Global Green Transformers Market - Key Trends & Drivers Summarized

Why Are Green Transformers Becoming Essential to Sustainable Grid Infrastructure?

Green transformers - also referred to as eco-friendly or sustainable transformers - are emerging as a key component in modernizing power grids while reducing environmental impact. Unlike conventional oil-filled transformers that use mineral oils and emit higher CO2 over their lifecycle, green transformers utilize biodegradable insulating fluids such as natural esters (vegetable-based oils), exhibit lower energy losses, and are often built using recyclable materials. Their design prioritizes energy efficiency, fire safety, and minimal ecological footprint, aligning with the global push toward decarbonization, renewable integration, and resilient electric infrastructure.The growing electrification of economies and the accelerated deployment of renewable energy projects are increasing demand for transformer technology that supports sustainable development goals. Green transformers play a critical role in renewable integration by enhancing grid reliability, improving transformer lifespan under thermal stress, and supporting variable load operations. Their non-toxic, biodegradable fluid insulation also allows installation in environmentally sensitive areas - urban centers, water protection zones, and underground substations - without the risks posed by traditional transformer oils. As utilities, industries, and governments commit to carbon-neutral strategies, green transformers are becoming a standard rather than a niche innovation.

How Are Design Innovations and Standards Elevating the Performance of Green Transformers?

Technological advancements in transformer design are expanding the capabilities and adoption of green transformers. One of the most impactful developments is the use of natural ester fluids with superior fire point (>300°C) and moisture-absorbing properties, which enhance dielectric strength and reduce risk of insulation failure. These fluids also enable compact transformer designs, making green transformers ideal for space-constrained installations such as offshore wind platforms, data centers, and mobile substations. Additionally, amorphous metal core technology is being adopted to reduce core losses by up to 70% compared to traditional silicon steel cores, significantly improving efficiency.The industry is also moving toward modular, digital-ready green transformers, embedded with smart sensors, condition monitoring systems, and IoT connectivity for predictive maintenance and real-time energy management. Standards bodies such as IEC, IEEE, and CIGRÉ are increasingly incorporating guidelines for environmental performance, biodegradable fluids, and eco-design in transformer specifications. Compliance with global environmental certifications (like ISO 14000) and safety regulations is becoming a procurement priority, especially for public infrastructure projects and utility-scale renewable energy installations. Together, these design enhancements and regulatory alignments are making green transformers more technically competitive and commercially viable.

Which Sectors and Applications Are Driving the Demand for Green Transformers?

The demand for green transformers is rising sharply across sectors prioritizing energy efficiency, environmental compliance, and high-reliability power systems. In the renewable energy sector, green transformers are essential for grid connection of wind and solar farms, where variable output and harsh environmental conditions require durable, eco-safe solutions. Utilities and grid operators are deploying these transformers in urban substations, smart grid expansions, and rural electrification projects, particularly in regions adopting stringent emission and safety norms.In the commercial and industrial segments, green transformers are being installed in data centers, hospitals, airports, and commercial complexes, where fire safety, energy conservation, and space optimization are critical. Eco-industrial parks and green-certified buildings are also adopting these transformers to meet LEED, BREEAM, and other green building certification criteria. Additionally, transportation infrastructure - especially in electric railways, metro systems, and EV charging networks - is increasingly integrating green transformers to align with government-led decarbonization initiatives. These diverse end-uses reflect the expanding recognition of transformers as a central pillar in sustainable and future-ready energy systems.

What Is Driving Growth in the Global Green Transformers Market Across Regions?

The growth in the green transformers market is driven by a confluence of environmental policy, technological innovation, and power infrastructure expansion. One of the primary drivers is the global transition toward low-carbon energy systems, underpinned by government mandates, emissions reduction targets, and green financing mechanisms. Countries in Europe and North America are leading adoption due to aggressive climate policies, while emerging economies in Asia-Pacific, Latin America, and Africa are incorporating green transformers into renewable energy and smart grid projects supported by multilateral funding agencies.Moreover, rising demand for energy-efficient power distribution - fueled by urbanization, digitalization, and industrial growth - is creating new opportunities for transformers with low operational losses and high lifecycle sustainability. Cost parity between green and conventional transformers is improving, thanks to economies of scale, technological standardization, and material optimization. Additionally, public and private investments in resilient grid modernization and sustainable urban infrastructure are directly supporting the deployment of green transformer technologies. These converging forces are not only expanding market adoption but also reinforcing green transformers as essential assets in building climate-resilient, high-efficiency power networks worldwide.

Report Scope

The report analyzes the Green Transformers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Installation (Indoor, Outdoor); Phase (Single Phases, Three Phases); End-Use (Residential, Commercial, Industrial, Utilities).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Indoor Installation segment, which is expected to reach US$8.7 Billion by 2030 with a CAGR of a 3.7%. The Outdoor Installation segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.1 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Green Transformers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Green Transformers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Green Transformers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atlantic Specialty Coffee, Batdorf & Bronson, Covoya Coffee, ECOM Agroindustrial, Falcon Coffees and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Green Transformers market report include:

- ABB Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- CG Power and Industrial Solutions Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- Eaton Corporation

- Efacec

- Ermco

- Flame Toys

- General Electric (GE)

- Green Transfo SAS

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- SGB-SMIT Group

- Siemens AG

- SPX Transformer Solutions

- TBEA Co., Ltd.

- Toshiba Corporation

- Urja Techniques (India) Pvt. Ltd.

- Voltamp Transformers Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- CG Power and Industrial Solutions Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- Eaton Corporation

- Efacec

- Ermco

- Flame Toys

- General Electric (GE)

- Green Transfo SAS

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- SGB-SMIT Group

- Siemens AG

- SPX Transformer Solutions

- TBEA Co., Ltd.

- Toshiba Corporation

- Urja Techniques (India) Pvt. Ltd.

- Voltamp Transformers Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 364 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

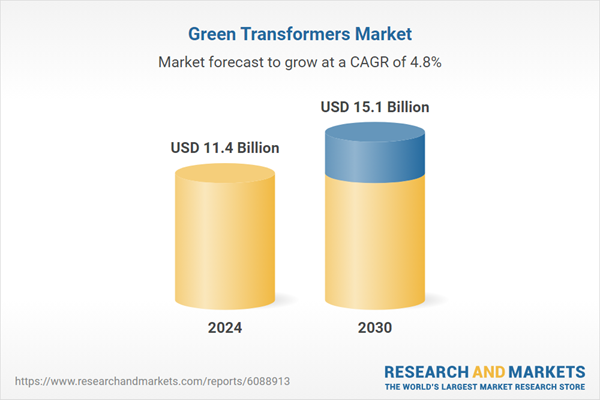

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 15.1 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |