Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Manufacturers are also introducing purpose-built electric vans, trucks, and buses to meet the specific needs of last-mile delivery, public transport, and urban freight operations. A key trend shaping the market is the integration of connected and autonomous features in electric commercial vehicles to enhance route optimization, safety, and efficiency. Battery-swapping models, modular vehicle architectures, and flexible leasing programs are gaining traction among fleet operators aiming to reduce upfront costs.

Market Drivers

Fleet Electrification by Logistics and Delivery Companies

The increasing push by logistics, retail, and courier companies to electrify their fleets is significantly driving the electric commercial vehicle market. With rising fuel costs and pressure to meet environmental targets, companies are prioritizing electric vans and light trucks for urban and last-mile delivery operations. The growing e-commerce sector has accelerated the need for efficient and eco-friendly delivery solutions. Electric vehicles offer lower operational costs, reduced emissions, and access to low-emission zones, making them highly attractive for businesses focused on sustainability. Leasing options and total cost of ownership models are also facilitating adoption by minimizing upfront costs.Major logistics players are entering long-term agreements with electric vehicle manufacturers, leading to bulk orders and faster deployment of supporting infrastructure. The availability of purpose-built electric commercial vehicles tailored for specific operational needs is accelerating this transition. For instance, DHL Group has partnered with E.ON to install fast-charging infrastructure for heavy electric commercial vehicles at its German distribution centers. The setup includes tailored solutions like dock-integrated and overhead cable chargers, with access also available to DHL service partners. DHL currently operates 35 e-trucks and over 35,200 electric delivery vehicles, aiming for 60% fleet electrification by 2030 as part of its Strategy 2025 to reduce logistics-related emissions below 29 million tons CO₂e.

Key Market Challenges

Limited Charging Infrastructure for Commercial Use

The lack of adequate and specialized charging infrastructure for commercial electric vehicles remains a major challenge. While charging networks for passenger EVs have expanded in recent years, the needs of commercial fleets differ in terms of power capacity, space requirements, and turnaround times. Commercial vehicles often require overnight depot charging or high-power fast charging to remain operational without impacting delivery schedules.However, the limited availability of dedicated fleet charging hubs, especially those capable of servicing heavy-duty electric trucks, is slowing down adoption. The installation of such infrastructure requires substantial capital investment, land availability, and grid connectivity, all of which involve complex regulatory approvals and long timelines. Charging downtime translates into lost productivity for commercial operators, making infrastructure availability critical to the vehicle's viability.

Key Market Trends

Adoption of Connected Fleet and Telematics Solutions

The integration of connected technologies and telematics in electric commercial vehicles is emerging as a defining trend in fleet management. These systems offer real-time insights into vehicle performance, battery status, route efficiency, and driver behavior, enabling data-driven decision-making. Fleet managers can optimize delivery routes based on traffic, charging station availability, and energy consumption patterns, which enhances operational efficiency and reduces downtime. Predictive maintenance alerts triggered by sensor data help reduce unexpected breakdowns and extend vehicle lifespan. Remote diagnostics, software updates over the air, and intelligent energy management are making electric fleets smarter and more autonomous. Connectivity features also aid in complying with regulatory requirements by generating automated reports on vehicle emissions, usage patterns, and maintenance history.Key Market Players

- Daimler AG

- Volkswagen AG

- MAN Truck & Bus AG

- IVECO Magirus AG

- Renault Trucks Deutschland GmbH

- Ford-Werke GmbH

- AB Volvo

- Scania AB

- Toyota Motor Corporation

- Volta Commercial Vehicles

Report Scope:

In this report, the Germany Electric Commercial Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Germany Electric Commercial Vehicle Market, By Vehicle Type:

- Light Commercial Vehicle (LCV)

- Medium Commercial Vehicle (MCV)

- Heavy Commercial Vehicle (HCV)

Germany Electric Commercial Vehicle Market, By Propulsion:

- BEV

- HEV

- PHEV

- FCEV

Germany Electric Commercial Vehicle Market, By Range:

- 0-150 Miles

- 151-250 Miles

- 251-500 Miles

- Above 500 Miles

Germany Electric Commercial Vehicle Market, By Battery Capacity:

- Up to 100 kWh

- 101-200 kWh

- above 200 kWh

Germany Electric Commercial Vehicle Market, By Region:

- South-West

- South-East

- North-West

- North-East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Germany Electric Commercial Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daimler AG

- Volkswagen AG

- MAN Truck & Bus AG

- IVECO Magirus AG

- Renault Trucks Deutschland GmbH

- Ford-Werke GmbH

- AB Volvo

- Scania AB

- Toyota Motor Corporation

- Volta Commercial Vehicles

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

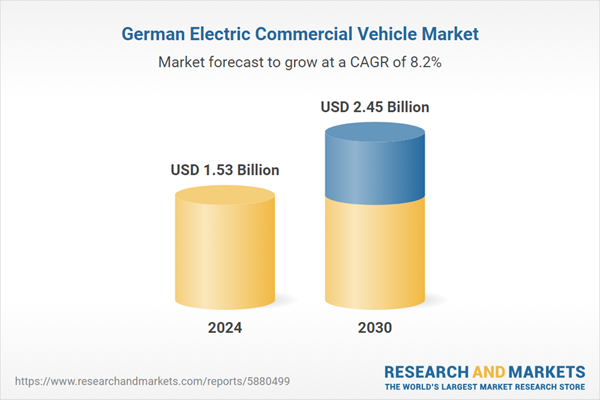

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.53 Billion |

| Forecasted Market Value ( USD | $ 2.45 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Germany |

| No. of Companies Mentioned | 10 |