Global Hydronic Underfloor Heating Market - Key Trends & Drivers Summarized

Why Is Hydronic Underfloor Heating Reshaping Modern Heating Paradigms?

Hydronic underfloor heating is rapidly redefining the global heating landscape, offering an energy-efficient, comfortable, and increasingly preferred solution for residential, commercial, and industrial spaces. Unlike traditional heating systems that warm the air, hydronic underfloor heating uses a network of water-filled pipes embedded beneath the floor surface to radiate heat evenly across a room. This system enables a more balanced indoor temperature distribution, reduces energy consumption, and enhances thermal comfort by warming objects and people directly rather than relying solely on air convection. As sustainability and building energy efficiency become critical to climate strategy, hydronic underfloor heating systems are being integrated into passive house designs, zero-energy buildings, and green-certified construction projects. The technology is particularly favored in regions with cold climates or where energy codes promote low-temperature heating. Its ability to operate efficiently with renewable energy sources, such as air-to-water and ground-source heat pumps, further strengthens its relevance in the transition to decarbonized, all-electric heating solutions. With consumer expectations for invisible, silent, and space-saving heating alternatives on the rise, hydronic underfloor systems are becoming a sought-after upgrade in both new builds and energy-efficient retrofits.How Are Design Innovations and Smart Technology Elevating Underfloor Heating Systems?

Recent technological and design innovations have significantly enhanced the performance, ease of installation, and control of hydronic underfloor heating systems. Engineers and manufacturers have developed ultra-thin panel systems, pre-insulated pipe mats, and modular screedless designs that allow underfloor heating to be installed more quickly and efficiently, even in renovations where floor height and construction disruption are concerns. Enhanced multi-layer composite piping and advanced manifold systems have improved thermal conductivity, flexibility, and system responsiveness, enabling more precise zoning and quicker warm-up times. At the same time, the integration of smart thermostats, wireless sensors, and IoT-enabled control systems has revolutionized how users interact with underfloor heating, allowing them to adjust temperatures room-by-room via mobile apps or home automation systems. These intelligent control features not only improve comfort but also drive energy savings by optimizing temperature based on occupancy and usage patterns. Furthermore, compatibility with renewable energy sources and low-temperature heat pumps makes hydronic underfloor heating an ideal component in future-ready HVAC ecosystems. The combination of cutting-edge materials, digital controls, and flexible installation options is transforming hydronic underfloor heating from a niche luxury into a mainstream, high-performance heating solution.What Role Do Sustainability Regulations and Green Building Codes Play in Market Expansion?

Sustainability-focused regulations and evolving building standards are playing a pivotal role in accelerating the global adoption of hydronic underfloor heating. As governments around the world tighten building energy codes and emissions reduction targets, underfloor heating systems are being recognized for their compatibility with low-carbon, energy-efficient heating strategies. In Europe, regulations under the Energy Performance of Buildings Directive (EPBD) and regional decarbonization roadmaps are driving the demand for systems that align with low-temperature heating requirements - making hydronic underfloor heating systems an ideal fit. Countries such as Germany, the UK, and the Netherlands are leading in market penetration, with a rising number of residential and public-sector buildings incorporating underfloor heating to meet thermal efficiency and indoor comfort standards. In North America and Asia-Pacific, green building certifications such as LEED, WELL, and BREEAM are incentivizing the use of radiant systems that contribute to energy efficiency, indoor air quality, and occupant wellbeing. Moreover, as carbon-neutral building mandates and electrification policies gain momentum, hydronic underfloor heating’ s ability to pair with heat pumps and solar thermal systems is creating new opportunities across multi-unit dwellings, hospitals, educational facilities, and commercial buildings. Regulatory support is not only legitimizing the technology’ s long-term value but also creating favorable conditions for manufacturers, installers, and property developers to scale deployment across diverse geographies.What Is Driving the Strong Growth Trajectory of the Hydronic Underfloor Heating Market?

The growth in the hydronic underfloor heating market is driven by several factors related to energy efficiency trends, evolving construction practices, end-user preferences, and technological compatibility with next-generation heating systems. First, the global surge in sustainable construction and building retrofits is pushing the adoption of radiant heating systems that offer improved thermal performance and lower operational costs. Second, the widespread deployment of air-to-water and ground-source heat pumps is creating a natural demand for heating distribution systems - like hydronic underfloor heating - that function optimally at lower temperatures. Third, consumer demand for aesthetically unobtrusive, quiet, and comfortable indoor heating is encouraging the shift away from bulky radiators and forced-air systems toward sleek, invisible underfloor options. Fourth, the hospitality, healthcare, and luxury housing sectors are increasingly integrating underfloor systems to elevate comfort and energy credentials, thereby expanding the technology’ s application scope. Fifth, advancements in modular systems and installation techniques are reducing project timelines and costs, making hydronic underfloor heating more accessible to mid-tier housing projects and small-scale renovations. Lastly, government-backed incentive programs and favorable regulatory environments in regions prioritizing decarbonization are fueling market growth by supporting installations through rebates and grants. These converging factors are positioning hydronic underfloor heating as a cornerstone technology in high-performance, low-carbon buildings of the future.Report Scope

The report analyzes the Hydronic Underfloor Heating market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Facility (New Buildings Facility, Retrofit Facility); Application (Residential Application, Commercial Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the New Buildings Facility segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of a 3.2%. The Retrofit Facility segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 7% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydronic Underfloor Heating Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydronic Underfloor Heating Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydronic Underfloor Heating Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Antrax IT S.r.l., Buderus (a Bosch brand), Cinier, De'Longhi Radiators, Eskimo Products Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Hydronic Underfloor Heating market report include:

- Arctic Heat Pumps

- Danfoss A/S

- Emerson Electric Co.

- Giacomini S.p.A.

- Incognito Heat Co.

- John Guest (a RWC Brand)

- Mitsubishi Electric Corporation

- nVent Electric plc

- Plastics Pipe Institute Inc.

- REHAU Group

- Robert Bosch GmbH

- Schneider Electric

- Siemens AG

- Thermosoft International Corporation

- Uponor Corporation

- Viega GmbH & Co. KG

- Warmboard, Inc.

- WarmlyYours

- Warmup Plc

- Warmzone

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arctic Heat Pumps

- Danfoss A/S

- Emerson Electric Co.

- Giacomini S.p.A.

- Incognito Heat Co.

- John Guest (a RWC Brand)

- Mitsubishi Electric Corporation

- nVent Electric plc

- Plastics Pipe Institute Inc.

- REHAU Group

- Robert Bosch GmbH

- Schneider Electric

- Siemens AG

- Thermosoft International Corporation

- Uponor Corporation

- Viega GmbH & Co. KG

- Warmboard, Inc.

- WarmlyYours

- Warmup Plc

- Warmzone

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | February 2026 |

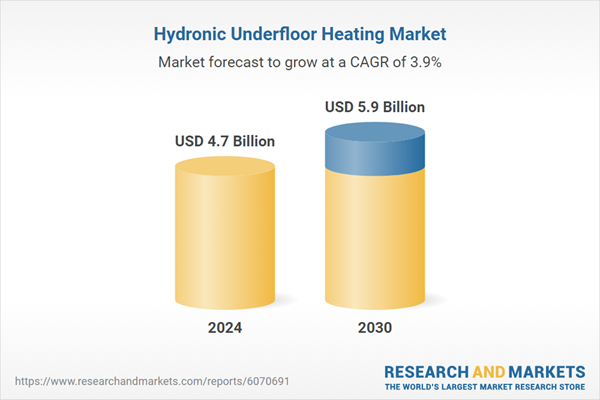

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |