Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction that frames fine chemicals as critical innovation drivers while highlighting supply chain, sustainability, and partnership imperatives

The fine chemicals sector sits at the intersection of advanced materials science and practical industrial application, making it a pivotal enabler of innovation across pharmaceuticals, agrochemicals, electronics, coatings, and specialty manufacturing. This introduction frames the landscape by underscoring how incremental improvements in reagent performance, process efficiency, and regulatory compliance cascade into measurable advantages for formulators and end users. It also contextualizes current market dynamics by highlighting supply chain complexity, the rising premium on sustainability, and the accelerating pace of chemical innovation driven by computational design and green chemistry principles.Moreover, evolving customer expectations are causing a shift from commodity purchasing toward strategic partnerships with suppliers that can provide technical support, regulatory guidance, and risk mitigation. In this environment, differentiation is increasingly achieved through product stewardship, quality consistency, and the ability to deliver integrated solutions rather than standalone components. As a result, decision-makers are placing higher value on traceability, lifecycle impacts, and the resilience of sourcing strategies. This introduction, therefore, establishes the foundational perspectives and themes that guide the deeper analysis, emphasizing practical implications for procurement leaders, product developers, and corporate strategists seeking to navigate change and capture opportunity in the fine chemicals arena.

A clear examination of the fundamental technological, regulatory, sustainability, and commercial shifts reshaping competitive dynamics and value chains

The landscape for fine chemicals is undergoing a set of transformative shifts that are redefining competitive boundaries and operational priorities. Technological innovation is accelerating the discovery and scale-up of specialty molecules through advanced catalysis, precision synthesis, and automated process optimization, which together reduce cycle times and enable more complex chemistries to reach commercialization. Simultaneously, regulatory expectations are tightening around impurity profiles, environmental emissions, and documentation, pushing manufacturers to invest in stronger analytical capability and compliance systems.Another major shift is the integration of sustainability as a core strategic lens; suppliers are embedding lifecycle thinking into product development, from sourcing bio-based feedstocks to improving energy and solvent efficiency in manufacturing. Market participants are also revisiting geographic footprint and inventory strategies in response to geopolitical friction and logistiscal fragility, making regional resilience and supplier diversification critical topics. Finally, the nature of customer-supplier relationships is evolving toward collaborative models where co-development, technical services, and long-term contracts become the mainstay. Taken together, these shifts create both challenges and opportunities for organizations that can combine technical excellence with adaptive commercial models and robust governance practices.

An in-depth analysis of how 2025 tariff adjustments are prompting strategic supply chain reconfiguration, sourcing shifts, and resilience investments across the sector

The introduction of new tariffs and trade measures in 2025 has added a material layer of complexity to the global fine chemicals ecosystem, prompting rapid reassessments of sourcing, manufacturing location, and cost management strategies. As import duties and related trade policy instruments have been applied selectively across certain product lines and origins, supply chain teams have had to weigh the trade-offs between cost, lead time, and supplier reliability with renewed urgency. This environment has encouraged nearshoring and the reconfiguration of multi-supplier strategies to buffer exposure to asymmetric tariff impacts.Procurement functions are responding by increasing transparency into landed cost calculations and by strengthening contractual terms such as long-term agreements, hedging arrangements for key feedstocks, and more granular incoterm negotiations. In parallel, companies are accelerating investments in domestic or regional capacity for critical intermediates to reduce dependence on products subject to punitive tariffs. Regulatory and customs compliance capabilities are being augmented to ensure correct tariff classifications and to take advantage of available preferential trade arrangements where feasible. Ultimately, the cumulative impact of these tariff changes has been to raise the strategic premium on supply chain intelligence, manufacturing flexibility, and the ability to rapidly operationalize alternative sourcing pathways.

Comprehensive segmentation insights that reveal how type, chemistry, end-user applications, and distribution channels shape strategic priorities, development paths, and go-to-market approaches

Segmentation-based insights reveal differentiated drivers of demand, route-to-market considerations, and innovation priorities across the fine chemicals value chain. Based on type, performance-sensitive categories such as catalysts and free radical initiators command intensive application support and strict quality controls, whereas surfactants and extractants are often assessed on cost-to-performance and regulatory profiles. Cross-linking and curing agents require deep formulation know-how to ensure compatibility and stability, and vulcanizing agents involve particular regulatory and safety management attention in elastomer processing.Based on chemistry, the divide between bio-based and synthetic chemistries is becoming a strategic axis; bio-based alternatives are gaining traction where lifecycle benefits and consumer-facing sustainability claims provide differentiation, while synthetic routes remain dominant where scale, cost efficiency, and molecular specificity are paramount. Based on end user, demand patterns differ markedly across industries: agriculture requires agrochemical intermediates and soil enhancement solutions with attention to environmental acceptability; electronics demands ultra-high purity chemistries and tight contamination control; food and beverages relies on colorants and emulsifiers with rigorous safety and sensory performance criteria; paints and coatings prioritize dispersion, durability, and regulatory compliance; pharmaceuticals call for active pharmaceutical ingredients and excipients with validated supply chains and traceability; textiles evaluates coating chemicals and dyes for colorfastness and process compatibility; and water treatment focuses on treatment chemistries that meet regulatory and operational constraints. The agriculture segment subdivides into crop protection and soil enhancement, each with distinct formulation and delivery challenges. The food & beverages segment differentiates between colorants and emulsifiers, which face different technical and regulatory hurdles. The pharmaceuticals segment separates active pharmaceutical ingredients and excipients, reflecting contrasting purity, regulatory, and manufacturing demands. The textiles segment splits into coating chemicals and dyes, which require separate performance and environmental profiles.

Based on distribution channel, offline and online pathways create divergent expectations for order size, lead time, and technical support. Offline channels continue to serve large-volume industrial customers with integrated logistics and in-person technical services, while online channels are changing procurement behaviors for smaller volumes, specialty blends, and rapid reordering, requiring enhanced digital product data and e-commerce-enabled aftersales support. Together, these segmentation lenses inform prioritization of R&D, regulatory investment, go-to-market approaches, and customer engagement models for firms seeking to align their capabilities with the nuanced requirements of each segment.

Key regional perspectives highlighting North and South American manufacturing strength, EMEA sustainability leadership, and Asia-Pacific production scale and market expansion

Regional dynamics in fine chemicals exhibit clear but distinct patterns of demand, capability, and strategic focus that shape where investment and supply chain resilience are being built. In the Americas, there is strong emphasis on advanced manufacturing, high-value pharmaceutical intermediates, and agricultural chemistry innovation, supported by a large domestic market, established regulatory frameworks, and active private investment. Firms in this region tend to prioritize regulatory compliance, intellectual property protection, and closer integration with customers in North and South America to reduce lead times and improve aftersales technical support.Europe, the Middle East & Africa present a mosaic of mature regulatory regimes, sustainability-oriented policy drivers, and an increasing focus on circular economy solutions. European customers often lead on stringent environmental and safety expectations, prompting producers to advance solvent reduction, waste minimization, and alternative feedstock adoption. The Middle East is emphasizing downstream chemical value chain development and feedstock-based investments, whereas parts of Africa are emerging as markets for agricultural inputs and basic specialty chemicals, creating a diverse set of commercial opportunities and logistical requirements.

Asia-Pacific remains a focal point for large-scale production, complex supply networks, and rapid end-market growth, particularly in electronics, textiles, and consumer goods. Capacity expansion and technology adoption in this region continue to shape global supply dynamics, while rising domestic regulatory scrutiny and local content considerations are influencing investment decisions. Across all regions, companies are balancing cost competitiveness with the need to meet increasingly stringent quality and sustainability standards, which is driving investments in analytics, traceability, and regional manufacturing flexibility.

A focused analysis of competitive positioning, capability-based differentiation, and partnership strategies that define leadership and specialization in the sector

Competitive dynamics among leading firms reflect a combination of deep technical expertise, targeted portfolio differentiation, and service-oriented commercial models. Market leaders typically combine robust R&D pipelines with strong regulatory and quality systems, enabling them to support complex customer requirements across pharmaceuticals, agrochemicals, and specialty applications. These organizations often invest in application laboratories, on-site technical teams, and collaborative development projects that reduce customer time-to-market while deepening commercial relationships.Mid-sized specialists are carving out defensible niches by focusing on high-margin product families, bespoke formulations, or service bundles such as regulatory dossier preparation and custom packaging solutions. Their agility allows rapid response to customer-specific needs and emerging regulatory shifts. Smaller innovators and start-ups are leveraging platform chemistries, green-process technologies, and digital tools to displace incumbents in specific subsegments or to provide white-label components used by larger formulators.

Across the competitive spectrum, partnerships and alliances are increasingly common, as firms seek complementary capabilities in catalysis, analytics, or distribution to accelerate growth. Strategic M&A activity targets portfolio consolidation, entry into adjacent end-markets, or acquisition of specialized regulatory and quality assets. Overall, success is defined not just by product breadth but by the ability to integrate technical services, ensure transparent compliance, and deliver consistent supply under varying market conditions.

Practical, high-impact recommendations for executives to build resilience, advance sustainability, and monetize technical services while managing regulatory and tariff risks

To convert insight into tangible advantage, industry leaders should adopt a set of actionable measures that balance short-term resilience with long-term strategic positioning. First, organizations should prioritize strengthening supply chain transparency and scenario planning so they can rapidly shift sourcing and production in response to tariff changes, raw material volatility, or logistics disruptions. Investments in digital tools for landed cost modeling, supplier risk scoring, and demand sensing will materially improve decision-making under uncertainty.Second, embedding sustainability into product roadmaps and operational processes will unlock customer demand and preempt regulatory nosewinds. This includes scaling bio-based feedstocks where feasible, reducing solvent and energy intensity, and designing products for improved end-of-life profiles. Third, firms should evolve commercial models to emphasize technical services and co-development agreements, thereby deepening customer relationships and creating higher switching costs. Fourth, targeted capability-building in analytics, regulatory affairs, and quality systems will be critical for accessing high-value markets such as pharmaceuticals and electronics. Finally, executives should pursue a balanced footprint strategy that blends cost-efficient production with regional hubs able to meet local regulatory requirements and shorten lead times. By sequencing these actions pragmatically, leaders can enhance competitiveness while reducing exposure to external shocks.

A transparent, practitioner-focused research methodology combining expert interviews, technical literature synthesis, and cross-validated case analysis to ensure actionable credibility

The research methodology integrates primary and secondary approaches to deliver robust, reproducible insight that supports strategic decision-making. Primary research involved structured interviews with industry leaders, technical experts, procurement professionals, and regulatory specialists to capture qualitative perspectives on innovation trends, commercial models, and operational challenges. These conversations were designed to elicit practitioner experience regarding supply chain adaptations, product performance expectations, and customer-supplier dynamics.Secondary research synthesized patent literature, regulatory guidance documents, technical journals, and public company disclosures to corroborate innovation trajectories and to identify benchmark practices in manufacturing and sustainability. Where appropriate, case studies of manufacturing redesigns, green chemistry adoption, and regulatory compliance programs were analyzed to derive practical lessons. Cross-validation techniques were used to reconcile differences between stated intentions and observable investments, and findings were iteratively tested with multiple expert sources to ensure credibility. The methodology emphasizes transparency in assumptions, traceability of qualitative inputs, and a practitioner-oriented lens that prioritizes actionable conclusions over theoretical constructs.

A conclusive synthesis emphasizing the strategic imperative of combining innovation, sustainability, and supply chain agility to secure long-term competitive advantage

In conclusion, the fine chemicals sector is at an inflection point where technical innovation, sustainability demands, and evolving trade policies converge to redefine competitive advantage. Companies that invest in advanced analytics, regulatory excellence, and sustainable process design will be best positioned to capture differentiated demand across pharmaceuticals, agrochemicals, coatings, electronics, and consumer-facing markets. At the same time, strategic supply chain redesign and enhanced sourcing intelligence are essential responses to tariff-induced complexity and geopolitical uncertainty.Decision-makers should therefore adopt an integrated approach that aligns R&D priorities with regulatory strategy and customer engagement models, while maintaining flexible manufacturing footprints that can be adapted to regional requirements. By doing so, organizations will not only mitigate risk but also create commercial opportunities through differentiated product performance, improved lifecycle profiles, and deeper technical partnerships. The path forward requires disciplined execution, targeted investment, and ongoing monitoring of policy and market signals to ensure sustained competitiveness.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Fine Chemicals Market

Companies Mentioned

- ACTYLIS

- Albemarle Corporation

- Arkema S.A.

- BASF SE

- Belami Fine Chemicals

- Catalent, Inc.

- Croda International Plc

- DC Fine Chemicals S. L

- Eastman Chemical Company

- Eternis Fine Chemicals

- Eternis Fine Chemicals Limited

- Johnson Matthey PLC

- LANXESS AG

- Lotte Fine Chemical

- Mitsubishi Chemical Group Corporation.

- Nouryon Chemicals Holding B.V.

- Organic Fine Chemicals

- Oxford Lab Fine Chem LLP.

- Royal DSM N.V.

- Sarex

- Solvay SA

- Sumitomo Corporation

- Toray Fine Chemicals Co., Ltd.

- W. R. Grace & Co.

- WeylChem International GmbH

Table Information

| Report Attribute | Details |

|---|---|

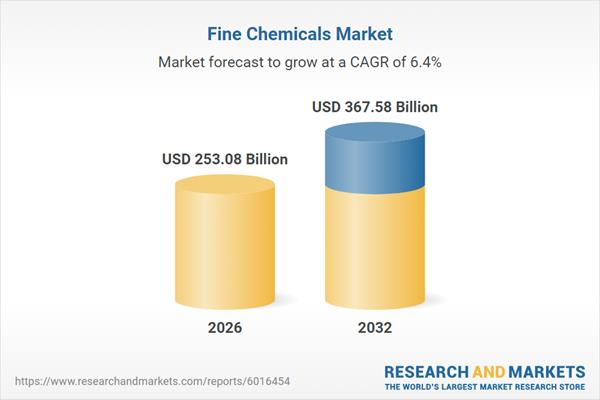

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 253.08 Billion |

| Forecasted Market Value ( USD | $ 367.58 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |