Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction framing modern rifle market dynamics, stakeholder priorities, technology inflection points, and supply chain pressures shaping competitive advantage

The contemporary landscape for rifles is characterized by converging pressures from technology, policy, and evolving end-user preferences that together reshape competitive positioning and product strategy. Advanced materials and modular architectures are influencing product roadmaps, while regulatory developments and transportation logistics continue to alter sourcing decisions and channel economics. Stakeholders from manufacturers to specialty retailers must reconcile legacy production practices with the need for faster iteration cycles and enhanced aftermarket ecosystems.Against this backdrop, a pragmatic introduction emphasizes the interplay between demand-side differentiation and supply-side agility. End users are more segmented than ever, ranging from organized defense and law enforcement entities with mission-critical requirements to private individuals seeking personal defense options and sporting communities focused on specialized disciplines. As a result, companies that align R&D, materials selection, and distribution pathways to distinct user requirements will capture durable competitive advantage. This report frames those priorities, highlights structural inflection points, and situates near-term tactical actions within longer-term strategic choices that industry leaders must make to remain resilient and growth-oriented.

An in-depth overview of the transformative technological, distributional, and regulatory shifts reshaping rifle product strategies and competitive positioning

Several transformative shifts are redefining the rifle market and will continue to influence strategic decision-making across product development, distribution, and aftersales support. First, material science advances and manufacturing techniques such as additive manufacturing and precision machining are enabling lighter, more reliable platforms that meet stricter performance tolerances while opening new possibilities for customization. These capabilities shift the cost-performance equation and lower barriers for niche, high-performance offerings.Second, distribution models are evolving as digital channels gain permanence alongside specialty retail and direct sales. Consumers expect richer digital experiences, transparent compliance workflows, and streamlined fulfillment procedures. Third, regulatory complexity and trade policy volatility are accelerating supply chain diversification, encouraging near-sourcing and inventory hedging. Fourth, the professional market is demanding integrated solutions that combine weapon systems, optics, and data-driven training platforms, thereby encouraging partnerships across traditional industry boundaries. Together, these shifts are making product differentiation, channel strategy, and partnerships the primary levers for future competitiveness, requiring firms to re-evaluate capabilities, supplier relationships, and customer engagement models.

A comprehensive examination of how United States tariff actions implemented in 2025 reshaped supply chains, pricing dynamics, and compliance requirements across the rifle industry

The tariff measures implemented by the United States in 2025 have exerted a material influence on supply chain choices, procurement practices, and product cost structures across the industry. Increased import duties on specific firearm categories and components elevated landed costs for manufacturers and assemblers that relied on cross-border sourcing. As a consequence, procurement teams have had to re-examine supplier contracts, reprice commercial agreements, and consider alternative sourcing geographies to mitigate margin erosion.In addition to cost impacts, tariffs drove a reconfiguration of inventory strategies and increased compliance burdens. Companies experienced longer lead times as suppliers adjusted production and logistics to optimize duty exposure, and compliance teams expanded documentation and classification efforts to avoid retroactive penalties. Supply chain managers responded by accelerating qualifying domestic suppliers or nearshore partners and by redesigning bill-of-materials to substitute tariff-exposed components with alternatives in permitted categories. Finally, the tariffs reshaped channel economics: specialty retailers and online platforms adjusted pricing strategies to maintain competitiveness, while manufacturers weighed vertical integration and aftermarket services to offset distribution margin pressures. The cumulative effect favored organizations with flexible supply chains, strong regulatory capabilities, and rapid product adaptation processes.

A multidimensional segmentation analysis clarifying user cohorts, platform architectures, distribution pathways, and material choices that determine product and go-to-market strategies

Key segmentation nuances reveal how demand and product development must be tailored to distinct user cohorts and technical configurations. Based on application, demand separates into defense and law enforcement where requirements cover law enforcement use, military use, and private security that itself segments into corporate security and personal security; personal defense characterized by concealed carry, home defense, and vehicular defense; and sporting and hunting that includes big game, small game, and target shooting with the latter further broken down into action shooting, benchrest, and precision long range. Each of these application clusters drives specific ergonomic, sighting, and accessory requirements that influence platform selection and value propositions.Action type segmentation underscores divergent design and maintenance profiles across bolt action, lever action, pump action, semi-automatic, and single shot platforms, each attracting distinct user expectations for rate of fire, reliability, and training overhead. Caliber distinctions across large bore, medium bore, and small bore determine logistics around ammunition supply and recoil management. Barrel length variations such as under 16 inches, 16 to 20 inches, and over 20 inches affect maneuverability and accuracy trade-offs, guiding component engineering choices. Distribution channel dynamics span direct sales, online, and specialty retail pathways and influence how products are marketed, regulated, and serviced. Finally, material choices between aluminum, composite, and steel affect durability, weight profiles, and cost of goods sold, prompting different positioning strategies for premium versus value offerings. Together, these segmentation axes provide a multidimensional framework for aligning R&D, manufacturing, and go-to-market tactics to prioritized customer segments.

A nuanced regional insight report detailing how geographic regulatory regimes, distribution channels, and procurement priorities shape rifle industry strategies across major territories

Regional dynamics vary considerably and should inform strategic prioritization for manufacturing footprints, channel investments, and regulatory engagement. In the Americas, a combination of mature demand in sporting and law enforcement sectors alongside a robust direct and specialty retail network creates opportunities for differentiated product lines and aftermarket services. The region also features significant policy heterogeneity across jurisdictions, making localized compliance and channel strategies essential for market access and long-term success.Across Europe, the Middle East & Africa, regulatory frameworks and procurement cycles differ substantially between professional and civilian segments, which places a premium on certification processes, interoperability with existing systems, and localized partner networks. In the Asia-Pacific region, rapid modernization in several defense markets and growing civilian interest in sport shooting are driving interest in both high-performance and cost-effective platforms; supply chain proximity and component expertise in regional manufacturing hubs are factors that suppliers must weigh when designing regional strategies. Overall, regional variation underscores the importance of tailored positioning: successful players combine global platform standards with localized product adaptations, distribution agreements, and regulatory engagement to capture durable advantages in each geography.

Actionable competitive insights highlighting how innovation, channel orchestration, supply chain flexibility, and service integration determine leadership in the rifle industry

Competitive dynamics among leading firms demonstrate several recurring strategic themes that influence resilience and growth potential. First, innovation in materials and modularity has become a defining axis of differentiation; companies investing in lighter alloys, composites, and modular accessory ecosystems are better positioned to serve both professional and consumer segments. Second, channel orchestration is a central battleground: firms that harmonize direct sales, online presence, and specialty retail relationships capture higher lifetime value by controlling customer experience and aftermarket services.Third, operational flexibility in sourcing and production provides a competitive buffer against tariff and logistics volatility. Organizations that deploy dual-source strategies and maintain qualification pipelines for domestic and nearshore suppliers reduce execution risk. Fourth, successful companies are integrating training, warranty, and spare parts services into the proposition to deepen customer relationships and stabilize revenue beyond initial sales. Finally, partnerships-whether technical alliances for optics and electronics or commercial agreements with distributors-accelerate time-to-market and enhance product completeness. Collectively, these insights point to a landscape where product excellence, supply chain agility, and service-rich offerings determine relative market success.

Practical and prioritized recommendations for industry leaders to enhance resilience, accelerate product differentiation, and convert segmentation insights into measurable commercial outcomes

Industry leaders should prioritize a set of actionable steps to convert insight into operational advantage, balancing near-term tactical moves with medium-term capability building. First, invest in modular design platforms and material innovation that allow rapid configuration for law enforcement, personal defense, and sporting applications; this reduces time-to-customer for new variants and supports premium differentiation. Second, diversify supply bases and qualify domestic or nearshore suppliers for critical components to reduce tariff exposure and compress lead times while maintaining rigorous quality assurance protocols.Third, adopt unified channel strategies that integrate direct sales, online presence, and specialty retail experiences to ensure consistent regulatory compliance and customer service standards. Fourth, expand aftermarket services such as certified training, extended warranties, and spare-parts subscriptions to create recurring revenue streams and strengthen customer retention. Fifth, strengthen regulatory and trade-compliance functions to proactively manage classification, certification, and cross-border logistics requirements. Finally, pursue targeted partnerships for optics, electronic integration, and training technologies to create bundled solutions that appeal to both professional procurement teams and discerning civilian users. Implementing these actions in a phased, measurable manner will enable firms to protect margins, enhance resilience, and accelerate differentiated growth.

A transparent mixed-methods research methodology combining primary stakeholder engagement, technical literature review, and regulatory analysis to underpin strategic recommendations

This research synthesis relies on a mixed-methods approach that triangulates primary interviews, technical literature, publicly available regulatory documentation, and observed industry behaviors to ensure robust and actionable conclusions. Primary inputs included structured conversations with procurement officials, manufacturing and supply chain managers, channel partners, and aftermarket service providers to validate operational implications and to surface real-world constraints that shape sourcing and pricing decisions. Secondary inputs included technical papers on materials and manufacturing processes, public trade and regulatory notices, and case studies of distribution adaptations to tariff changes.Analytical procedures emphasized cross-validation between qualitative insights and documented regulatory actions to avoid overreliance on anecdotal evidence. Where appropriate, product engineering and logistics considerations were modeled at a conceptual level to test the sensitivity of proposed actions to changes in supply chain configuration and material selection. The methodology prioritized transparency in assumptions and traceability of inputs, enabling a clear line of sight from observed market behavior to the strategic recommendations presented. Limitations include the variability of local regulatory regimes and the proprietary nature of some supplier contracts, both of which were managed through sensitivity analysis and careful-source attribution.

A forward-looking conclusion synthesizing strategic imperatives for innovation, supply chain resilience, and customer-centric channel strategies to secure durable advantage

In conclusion, the rifle industry is at an inflection point driven by material and manufacturing innovation, evolving distribution paradigms, and heightened regulatory and trade complexity. These forces are fragmenting traditional demand pools and rewarding firms that can marry product modularity with supply chain agility and service-rich propositions. Organizations that ignore the need for diversified sourcing, robust compliance capabilities, and integrated channel strategies risk margin compression and slower response to shifting end-user preferences.Conversely, firms that adopt a holistic approach-aligning R&D investments with targeted segmentation, qualifying alternative suppliers, and embedding aftermarket services into their commercial models-will be better equipped to respond to tariff-induced disruptions and regional regulatory divergences. The imperative for leaders is clear: invest in adaptable platforms, institutionalize supply chain resilience, and build the customer-facing capabilities needed to capture value across defense, personal defense, and sporting applications. Doing so will unlock competitive positioning that is durable in the face of policy and market uncertainty.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Rifles Market

Companies Mentioned

- Aero Precision LLC

- Barrett Firearms Manufacturing, Inc.

- Beretta USA Corp.

- Bravo Company Manufacturing, Inc.

- Browning Arms Company

- CheyTac USA

- Colt's Manufacturing Company LLC

- Daniel Defense, Inc.

- Diamondback Firearms, LLC

- FN America, LLC

- Heckler & Koch, Inc.

- Henry Repeating Arms Co.

- IWI US, Inc.

- O.F. Mossberg & Sons, Inc.

- Palmetto State Armory, LLC

- Pioneer Arms USA

- Remington Arms Company, LLC

- Samsun Yurt Savunma Sanayi ve Ticaret A.Ş.

- Savage Arms, Inc.

- SIG Sauer, Inc.

- Smith & Wesson Brands, Inc.

- Springfield Armory, Inc.

- Sturm, Ruger & Co., Inc.

- Taurus USA

- Weatherby, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

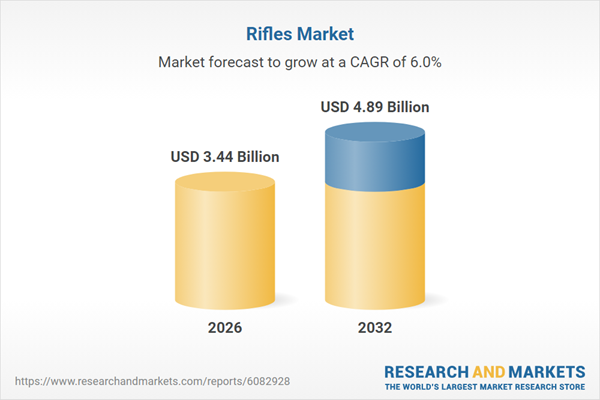

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.44 Billion |

| Forecasted Market Value ( USD | $ 4.89 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |