worksites and minimizing operational downtime is driving the demand for intelligent excavator models.Europe Excavator Market Analysis

The European excavator market is growing due to a rise in urban renewal projects and improvements in transportation infrastructure. Funding in high-speed rail networks, metro expansions, and eco-friendly construction methods is driving the need for equipment. As reported by the U.S. Green Building Council (USGBC), Europe is one of the fastest-expanding areas for green buildings, boasting more than 6,000 LEED-certified projects that span approximately 113 million gross square meters, reflecting an increasing alignment with sustainable construction trends. This trend is catalyzing the demand for electric and low-emission excavators. The adoption of technological integration, including automation features and machine control systems, aims to satisfy regulatory requirements and improve safety on-site. The rental market is deeply rooted in the area, promoting broad availability of cutting-edge excavator models for projects of different sizes. The rehabilitation of historic buildings and the development of green areas are also generating specialized opportunities. These trends, bolstered by the availability of skilled labor and digital construction planning, are offering an optimistic European excavator market outlook.Asia Pacific Excavator Market Analysis

The excavator market in the Asia Pacific is experiencing growth, driven by swift industrialization and urban expansion in emerging economies. Significant investments in expanding ports, energy initiatives, and transportation systems is driving the need for high-efficiency excavators. India intends to invest USD 82 billion in port development by 2035, as reported by the India Brand Equity Foundation, demonstrating the region's significant dedication to improving logistics and maritime infrastructure. Increased automation in construction methods is encouraging the adoption of smart excavator systems equipped with features, such as real-time diagnostics and remote operation functionalities. Additionally, the growth of rural electrification and irrigation infrastructure is catalyzing the demand for reliable machinery that can function in various terrain conditions. The rise of megacities and smart city projects is driving the need for effective earthmoving machinery to adhere to strict construction schedules. Moreover, the presence of affordable labor combined with government-driven infrastructure initiatives is enhancing the region’s equipment usage.Latin America Excavator Market Analysis

The Latin American excavator market is advancing consistently, supported by a revival in the exploration of natural resources and the development of agricultural land. The development of infrastructure in poorly connected areas is driving the demand for robust machinery that can adapt to various terrains. Industry forecasts indicate that Brazil's infrastructure sector is anticipated to expand at a CAGR of 4.36% from 2025 to 2033, underscoring steady capital investments in essential civil construction. Improvements in hydraulic efficiency and machine adaptability attract contractors looking for economical performance in diverse applications. The growing preference for digital fleet management solutions is enhancing equipment deployment in distant locations, accelerating project completion schedules. Additionally, public-private partnerships (PPP) in transportation and utility initiatives are creating new demand cycles. Seasonal building activities tied to crop logistics and water resource management are also influencing short-term variations in equipment demand.Middle East and Africa Excavator Market Analysis

The excavator market in the Middle East and Africa is gaining momentum as a result of growth in logistics centers, industrial areas, and desert reclamation initiatives. The logistics infrastructure in the region is experiencing strong development, with Saudi Arabia's logistics sector expected to grow from USD 136.3 billion in 2024 to USD 198.9 billion by 2030, as per recent findings. This is anticipated to drive equipment demand in warehousing, intermodal transport, and aid construction. The advancement of large-scale infrastructure initiatives, such as railways and utility pathways, is driving the need for equipment with improved excavation capability and resilience in extreme weather conditions. Increasing demand for renewable energy infrastructure is also generating opportunities for excavation of machinery designed for large-scale projects. Improved fleet availability via predictive maintenance strategies is emerging as a central operational priority, resulting in the implementation of digitally integrated excavator systems.Competitive Landscape:

Major participants in the market are concentrating on technological progress, eco-friendliness, and broadening their product ranges to uphold a competitive advantage. For instance, in 2024, New Holland unveiled a new midi excavator range at EIMA 2024, expanding into the 6-12 tons class with five models: E70D, E75D, E85D, E90D, and E100D. These excavators featured zero tail swing designs, multiple boom options, customizable hydraulics, and enhanced comfort and maintenance features. Businesses are progressively incorporating intelligent technologies, including telematics, GPS, and self-driving capabilities, into their excavators to boost efficiency, lower fuel usage, and enhance safety. Moreover, leading producers are allocating resources to electric and hybrid models to satisfy the increasing need for environment-friendly equipment. To meet varied market demands, businesses are providing tailored solutions for different sectors, ranging from construction to mining. Additionally, strategic alliances and acquisitions are prevalent as these companies aim to broaden their international presence and enhance operational efficiencies.The report provides a comprehensive analysis of the competitive landscape in the excavator market with detailed profiles of all major companies, including:

- Caterpillar Inc.

- CNH Industrial N.V.

- Doosan Corporation

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Heavy Industries Ltd.

- John Deere

- Joseph Cyril Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr Group

- Sany Heavy Industries Co. Ltd.

- Terex Corporation

- Yanmar Construction Equipment Co. Ltd.

- Volvo Construction Equipment AB

Key Questions Answered in This Report

1. How big is the excavator market?2. What is the future outlook of excavator market?

3. What are the key factors driving the excavator market?

4. Which region accounts for the largest excavator market share?

5. Which are the leading companies in the global excavator market?

Table of Contents

Companies Mentioned

- Caterpillar Inc.

- CNH Industrial N.V.

- Doosan Corporation

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Heavy Industries Ltd.

- John Deere

- Joseph Cyril Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr Group

- Sany Heavy Industries Co. Ltd.

- Terex Corporation

- Yanmar Construction Equipment Co. Ltd.

- Volvo Construction Equipment AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

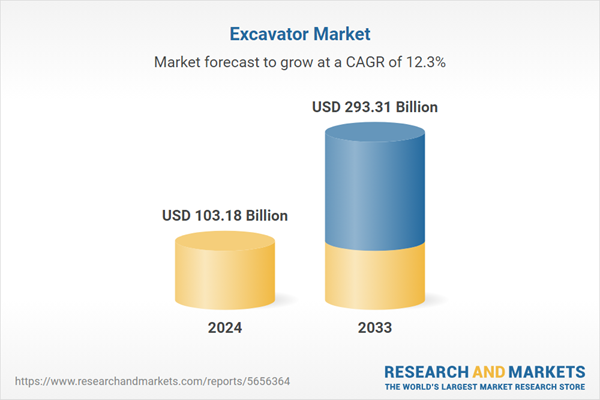

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 103.18 Billion |

| Forecasted Market Value ( USD | $ 293.31 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |