Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their compact design and dependable energy output make them ideal for powering devices with space constraints such as wristwatches, calculators, hearing aids, and medical instruments. Lithium variants, in particular, are preferred for their extended shelf life and higher energy capacity. While button cells provide convenience and efficient power, they must be managed responsibly due to potential environmental and safety hazards, especially in terms of disposal. Despite these challenges, their role remains critical in supporting the functionality of many everyday portable devices across consumer and healthcare applications.

Key Market Drivers

Growing Demand from Consumer Electronics

The rapid expansion of India’s consumer electronics sector is a major driver of the button cell market. The widespread adoption of compact electronic devices such as wristwatches, hearing aids, calculators, digital thermometers, and keyless entry systems has significantly increased the need for small, efficient power sources. Button cells are preferred due to their lightweight and compact form factor, which aligns well with the design needs of portable gadgets.The growing middle-class population and increasing affordability of electronics have contributed to their broader usage in Indian households. Devices like health monitors and glucometers rely heavily on button cells to deliver consistent, portable power. The emergence of IoT-enabled and wearable technologies has further amplified this demand, as these devices require energy-efficient batteries with extended life. As consumers become more reliant on tech-driven lifestyles, the demand for button cells is expected to rise consistently.

Key Market Challenges

Environmental Concerns and Disposal Issues

Environmental impact and disposal difficulties are among the key challenges facing the India button cell market. These batteries often contain hazardous materials such as mercury, cadmium, and lithium, which pose risks to both health and the environment if improperly discarded. In India, limited public awareness and underdeveloped recycling infrastructure contribute to the unsafe disposal of button cells.Improperly discarded batteries can contaminate landfills and groundwater with toxic substances, creating long-term ecological and health risks. Informal recycling practices, lacking proper safety measures, further exacerbate exposure to harmful chemicals. Moreover, the small size of button cells makes them harder to track and collect, complicating recycling efforts and waste management. Addressing these issues requires greater regulatory oversight and public awareness regarding safe disposal methods.

Key Market Trends

Shift Towards Lithium-Based Button Cells

A growing trend in the India button cell market is the transition toward lithium-based variants. These cells are favored for their superior energy density, longer lifespan, and stable performance across a wider temperature range. Offering a voltage output of around 3 volts, lithium button cells are well-suited for modern electronic applications requiring consistent and long-term power, such as fitness trackers, smartwatches, and critical medical devices.The shift is also driven by the growing demand for miniaturized electronics with advanced features. Lithium cells also benefit from a lower self-discharge rate, making them ideal for devices that are used intermittently but need immediate power readiness. From a sustainability perspective, lithium button cells are relatively safer due to reduced levels of toxic metals. Although their cost is higher, the performance benefits and alignment with evolving consumer expectations are driving broader adoption across various end-use segments.

Key Market Players

- Panasonic Corporation

- Sony Corporation

- Maxell Holdings, Ltd.

- Energizer Holdings, Inc.

- Renata SA

- Duracell Inc.

- VARTA AG

- Toshiba Corporation

Report Scope:

In this report, the India Button Cell Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Button Cell Market, By Type:

- Alkaline

- Lithium

- Mercury

- Silver Oxide

- Zinc-Air

India Button Cell Market, By Voltage Range:

- 1.5-3 Volts

- Above 3 Volts

- Under 1.5 Volts

India Button Cell Market, By Application:

- Automotive

- Consumer Electronics

- Medical Devices

- Toys & Games

India Button Cell Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Button Cell Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Panasonic Corporation

- Sony Corporation

- Maxell Holdings, Ltd.

- Energizer Holdings, Inc.

- Renata SA

- Duracell Inc.

- VARTA AG

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | May 2025 |

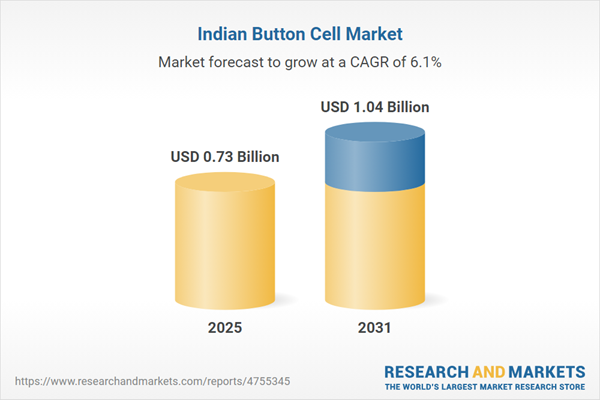

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.73 Billion |

| Forecasted Market Value ( USD | $ 1.04 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |