Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A significant barrier to market scalability involves the acute shortage of certified maintenance technicians, which limits service throughput and prolongs turnaround times. This labor constraint jeopardizes efficiency even as the global fleet continues to grow in both volume and value. According to the General Aviation Manufacturers Association, the preliminary value of helicopter deliveries in 2024 reached 4.5 billion dollars, representing an increase of approximately 7.6 percent. This data underscores the intensifying capital investment in rotorcraft, which necessitates sustained professional technical support to maintain these assets.

Market Drivers

Rising defense budgets and military fleet modernization initiatives significantly propel the global Helicopter MRO market as armed forces prioritize the readiness and longevity of their rotorcraft assets. Military operators are increasingly investing in sustainment contracts and comprehensive upgrade packages to integrate advanced avionics and extend the service life of legacy airframes. This strategic focus ensures operational capability against evolving geopolitical threats, generating substantial recurring revenue for maintenance providers. For instance, the U.S. Department of Defense announced in June 2024 that The Boeing Company was awarded a contract modification valued at approximately $115 million for the procurement of MH-47G renew build rotary wing aircraft, illustrating the massive scale of capital allocated to military rotorcraft modernization.Simultaneously, the growing utilization of helicopters in civil and commercial sectors necessitates rigorous adherence to maintenance intervals and drives demand for aftermarket support. As operators expand their fleets to meet rising demand for diverse missions ranging from emergency medical services to offshore energy transport, the volume of required airworthiness inspections and component overhauls increases proportionally. According to Leonardo’s first-half 2024 results, the Helicopters sector recorded a revenue increase of approximately 11 percent year-on-year, driven significantly by a surge in demand for after-sales services and support. This positive momentum is further reflected in the broader market's fleet expansion, with Airbus registering 233 net helicopter orders in the first half of 2024 - a 78 percent increase compared to the same period in 2023 - ensuring a steady pipeline of future maintenance requirements.

Market Challenges

The primary challenge impeding the Global Helicopter MRO Market is the critical shortage of certified maintenance technicians. This labor deficit directly restricts the operational capacity of MRO providers and prevents them from scaling services to meet the demands of an expanding global rotorcraft fleet. As the volume of airframe inspections and component repairs increases, the lack of qualified personnel leads to significant bottlenecks that extend aircraft turnaround times and reduce overall service throughput. This inefficiency limits the revenue potential of maintenance facilities and creates operational risks for fleet operators who rely on timely adherence to strict regulatory mandates.The impact of this workforce gap is intensified by the specialized nature of rotorcraft maintenance, which competes for talent with the broader aviation sector. According to the Aviation Technician Education Council's 2024 industry pipeline report, the sector faces a severe workforce gap with an anticipated 20 percent shortfall in maintenance technicians by 2028. This statistical reality highlights a structural inability to support the increasing capital investment in new helicopters. Consequently, the market faces a scenario where capital assets are entering service faster than the technical workforce can expand to maintain them, which effectively caps the market growth trajectory.

Market Trends

The adoption of sustainable and eco-friendly MRO practices is fundamentally reshaping maintenance operations as stakeholders prioritize carbon neutrality and environmental compliance. Operators and maintenance providers are increasingly integrating green technologies into their workflows, such as the use of biodegradable cleaning solvents and the implementation of Sustainable Aviation Fuel (SAF) for post-maintenance test flights and engine run-ups. This shift not only aligns with global environmental regulations but also enhances the corporate social responsibility profiles of major industry players. According to AFM.aero in January 2025, Airbus Helicopters reported increasing its usage of sustainable aviation fuel for test and training flights to nearly 20 percent, a transition that necessitates new fuel handling protocols and storage infrastructure within MRO facilities.Concurrently, the utilization of additive manufacturing for spare parts is revolutionizing supply chain management by addressing the critical challenge of component obsolescence and long lead times. MRO providers are leveraging 3D printing technologies to fabricate complex, low-volume parts on demand, which significantly reduces the need for massive physical inventories and minimizes aircraft downtime. This technology is particularly vital for maintaining aging military and civil fleets where original tooling may no longer exist. As noted by eVTOL.news in April 2025 regarding Sikorsky's innovations, the S-104 HEX demonstrator program successfully employed three different additive manufacturing technologies to fabricate critical dynamic and airframe components, proving that rapid production of flight-critical hardware provides a strategic advantage in maintaining fleet readiness.

Key Players Profiled in the Helicopter MRO Market

- Airbus SAS

- CHC Group LLC

- Honeywell International Inc.

- Leonardo S.p.A.

- MTU Aero Engines AG

- Rolls-Royce PLC

- Safran S.A.

- StandardAero Aviation Holdings, Inc.

- Textron Inc.

- RTX Corporation

Report Scope

In this report, the Global Helicopter MRO Market has been segmented into the following categories:Helicopter MRO Market, by Type:

- Airframe Heavy Maintenance

- Engine Maintenance

- Component Maintenance

- Line Maintenance

Helicopter MRO Market, by Helicopter Type:

- Light Helicopter (3.1 Tons)

- Medium Helicopter (3.1 - 9.0 Tons)

- Heavy Helicopter (9.0 Tons)

Helicopter MRO Market, by Application:

- Civil

- Military

Helicopter MRO Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Helicopter MRO Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Helicopter MRO market report include:- Airbus SAS

- CHC Group LLC

- Honeywell International Inc

- Leonardo S.p.A.

- MTU Aero Engines AG

- Rolls-Royce PLC

- Safran S.A.

- StandardAero Aviation Holdings, Inc

- Textron Inc

- RTX Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

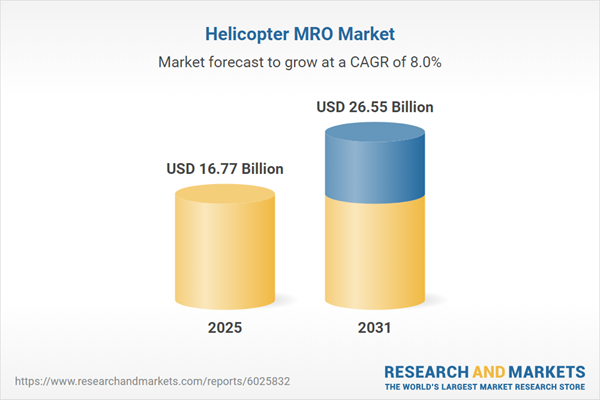

| Estimated Market Value ( USD | $ 16.77 Billion |

| Forecasted Market Value ( USD | $ 26.55 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |