List of Tables

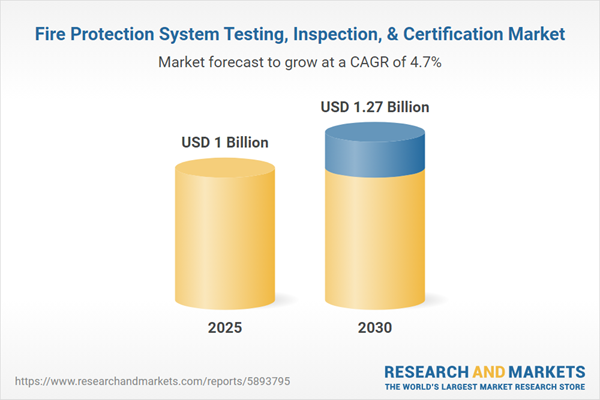

TABLE 1. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, 2018-2030 (USD THOUSAND)

TABLE 2. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD THOUSAND)

TABLE 3. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 4. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 5. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 6. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CERTIFICATION, 2018-2030 (USD THOUSAND)

TABLE 7. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 8. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 9. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 10. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSTALLATION CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 11. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSTALLATION CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 12. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSTALLATION CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 13. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MAINTENANCE CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 14. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MAINTENANCE CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 15. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MAINTENANCE CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 16. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PERSONNEL CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 17. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PERSONNEL CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 18. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PERSONNEL CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 19. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SYSTEM CERTIFICATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 20. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SYSTEM CERTIFICATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 21. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SYSTEM CERTIFICATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 22. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 23. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 24. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 25. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSPECTION, 2018-2030 (USD THOUSAND)

TABLE 26. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 27. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 28. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMPLIANCE INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 29. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONTROL PANEL INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 30. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONTROL PANEL INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 31. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONTROL PANEL INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 32. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MECHANICAL INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 33. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MECHANICAL INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 34. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MECHANICAL INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 35. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SITE INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 36. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SITE INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 37. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SITE INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 38. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY VISUAL INSPECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 39. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY VISUAL INSPECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 40. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY VISUAL INSPECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 41. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 42. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 43. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 44. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY TESTING, 2018-2030 (USD THOUSAND)

TABLE 45. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLOW TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 46. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLOW TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 47. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLOW TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 48. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FUNCTIONAL TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 49. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FUNCTIONAL TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 50. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FUNCTIONAL TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 51. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HYDROSTATIC TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 52. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HYDROSTATIC TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 53. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HYDROSTATIC TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 54. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRESSURE TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 55. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRESSURE TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 56. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRESSURE TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 57. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY THERMAL TESTING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 58. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY THERMAL TESTING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 59. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY THERMAL TESTING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 60. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SYSTEM TYPE, 2018-2030 (USD THOUSAND)

TABLE 61. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DETECTORS & SENSORS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 62. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DETECTORS & SENSORS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 63. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DETECTORS & SENSORS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 64. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DETECTORS & SENSORS, 2018-2030 (USD THOUSAND)

TABLE 65. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLAME DETECTORS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 66. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLAME DETECTORS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 67. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FLAME DETECTORS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 68. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEAT DETECTORS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 69. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEAT DETECTORS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 70. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEAT DETECTORS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 71. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SMOKE DETECTORS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 72. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SMOKE DETECTORS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 73. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SMOKE DETECTORS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 74. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE ALARM SYSTEMS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 75. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE ALARM SYSTEMS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 76. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE ALARM SYSTEMS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 77. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE ALARM SYSTEMS, 2018-2030 (USD THOUSAND)

TABLE 78. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONVENTIONAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 79. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONVENTIONAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 80. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONVENTIONAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 81. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WIRELESS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 82. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WIRELESS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 83. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WIRELESS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 84. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE EXTINGUISHERS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 85. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE EXTINGUISHERS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 86. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE EXTINGUISHERS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 87. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE EXTINGUISHERS, 2018-2030 (USD THOUSAND)

TABLE 88. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO2 EXTINGUISHER, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 89. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO2 EXTINGUISHER, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 90. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO2 EXTINGUISHER, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 91. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY CHEMICAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 92. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY CHEMICAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 93. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY CHEMICAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 94. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOAM EXTINGUISHER, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 95. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOAM EXTINGUISHER, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 96. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOAM EXTINGUISHER, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 97. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WATER EXTINGUISHER, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 98. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WATER EXTINGUISHER, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 99. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WATER EXTINGUISHER, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 100. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET CHEMICAL EXTINGUISHER, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 101. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET CHEMICAL EXTINGUISHER, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 102. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET CHEMICAL EXTINGUISHER, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 103. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PASSIVE FIRE PROTECTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 104. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PASSIVE FIRE PROTECTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 105. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PASSIVE FIRE PROTECTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 106. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PASSIVE FIRE PROTECTION, 2018-2030 (USD THOUSAND)

TABLE 107. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DAMPERS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 108. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DAMPERS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 109. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DAMPERS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 110. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DOORS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 111. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DOORS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 112. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRE DOORS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 113. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRESTOPPING SYSTEMS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 114. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRESTOPPING SYSTEMS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 115. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FIRESTOPPING SYSTEMS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 116. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INTUMESCENT COATINGS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 117. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INTUMESCENT COATINGS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 118. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INTUMESCENT COATINGS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 119. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SPRINKLER SYSTEMS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 120. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SPRINKLER SYSTEMS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 121. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SPRINKLER SYSTEMS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 122. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SPRINKLER SYSTEMS, 2018-2030 (USD THOUSAND)

TABLE 123. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DELUGE, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 124. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DELUGE, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 125. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DELUGE, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 126. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY PIPE, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 127. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY PIPE, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 128. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DRY PIPE, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 129. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRE-ACTION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 130. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRE-ACTION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 131. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY PRE-ACTION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 132. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET PIPE, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 133. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET PIPE, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 134. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WET PIPE, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 135. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FREQUENCY, 2018-2030 (USD THOUSAND)

TABLE 136. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 137. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 138. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 139. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MONTHLY, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 140. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MONTHLY, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 141. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MONTHLY, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 142. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY QUARTERLY, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 143. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY QUARTERLY, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 144. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY QUARTERLY, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 145. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SEMIANNUAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 146. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SEMIANNUAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 147. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY SEMIANNUAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 148. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CONTRACT TYPE, 2018-2030 (USD THOUSAND)

TABLE 149. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL MAINTENANCE CONTRACT, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 150. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL MAINTENANCE CONTRACT, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 151. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ANNUAL MAINTENANCE CONTRACT, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 152. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MULTI-YEAR FRAMEWORK AGREEMENT, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 153. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MULTI-YEAR FRAMEWORK AGREEMENT, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 154. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MULTI-YEAR FRAMEWORK AGREEMENT, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 155. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ON-DEMAND/CALL-OUT, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 156. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ON-DEMAND/CALL-OUT, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 157. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ON-DEMAND/CALL-OUT, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 158. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INSTALLATION TYPE, 2018-2030 (USD THOUSAND)

TABLE 159. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY NEW INSTALLATION, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 160. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY NEW INSTALLATION, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 161. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY NEW INSTALLATION, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 162. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETROFIT, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 163. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETROFIT, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 164. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETROFIT, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 165. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DELIVERY MODE, 2018-2030 (USD THOUSAND)

TABLE 166. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ONSITE, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 167. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ONSITE, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 168. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY ONSITE, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 169. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY REMOTE MONITORING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 170. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY REMOTE MONITORING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 171. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY REMOTE MONITORING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 172. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OWNERSHIP MODEL, 2018-2030 (USD THOUSAND)

TABLE 173. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO-MANAGED, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 174. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO-MANAGED, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 175. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CO-MANAGED, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 176. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY IN-HOUSE, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 177. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY IN-HOUSE, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 178. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY IN-HOUSE, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 179. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OUTSOURCED, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 180. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OUTSOURCED, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 181. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OUTSOURCED, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 182. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY END USER, 2018-2030 (USD THOUSAND)

TABLE 183. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMMERCIAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 184. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMMERCIAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 185. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMMERCIAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 186. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY COMMERCIAL, 2018-2030 (USD THOUSAND)

TABLE 187. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DATA CENTERS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 188. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DATA CENTERS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 189. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY DATA CENTERS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 190. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY EDUCATIONAL INSTITUTES, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 191. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY EDUCATIONAL INSTITUTES, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 192. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY EDUCATIONAL INSTITUTES, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 193. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEALTHCARE FACILITIES, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 194. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEALTHCARE FACILITIES, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 195. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HEALTHCARE FACILITIES, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 196. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HOSPITALITY, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 197. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HOSPITALITY, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 198. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY HOSPITALITY, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 199. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OFFICES & CORPORATE CAMPUSES, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 200. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OFFICES & CORPORATE CAMPUSES, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 201. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OFFICES & CORPORATE CAMPUSES, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 202. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETAIL & MALLS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 203. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETAIL & MALLS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 204. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY RETAIL & MALLS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 205. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WAREHOUSING & LOGISTICS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 206. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WAREHOUSING & LOGISTICS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 207. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY WAREHOUSING & LOGISTICS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 208. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INDUSTRIAL, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 209. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INDUSTRIAL, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 210. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INDUSTRIAL, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 211. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY INDUSTRIAL, 2018-2030 (USD THOUSAND)

TABLE 212. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CHEMICALS & PHARMACEUTICALS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 213. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CHEMICALS & PHARMACEUTICALS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 214. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY CHEMICALS & PHARMACEUTICALS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 215. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOOD & BEVERAGE PROCESSING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 216. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOOD & BEVERAGE PROCESSING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 217. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY FOOD & BEVERAGE PROCESSING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 218. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MANUFACTURING, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 219. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MANUFACTURING, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 220. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MANUFACTURING, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 221. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MINING & METALS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 222. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MINING & METALS, BY GROUP, 2018-2030 (USD THOUSAND)

TABLE 223. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY MINING & METALS, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 224. GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, & CERTIFICATION MARKET SIZE, BY OIL & GAS, BY REGION, 2018-2030 (USD THOUSAND)

TABLE 225. GLOBAL FIRE P