The feed additives market is also benefiting from ongoing innovation and technological advancements. Companies are investing heavily in research and development to create new and improved products that cater to the evolving needs of the livestock industry. In December 2023, Adisseo (France) inaugurated its European R&I Centre, ELISE (European Lab for Innovation, Science & Expertise), located in Lyon, France. The center consolidates Research and Innovation teams focused on process chemistry, engineering, and nutrition research. With 100 researchers, the facility aims to foster collaboration with universities and regional technology partners. Additional research activities remain in Commentary, La Rochelle, and Toulouse, while Adisseo's global R&I workforce spans France, China, Singapore, and the USA.

The development of new feed additives aimed at reducing methane emissions is significantly contributing to the growth of the feed additives market. In January 2024, Clemson University, in partnership with the University of Florida and Auburn University, launched a project to develop safe, effective, and affordable feed additives to mitigate enteric methane emissions in grass-fed cattle. Methane is a potent greenhouse gas produced during ruminant digestion. Funded by a USD 5 million USDA grant, the project supports sustainability efforts and enhances demand for innovative feed solutions.

Innovations such as artificial intelligence and advanced enzyme formulations are enhancing feed performance and livestock management. These technologies are designed to address specific challenges in animal nutrition and health, providing more precise and effective solutions. In March 2023, MASCO (US) introduced AI audio sensors that revolutionized swine production by continuously monitoring respiratory events, thereby reducing mortality rates and improving herd health management. This system delivers real-time, objective alerts for timely intervention.

Additionally, Danisco Animal Nutrition & Health, a business unit of IFF (US), has launched Axtra PRIME, an enzyme blend formulated to address key digestibility challenges in piglet production. This blend, which includes xylanase, beta-glucanase, alpha-amylase, and protease, enhances nutrient digestion and gut health, supporting faster growth and better performance during stressful periods such as weaning. These advancements reflect the industry’s commitment to leveraging technology to optimize animal health and feed efficiency.

Disruptions in Feed Additives Market

Raw material supply challenges in the feed additives market are exacerbated by various global factors, including volatile costs and supply chain disruptions. According to Alltech's 2024 Agri-Food Outlook, overall feed production slightly declined by 0.2% in 2023, reflecting the tightening margins and reduced demand for animal feed. This decline is linked to increasing production costs, geopolitical tensions, and changing consumption patterns driven by inflation. Additionally, certain sectors like beef feed witnessed more pronounced decreases due to stricter sustainability policies in Europe and shifts in cattle cycles in the U.S. Meanwhile, feed efficiency improvements are helping offset raw material disruptions in some regions, but fluctuations in costs and availability remain critical challenges impacting production and pricing globally.The Key representative of animal nutrition at ADM (US) outlines four critical factors influencing the feed additives market in 2023: geopolitical tensions, food security, energy challenges, and the rise of plant-based protein. Heightened tensions between nations, notably the US-China rivalry and the Ukraine-Russia conflict, have disrupted global supply chains, creating significant challenges for feed ingredients like vitamins and amino acids, which are predominantly manufactured in China. Additionally, soaring energy costs have increased production and transportation expenses, further straining the industry. The growing development of plant-based and cultured proteins is also shifting demand away from animal protein, particularly in emerging markets.

These dynamics disrupt the feed additives market by increasing operational costs, complicating supply chain logistics, and reducing demand for traditional animal-based feed additives. However, opportunities remain in enhancing feed conversion efficiency, meeting consumer preferences for antibiotic-free livestock, and driving sustainability through innovations like methane-reducing seaweed additives. While growth is expected in aquaculture and poultry production across Asia and Africa, the market faces long-term hurdles such as slower growth rates, industry consolidation, and a pressing need to focus on sustainability and animal health.

Poultry emerges as the dominant livestock segment during the forecast period.

Poultry has emerged as the dominant segment in the livestock industry due to its significant economic contribution and steady production growth. According to USDA, In 2023, the combined value of production from broilers, eggs, turkeys, and chickens reached USD 67.1 billion, with broilers alone contributing 64% of this total, equivalent to USD 42.6 billion. This dominance is driven by the consistent demand for poultry meat, which is favored for its affordability and versatility compared to other meats. Broiler production amounted to 9.16 billion birds, with a total live weight of 59.7 billion pounds, reflecting a steady increase from the previous year. The egg sector followed, contributing 27% to the total value, underscoring the essential role of poultry in the global diet.Key players are actively enhancing their offerings to meet rising consumer demand and improve production efficiency. In December 2023, Cargill introduced tailored solutions to improve poultry health and performance, including innovative feed additives like Dia V MBPRO and postbiotics. These advancements aim to reduce antibiotic use while addressing consumer preferences for healthier poultry products. Additionally, Cargill launched REVEAL Layers, a patent-pending NIR technology that provides real-time, mobile-accessible insights into the relationship between body fat and egg production in laying poultry. This tool allows for the optimization of diet composition, enhancing profitability and contributing to the segment's growth and innovation.

Amino acids are estimated to dominate the feed additives market during the forecast period

Amino acids are fundamental to animal growth and development. They are the building blocks of proteins, which are crucial for muscle development, tissue repair, and overall health in livestock. For instance, L-lysine and DL-methionine are essential amino acids often supplemented in poultry feed to meet the specific nutritional needs of broilers and layers. By ensuring that the diet contains adequate levels of these amino acids, producers can enhance growth rates and egg production. For example, L-lysine supplementation in broiler diets has been shown to improve weight gain and feed conversion ratios, leading to more efficient production and better economic returns.Amino acids help in optimizing feed efficiency and reducing feed costs. By supplementing animal feeds with specific amino acids, feed manufacturers can formulate more balanced and nutrient-dense diets. This approach reduces the need for protein-rich ingredients such as soybean meal, which are often more expensive. Companies such as ADM (US) are innovating by offering amino acids in liquid and encapsulated forms. These formats improve nutritional absorption, reduce dust in feed mills, and enhance feed efficiency. Liquid lysine allows for accurate dosing and minimizes waste, contributing to a cleaner production environment.

US is estimated to dominate the feed additives market in the North American region during the forecasted period

Feed additives in North America are currently being dominated by the United States. With estimates indicating a rise in poultry meat, poultry products, and swine meat, investment towards the expansion of production capacities is expected to rise in the United States. Another reason for increased expenditure on livestock nutrition is the growing acceptance of precision feeding practices in order to satisfy high-quality feed demand. This has been a major factor in the increased use of effective feed additives in the region.In June 2024, Kemin Industries Inc. (US) introduced FORMYL, a feed acidifier for swine in the US market. According to Kemin, FORMYL combines calcium formate and citric acid into a single product that will beneficially affect gut health, lead to the defeat of pathogens, and enhance digestion.

The strategic licensing deal Alltech (US) has formed with EnviroEquine (US) in September 2024, would be used in introducing the latter's equine nutritional supplements using Alltech's advanced technologies. The products would be strengthened with science-based solutions for greater efficacy while brand presence in North America and Europe is consolidated. It is according to the two companies' mutual commitment to sustainability and quality in animal nutrition. The initiatives by Kemin Industries and the partnership between Alltech and EnviroEquine clearly demonstrate the growing demand for feed additives in the North American market.

The break-up of the profile of primary participants in the feed additives market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World - 10%

Research Coverage:

This research report categorizes the feed additives market by Type (Amino Acids, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors & sweeteners, Antibiotics, Minerals, Antioxidants, Nonprotein Nitrogen, Phytogenics, Preservatives, and Probiotics), Source (Natural and Synthetic), Form (Dry and Liquid), Livestock (Ruminants, Swine, Poultry, Aquatic Animals, Other Livestock), Functions (Gut Health, Palatability Enhancers, Growth Boosters, Immune System Support, Other Functions), and Region (North America, Europe, Asia Pacific, South America, and Rest of the World).The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the feed additives market. It also provides a detailed analysis of the major players in the market, including their business overview, products offered; key strategies; partnerships, new product launches, expansions, and acquisitions. Competitive benchmarking of upcoming startups in the feed additives market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall feed additives market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of key drivers (Increase in demand and consumption of livestock-based products), restraints (Ban on antibiotics in different nations), opportunities (Developing countries emerge as strong consumers of feed additives), and challenges (High Sustainability of feed and livestock chain) influencing the growth of the feed additives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the feed additives market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the feed additives market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the feed additives market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), Evonik Industries AG (Germany), BASF SE (Germany), dsm-firmenich (Switzerland), Ajinomoto Co., Inc. (Japan), Novonesis Group (Denmark), Adisseo (France), Solvay (Belgium), Nutreco (Netherlands), Kemin Industries, Inc. (US), Lallemand Inc. (Canada), BRF Global (Brazil), Bentoli (US), VITALAC (France), and Alltech (US), among others in the feed additives market strategies. The report also helps stakeholders understand the feed additives market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- Adm

- International Flavors & Fragrances Inc.

- Evonik Industries AG

- BASF SE

- DSM-Firmenich

- Alltech

- Ajinomoto Co. Inc.

- Novonesis Group

- Adisseo

- Jubilant Ingrevia Limited

- Nutreco

- Brf Global

- Volac International Ltd.

- Kemin Industries, Inc.

- Lallemand Inc.

- Bentoli

- Neospark Drugs and Chemicals Private Limited

- Novus International, Inc.

- Global Nutrition International

- Vitalac

- Tex Biosciences (P) Ltd.

- Centafarm Srl

- Nuqo Feed Additives

- Palital Feed Additives B.V.

- Phytobiotics Futterzusatzstoffe GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 398 |

| Published | January 2025 |

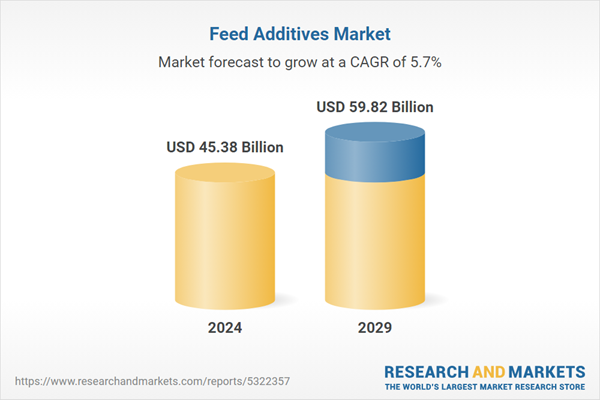

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 45.38 Billion |

| Forecasted Market Value ( USD | $ 59.82 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |