Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Surge in Manufacturing Automation and Industry 4.0 Adoption

India’s manufacturing industry is rapidly integrating automation to enhance productivity, consistency, and competitiveness. Collaborative robots are emerging as a preferred automation solution due to their ability to operate safely alongside human workers, eliminating the need for protective barriers. Their flexibility allows easy reconfiguration across various tasks like assembly and material handling, making them ideal for small-batch production and space-constrained settings. As Indian manufacturing adopts Industry 4.0 technologies, cobots offer a cost-effective and scalable automation alternative that aligns with modern factory needs.Key Market Challenges

High Initial Cost of Deployment and Integration

Despite their operational benefits, collaborative robots entail high initial costs related to procurement, integration, and customization. Cobots often require application-specific end-effectors, safety tuning, and system integration with legacy machinery - leading to additional capital expenditure. For small and medium businesses in India, justifying these upfront investments without short-term ROI certainty is a challenge. The limited availability of leasing or tailored financing options further hinders adoption, especially for firms in cost-sensitive sectors or unorganized manufacturing clusters.Key Market Trends

Rising Demand for Human-Robot Collaboration in Non-Traditional Sectors

Beyond traditional manufacturing, collaborative robots are gaining traction in sectors such as healthcare, pharmaceuticals, food processing, and education. These industries benefit from cobots' compact size, flexibility, and ability to work in shared spaces. Applications such as lab automation, surgical assistance, food packaging, and classroom demonstrations are creating new opportunities for cobot deployment. This sectoral diversification is driving partnerships between OEMs and specialized system integrators, while also encouraging local startups to develop industry-specific cobot solutions tailored to Indian market needs.Key Market Players

- Universal Robots A/S

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- YASKAWA Electric Corporation

- Techman Robot Inc.

- AUBO (Beijing) Robotics Technology Co., Ltd.

- Doosan Robotics Inc.

Report Scope:

In this report, the India Collaborative Robot Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Collaborative Robot Market, By Payload Capacity:

- Up to 5 Kg

- Between 5 and 10 Kg

- Above 10 Kg

India Collaborative Robot Market, By Application:

- Assembly

- Pick & Place

- Machine Tending

- Others

India Collaborative Robot Market, By Industry:

- Automotive

- Electronics

- Metals & Machining

- Plastics & Polymers

- Others

India Collaborative Robot Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Collaborative Robot Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Universal Robots A/S

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- YASKAWA Electric Corporation

- Techman Robot Inc.

- AUBO (Beijing) Robotics Technology Co., Ltd.

- Doosan Robotics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

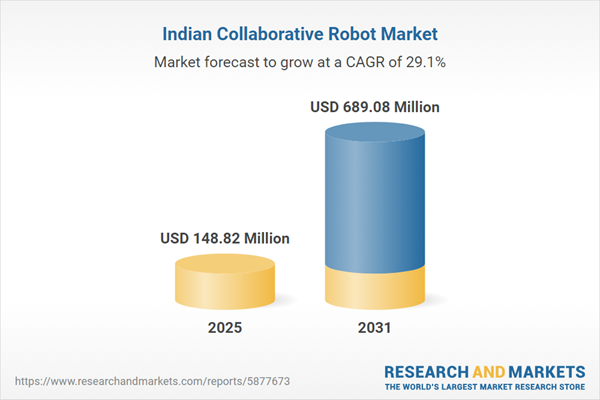

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 148.82 Million |

| Forecasted Market Value ( USD | $ 689.08 Million |

| Compound Annual Growth Rate | 29.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |