Global Gastroenterology Market - Key Trends & Drivers Summarized

Why Is Gastroenterology Becoming a Key Focus in Modern Medicine?

Gastroenterology, the branch of medicine focused on the digestive system and its disorders, has become an increasingly critical field in modern healthcare due to the rising prevalence of digestive diseases globally. The growing incidence of conditions such as irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), inflammatory bowel diseases (IBD) like Crohn's disease and ulcerative colitis, and liver diseases like non-alcoholic fatty liver disease (NAFLD) is propelling the demand for specialized care in gastroenterology. Factors such as aging populations, changes in dietary habits, increased awareness of digestive health, and the global rise in conditions like obesity and diabetes contribute to the growing burden of gastrointestinal disorders. Additionally, environmental and genetic factors are increasingly being recognized as major contributors to gastrointestinal diseases, making gastroenterology more relevant in understanding both the etiology and treatment of these conditions. As a result, gastroenterology has become an essential part of preventive healthcare, with early diagnosis and management being crucial for improving patient outcomes. Advances in diagnostics, treatments, and a growing emphasis on personalized medicine are making gastroenterology an exciting and rapidly evolving area of modern healthcare, with an increasing number of healthcare providers and researchers focusing on this field to address the growing global health challenge.How Are Technological Advancements Transforming Gastroenterology Practices?

Technological advancements have dramatically transformed the field of gastroenterology, significantly improving both diagnostic accuracy and treatment effectiveness. In diagnostic imaging, the development of high-definition endoscopy, capsule endoscopy, and confocal laser endomicroscopy (CLE) has enhanced the ability to detect gastrointestinal abnormalities at earlier stages. For instance, capsule endoscopy allows for the non-invasive visualization of the entire gastrointestinal tract, particularly the small intestine, a traditionally difficult area to assess. Additionally, advancements in biomarkers and molecular testing are allowing for more accurate diagnosis and personalized treatment plans, particularly in the case of colorectal cancer, where genetic testing can help identify risk factors and tailor therapies. Artificial intelligence (AI) is also playing a growing role in gastroenterology, particularly in the analysis of endoscopic images and patient data to identify patterns that may be difficult for human practitioners to detect. AI algorithms can assist in early detection of gastrointestinal cancers, inflammatory diseases, and other conditions by identifying subtle changes in imaging and laboratory results. Furthermore, the use of minimally invasive techniques, such as endoscopic ultrasound (EUS) and endoscopic retrograde cholangiopancreatography (ERCP), has significantly reduced patient recovery time and risk of complications compared to traditional surgical methods. These technological innovations are improving patient outcomes, enhancing treatment precision, and enabling earlier detection and more effective management of gastrointestinal disorders.What Are the Key Factors Driving Growth in the Gastroenterology Market?

The gastroenterology market is experiencing significant growth due to several driving factors, including an aging population, lifestyle changes, and increasing awareness of gastrointestinal health. As the global population ages, there is a higher incidence of gastrointestinal diseases such as colorectal cancer, liver diseases, and functional gastrointestinal disorders, which are more common in older adults. Additionally, lifestyle factors such as poor diet, lack of exercise, and high stress levels have contributed to an increase in conditions like obesity, GERD, and IBD. The rising prevalence of obesity, which is closely linked to conditions like NAFLD and gastroesophageal reflux disease, is becoming a global health crisis, particularly in developed countries. As awareness of the connection between lifestyle and gastrointestinal health grows, more people are seeking preventive care, regular screenings, and treatments for digestive disorders. The rise in global awareness of conditions like colorectal cancer and hepatitis C has also contributed to the increasing demand for gastroenterology services. The development of screening programs, particularly for colorectal cancer, has led to higher detection rates and better outcomes, further driving the growth of the gastroenterology market. Additionally, increasing access to healthcare in emerging economies is expanding the reach of gastroenterology services, where rising middle-class populations are demanding better care for digestive disorders. The expansion of specialized gastroenterology centers and the growing availability of advanced diagnostics and treatments are helping to address the growing global burden of digestive diseases.What Are the Primary Drivers Behind the Growth of the Gastroenterology Market?

The growth of the gastroenterology market is driven by several factors that combine advancements in technology, increasing disease prevalence, and a focus on patient-centered care. A key driver is the rising global prevalence of gastrointestinal diseases, particularly conditions like IBD, colorectal cancer, and NAFLD, which are more common due to modern lifestyle factors such as poor diets, smoking, and sedentary lifestyles. As these diseases become more prevalent, there is a greater demand for gastroenterology specialists, diagnostics, and treatments to manage these conditions. Additionally, technological innovations in diagnostics and treatments, such as AI-assisted endoscopy and minimally invasive surgeries, are improving the accuracy, speed, and patient outcomes associated with gastroenterology procedures. The integration of genomics into gastroenterology is also driving growth, as the field moves toward personalized medicine and targeted therapies for gastrointestinal diseases. The increasing focus on preventive care is another significant growth driver. With improved access to screenings for colorectal cancer, hepatitis, and other gastrointestinal diseases, healthcare systems can catch these conditions at earlier stages, leading to more effective treatment and improved survival rates. Moreover, the expanding middle class in emerging markets is contributing to the global growth of gastroenterology services, as more people seek specialized care for digestive disorders. Public health campaigns, government initiatives, and international efforts to raise awareness of gastrointestinal diseases are further fueling the demand for gastroenterology services. Finally, the growing interest in gut microbiota and its role in gastrointestinal health and overall well-being is sparking new research and treatment options, positioning gastroenterology at the forefront of medical innovation. Together, these factors are driving the expansion of the gastroenterology market and enhancing the quality of care for patients with digestive diseases worldwide.Report Scope

The report analyzes the Gastroenterology market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Drug Type (Biologics / Biosimilars, Antacids, Laxatives, Antidiarrheal Agents, Antiemetics, Antiulcer Agents, Other Drug Types); Disease Type (Inflammatory Bowel Diseases, Crohn's Disease, Ulcerative Colitis, Irritable Bowel Syndrome, Gastroesophageal Reflux Disease, Liver Diseases, Colorectal Cancer, Other Disease Types); Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biologics / Biosimilars segment, which is expected to reach US$11.3 Billion by 2030 with a CAGR of a 3.8%. The Antacids segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.3 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $8.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gastroenterology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gastroenterology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gastroenterology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Abbott Laboratories, Akums Drugs and Pharmaceuticals, AstraZeneca plc, Bayer AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Gastroenterology market report include:

- AbbVie Inc.

- Abbott Laboratories

- AstraZeneca plc

- Bayer AG

- Bausch Health Companies Inc.

- Boehringer Ingelheim GmbH

- Boston Scientific Corporation

- Cipla Ltd.

- Ferring Pharmaceuticals

- GI Alliance

- GlaxoSmithKline plc

- Johnson & Johnson

- Medtronic plc

- Novartis AG

- Olympus Corporation

- Pfizer Inc.

- Salix Pharmaceuticals

- Sanofi S.A.

- Sebela Pharmaceuticals

- Takeda Pharmaceutical Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Abbott Laboratories

- AstraZeneca plc

- Bayer AG

- Bausch Health Companies Inc.

- Boehringer Ingelheim GmbH

- Boston Scientific Corporation

- Cipla Ltd.

- Ferring Pharmaceuticals

- GI Alliance

- GlaxoSmithKline plc

- Johnson & Johnson

- Medtronic plc

- Novartis AG

- Olympus Corporation

- Pfizer Inc.

- Salix Pharmaceuticals

- Sanofi S.A.

- Sebela Pharmaceuticals

- Takeda Pharmaceutical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 401 |

| Published | February 2026 |

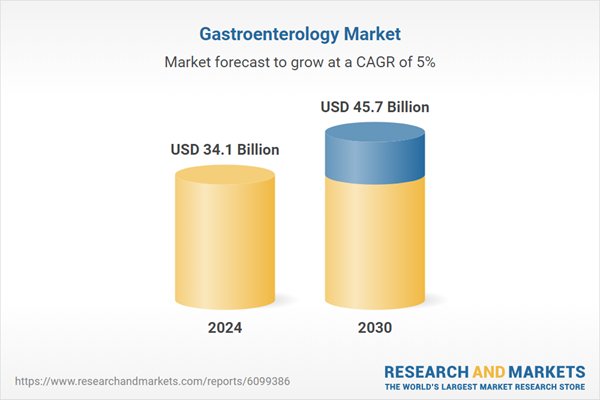

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.1 Billion |

| Forecasted Market Value ( USD | $ 45.7 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |