Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the market faces a significant hurdle regarding the shortage of skilled technicians qualified to operate these complex systems and correctly interpret acoustic data. This workforce gap risks creating bottlenecks in inspection capabilities across vital sectors. As reported by the American Society for Nondestructive Testing in 2024, the sector saw a 15% drop in new Level II certifications even as industry demand grew by 8%, illustrating a widening disconnect between the available labor supply and the operational requirements of the testing market.

Market Drivers

The growth of the semiconductor industry and the transition toward advanced IC packaging act as the main drivers for the adoption of acoustic microscopes. As manufacturers incorporate complex architectures such as chiplets and stacked dies, the potential for hidden defects like delamination or cracking rises, requiring the penetrative power of high-frequency ultrasound for inspection. This necessity is linked directly to high production volumes and the financial implications of failure analysis in maintaining yield rates. According to the Semiconductor Industry Association's October 2024 report, global semiconductor sales rose 20.6% year-over-year in August to reach $53.1 billion, indicating massive production throughput that necessitates strict quality control.Furthermore, the increasing integration of electronic components in automotive manufacturing accelerates the deployment of these inspection systems. The shift toward autonomous and electric vehicles requires absolute reliability for safety-critical parts, such as power modules and sensors, which function under severe mechanical and thermal stress. Acoustic microscopy is crucial for verifying the structural integrity of these components to avoid field failures. According to the International Energy Agency's 'Global EV Outlook 2024', electric car sales were projected to hit approximately 17 million units by the end of the year, generating significant demand for component verification. To support this scale, capital expenditures have increased; SEMI forecast that global fab equipment spending would rise to $109 billion in 2024, providing the budget needed to procure advanced inspection instrumentation.

Market Challenges

A primary obstacle to market growth is the shortage of skilled technicians proficient in operating complex acoustic microscopy systems and interpreting the resulting data. Operators require specialized knowledge of material acoustic impedance and ultrasound wave propagation to differentiate between signal artifacts and actual defects. When manufacturers are unable to bridge this technical skills gap, integrating these instruments into quality control workflows becomes inefficient. This inability to fully leverage the equipment often leads to inspection bottlenecks, causing companies to delay or scale back capital expenditures on new testing hardware until their staffing levels can support the technology.This workforce constraint is apparent across the broader manufacturing sector that depends on such inspection methods. According to IPC, in 2024, roughly 70 percent of electronics manufacturing companies identified a lack of skilled labor as a primary limitation on their capacity to expand production and implement advanced testing protocols. This pervasive talent deficit restricts the scalability of acoustic inspection operations. Consequently, the market sees slower adoption rates because the demand for nondestructive testing hardware is effectively capped by the availability of qualified human expertise necessary to manage these systems.

Market Trends

The incorporation of Artificial Intelligence for Automated Defect Recognition is fundamentally transforming data analysis in acoustic microscopy. Operators are applying machine learning algorithms to detect subtle variations in signal phase and amplitude that might be missed during manual observation. This technological advancement automates the classification of internal anomalies, such as voids or delaminations, which significantly improves repeatability and reduces inspection cycle times. This shift toward algorithmic decision-making aligns with broader industrial digitization strategies. According to Rockwell Automation's '9th Annual State of Smart Manufacturing Report' from March 2024, 85% of manufacturers had already invested or planned to invest in AI and machine learning technologies in 2024, reflecting a widespread commitment to enhancing inspection capabilities through intelligent software.Simultaneously, the use of acoustic microscopy in biomedical research is extending the technology's application beyond industrial hard materials. Researchers are now using high-frequency ultrasound to characterize the mechanical properties of biological tissues, cells, and biomaterial scaffolds without the need for destructive staining. This capability is critical for regenerative medicine and mechanobiology, where observing density and elasticity variations provides insights into tissue engineering efficacy and disease progression. Strong financial backing for life sciences further drives this adoption. According to the Association of American Medical Colleges in March 2024, approved federal legislation allocated $47.1 billion to the National Institutes of Health, ensuring sustained capital funding for advanced experimental methodologies and research instrumentation.

Key Players Profiled in the Acoustic Microscope Market

- Sonoscan, Inc.

- Hitachi High-Technologies Corporation

- PVA TePla AG

- EAG Laboratories

- NTS-Transport-Service GmbH

- Sonix Inc.

- IP-holding LLC

- Acoustic Technologies Group, Inc.

- Olympus Corporation

- Nikon Corporation

Report Scope

In this report, the Global Acoustic Microscope Market has been segmented into the following categories:Acoustic Microscope Market, by Offering:

- Microscopes

- Accessories and Software

- Services

Acoustic Microscope Market, by Application:

- Non-Destructive Testing

- Quality Control

- Failure Analysis

- Others

Acoustic Microscope Market, by End User:

- Semiconductor

- Life Science

- Material Science

- Nanotechnology

- Others

Acoustic Microscope Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Acoustic Microscope Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Acoustic Microscope market report include:- Sonoscan, Inc

- Hitachi High-Technologies Corporation

- PVA TePla AG

- EAG Laboratories

- NTS-Transport-Service GmbH

- Sonix Inc.

- IP-holding LLC

- Acoustic Technologies Group, Inc.

- Olympus Corporation

- Nikon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

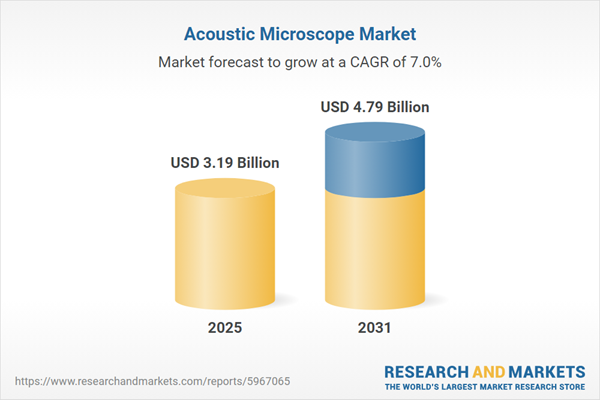

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.19 Billion |

| Forecasted Market Value ( USD | $ 4.79 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |