Speak directly to the analyst to clarify any post sales queries you may have.

A comprehensive introduction that situates febuxostat within evolving clinical practice, regulatory considerations, and strategic decision-making contexts

Febuxostat has emerged as an important oral therapeutic option within the broader gout and hyperuricemia landscape, characterized by its xanthine oxidase inhibitory mechanism and distinct safety and efficacy profile. Clinicians and formulary decision-makers consider febuxostat when balancing urate-lowering effectiveness with individual patient comorbidities, tolerability, and previous treatment responses. Over recent years, attention has focused on optimizing dosing strategies, monitoring for cardiovascular safety signals, and integrating febuxostat into personalized care pathways for patients with recurrent gout flares or insufficient response to alternative therapies.Against this clinical backdrop, stakeholders across development, regulatory affairs, and commercial functions are recalibrating priorities. Research activity continues to refine indications and to explore combination regimens that may reduce flare risk or improve long-term adherence. At the same time, payers and procurement teams increasingly assess the role of branded and generic alternatives within formularies, evaluating comparative safety data and real-world adherence patterns. These converging clinical, regulatory, and commercial dynamics set the stage for strategic decisions by manufacturers, health systems, and distribution partners seeking to align product positioning with shifting patient and payer expectations.

A strategic analysis of the major transformation drivers reshaping febuxostat utilization, distribution, evidence generation, and competitive positioning across healthcare systems

The febuxostat landscape is undergoing transformative shifts driven by changes in evidence generation, regulatory emphasis on safety profiling, and innovation in distribution models. Real-world data initiatives and extended post-marketing surveillance have raised the bar for demonstrating long-term cardiovascular and renal outcomes, and this increased evidentiary requirement has influenced prescribing behavior and regulatory dialogue. Simultaneously, the maturation of generic entrants and lifecycle management strategies has intensified competitive dynamics, prompting innovation in patient support services and adherence technologies.Parallel to clinical and competitive evolution, distribution channels are adapting. The growth of digital pharmacies and remote prescribing pathways, accelerated by telehealth expansion, has reshaped patient access and adherence monitoring. Manufacturers are responding by strengthening digital engagement, developing educational platforms for prescribers and patients, and exploring value-based contracting that links reimbursement to demonstrable patient outcomes. Taken together, these shifts are redefining the commercial and clinical ecosystem for febuxostat, with implications for product positioning, evidence generation priorities, and cross-functional collaboration across manufacturers, providers, and payers.

A focused overview of how tariffs introduced in 2025 could alter febuxostat supply chains, procurement strategies, regional manufacturing decisions, and commercial resilience planning

Anticipated tariff measures introduced by a major economy in 2025 are likely to reverberate through global pharmaceutical supply chains and procurement practices, with material consequences for febuxostat stakeholders. Many small-molecule active pharmaceutical ingredients and intermediates are sourced from geographically concentrated manufacturing hubs; any incremental import duties can increase input costs, incentivize supply chain redundancy, and accelerate nearshoring or supplier diversification initiatives. Procurement teams will respond by re-evaluating supplier contracts, increasing inventory buffers where appropriate, and prioritizing suppliers with integrated compliance and traceability capabilities to mitigate disruption risk.In addition to cost implications, tariffs reshape competitive dynamics. Manufacturers with vertically integrated or locally situated API and formulation capabilities may be better positioned to absorb or offset duties, whereas those dependent on cross-border supply may face margin pressure and intensified pricing negotiations with payers. Clinical trial logistics and ancillary supply imports could also confront greater administrative complexity and lead times, influencing project timelines. Consequently, companies are likely to accelerate contingency planning, invest in regional manufacturing capacity, and explore contractual mechanisms to share or hedge tariff-related cost exposure with distributors and procurement partners, thereby preserving continuity of patient access and supporting operational resilience.

An integrated segmentation perspective revealing how distribution, type, strength, formulation, end user, and therapeutic indication intersect to shape febuxostat strategy and operations

Analyzing febuxostat through multiple segmentation lenses reveals nuanced opportunities and operational considerations across clinical and commercial decision axes. Distribution channel dynamics show differentiated demand patterns where hospital pharmacy procurement emphasizes inpatient protocols and formulary negotiations, online pharmacy growth supports chronic therapy adherence through subscription and delivery models, and retail pharmacies remain central to community access and point-of-care counseling. Type segmentation distinguishes branded formulations that prioritize value-added services and evidence programs from generic alternatives that emphasize cost-efficiency and supply reliability. Strength variations between 40 milligram and 80 milligram regimens create dosing pathway strategies that influence prescribing habits, titration protocols, and adherence counseling.Formulation segmentation highlights the role of standard tablets versus extended release tablet technologies in addressing adherence and tolerability trade-offs, while end user segmentation draws attention to differing care settings where clinics focus on outpatient initiation and monitoring, home care emphasizes medication delivery and remote support, and hospitals manage acute presentations and complex comorbidities. Therapeutic indication segmentation surfaces clinical differentiation, as chronic gout management requires ongoing urate control and flare prevention, hyperuricemia management often overlaps with metabolic and renal comorbidity considerations, and tumor lysis syndrome presents acute, protocol-driven use cases where rapid urate reduction and coordination with oncology services are essential. Integrating these segmentation perspectives enables targeted commercial strategies, tailored evidence generation, and service design that reflect the distinct needs of prescribers, patients, and payers across care pathways.

A regionally informed assessment of how regulatory frameworks, payer structures, and distribution ecosystems across the Americas, Europe Middle East & Africa, and Asia-Pacific shape febuxostat access and commercialization

Regional dynamics exert a powerful influence over febuxostat access, regulatory interaction, and commercialization strategy across the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In the Americas, regulatory frameworks and payer negotiation processes shape formulary inclusion and reimbursement pathways, and there is strong emphasis on real-world evidence to support value arguments. Manufacturers and distributors operating in this region invest in patient support programs, adherence initiatives, and clinician education to navigate heterogeneous payer landscapes and to demonstrate sustainable clinical and economic value.Across Europe, the Middle East & Africa, regulatory harmonization efforts and regional procurement mechanisms inform launch sequencing and pricing strategies, while public tendering and national formulary decisions require tailored evidence and health economic dossiers. The Asia-Pacific region exhibits rapidly evolving access models, with diverse regulatory environments and an increasing focus on local manufacturing capabilities, technology-enabled distribution, and partnerships that address affordability and access. Understanding these regional nuances is essential for aligning clinical development priorities, supply chain investments, and commercial execution plans with local healthcare system incentives and patient access pathways.

A concise landscape of company-level strategies emphasizing evidence generation, supply resilience, generics capability, and collaborative service models to sustain febuxostat competitiveness

Industry participants in the febuxostat space are diversifying approaches across development, lifecycle management, and commercial support to address evolving clinical and payer demands. Companies with differentiated portfolios are investing in robust pharmacovigilance programs and targeted real-world evidence generation to substantiate safety narratives and to inform label updates or risk management strategies. Meanwhile, entities focusing on generics are building scalable manufacturing platforms and supply chain resilience to meet tender and retail demand, optimizing cost structures while ensuring regulatory compliance across multiple jurisdictions.Collaborative models are also gaining traction, with commercialization partners and service providers offering integrated patient engagement, adherence solutions, and data analytics to support outcomes-based contracting and post-authorization evidence collection. Research alliances that explore combination therapies, alternative dosing regimens, and indication expansion are emerging as pragmatic pathways to sustain product relevance. Overall, the competitive environment is defined less by singular product attributes and more by the ability to combine clinical evidence, service offerings, and supply reliability to meet the multifaceted requirements of clinicians, payers, and patients.

Actionable guidance for executives to integrate evidence generation, supply diversification, patient support, and cross-functional alignment to strengthen febuxostat market positioning

Leaders seeking to strengthen their febuxostat position should prioritize an integrated strategy that aligns clinical evidence, supply chain resilience, and commercial innovation. First, investing in targeted real-world studies and safety registries will bolster confidence among clinicians and payers, enabling more persuasive value narratives that address cardiovascular and renal outcome concerns. These initiatives should be coordinated with pharmacovigilance programs and communicated through clinician-facing educational platforms that facilitate evidence uptake and appropriate prescribing.Second, supply chain diversification and regional manufacturing investments will mitigate tariff and disruption risk while supporting timely access. Companies should evaluate strategic supplier partnerships, nearshoring options, and inventory optimization techniques to preserve margins and maintain continuity of supply. Third, commercial differentiation can be achieved through patient support services and technology-enabled adherence solutions that reduce discontinuation and improve outcomes; coupling these services with outcomes-linked contracting will resonate with value-oriented payers. Finally, cross-functional alignment across R&D, regulatory, medical affairs, and commercial teams is essential to translate evidence into practice, to refine positioning for different care settings, and to adapt proactively to regional policy shifts and distribution channel transformations.

A transparent description of the multi-method research approach combining literature synthesis, expert interviews, regulatory review, and triangulated validation to ensure robust febuxostat insight generation

The research underpinning this report draws on a multi-method approach that combines systematic literature review, targeted stakeholder interviews, and synthesis of regulatory and clinical trial records to construct a comprehensive view of febuxostat clinical, commercial, and supply chain dynamics. Peer-reviewed clinical publications and regulatory communications were analyzed to characterize the safety and efficacy landscape, while relevant guideline updates and consensus statements were reviewed to understand shifts in clinical practice. Interviews with clinical experts, hospital pharmacists, and distribution specialists provided practical insight into prescribing behavior, procurement priorities, and channel-specific operational considerations.Complementing qualitative inputs, regulatory filings and pharmacovigilance summaries were examined to map post-marketing surveillance trends and label evolution. Industry reports and public procurement notices were consulted to contextualize distribution and tender behaviors, and data triangulation across these sources supported robust interpretation of emergent patterns. Throughout the process, findings were validated through iterative expert review to ensure accuracy, applicability, and relevance to stakeholders seeking to inform strategy, operations, and evidence planning for febuxostat-related activities.

A balanced conclusion synthesizing clinical, operational, and commercial imperatives that will determine febuxostat relevance and access across diverse healthcare environments

In closing, febuxostat occupies a distinct and strategically important niche within urate-lowering therapy options, influenced by evolving clinical evidence, regional regulatory frameworks, and changing distribution paradigms. The interplay between branded and generic offerings, dosage and formulation considerations, and end-user needs underscores the importance of finely tuned strategies that address both clinical imperatives and access realities. Manufacturers that proactively invest in rigorous safety monitoring, real-world evidence, and resilient supply chains will be better positioned to navigate payer scrutiny and to sustain clinician confidence.Simultaneously, commercialization success will hinge on the ability to deliver comprehensive support services and to adapt distribution models in response to digital pharmacy growth and regional procurement complexities. By aligning clinical development with operational execution and payer-facing value demonstration, stakeholders can create differentiated propositions that address patient outcomes, system-level efficiency, and long-term sustainability for febuxostat therapies.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Febuxostat Market

Companies Mentioned

The key companies profiled in this Febuxostat market report include:- Abbott Laboratories

- Ajanta Pharma Limited

- Albert David Limited

- Alembic Pharmaceuticals Limited

- Alkem Laboratories Limited

- Casca Remedies Private Limited

- Cipla Limited

- Crossford Healthcare Private Limited

- Dr. Reddy’s Laboratories Limited

- Franco-Indian Pharmaceuticals Private Limited

- Intas Pharmaceuticals Limited

- Leeford Healthcare Limited

- Lupin Limited

- Macleods Pharmaceuticals Private Limited

- Neuracle Lifesciences Private Limited

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Limited

- Torrent Pharmaceuticals Limited

- Yodley Life Sciences Private Limited

- Zydus Lifesciences Limited (formerly Cadila Healthcare Limited)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | January 2026 |

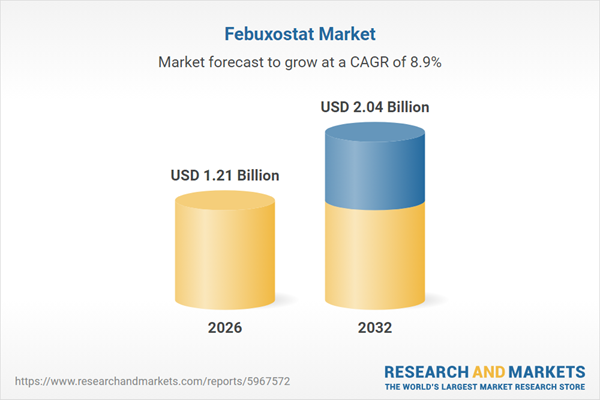

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.21 Billion |

| Forecasted Market Value ( USD | $ 2.04 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |