Speak directly to the analyst to clarify any post sales queries you may have.

A concise practitioner-focused introduction framing how policy volatility, agronomic innovation, and supply chain pressures are reshaping grain farming decision-making

This executive summary introduces a concise, practitioner-focused overview of current dynamics shaping grain farming across major production systems. The narrative synthesizes structural drivers, policy shocks, and operational innovations that matter to producers, traders, input suppliers, and technology providers. Readers will find prioritized implications for risk management, supply chain resilience, and investment prioritization, presented to inform board-level decisions and farm-level strategy alike.The introduction situates the analysis within an era of elevated policy volatility and rapid agronomic innovation. By framing the conversation around practical business choices rather than abstract projections, this section equips decision-makers with a clear sense of prevailing headwinds and tailwinds, and establishes a baseline for the subsequent, more detailed sections.

How technology adoption, consolidation in handling and trading, and climate pressures are collectively redefining competitive advantage and operational priorities in grain farming

The grain farming landscape is undergoing transformative shifts driven by an interplay of technological adoption, evolving trade policies, and climate variability. Advances in seed genetics, precision agronomy, and digital farm management platforms are accelerating productivity gains while simultaneously changing input and labor requirements. Consequently, farms that invest in data-driven decision systems are achieving improved resource efficiency and are better positioned to manage price and policy shocks.Meanwhile, structural consolidation among grain handlers and the expanding role of commodity exchange platforms are changing how price signals are transmitted from field to market. These shifts are also prompting a reevaluation of risk management tools, including the interplay between physical storage strategies and financial hedging. Taken together, these forces are reconfiguring competitive advantage in grain farming, favoring operators that integrate technological capability with adaptive supply chain strategies.

An integrated assessment of how the United States tariffs implemented in 2025 have reshaped sourcing, logistics flexibility, and contractual risk across the grain value chain

The cumulative impact of the United States tariffs announced in 2025 has reverberated through input procurement, export routing, and contractual obligations across the grain sector. Tariff adjustments altered pricing relationships between domestic and international buyers, prompting downstream buyers to reconfigure sourcing strategies and, in some cases, to accelerate diversification toward alternative suppliers or substitute crops. In turn, these shifts influenced planting decisions, storage dynamics, and seasonal cash flow management across producing regions.Moreover, tariff-induced changes in trade flows have heightened the importance of logistics agility. Firms that maintained flexible shipping contracts and those with diversified port access gained a competitive edge when traditional routes experienced congestion or rerouting. As a result, the tariff environment has underscored the need for integrated trade risk assessment within farm-level and corporate planning cycles, connecting procurement choices to currency exposure, freight cost volatility, and evolving phytosanitary requirements.

Detailed segmentation insights revealing how crop varietals, farming models, seed choices, irrigation infrastructure and distribution routes jointly determine resilience and margin outcomes

Segment-level insights reveal differentiated opportunities and vulnerabilities across crop types, farming models, seed technologies, irrigation approaches, and distribution channels. Based on crop type, the landscape spans barley, corn with dent, flint and sweet varieties, oats, rice differentiated into basmati, brown, jasmine and white, sorghum, soybean split between conventional and GMO, and wheat with durum, hard red and soft red classes; understanding varietal demand and end-use requirements is essential for aligning production with premium markets. Based on farming model, contract arrangements, conventional practices and organic systems continue to attract distinct buyer bases and regulatory considerations, with contract farming offering predictability while organic commands and maintains niche premiums.Based on seed type, differences between GMO, hybrid and open-pollinated seeds drive input regimes, input costs, and stewardship obligations, and seed choice increasingly interfaces with market access constraints. Based on irrigation method, farms operating irrigated systems using drip, flood and sprinkler technologies face different risk profiles and capital intensity than rainfed operations, affecting resilience to seasonal variability and water policy shifts. Based on distribution channel, the routes to market including commodities exchange, cooperatives, direct sales and online platforms shape margin realization, contract terms and the speed at which farms can respond to price signals and buyer specifications. Synthesizing these segmentation layers reveals how strategic choices at the farm level cascade into supply chain performance and value capture.

Regional analysis highlighting how infrastructure, policy heterogeneity and demand patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific shape strategic choices in grain farming

Regional dynamics are central to understanding trade flows, input availability and regulatory exposure across grain farming. In the Americas, structural strengths include high mechanization rates, scalable logistics networks and proximity to major export gateways, yet the region also contends with concentrated weather risk zones and policy debates over subsidy frameworks. Consequently, producers and buyers must balance efficiency gains with contingency planning for episodic disruptions.In Europe, Middle East & Africa, the landscape is heterogeneous: parts of Europe combine intensive farming systems with stringent sustainability standards, while Middle Eastern and African markets often face infrastructure constraints and diverse regulatory regimes. This mix creates both import dependence in some geographies and export opportunities in others. In the Asia-Pacific, demand-side dynamics, diverse rice and wheat consumption patterns, and regional trade agreements influence planting incentives and varietal selection. Across all regions, regional trade relationships, port capacity, and domestic policy decisions interact to shape supply chain resilience and commercial strategy.

Corporate strategic moves across input suppliers, handlers, agtech and equipment makers that are driving integrated service models and reshaping competitive positioning in grain systems

Key companies across the grain value chain are responding to market shifts through strategic partnerships, investment in digital capabilities, and diversification of service portfolios. Leading input suppliers are expanding integrated offerings that combine advanced seed genetics with digital advisory services to help farmers translate genetics into on-farm performance. At the same time, major grain handlers and cooperatives are investing in storage optimization and logistics solutions to reduce post-harvest losses and to offer more flexible pricing arrangements to producer-members.Agtech start-ups are accelerating the deployment of decision-support systems and traceability platforms that enable more transparent supply chains, while equipment manufacturers are introducing machines designed for precision applications and lower-energy footprints. Commodity traders and online trading platforms are innovating contract structures to provide greater short-term liquidity and to facilitate access for smaller producers. Collectively, these company-level moves are shifting the competitive landscape toward integrated service models that blend product, data, and logistics capabilities.

Actionable recommendations that combine scenario-based trade risk planning, targeted digital investments, strategic partnerships, and resource-efficiency measures to strengthen resilience and growth

Industry leaders should prioritize a blend of operational agility and strategic investments to navigate evolving trade policies and technological change. First, firms should establish scenario-based trade risk frameworks that link tariff scenarios to sourcing alternatives, logistics contingencies and contract renegotiation protocols, thereby reducing reaction time when policies change. Second, investing selectively in digital agronomy tools and decision-support platforms will yield faster returns where data translates directly into input efficiency and yield stability.Additionally, firms should pursue partnerships that extend value chain reach-collaborations between seed companies, logistics providers and buyer groups can create differentiated, quality-assured product flows. Water and energy efficiency investments in irrigation and mechanization will improve resilience and reduce exposure to regulatory shifts. Finally, leadership teams must embed continuous learning processes and cross-functional coordination so that R&D, commercial, and logistics teams convert emerging signals into prioritized investments and adaptive operating models.

A rigorous mixed-methods research methodology combining primary industry interviews, policy review, and agronomic literature synthesis to deliver validated and actionable insights

The research methodology underpinning this analysis integrates primary interviews, comparative policy review, and a synthesis of peer-reviewed agronomy literature to provide a balanced and verifiable foundation for conclusions. Primary inputs included structured interviews with supply chain executives, farm operators, trade intermediaries and technology providers to capture on-the-ground responses to recent policy and market shifts. These qualitative inputs were triangulated with regulatory announcements, trade flow data and technical agronomy studies to validate operational implications.Analytical rigor was achieved through cross-validation of interview findings with independent literature and operational case studies, while attention to regional specificity ensured that recommendations are contextually grounded. The methodology emphasizes transparency in assumptions and a conservative approach to inference, focusing on observable behavior changes, documented policy actions, and verifiable technological adoption patterns rather than speculative projections.

A conclusive synthesis that ties policy, technology and trade dynamics into practical strategic priorities for resilient and profitable grain production

In conclusion, grain farming is at an inflection point where policy shifts, technological advancement, and changing trade relationships are creating both constraints and opportunities. Farms and firms that adopt an integrated strategy-combining flexible risk management, targeted technology adoption, and stronger connectivity to buyers-will be better positioned to capture value and to mitigate downside exposure. Strategic clarity around crop selection, seed strategy, irrigation investment and channel optimization will determine who benefits from the structural changes currently underway.Looking ahead, sustained attention to logistics resilience, diversification of distribution channels, and purposeful partnerships will be critical. Decision-makers should treat the present environment not as a return to volatility for its own sake but as a strategic opening to reconfigure operations for improved efficiency, stronger market access and more resilient revenue streams.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Grain Farming Market

Companies Mentioned

- AG Processing Inc.

- Archer Daniels Midland Company

- Ardent Mills

- BASF

- Bunge Global SA

- Bunge Limited

- Cargill, Incorporated

- CHS Inc.

- COFCO International Traders Holding GmbH

- Louis Dreyfus Company B.V.

- Marubeni Corporation

- Olam International Limited

- Viterra Inc.

Table Information

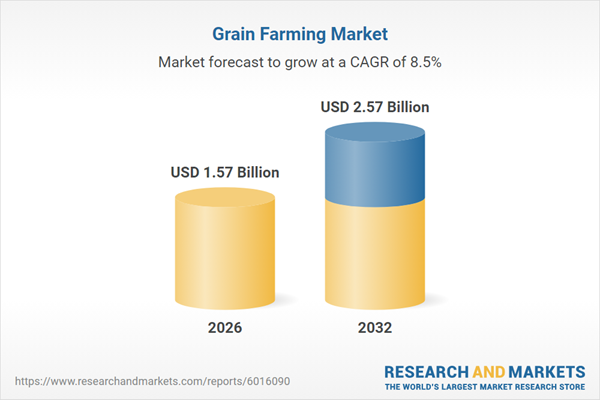

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.57 Billion |

| Forecasted Market Value ( USD | $ 2.57 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |