List of Tables

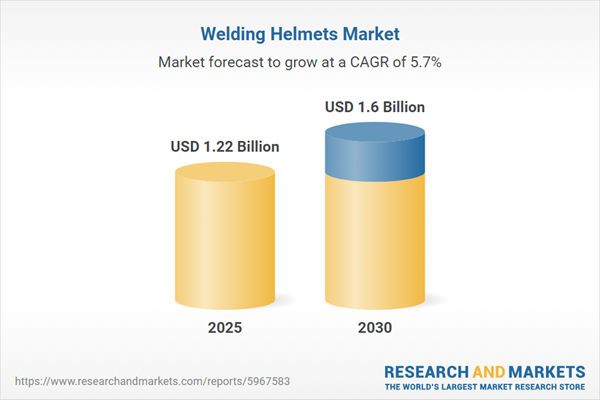

TABLE 1. GLOBAL WELDING HELMETS MARKET SIZE, 2018-2030 (USD MILLION)

TABLE 2. GLOBAL WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 3. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS METAL ARC WELDING/MIG, BY REGION, 2018-2030 (USD MILLION)

TABLE 4. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS METAL ARC WELDING/MIG, BY GROUP, 2018-2030 (USD MILLION)

TABLE 5. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS METAL ARC WELDING/MIG, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 6. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS TUNGSTEN ARC/TIG, BY REGION, 2018-2030 (USD MILLION)

TABLE 7. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS TUNGSTEN ARC/TIG, BY GROUP, 2018-2030 (USD MILLION)

TABLE 8. GLOBAL WELDING HELMETS MARKET SIZE, BY GAS TUNGSTEN ARC/TIG, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 9. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIELDED METAL ARC, BY REGION, 2018-2030 (USD MILLION)

TABLE 10. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIELDED METAL ARC, BY GROUP, 2018-2030 (USD MILLION)

TABLE 11. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIELDED METAL ARC, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 12. GLOBAL WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 13. GLOBAL WELDING HELMETS MARKET SIZE, BY FLIP-UP, BY REGION, 2018-2030 (USD MILLION)

TABLE 14. GLOBAL WELDING HELMETS MARKET SIZE, BY FLIP-UP, BY GROUP, 2018-2030 (USD MILLION)

TABLE 15. GLOBAL WELDING HELMETS MARKET SIZE, BY FLIP-UP, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 16. GLOBAL WELDING HELMETS MARKET SIZE, BY FULL-FACE, BY REGION, 2018-2030 (USD MILLION)

TABLE 17. GLOBAL WELDING HELMETS MARKET SIZE, BY FULL-FACE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 18. GLOBAL WELDING HELMETS MARKET SIZE, BY FULL-FACE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 19. GLOBAL WELDING HELMETS MARKET SIZE, BY HALF-MASK, BY REGION, 2018-2030 (USD MILLION)

TABLE 20. GLOBAL WELDING HELMETS MARKET SIZE, BY HALF-MASK, BY GROUP, 2018-2030 (USD MILLION)

TABLE 21. GLOBAL WELDING HELMETS MARKET SIZE, BY HALF-MASK, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 22. GLOBAL WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 23. GLOBAL WELDING HELMETS MARKET SIZE, BY FIXED SHADE, BY REGION, 2018-2030 (USD MILLION)

TABLE 24. GLOBAL WELDING HELMETS MARKET SIZE, BY FIXED SHADE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 25. GLOBAL WELDING HELMETS MARKET SIZE, BY FIXED SHADE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 26. GLOBAL WELDING HELMETS MARKET SIZE, BY VARIABLE SHADE, BY REGION, 2018-2030 (USD MILLION)

TABLE 27. GLOBAL WELDING HELMETS MARKET SIZE, BY VARIABLE SHADE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 28. GLOBAL WELDING HELMETS MARKET SIZE, BY VARIABLE SHADE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 29. GLOBAL WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 30. GLOBAL WELDING HELMETS MARKET SIZE, BY ACRYLONITRILE BUTADIENE STYRENE, BY REGION, 2018-2030 (USD MILLION)

TABLE 31. GLOBAL WELDING HELMETS MARKET SIZE, BY ACRYLONITRILE BUTADIENE STYRENE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 32. GLOBAL WELDING HELMETS MARKET SIZE, BY ACRYLONITRILE BUTADIENE STYRENE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 33. GLOBAL WELDING HELMETS MARKET SIZE, BY FIBERGLASS, BY REGION, 2018-2030 (USD MILLION)

TABLE 34. GLOBAL WELDING HELMETS MARKET SIZE, BY FIBERGLASS, BY GROUP, 2018-2030 (USD MILLION)

TABLE 35. GLOBAL WELDING HELMETS MARKET SIZE, BY FIBERGLASS, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 36. GLOBAL WELDING HELMETS MARKET SIZE, BY NYLON-BASED, BY REGION, 2018-2030 (USD MILLION)

TABLE 37. GLOBAL WELDING HELMETS MARKET SIZE, BY NYLON-BASED, BY GROUP, 2018-2030 (USD MILLION)

TABLE 38. GLOBAL WELDING HELMETS MARKET SIZE, BY NYLON-BASED, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 39. GLOBAL WELDING HELMETS MARKET SIZE, BY POLYCARBONATE, BY REGION, 2018-2030 (USD MILLION)

TABLE 40. GLOBAL WELDING HELMETS MARKET SIZE, BY POLYCARBONATE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 41. GLOBAL WELDING HELMETS MARKET SIZE, BY POLYCARBONATE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 42. GLOBAL WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 43. GLOBAL WELDING HELMETS MARKET SIZE, BY BATTERY-POWERED, BY REGION, 2018-2030 (USD MILLION)

TABLE 44. GLOBAL WELDING HELMETS MARKET SIZE, BY BATTERY-POWERED, BY GROUP, 2018-2030 (USD MILLION)

TABLE 45. GLOBAL WELDING HELMETS MARKET SIZE, BY BATTERY-POWERED, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 46. GLOBAL WELDING HELMETS MARKET SIZE, BY NON-POWERED, BY REGION, 2018-2030 (USD MILLION)

TABLE 47. GLOBAL WELDING HELMETS MARKET SIZE, BY NON-POWERED, BY GROUP, 2018-2030 (USD MILLION)

TABLE 48. GLOBAL WELDING HELMETS MARKET SIZE, BY NON-POWERED, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 49. GLOBAL WELDING HELMETS MARKET SIZE, BY SOLAR-POWERED, BY REGION, 2018-2030 (USD MILLION)

TABLE 50. GLOBAL WELDING HELMETS MARKET SIZE, BY SOLAR-POWERED, BY GROUP, 2018-2030 (USD MILLION)

TABLE 51. GLOBAL WELDING HELMETS MARKET SIZE, BY SOLAR-POWERED, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 52. GLOBAL WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 53. GLOBAL WELDING HELMETS MARKET SIZE, BY AEROSPACE, BY REGION, 2018-2030 (USD MILLION)

TABLE 54. GLOBAL WELDING HELMETS MARKET SIZE, BY AEROSPACE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 55. GLOBAL WELDING HELMETS MARKET SIZE, BY AEROSPACE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 56. GLOBAL WELDING HELMETS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2030 (USD MILLION)

TABLE 57. GLOBAL WELDING HELMETS MARKET SIZE, BY AUTOMOTIVE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 58. GLOBAL WELDING HELMETS MARKET SIZE, BY AUTOMOTIVE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 59. GLOBAL WELDING HELMETS MARKET SIZE, BY CONSTRUCTION, BY REGION, 2018-2030 (USD MILLION)

TABLE 60. GLOBAL WELDING HELMETS MARKET SIZE, BY CONSTRUCTION, BY GROUP, 2018-2030 (USD MILLION)

TABLE 61. GLOBAL WELDING HELMETS MARKET SIZE, BY CONSTRUCTION, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 62. GLOBAL WELDING HELMETS MARKET SIZE, BY ELECTRICAL & ELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

TABLE 63. GLOBAL WELDING HELMETS MARKET SIZE, BY ELECTRICAL & ELECTRONICS, BY GROUP, 2018-2030 (USD MILLION)

TABLE 64. GLOBAL WELDING HELMETS MARKET SIZE, BY ELECTRICAL & ELECTRONICS, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 65. GLOBAL WELDING HELMETS MARKET SIZE, BY MINING, BY REGION, 2018-2030 (USD MILLION)

TABLE 66. GLOBAL WELDING HELMETS MARKET SIZE, BY MINING, BY GROUP, 2018-2030 (USD MILLION)

TABLE 67. GLOBAL WELDING HELMETS MARKET SIZE, BY MINING, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 68. GLOBAL WELDING HELMETS MARKET SIZE, BY OIL & GAS, BY REGION, 2018-2030 (USD MILLION)

TABLE 69. GLOBAL WELDING HELMETS MARKET SIZE, BY OIL & GAS, BY GROUP, 2018-2030 (USD MILLION)

TABLE 70. GLOBAL WELDING HELMETS MARKET SIZE, BY OIL & GAS, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 71. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIPBUILDING, BY REGION, 2018-2030 (USD MILLION)

TABLE 72. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIPBUILDING, BY GROUP, 2018-2030 (USD MILLION)

TABLE 73. GLOBAL WELDING HELMETS MARKET SIZE, BY SHIPBUILDING, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 74. GLOBAL WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 75. GLOBAL WELDING HELMETS MARKET SIZE, BY OFFLINE, BY REGION, 2018-2030 (USD MILLION)

TABLE 76. GLOBAL WELDING HELMETS MARKET SIZE, BY OFFLINE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 77. GLOBAL WELDING HELMETS MARKET SIZE, BY OFFLINE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 78. GLOBAL WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 79. GLOBAL WELDING HELMETS MARKET SIZE, BY DIRECT SALES, BY REGION, 2018-2030 (USD MILLION)

TABLE 80. GLOBAL WELDING HELMETS MARKET SIZE, BY DIRECT SALES, BY GROUP, 2018-2030 (USD MILLION)

TABLE 81. GLOBAL WELDING HELMETS MARKET SIZE, BY DIRECT SALES, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 82. GLOBAL WELDING HELMETS MARKET SIZE, BY DISTRIBUTORS, BY REGION, 2018-2030 (USD MILLION)

TABLE 83. GLOBAL WELDING HELMETS MARKET SIZE, BY DISTRIBUTORS, BY GROUP, 2018-2030 (USD MILLION)

TABLE 84. GLOBAL WELDING HELMETS MARKET SIZE, BY DISTRIBUTORS, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 85. GLOBAL WELDING HELMETS MARKET SIZE, BY ONLINE, BY REGION, 2018-2030 (USD MILLION)

TABLE 86. GLOBAL WELDING HELMETS MARKET SIZE, BY ONLINE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 87. GLOBAL WELDING HELMETS MARKET SIZE, BY ONLINE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 88. GLOBAL WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 89. GLOBAL WELDING HELMETS MARKET SIZE, BY E-COMMERCE PLATFORM, BY REGION, 2018-2030 (USD MILLION)

TABLE 90. GLOBAL WELDING HELMETS MARKET SIZE, BY E-COMMERCE PLATFORM, BY GROUP, 2018-2030 (USD MILLION)

TABLE 91. GLOBAL WELDING HELMETS MARKET SIZE, BY E-COMMERCE PLATFORM, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 92. GLOBAL WELDING HELMETS MARKET SIZE, BY MANUFACTURER WEBSITE, BY REGION, 2018-2030 (USD MILLION)

TABLE 93. GLOBAL WELDING HELMETS MARKET SIZE, BY MANUFACTURER WEBSITE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 94. GLOBAL WELDING HELMETS MARKET SIZE, BY MANUFACTURER WEBSITE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 95. GLOBAL WELDING HELMETS MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

TABLE 96. AMERICAS WELDING HELMETS MARKET SIZE, BY SUBREGION, 2018-2030 (USD MILLION)

TABLE 97. AMERICAS WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 98. AMERICAS WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 99. AMERICAS WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 100. AMERICAS WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 101. AMERICAS WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 102. AMERICAS WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 103. AMERICAS WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 104. AMERICAS WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 105. AMERICAS WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 106. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 107. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 108. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 109. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 110. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 111. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 112. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 113. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 114. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 115. NORTH AMERICA WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 116. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 117. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 118. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 119. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 120. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 121. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 122. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 123. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 124. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 125. LATIN AMERICA WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 126. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY SUBREGION, 2018-2030 (USD MILLION)

TABLE 127. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 128. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 129. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 130. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 131. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 132. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 133. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 134. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 135. EUROPE, MIDDLE EAST & AFRICA WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 136. EUROPE WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 137. EUROPE WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 138. EUROPE WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 139. EUROPE WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 140. EUROPE WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 141. EUROPE WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 142. EUROPE WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 143. EUROPE WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 144. EUROPE WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 145. EUROPE WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 146. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 147. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 148. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 149. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 150. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 151. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 152. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 153. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 154. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 155. MIDDLE EAST WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 156. AFRICA WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 157. AFRICA WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 158. AFRICA WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 159. AFRICA WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 160. AFRICA WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 161. AFRICA WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 162. AFRICA WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 163. AFRICA WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 164. AFRICA WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 165. AFRICA WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 166. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 167. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 168. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 169. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 170. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 171. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 172. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 173. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 174. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 175. ASIA-PACIFIC WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 176. GLOBAL WELDING HELMETS MARKET SIZE, BY GROUP, 2018-2030 (USD MILLION)

TABLE 177. ASEAN WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 178. ASEAN WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 179. ASEAN WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 180. ASEAN WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 181. ASEAN WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 182. ASEAN WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 183. ASEAN WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 184. ASEAN WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 185. ASEAN WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 186. ASEAN WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 187. GCC WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 188. GCC WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 189. GCC WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 190. GCC WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 191. GCC WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 192. GCC WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 193. GCC WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 194. GCC WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 195. GCC WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 196. GCC WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 197. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 198. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 199. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 200. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 201. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 202. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 203. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 204. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 205. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 206. EUROPEAN UNION WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 207. BRICS WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 208. BRICS WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 209. BRICS WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 210. BRICS WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 211. BRICS WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 212. BRICS WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 213. BRICS WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 214. BRICS WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 215. BRICS WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 216. BRICS WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 217. G7 WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 218. G7 WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 219. G7 WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 220. G7 WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 221. G7 WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 222. G7 WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 223. G7 WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 224. G7 WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 225. G7 WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 226. G7 WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 227. NATO WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 228. NATO WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 229. NATO WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 230. NATO WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 231. NATO WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 232. NATO WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 233. NATO WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 234. NATO WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 235. NATO WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 236. NATO WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 237. GLOBAL WELDING HELMETS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

TABLE 238. UNITED STATES WELDING HELMETS MARKET SIZE, 2018-2030 (USD MILLION)

TABLE 239. UNITED STATES WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 240. UNITED STATES WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 241. UNITED STATES WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 242. UNITED STATES WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 243. UNITED STATES WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 244. UNITED STATES WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 245. UNITED STATES WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 246. UNITED STATES WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 247. UNITED STATES WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)

TABLE 248. CHINA WELDING HELMETS MARKET SIZE, 2018-2030 (USD MILLION)

TABLE 249. CHINA WELDING HELMETS MARKET SIZE, BY WELDING PROCESS, 2018-2030 (USD MILLION)

TABLE 250. CHINA WELDING HELMETS MARKET SIZE, BY STYLE, 2018-2030 (USD MILLION)

TABLE 251. CHINA WELDING HELMETS MARKET SIZE, BY LENS SHADE, 2018-2030 (USD MILLION)

TABLE 252. CHINA WELDING HELMETS MARKET SIZE, BY MATERIAL, 2018-2030 (USD MILLION)

TABLE 253. CHINA WELDING HELMETS MARKET SIZE, BY POWER SOURCE, 2018-2030 (USD MILLION)

TABLE 254. CHINA WELDING HELMETS MARKET SIZE, BY END USER INDUSTRY, 2018-2030 (USD MILLION)

TABLE 255. CHINA WELDING HELMETS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

TABLE 256. CHINA WELDING HELMETS MARKET SIZE, BY OFFLINE, 2018-2030 (USD MILLION)

TABLE 257. CHINA WELDING HELMETS MARKET SIZE, BY ONLINE, 2018-2030 (USD MILLION)