Global 'Tarpaulin Sheets' Market - Key Trends & Drivers Summarized

Why Are Tarpaulin Sheets More Than Just Temporary Covers Today?

What was once considered a simple, utilitarian product - used primarily for covering goods and shielding items from the elements - has evolved into a high-performance, multi-use material with critical applications across sectors. Tarpaulin sheets, also known as tarps, are flexible, water-resistant, and durable covers made from woven polyethylene (PE), polyvinyl chloride (PVC), canvas, or other synthetic materials. In today's industrial landscape, their role goes far beyond protection from sun and rain; they're used in construction, agriculture, transportation, disaster relief, and even military logistics, often fulfilling structural, containment, and operational roles.Modern tarpaulins are engineered with specific coatings and reinforcements that offer ultraviolet (UV) resistance, flame retardancy, chemical resistance, and anti-fungal properties. Their rising prominence is tied to their adaptability and affordability in both developed and emerging markets. In developing regions, tarps are used as makeshift shelters, roofing alternatives, or mobile infrastructure during emergencies. In the commercial world, they serve as truck covers, tent canopies, pond liners, scaffolding wraps, and grain silo protection. The growth in logistics and infrastructure sectors globally is propelling new use cases that demand performance-centric innovations in tarpaulin design.

How Are Innovations in Fabric Engineering Transforming Tarpaulin Quality?

The quality and functionality of tarpaulin sheets have improved dramatically with innovations in polymer science, weaving technology, and coating processes. High-density polyethylene (HDPE) and low-density polyethylene (LDPE) are now being blended with UV inhibitors and anti-aging agents to extend outdoor lifespan, even under extreme weather. Modern tarps come with high-tensile scrims (internal mesh) and laminated coatings that prevent delamination and resist tearing under mechanical stress, making them ideal for rugged industrial environments. Multilayer constructions - such as three-ply or five-ply tarps - offer enhanced puncture resistance and water impermeability.Heat-sealed or ultrasonic-welded seams are replacing traditional stitched edges, increasing the structural integrity of tarpaulin sheets and making them fully waterproof. Eyelets and grommets, traditionally weak points, are now made from reinforced polycarbonate or corrosion-resistant metals and are fused using high-frequency welding. Some tarps now include antimicrobial treatments to prevent bacterial and fungal growth in humid storage or agricultural applications. These technical enhancements are enabling tarpaulins to act not just as covers, but as semi-permanent solutions for roofing, containment, and environmental protection. The result is a shift in perception - from cheap and disposable to engineered, durable, and reliable.

Where Is Demand for Advanced Tarpaulins Growing Most Rapidly?

Demand for tarpaulin sheets is rising sharply in construction, transportation, agriculture, and humanitarian aid sectors, particularly in Asia-Pacific, the Middle East, and Latin America. In construction, tarps are used extensively as temporary building wraps, scaffold sheeting, concrete curing blankets, and windbreaks. Rapid urbanization in countries like India, Indonesia, and Nigeria is fueling continuous demand for these functional barriers on construction sites. In logistics and transportation, lightweight and heavy-duty tarps are essential for covering cargo in trucks, railway wagons, and ships, especially where weatherproofing is essential to supply chain reliability.In agriculture, tarpaulins are deployed to protect crops, create makeshift greenhouses, and cover silage or fertilizers, helping farmers mitigate weather impacts and reduce spoilage. Climate change is making such use cases more urgent and widespread. Relief organizations are another major consumer group, using tarpaulin sheets for emergency shelters, ground covers, and water containment solutions in disaster-hit regions. With a rise in frequency and intensity of climate-related disasters, demand for high-quality, rapidly deployable tarps is expected to soar. Additionally, recreational and commercial uses are growing - ranging from camping gear to event tents and outdoor canopies - creating a parallel consumer market that values aesthetic finishes and ease of handling.

The Growth in the Tarpaulin Sheets Market Is Driven by Several Factors…

The growth in the tarpaulin sheets market is driven by several factors stemming from material innovation, infrastructure expansion, and shifting user needs across key sectors. Technological improvements in polymer formulation, UV stabilization, and fabrication processes have resulted in longer-lasting, more versatile products that appeal to industries with both temporary and semi-permanent covering needs. In construction and civil engineering, the continued rise of megaprojects and smart infrastructure developments is increasing the need for protective coverings that meet both safety and environmental standards.End-use expansion in agriculture, transportation, and humanitarian sectors is a significant driver. Farmers are increasingly adopting tarpaulin-based storage and irrigation solutions in regions vulnerable to erratic weather patterns. Logistics companies require customized tarps that reduce drag, resist tearing, and handle high-speed travel conditions. The humanitarian sector continues to demand lightweight, high-tensile tarps that can be mass-produced and deployed quickly during crises. In tandem, consumer behavior is shifting toward greater awareness of durability and eco-friendliness, prompting interest in recyclable or biodegradable tarpaulin options.

Geographically, rapid industrialization in Asia-Pacific and Africa is leading to a surge in regional manufacturers offering tarpaulins tailored to local climate and operational needs. Moreover, stringent environmental regulations in developed markets are driving innovations in flame-retardant, toxin-free, and recyclable tarp materials. E-commerce expansion and DIY culture in North America and Europe are also creating new retail channels for household and small-business applications. These diverse factors collectively point to a maturing yet vibrant market with strong potential for material-led disruption and sustained global demand.

Report Scope

The report analyzes the Tarpaulin Sheets market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Insulated Tarps, Hoarding Tarps, Truck Tarps, UV Protected Tarps, Sports Tarps, Mesh Tarps, Other Product Types); Application (Agriculture, Building & Construction, Automobiles, Storage, Warehousing & Logistics, Consumer Goods, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Insulated Tarps segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 5.1%. The Hoarding Tarps segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tarpaulin Sheets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tarpaulin Sheets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tarpaulin Sheets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Tarpaulin Sheets market report include:

- A & B Canvas Australia

- Bag Poly International Pvt Ltd

- C&H Vina Co., Ltd.

- Canadian Tarpaulin Manufacturers LTD

- Cunningham Covers

- Darling Downs Tarpaulins

- Del Tarpaulins

- Dolphin Impex

- Fulin Plastic Industry

- Gia Loi JSC

- J Clemishaw 1870 Ltd

- JK Plastopack Pvt Ltd

- KSA Polymer

- K-TARP VINA Co., Ltd.

- Mahashakti Polycoat

- Marson Industries Pty Ltd

- Polytex S.A.

- Rainproof Exports

- Rhino UK

- Tan Dai Hung Plastic JSC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A & B Canvas Australia

- Bag Poly International Pvt Ltd

- C&H Vina Co., Ltd.

- Canadian Tarpaulin Manufacturers LTD

- Cunningham Covers

- Darling Downs Tarpaulins

- Del Tarpaulins

- Dolphin Impex

- Fulin Plastic Industry

- Gia Loi JSC

- J Clemishaw 1870 Ltd

- JK Plastopack Pvt Ltd

- KSA Polymer

- K-TARP VINA Co., Ltd.

- Mahashakti Polycoat

- Marson Industries Pty Ltd

- Polytex S.A.

- Rainproof Exports

- Rhino UK

- Tan Dai Hung Plastic JSC

Table Information

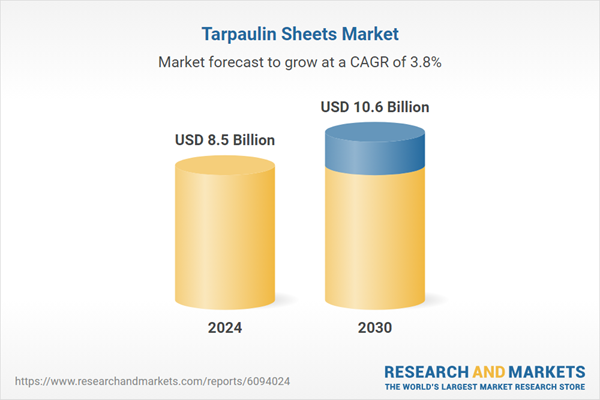

| Report Attribute | Details |

|---|---|

| No. of Pages | 303 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.5 Billion |

| Forecasted Market Value ( USD | $ 10.6 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |