Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These servers are the foundation of modern IT infrastructure, enabling a wide variety of workloads from business-critical applications to cloud-based services. Known for their affordability, flexibility, and compatibility with most operating systems and applications, x86 servers are used extensively across industries including finance, healthcare, retail, and telecommunications. Their adaptability makes them ideal for both small businesses and hyperscale data centers.

The market is witnessing rapid growth due to a surge in cloud adoption, edge computing, and the rise of artificial intelligence and machine learning workloads. Organizations are modernizing legacy systems and shifting toward hybrid and multi-cloud environments, increasing their reliance on high-density x86 servers. Moreover, as data generation continues to soar - driven by social media, IoT, and digital services - enterprises require scalable infrastructure to process, store, and analyze this data in real time. X86 servers offer the balance of performance, energy efficiency, and cost needed to meet these demands.

Key Market Drivers

Rising Adoption of Cloud Computing Across Enterprises

The exponential increase in cloud computing adoption is significantly boosting the demand for x86 servers. Enterprises are moving their workloads to public, private, and hybrid cloud environments, seeking scalable, cost-effective, and efficient infrastructure. X86 servers, known for their compatibility, flexibility, and ease of deployment, are a preferred choice for cloud service providers offering Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS). As organizations shift to digital-first operations, they require robust server solutions that can scale seamlessly across distributed cloud environments.Moreover, the agility that x86 servers provide enables businesses to deploy new services faster, reduce capital expenditures, and support diverse cloud-native workloads such as container orchestration, real-time analytics, and big data processing. Hyperscale data center operators - such as Microsoft, Amazon Web Services, and Google - rely heavily on x86-based architecture to support their massive virtual machine infrastructure and storage needs.

This trend is particularly strong in emerging markets, where digital transformation initiatives are in full swing and cloud adoption is rising rapidly among startups and government entities alike. In 2024, more than 94 percent of enterprises globally adopted cloud services across various functions. Notably, over 75 percent of these cloud-based workloads were hosted on x86 server platforms. This strong dependence on x86 architecture underscores its centrality in supporting elastic compute demands, cost-efficient scalability, and interoperability across both public and private cloud ecosystems worldwide.

Key Market Challenges

Intensifying Competition from Alternative Architectures

The rise of alternative processor architectures - especially Arm-based systems - poses a growing challenge to the dominance of x86 servers. Arm architectures deliver high performance-per-watt benefits, making them attractive for both hyperscale data centers and energy-conscious edge deployments. Cloud providers like Amazon Web Services and Microsoft Azure are integrating Arm servers into their infrastructure to reduce power and cooling costs, which undermines x86 price-performance advantages. The momentum behind Arm is driven further by open ecosystems that allow for customized System-on-Chip designs tailored to specific workloads, such as AI inference or media streaming. This fragmentation means original x86-based vendors must innovate rapidly or risk losing market share, particularly where low-power, high-density computing is preferred.For x86 server manufacturers, this competitive pressure necessitates aggressive investment in processor efficiency, custom accelerators (e.g., 3D V-Cache, Optane memory), and vertical integration. However, the arms race in silicon design requires substantial capital and long development cycles, potentially delaying time-to-market. Furthermore, migration to alternative architectures entails considerable software re-engineering and ecosystem support - costly and time-consuming for enterprise clients locked into x86-optimized applications. Unless x86 vendors can clearly demonstrate superior total cost of ownership, software compatibility, and workload flexibility, the continued erosion at both edges - cloud and edge - could compromise market leadership.

Key Market Trends

Integration of Accelerated Computing and AI Workloads

A prominent trend in the Global X86 Server Market is the increasing integration of accelerated computing capabilities to support artificial intelligence and machine learning workloads. Traditional x86 architecture, while efficient for general-purpose processing, is being enhanced with specialized accelerators such as Graphics Processing Units, Field-Programmable Gate Arrays, and custom Artificial Intelligence chips to manage the rising demand for high-throughput and low-latency computation. Leading x86 server manufacturers are embedding these accelerators directly into server platforms, enabling enterprises to train and deploy complex AI models with improved speed and efficiency. This architectural evolution is crucial to support next-generation use cases such as predictive analytics, autonomous systems, and real-time fraud detection.Additionally, enterprises across sectors such as healthcare, retail, finance, and manufacturing are increasingly prioritizing AI-powered analytics, which is accelerating the shift toward AI-ready server infrastructure. The x86 server ecosystem is also evolving to support software frameworks and toolkits like TensorFlow, PyTorch, and ONNX more efficiently. These software integrations enhance compatibility and reduce deployment friction, making x86 servers a competitive platform for advanced data science and machine learning workloads. This trend is expected to drive significant investment in hybrid AI infrastructure that balances traditional CPU-based processing with modern accelerator-based performance enhancements.

Key Market Players

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Lenovo Group Limited

- Cisco Systems, Inc.

- Inspur Group Co., Ltd.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Super Micro Computer, Inc.

Report Scope:

In this report, the Global X86 Server Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:X86 Server Market, By Processor Type:

- Intel-based X86 Servers

- AMD-based X86 Servers

X86 Server Market, By Price Range:

- Entry-Level X86 Servers

- Mid-Range X86 Servers

- High-End X86 Servers

X86 Server Market, By End-User Industry:

- Healthcare

- IT and Telecom

- Hospitality

- Retail

- Manufacturing

X86 Server Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- South America

- Brazil

- Colombia

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global X86 Server Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Lenovo Group Limited

- Cisco Systems, Inc.

- Inspur Group Co., Ltd.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Super Micro Computer, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

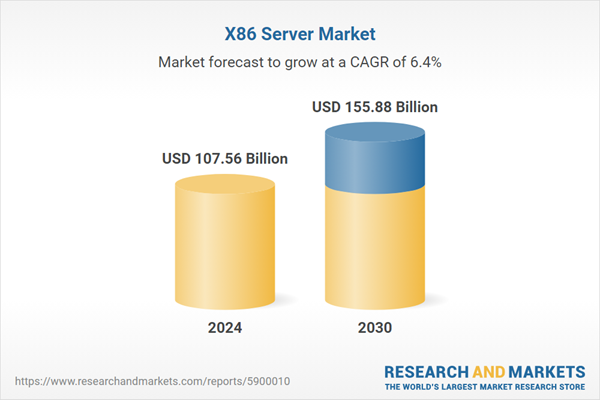

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 107.56 Billion |

| Forecasted Market Value ( USD | $ 155.88 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |