COVID-19 affected the German endoscopy devices market significantly. Endoscopic services were adversely affected due to the outbreak of the pandemic. As per the article published in the European Journal of Medical Research in March 2022, endoscopic societies in Germany first advised a decrease in endoscopic procedures in response to COVID-19, and endoscopies that aren't urgent were delayed in particular. Moreover, as per the suggestions of the specialist societies regarding the COVID-19 pandemic, on 18th March 2020, the European Society of Gastrointestinal Endoscopy (ESGE) issued recommendations for the handling of COVID-19 patients in endoscopy units, which were adopted by the German specialist society DGVS (German Society for Gastroenterology, Digestive and Metabolic Diseases). The above factors have led to a decrease in market growth during the initial phases, but as the guidelines for endoscopy for COVID-19 have been issued, there will be significant growth of the market in the later phases of the pandemic, and the market is to reach pre-pandemic levels by mid-2023.

The growth in the German endoscopy devices market is predominantly due to the increasing patient preference for minimally invasive procedures, high incidences of chronic diseases, increased awareness related to an early screening of chronic diseases and treatment, technological advancements in endoscopy devices, acquisition between key market players, and the launch of new products. For instance, in November 2021, Fujifilm launched ColoAssist PRO, a real-time endoscope visualization system in Germany. The device is designed to assist endoscopists in performing colonoscopies such as colon polyp detection and characterization function utilizing AI technology. In addition, in April 2021, Erbe Elektromedizia acquired Germany-based Maxer endoscopy to expand its presence in the surgical endoscopy business in Germany. Therefore, such launches and acquisitions for the expansion of services of Endoscopy in Germany are expected to drive market growth due to the rise in the adoption of the products.

The increasing burden of common gastrointestinal (GI) conditions, such as diarrhea. Irritable bowel syndrome and colorectal cancer, among others, have been observed commonly in German patients. Furthermore, many times, there are chances of misdiagnosis among GI conditions. For instance, according to the study published in BMC Gastroenterology in February 2022, in Germany, the most prevalent functional condition of the gastrointestinal tract is irritable bowel syndrome (IBS) but many patients with IBS display complex gastrointestinal (GI) symptoms leading to an overlapping diagnosis of IBS and other GI diseases in many patients. Such studies will highlight the importance of endoscopy for the proper diagnosis of overlapping disease conditions, thereby increasing its adoption and driving market growth in the country.

As per the facts mentioned above, such as rising initiatives from the key market players and the importance of endoscopy in proper diagnosis, German endoscopy devices are expected to witness growth over the forecast period. However, the lack of skilled technicians may restrain the market growth.

Germany Endoscopy Devices Market Trends

Orthopedics Surgery Segment is Expected to Exhibit Fastest Growth Rate Over the Forecast Period

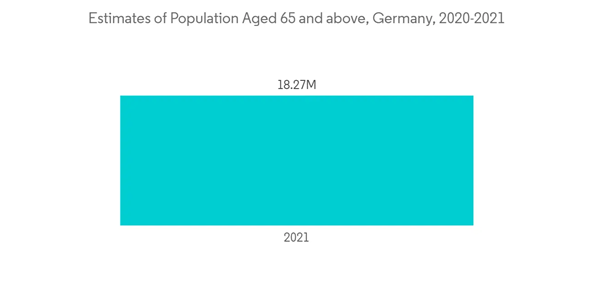

Orthopedic surgery is the branch of surgery concerned with conditions involving the musculoskeletal system. Orthopedic surgeons use both surgical and nonsurgical means to treat musculoskeletal trauma, spine diseases, sports injuries, degenerative diseases, infections, tumors, and congenital disorders. The advantages of endoscopic surgery in orthopedics are short rehabilitation periods, precise surgery, short hospital stays, and lower costs.Orthopedic Surgeries are also seen to be more prevalent in the geriatric population. In Germany, the percentage of the geriatric population is high and is expected to increase in the future. As per the World Bank statistics in 2022, the population aged 65 and above in Germany in 2021 was 18,269,366. Such a huge elderly population is expected to drive the growth of the segment as the elderly population is more prone to orthopedic conditions.

Moreover, the rising importance of endoscopy in orthopedic surgery is further expected to drive segment growth. For instance, according to the study published in Trauma in January 2022, endoscopic anterior intrapelvic plate osteosynthesis was possible in the majority of the cases investigated during the study. With this, endoscopic pelvic surgery will probably be a viable alternative in the future for specific pelvic trauma cases. Therefore, the rising importance of endoscopy in pelvic trauma is expected to drive segment growth due to the increased adoption of endoscopies in orthopedic surgery.

As per the factors mentioned above Orthopedic surgery segment is likely to witness growth over the forecast period.

Endoscopic Camera in the Visualization Equipment is Expected to Show a Significant Growth Over the Forecast Period.

During surgical endoscopic operations, high-definition endoscopic camera systems are utilized to capture still and moving images in the operating room. A variety of rigid and flexible scopes attached to the camera head transport the optical image from the surgical site to the camera head. The system comprises a camera head with an integrated cable connecting to the camera control unit (CCU).The factors driving the growth of this segment include rising initiatives for key market players, such as partnerships and exhibitions of the products in the German Market. For instance, in November 2021, OmniVision Technologies and Diaspective Vision GmbH, developer of high-quality hyperspectral and multispectral camera systems for medical applications, entered a partnership to develop a new type of endoscopic camera, the MALYNA system, which is based on proprietary multispectral imaging technology.

In addition, in November 2022, OMNIVISION announced that the OH02B imager and OCH2B camera used in the visualization endoscopy would be demonstrated in Germany on November 2022. The OH02B image sensors are used for various applications such as gastrointestinal, ENT, orthopedic, surgical, dental, and veterinarian reusable and disposable endoscopes, catheters, and guide wires.

Therefore, owing to the above-mentioned factors, the endoscopic camera segment is expected to show significant growth over the forecast period.

Germany Endoscopy Devices Industry Overview

The market is moderately competitive and consists of several global players. The key players in the market are implementing strategies such as partnerships for distribution, acquisition of other companies, and launch of products. Some of the players operating in the market are Stryker Corporation, Karl Storz GmbH, Medtronic PLC, B. Braun Melsungen AG, and Boston Scientific Corporation, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B. Braun Melsungen AG

- Boston Scientific Healthcare

- Fujifilm Holdings Corporation

- Johnson & Johnson

- Karl Storz GmbH

- Medtronic PLC

- Olympus Medical Systems Corporation

- Richard Wolf GmbH

- Steris Corporation

- Stryker Corporation