Speak directly to the analyst to clarify any post sales queries you may have.

A compelling overview of how industrial inkjet technologies are transforming production workflows, enabling customization, and redefining manufacturing efficiencies

Industrial inkjet printing has matured from a specialized prototyping tool into a cornerstone of diverse manufacturing ecosystems, offering precision, flexibility, and digital control across substrates and industries. Advances in printhead design, fluid chemistry, and process integration have enabled manufacturers to shift hard tooling constraints toward agile, on-demand production methods. As a result, stakeholders across packaging, textiles, ceramics, and commercial graphics are reassessing workflows to capitalize on reduced inventory, shorter lead times, and bespoke product variants.Concurrently, technological convergence-combining robotics, inline quality inspection, and cloud-native production analytics-has elevated inkjet from a stand-alone printing solution to a platform for industrial digitalization. This evolution encourages new business models, including micro-factories, localized production nodes, and mass customization at scale. While these opportunities are compelling, they require disciplined approaches to material compatibility, sustainability trade-offs, and capital planning.

Looking forward, decision-makers must weigh innovation adoption against regulatory dynamics, supply-chain resilience, and evolving customer expectations for sustainability and personalization. The introduction lays the groundwork for a nuanced examination of these dynamics, emphasizing practical implications for operations, R&D priorities, and strategic partnerships in the industrial inkjet ecosystem.

An in-depth examination of the intersecting technological, commercial, and regulatory shifts that are redefining industrial inkjet capabilities and adoption pathways

The landscape for industrial inkjet printing is being reshaped by several transformative shifts that are simultaneously technical, commercial, and regulatory in nature. On the technical front, the move toward finer droplet control and higher resolution has unlocked new application spaces, particularly where surface quality and color consistency are critical. Improved droplet engineering reduces material waste and expands compatibility with a broader range of inks, including more sustainable chemistries and curable systems that meet faster throughput demands.Commercially, manufacturers are adopting hybrid production models that blend traditional printing with digital inkjet capabilities, enabling rapid product customization and decentralized production footprints. This structural change is reinforced by service providers offering integrated workflows that encompass prepress, color management, and downstream finishing, reducing the barrier to entry for industrial users.

Regulatory and sustainability imperatives are also compelling change. Voluntary and mandated reductions in solvent emissions, combined with extended producer responsibility for packaging, are accelerating demand for pigment-based and UV-curable systems in specific segments. Finally, industry collaboration around standards for color accuracy, test methods, and interoperability is maturing, helping buyers make more predictable investments. Together, these shifts are creating a more dynamic, interoperable, and sustainability-focused inkjet ecosystem.

A strategic assessment of how elevated tariff conditions in 2025 are reshaping sourcing, production localization, and design-for-cost practices across inkjet supply chains

The introduction of heightened United States tariff measures in 2025 has produced layered effects across procurement, supply-chain strategies, and pricing dynamics in industrial inkjet value chains. Tariff adjustments have increased the cost pressure on imported components such as precision printheads, specialized nozzles, and certain raw chemistries, prompting procurement teams to reassess vendor mixes and total landed cost rather than unit price alone. Vendors and OEMs are responding by diversifying supplier bases and accelerating qualification of alternate sources to mitigate tariff exposure.In parallel, some manufacturers have expedited local assembly or selective manufacturing of non-specialized subcomponents to reduce tariff burden while retaining access to global technology inputs. This rebalancing has implications for lead times and inventory policies, as organizations adopt higher local safety stock or dual-sourcing strategies to offset potential supply disruptions. Additionally, product managers are reconsidering bill-of-materials designs to identify tariff-sensitive parts that can be substituted or re-specified without compromising performance.

Finally, the tariff environment has catalyzed renewed emphasis on end-to-end cost transparency and scenario planning. Finance and supply-chain teams are collaborating more closely with engineering to explore design-for-sourcing opportunities, while commercial teams adjust contract structures to share or hedge cost fluctuations with key customers. These adaptive behaviors are likely to persist as stakeholders seek resilient models that buffer against policy volatility while preserving innovation trajectories.

A multi-axis segmentation framework explaining how ink chemistry, speed, droplet engineering, resolution, and application categories drive differentiated product and service strategies

Segmentation analysis reveals nuanced performance and adoption patterns when organized by ink chemistry, printing speed, droplet architecture, resolution capabilities, and end-use application. Based on ink type, technologies span Dye-Based, Pigment-Based, Solvent, and UV-Curable formulations, with Solvent differentiating into Eco-Solvent and traditional Oil-Based variants and UV-Curable splitting into LED UV-Curable and Mercury UV-Curable classes; these distinctions drive trade-offs among adhesion, durability, drying kinetics, and environmental compliance. Based on printing speed, systems are characterized as High-Speed, Low-Speed, and Medium-Speed, which correlates closely with target applications and required throughput economics. Based on droplet size, solutions range from ultra-small volumes under 10 pL-including 5-10 pL and sub-5 pL categories-to mid-range 10-50 pL and larger droplet families above 50 pL, where the latter subdivides into 50-100 pL and greater than 100 pL; droplet architecture directly influences print granularity, ink consumption, and substrate wetting behavior. Based on resolution, offerings are profiled as High at greater than 1200 DPI, Medium between 600 and 1200 DPI, and Standard below 600 DPI, with resolution choice impacting perceived print quality and downstream finishing needs. Based on application, the spectrum encompasses Ceramic Printing, Graphic Arts Printing, Label Printing, Packaging Printing, and Textile Printing, where Ceramic Printing further differentiates into Sanitaryware, Tableware, and Tiles, Graphic Arts into Commercial Printing, Photo Printing, and Proofing, Label Printing into In-Mold, Self-Adhesive, and Shrink Sleeve, Packaging Printing into Flexible and Rigid Packaging, and Textile Printing into Direct-To-Garment and Roll-To-Roll; application requirements govern chemistry selection, curing strategy, and inline handling systems. Together, these segmentation dimensions create a multi-axis framework that informs product roadmaps, aftermarket service offers, and channel strategies, helping stakeholders align technical capabilities with commercial targets.A regional perspective on adoption drivers and investment behavior across the Americas, Europe Middle East & Africa, and Asia-Pacific manufacturing clusters

Regional dynamics continue to influence where technology investment and adoption accelerate, shaped by manufacturing density, regulatory priorities, and customer demand profiles. The Americas exhibits strong uptake in packaging and label applications, driven by e-commerce packaging innovation and a consolidated print services sector that values rapid turnaround and customization. In this region, investments in automation and integrated finishing systems have reduced barriers for mid-sized converters seeking digital alternatives to conventional flexography for short runs and variable data jobs.Europe, Middle East & Africa combines stringent environmental regulations with sophisticated design and luxury markets that favor high-resolution graphic arts and ceramic printing use cases. The region’s regulatory emphasis on emissions and material stewardship has catalyzed transitions toward pigment-based and UV-curable systems, particularly where lifecycle claims and recyclability are commercially important. In addition, the region’s dense SME ecosystem benefits from service-level partnerships that offer color management and prepress support to accelerate digital adoption.

Asia-Pacific remains the largest concentration of manufacturing scale and rapid deployment, with strong activity in textile printing, ceramic tile production, and large-format signage. Industrial clusters in this region benefit from an integrated supply chain that supports rapid iteration, cost-effective component procurement, and close collaboration between OEMs and material suppliers. Across all regions, local policy, labor dynamics, and customer preferences will continue to shape investment priorities and the pace at which specific technologies migrate from pilot to high-volume production.

An analytical view of how R&D strength, integrated service models, and supply-chain resilience create sustainable competitive advantages for industrial inkjet leaders

Competitive dynamics in industrial inkjet are driven by a mix of established industrial OEMs, specialized component suppliers, and agile integrators that combine printheads, inks, and software into turnkey systems. Key firms continue to differentiate through investments in printhead reliability, nozzle density, and integrated color management solutions that reduce downtime and improve first-pass yield. Strategic partnerships between ink formulators and hardware manufacturers have become more prevalent, enabling tighter qualification cycles and faster adoption of novel chemistries adapted for specific substrates.Service-led business models, including managed print services and equipment-as-a-service contracts, are gaining traction as they lower capital barriers and provide recurring revenue streams for manufacturers and service providers. Aftermarket support and consumable ecosystems are increasingly important competitive levers because they drive long-term customer retention and enable premium pricing for validated consumables. In addition, research collaborations with academic institutions and materials labs are accelerating innovation in curable chemistries and high-performance pigments, creating differentiation in durability and color gamut.

Overall, companies that combine robust R&D pipelines, resilient supply chains, and customer-centric service models are best positioned to capture opportunities arising from customization trends and sustainability imperatives. Execution discipline in quality control and interoperability will remain decisive as buyer sophistication grows.

Targeted strategic moves that manufacturing leaders can implement now to build resilience, accelerate adoption, and capture recurring revenue in industrial inkjet operations

Industry leaders should take decisive actions to convert emerging trends into defensible advantages while managing operational and regulatory risk. First, prioritize modular architecture in product design to enable rapid substitution of tariff-sensitive components and to facilitate serviceability across geographies. This approach reduces disruption from policy shifts and shortens qualification cycles for alternate suppliers. A second imperative is to accelerate partnerships between ink chemists and hardware engineers to co-design formulations optimized for targeted printheads and substrates, which can improve reliability and lower total cost of ownership for end users.Third, scale post-sale services and consumable ecosystems to capture recurring revenue and increase customer lock-in through validated consumables and predictive maintenance offerings. Fourth, invest in sustainability credentials by pursuing lower-emission chemistries, improved waste handling, and transparent lifecycle documentation that customers increasingly demand. Fifth, strengthen commercial flexibility through creative contract structures that share cost risk with customers or provide hedging mechanisms for input price volatility. Finally, develop capability in scenario planning and cross-functional cost modeling so that engineering, procurement, and commercial teams can rapidly converge on trade-off decisions during periods of policy or supply-chain disruption.

These actions, executed in tandem, will help organizations transform transient challenges into strategic differentiation and sustained growth opportunities.

A robust mixed-method research approach combining executive interviews, technical validation, and supply-chain mapping to ensure actionable and verifiable insights

The research methodology underpinning these insights combines systematic primary research, comprehensive secondary synthesis, and rigorous technical validation to ensure reliability and practical relevance. Primary inputs include structured interviews with senior executives across OEMs, converters, and material suppliers, as well as discussions with process engineers and R&D leaders who provide detailed perspectives on performance constraints and adoption drivers. These qualitative inputs are complemented by technical evaluations of printhead specifications, droplet performance data, and ink-substrate interaction studies conducted in collaboration with independent laboratory partners.Secondary analysis integrates trade publications, patent filings, regulatory filings, and conference proceedings to map technology trajectories and competitive positioning. Supply-chain mapping and stakeholder interviews provide visibility into procurement strategies, component lead times, and logistics risks. Cross-validation is achieved by triangulating interview findings against observed product roadmaps and publicly available technical specifications. Assumptions are stress-tested through sensitivity scenarios that explore alternative outcomes stemming from policy changes, raw-material disruptions, or significant technological breakthroughs.

This mixed-method approach balances depth and breadth, delivering insights that are actionable for R&D prioritization, procurement strategy, and commercial planning while maintaining transparency about data provenance and analytical assumptions.

A strategic synthesis highlighting how technical progress, supply resilience, and sustainability commitments will determine future leaders in industrial inkjet printing

In conclusion, industrial inkjet printing is at an inflection point where technological maturity, supply-chain realignment, and heightened sustainability expectations converge to create both risk and opportunity. Advances in droplet control, curing technologies, and integrated digital workflows are expanding the addressable set of applications, while tariff dynamics and regulatory pressures are prompting companies to rethink sourcing and design strategies. Those that align product innovation with supply resilience and sustainability commitments will be better positioned to capture demand for customization, shorter lead times, and improved total cost of operation.As stakeholders navigate these changes, disciplined scenario planning, targeted partnerships, and an emphasis on service-led revenue streams will be essential. The path forward favors organizations that can translate technical differentiation into measurable operational benefits for customers while maintaining the flexibility to adapt to policy and material supply shifts. Ultimately, the winners will be those who couple engineering excellence with pragmatic commercial strategies to unlock the full potential of industrial inkjet across diverse manufacturing sectors.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Industrial Inkjet Printer Market

Companies Mentioned

The key companies profiled in this Industrial Inkjet Printer market report include:- Arrow Systems, Inc.

- Canon Inc.

- Citronix Inc.

- Diagraph Marking & Coding by Illinois Tool Works Inc.

- Domino Printing Sciences PLC by Brother Industries, Ltd.

- Engage Technologies Corporation

- Engineered Printing Solutions

- Hitachi, Ltd.

- HP Inc.

- HSA Systems A/S

- InkJet Inc. by Cyklop International

- Keyence Corporation

- Kishu Giken Kogyo Co., Ltd.

- Konica Minolta, Inc.

- Kyocera Corporation

- Linx Printing Technologies by Danaher Corporation

- Markem-Imaje by Dover Corporation

- Mimaki Engineering Co., Ltd.

- MSSC LLC

- Numeric Inkjet Technologies Pvt. Ltd.

- Pannier Corporation

- Paul Leibinger GmbH & Co.KG

- Quadient s.r.o.

- REA Elektronik GmbH

- Ricoh Company, Ltd.

- Roland DGA Corporation

- Seiko Epson Corporation

- Sun Packaging Technologies, Inc.

- Toshiba Corporation

- Ventec International Group

- Videojet Technologies Inc.

- Xerox Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

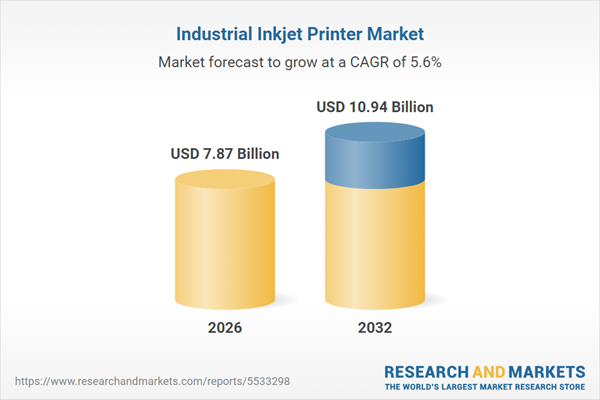

| Estimated Market Value ( USD | $ 7.87 Billion |

| Forecasted Market Value ( USD | $ 10.94 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |