Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Urbanization and Changing Consumer Lifestyles

The surge in urban population is reshaping consumer preferences in household cleaning habits across India. As of 2024, the country’s urban population stands at 461 million and is growing at a rate of 2.3% annually, with urban areas projected to contribute 75% of the national income by 2031. This shift toward city living has led to smaller nuclear households and busier routines, increasing demand for convenient and effective cleaning products.In this context, dishwashing liquids, gels, and tablets are rapidly gaining favor over conventional bars. Urban consumers, who often shop in modern trade channels and online platforms, seek solutions that offer superior cleaning performance, water efficiency, and ease of use. This demand has encouraged manufacturers to innovate and cater to specific urban needs, including products designed for use in dishwashing machines and hard water conditions. The rise in disposable incomes and exposure to global lifestyle trends are further enhancing the shift toward premium and multifunctional dishwashing detergents.

Key Market Challenges

Price Sensitivity and Competition from Traditional Alternatives

The Indian dishwashing detergent market faces significant challenges from price-sensitive consumers and entrenched traditional cleaning methods. In many rural and semi-urban regions, a large section of the population continues to use low-cost alternatives such as ash, mud, and detergent bars. These options, though less effective, are culturally accepted and economically accessible, posing a barrier to the adoption of newer formats like liquids and gels. Additionally, the market is highly competitive, with both national brands and local manufacturers competing on price, which compresses profit margins. While urban consumers are shifting towards modern formats, brands must still navigate affordability concerns and ensure that value propositions are clearly communicated. Moreover, increasing raw material and packaging costs further strain the ability to offer premium products at competitive prices, making it difficult for companies to scale innovation without compromising profitability.Key Market Trends

Shift from Bars to Liquids and Specialized Formats

A significant trend shaping the India Dishwashing Detergent Market is the gradual transition from traditional bar formats to more efficient and hygienic liquid-based products. While bars still dominate in terms of volume, particularly in lower-income and rural areas, urban and semi-urban consumers are rapidly adopting liquids, foaming sprays, and gels due to their ease of use, improved cleaning results, and perceived sanitation benefits.Liquids minimize physical contact and reduce wastage, making them more appealing to health-conscious and convenience-driven users. Furthermore, the uptake of dishwashing machines in higher-income households has led to growing interest in dishwasher-compatible gels and tablets. Product diversification in the form of fragrance variations, antibacterial properties, and eco-friendly formulations is also on the rise. This evolution in product formats is supported by aggressive marketing campaigns and in-store promotions by FMCG leaders, reinforcing consumer awareness and accelerating the trend toward modernization in dish care routines.

Key Market Players

- Hindustan Unilever Limited

- Jyothy Laboratories Ltd.

- RSPL Group Pvt Ltd.

- Patanjali Ayurved Limited

- Reckitt Benckiser India Limited

- Wipro Consumer Care Private Limited

- Nimra Limited

- Fena (P) Limited (India)

- Shantinath Detergents Pvt. Ltd.

- Selzer Innovex Pvt. Ltd.

Report Scope:

In this report, the India Dishwashing Detergent Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Dishwashing Detergent Market, By Product Type:

- Dishwashing Bars

- Dishwashing Liquid

- Dishwashing Powder

- Others

India Dishwashing Detergent Market, By End Use:

- Residential

- Commercial

India Dishwashing Detergent Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

India Dishwashing Detergent Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Dishwashing Detergent Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hindustan Unilever Limited

- Jyothy Laboratories Ltd.

- RSPL Group Pvt Ltd.

- Patanjali Ayurved Limited

- Reckitt Benckiser India Limited

- Wipro Consumer Care Private Limited

- Nimra Limited

- Fena (P) Limited (India)

- Shantinath Detergents Pvt. Ltd.

- Selzer Innovex Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | July 2025 |

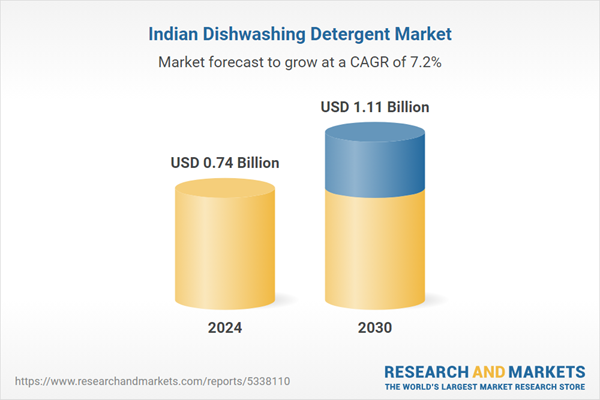

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.74 Billion |

| Forecasted Market Value ( USD | $ 1.11 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |