Global Hemodialysis Market - Key Trends and Drivers Summarized

Is Hemodialysis the Lifeline for Patients with Chronic Kidney Disease?

Hemodialysis is a life-saving treatment for individuals with kidney failure or chronic kidney disease (CKD), but what makes it so essential? Hemodialysis is a medical process that filters waste, salts, and excess fluids from the blood when the kidneys can no longer perform this function. It acts as an artificial replacement for kidney function, helping patients maintain a balance of fluids and electrolytes, remove toxins, and manage blood pressure. Without hemodialysis, individuals with end-stage kidney disease would face life-threatening complications from toxin buildup in their bloodstream.This treatment is particularly important for patients with CKD, as it provides a critical means of survival while they await a kidney transplant or as long-term management for those who are not eligible for transplantation. Hemodialysis typically requires patients to undergo treatments multiple times a week, either in a dialysis center or at home, depending on the type of dialysis prescribed. Each session can last several hours, during which blood is filtered through a dialysis machine before being returned to the body. As the incidence of kidney disease continues to rise globally, particularly with increasing rates of diabetes and hypertension, the demand for hemodialysis has grown, making it a crucial part of modern healthcare.

How Has Technology Enhanced Hemodialysis Treatment?

Advancements in medical technology have significantly improved the effectiveness, comfort, and accessibility of hemodialysis, transforming it from a challenging procedure to a more manageable and patient-friendly treatment. One of the most notable innovations is the development of home hemodialysis (HHD) machines, which allow patients to perform dialysis in the comfort of their own homes. These portable, compact devices enable more frequent dialysis sessions with greater flexibility in scheduling, leading to better health outcomes and improved quality of life. Home hemodialysis reduces the need for patients to travel to dialysis centers multiple times a week, making the treatment less disruptive to daily life.Technological improvements in dialysis machines have also made the process more efficient and less taxing on the body. Modern machines feature better sensors, advanced software, and automated systems that closely monitor blood flow, filtration rates, and fluid balance in real time. These innovations ensure that each dialysis session is optimized for the patient’s specific needs, reducing complications such as hypotension or fluid overload. Furthermore, developments in biocompatible dialysis membranes - such as those made from synthetic polymers - have enhanced the filtering capabilities of dialysis machines while minimizing inflammation and clotting, making treatments safer and more effective.

Another key advancement is the integration of wearable technologies and telemedicine into hemodialysis care. Remote monitoring systems now allow healthcare providers to track a patient’s vitals and treatment data in real-time, even when dialysis is performed at home. This connectivity enables early detection of potential issues, such as infections or access site problems, and allows for timely interventions, reducing hospital admissions and improving patient outcomes. In addition, advancements in vascular access devices, such as the creation of more durable and less invasive arteriovenous (AV) fistulas, have extended the lifespan of access sites, reducing complications and the need for repeated surgeries. These technological enhancements are making hemodialysis more efficient, safer, and accessible for patients worldwide.

Why Is Hemodialysis Essential for Patients with Kidney Failure?

Hemodialysis is essential for patients with kidney failure because it serves as the only effective treatment option for removing waste products and excess fluid from the body when the kidneys can no longer perform these vital functions. In the absence of functioning kidneys, the buildup of toxins, excess potassium, and fluids in the bloodstream can lead to severe complications, including cardiovascular issues, fluid retention in the lungs, and dangerous electrolyte imbalances. Without dialysis, these conditions would rapidly lead to organ failure and death. Hemodialysis helps manage these risks by mimicking the filtration process of healthy kidneys, allowing patients to maintain a semblance of normal bodily function.In addition to its life-sustaining role, hemodialysis offers patients the ability to lead relatively active lives. By controlling waste and fluid levels in the body, the treatment reduces symptoms like fatigue, swelling, and shortness of breath, which are common in patients with advanced kidney disease. While dialysis does not cure kidney failure, it significantly improves quality of life and enables patients to manage their condition over the long term. For many, hemodialysis is a bridge to kidney transplantation, while for others who are not candidates for transplant, it becomes a lifelong treatment.

Hemodialysis also plays a vital role in managing other health complications related to kidney failure, such as anemia and bone disease. During dialysis sessions, patients often receive medications that help regulate these conditions, making the treatment a comprehensive approach to managing the complexities of kidney failure. For those who suffer from end-stage renal disease (ESRD), hemodialysis is not only a treatment but a necessity for maintaining health and preventing the progression of potentially fatal complications. As the prevalence of kidney disease increases globally, particularly in populations with high rates of diabetes and hypertension, hemodialysis remains a critical treatment option for millions of people.

What Factors Are Driving the Growth of the Hemodialysis Market?

The growth of the hemodialysis market is driven by several key factors, including the rising incidence of chronic kidney disease (CKD), technological advancements in dialysis equipment, and an aging global population. One of the most significant drivers is the increasing prevalence of CKD, particularly as conditions like diabetes and hypertension - two leading causes of kidney disease - continue to rise worldwide. With the global burden of kidney disease growing, the demand for dialysis services, including hemodialysis, is expanding rapidly. In regions with high rates of obesity, metabolic syndrome, and cardiovascular disease, the need for accessible dialysis treatments is becoming more urgent.Technological advancements in dialysis machines and treatment methods are also contributing to market growth. Innovations such as home hemodialysis (HHD) machines, more efficient dialysis membranes, and improved vascular access devices are making treatments more patient-friendly and accessible. Home hemodialysis, in particular, is gaining traction as more patients and healthcare providers recognize the benefits of flexibility, improved health outcomes, and better quality of life compared to traditional in-center dialysis. The increasing availability of portable dialysis devices and wearable monitoring technologies is further fueling the adoption of hemodialysis in both developed and developing markets.

An aging population is another major factor driving the growth of the hemodialysis market. As the global population ages, the incidence of kidney disease increases, particularly among individuals over the age of 60. Older adults are more likely to develop CKD due to age-related declines in kidney function and the higher prevalence of comorbidities such as diabetes and hypertension. This demographic trend is increasing the demand for hemodialysis services and infrastructure to accommodate the growing number of patients requiring long-term kidney care.

Lastly, improved healthcare infrastructure and the expansion of dialysis centers in emerging markets are contributing to the growth of the hemodialysis market. Governments and private healthcare providers are investing in the expansion of dialysis services to meet the rising demand for treatment, particularly in regions where access to kidney care has historically been limited. This expansion is improving access to dialysis in rural and underserved areas, driving market growth and ensuring that more patients can receive life-saving hemodialysis treatments. As healthcare systems around the world continue to evolve, the demand for effective, accessible hemodialysis solutions is expected to grow, solidifying its role as a critical component of kidney disease management.

SCOPE OF STUDY:

The report analyzes the Hemodialysis market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Segment (Services, Drugs, Consumables & Equipment); End-Use (Dialysis Centers & Hospitals, Home Care)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Services segment, which is expected to reach US$80.1 Billion by 2030 with a CAGR of a 4.9%. The Drugs segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $26.0 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $28.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hemodialysis Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hemodialysis Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hemodialysis Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Argon Medical Devices, Inc., Asahi Kasei Medical Co., Ltd., B. Braun Melsungen AG, BARD, A Becton, Dickinson Company, Baxter International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Hemodialysis market report include:

- Argon Medical Devices, Inc.

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Baxter International, Inc.

- Baxter International, Inc.

- DaVita Healthcare Partners, Inc.

- Fresenius Medical Care AG & Co. KgaA

- Kawasumi Laboratories, Inc.

- Medical Components, Inc.

- Merit Medical Systems, Inc.

- Nikkiso Co., Ltd.

- Nipro Corporation

- Teleflex, Inc.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Argon Medical Devices, Inc.

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Baxter International, Inc.

- Baxter International, Inc.

- DaVita Healthcare Partners, Inc.

- Fresenius Medical Care AG & Co. KgaA

- Kawasumi Laboratories, Inc.

- Medical Components, Inc.

- Merit Medical Systems, Inc.

- Nikkiso Co., Ltd.

- Nipro Corporation

- Teleflex, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

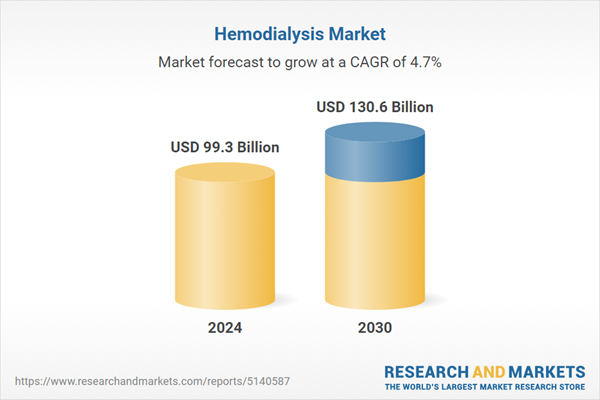

| Estimated Market Value ( USD | $ 99.3 Billion |

| Forecasted Market Value ( USD | $ 130.6 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |