The healthcare system has witnessed enormous challenges as a result of the COVID-19 pandemic. All outpatient treatments were postponed or restricted during the early COVID-19 pandemic to reduce the risk of viral transmission, as most chronic therapies were regarded as non-urgent. An article published by PubMed in January 2021 indicated that there was an 8.8% decrease in patient admission for lung cancer-related surgeries and 14.7% for malignant brain tumor-related surgeries during the early pandemic in Germany. The reduction in the number of surgeries in the nation significantly affected the market growth. However, as the pandemic has subsided currently, surgeries are taking place normally; hence the studied market is expected to have stable growth during the forecast period of the study.

The increase in the number of road accidents and the growing demand for minimally invasive devices, along with the increased spending on healthcare, are major factors contributing to the growth of the studied market in the nation over the forecast period.

According to the Federal Statistics Office of Germany, data on traffic accidents in Germany released in August 2022, over 2,314,938 accidents were recorded in Germany in the year 2021, with around 325,691 persons injured in the accidents. With the rising accidents, the number of people injured and seeking surgery has also risen significantly. This is augmenting the demand for general surgical devices in the country.

The medical device industry of Germany is the largest in Europe, and it has got a considerable place in the global medical device industry. Due to the consistent growth of the German medical devices market and the sophisticated healthcare system, there is a good opportunity for companies to invest in this market. In Germany, the demand for highly innovative technologies and diagnostic, therapeutic, and minimally invasive equipment is more which is augmenting the growth of the general surgical devices market.

The product innovations by the key players in the region are likely to add to the market growth. For instance, in June 2022, NGMedical GmbH, a Germany-based medical device manufacturer, launched its new ART Fixation System in Europe. The ART Fixation System aids the surgeon with a fixation system to perform dorsal spinal stabilizations simply, quickly, and effectively. Such product innovations in medical devices are expected to boost the growth of the studied market over the forecast period.

Added to that, financial development in Germany, expanding attention to wellbeing-related issues, and rising interest in outpatient surgery are some of the other factors propelling the market growth. However, stringent regulations and improper reimbursement for surgical devices are expected to slow down the growth of the market over the forecast period.

Germany General Surgical Devices Market Trends

Handheld Surgical Devices to Witness Steady Growth Over the Forecast Period

Handheld surgical devices are becoming increasingly advanced. The development of advanced devices, like robotic handheld surgical devices for laparoscopic interventions, enhances a surgeon's dexterity. Many innovations have been made due to the need for high reliability, accuracy, and patient safety. New cordless handheld devices are one such innovation that has added a level of comfort and control for surgeons. For example, COVIDien's Lapro-ClipTM clip applier is a handheld medical device used to ligate blood vessels during laparoscopic surgery.An article published by PubMed in September 2021 discussed a study on the use of minimally invasive handheld surgical instruments, which was funded by the Federal Ministry for Economic Affairs and Energy, Germany. The study focused on the manufacturing of a functional model as a proof of concept comprising the development of a suitable forceps mechanism and electronic circuit for position control and gripping force measurement. Such studies focusing on product innovations in the handheld surgical instruments segment are expected to add to the growth of the studied market over the forecast period.

Thus, owing to the increasing innovations in the development of handheld surgical tools in the nation, the studied segment is expected to grow significantly.

Gynecology and Urology Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Gynecological and urological diseases are becoming increasingly prevalent in Germany, and the rising demand for surgical devices like laparoscopy devices for the treatment of these diseases is expected to fuel the segment's growth. Factors like the increasing prevalence of gynecological and urological diseases, the increasing demand for laparoscopic surgical devices, the increasing geriatric population, and rising product launches by major market players are enhancing segment growth.According to an article published by PubMed Central in May 2022, Endometriosis is a chronic gynecological disease, and it is defined as the presence of functional endometrial mucosa outside the uterine cavity, often in the pelvis. The study suggests that Endometriosis has a high prevalence in Germany, and laparoscopic surgery is considered a gold standard for the diagnosis of Endometriosis. Hence, the rising prevalence of such diseases is expected to increase the demand for surgical devices such as laparoscopic devices.

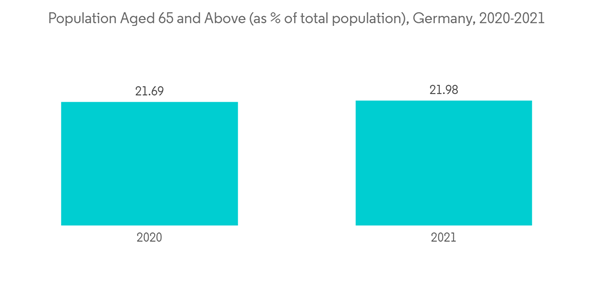

Moreover, the increasing demand for Germany-based laparoscopic surgical devices is also expected to enhance segment growth. For instance, according to an article published by PubMed Central in April 2022, a study was conducted among surgeons who were asked about the brand and company of the previously used handheld steerable laparoscopic instruments (SLI). The surgeons responded with 23 different brands and companies, of which 17% Karl Storz SE & Co. KG (Tuttlingen, Germany) and 10% Tuebingen Scientific Medical GmbH (Tuebingen, Germany) were the most common. Furthermore, the increasing geriatric population in the country is also expected to enhance segment growth, as old age is often associated with a high prevalence of urological diseases.

Thus, owing to the factors such as the increasing prevalence of gynecological and urological diseases, the increasing demand for laparoscopic surgical devices, and the increasing geriatric population, the studied segment is expected to grow significantly.

Germany General Surgical Devices Market Competitor Analysis

The German general surgical devices market is highly competitive, with the presence of global and a few local players in the country. A large share of the market is grabbed by the global players, whereas local companies also have intense competition to gain a substantial share in this market. The developed medical device industry is the prime reason behind more companies willing to expand in Germany. A few of the major players operating in Germany are B. Braun SE, Boston Scientific Corporation, Cadence Inc., Conmed Corporation, and Integer Holdings Corporation, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B. Braun SE

- Boston Scientific Corporation

- Cadence Inc.

- Conmed Corporation

- Integer Holdings Corporation

- Johnson & Johnson

- Getinge (Maquet Holding BV & Co. KG)

- Medtronic PLC

- Olympus Corporations

- Stryker Corporation