The market is primarily driven by rapid urbanization and rising disposable incomes, which are leading to greater spending on hygiene and sanitation products. According to industry reports, the gross disposable income of households recorded an average growth rate of 13.5 percent during 2021-22 and 2022-23. This income growth is enabling more consumers to prioritize household hygiene by investing in branded and specialized cleaning products, thereby accelerating the market expansion. Additionally, the increasing awareness of health and cleanliness, particularly after the COVID-19 pandemic, has shifted consumer preferences toward regular use of disinfectants and multi-purpose cleaners. Moreover, the expansion of the middle class and their changing lifestyles is accelerating the need for time-saving and efficient cleaning solutions, which is augmenting India household cleaners market share.

In addition to this, innovations in product formulations such as eco-friendly ingredients, fragrance options, and anti-bacterial properties - are attracting environmentally conscious consumers. According to industry reports, around half of all households in India are now nuclear. This demographic shift, along with the growing number of dual-income households, is creating a preference for convenient, ready-to-use cleaning products. This trend is significantly influencing household cleaners product demand, as consumers increasingly seek time-saving solutions that fit into their fast-paced lifestyles. Besides this, the influence of marketing campaigns and celebrity endorsements is strengthening brand recognition and trust. Also, the adoption of premium and specialized cleaners for surfaces like glass, wood, and electronics is on the rise.

India Household Cleaners Market Trends:

Need for Sustainable Products

The rising health concerns among consumers associated with chemical cleaners are augmenting the adoption of non-toxic, biodegradable, and plant-based household cleaners, which is positively impacting India household cleaners market growth. For example, in November 2023, the Organic World (TOW), one of the organic and natural retail store chains in India, introduced its three product ranges within its plant-based home care brand, Osh. Based in Bengaluru, the company aims to provide easier access to plant-based home cleaning solutions without straining the monthly budget of individuals. Moreover, the increasing investments by key players in plant-based cleaners are also strengthening the market in India. For instance, in February 2024, Koparo, a sustainable and plant-based home care brand offering cleaning products in India, secured an INR 70 Lakh investment. Besides this, government bodies across the country are implementing extended producer responsibility (EPR) regulations and supporting urban local bodies (ULBs), which are catalyzing the India household cleaners market growth. Furthermore, increasing awareness programs like Blue Flag Certification, the Coastal Clean Sea Campaign, and the Swachh Bharat Mission to combat ocean-bound plastic waste are escalating the demand for sustainable cleaning products. For example, floor cleaners by Happi Planet are gaining extensive traction in India, as they are prepared from active microbes that eliminate germs and naturally derived surfactants that remove dirt. Other than that, in September 2021, one of the packaged consumer goods companies, Hindustan Unilever Ltd., announced the transition of its popular detergent brand Surf Excel to recyclable bottles made from 50% post-consumer recycled plastic while adopting 100% biodegradable actives in its formulation.Rising Demand for Convenient Product

The busy lifestyles of the working population and the evolving preferences of consumers are increasing the requirement for multipurpose cleaners, as they offer convenience. This, in turn, is elevating the India household cleaners market recent price. Moreover, these products offer the advantage of simplifying cleaning routines by providing versatile solutions that can be used on several surfaces, thereby reducing the need for multiple specialized cleaners. Multipurpose cleaners are particularly appealing to urban households where time-saving and efficiency are paramount. Products like all-in-one surface sprays, disinfectant wipes, and multipurpose liquid cleaners are gaining traction for their ability to tackle dirt, grime, and germs across kitchens, bathrooms, and living areas with ease. For example, an industry report published in November 2023 highlighted the popularity of one of Hindustan Unilever Limited brands, Vim, products, such as Vim Scrubber, Vim Liquid, and Vim Matic (Machine dishwash). Additionally, in October 2023, Vim launched a novel scrubber that provides the benefit of a steel scrubber and a soft scrubber in one. Brands, such as Colin and Dettol, successfully tapped into this trend by offering effective, easy-to-use products that promise both convenience and comprehensive cleaning. For example, in September 2023, Dettol released a campaign urging individuals to use superior hand hygiene solutions, which provide germ-kill and efficient cleaning solutions.Accessibility via E-Commerce

The expanding e-commerce industry is transforming the way consumers purchase cleaning products across the country, which is an emerging India household cleaners market trend. For example, online platforms, such as Flipkart, Amazon, Big Basket, etc., offer a wide array of household cleaners, ranging from detergents and disinfectants to specialized surface cleaners and eco-friendly options. Besides this, the rising popularity of D2C brands, as they allow consumers to browse, compare, and select products, benefiting from user reviews, detailed descriptions, competitive pricing, etc., is one of the India household cleaners market opportunities. According to a report published in May 2024, the direct-to-consumer (D2C) market in India is projected to reach a size of USD 100 Billion by 2025. Additionally, in December 2023, one of the sustainable products brands based in India, Eco Soul Home, planned to expand its presence to all major e-commerce platforms. Apart from this, e-commerce platforms often provide attractive discounts, subscription services, and swift delivery options, catering to both urban and rural areas. For example, in May 2024, Empower India collaborated with LocalCircles, India's leading public and consumer pulse aggregator, to gather the data of consumers on e-commerce shopping. The survey aimed to understand the shift in individual preferences towards online transactions, which is fueled by the demand for better options and unparalleled convenience. Apart from this, it indicated that approximately 37% of women and 63% of men were inclined towards digital transactions.India Household Cleaners Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the India household cleaners market, along with forecasts at the regional level from 2025-2033. The market has been categorized based on product, ingredients, distribution channel, income group, application, and premiumization.Analysis by Product:

- Laundry

- Dishwashing

- Surface Cleaner

- Toilet Bowl Cleaner

- Window Cleaner

- Glass Cleaner

- Scourers

- Others

Analysis by Ingredients:

- Builders

- Solvents

- Surfactants

- Antimicrobials

- Others

Analysis by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Online

- Others

Analysis by Income Group:

- Middle (INR 2.5 lacs- INR 27.5 lacs)

- Low (Less than INR 2.5 Lacs)

- High (Greater than INR 27.5 lacs)

Analysis by Application:

- Fabric

- Kitchen

- Bathroom

- Floor

- Others

Analysis by Premiumization:

- Economy

- Mid-Sized

- Premium

Regional Analysis:

- North India

- West and Central India

- South India

- East India

Top Household Cleaners Companies, Brands & Manufacturers in India:

The market is characterized by high competition in product categories like surface cleaners, toilet cleaners, dishwashing liquids, and multipurpose sprays. A combination of old and new players competes on price, formulation, packaging innovation, and distribution coverage. According to the India household cleaners market analysis, urban demand is expected to rise in the coming years, led by hygiene consciousness, convenience, and a trend toward specialist cleaners, whereas rural markets will experience slow but steady penetration. Brands are investing in marketing initiatives, influencer promotions, and product bundling to win consumer mindshare. Online channels are emerging as principal battlegrounds, fueling competition through discounting and subscription-based models. Private-label products from large retailers are also gaining ground, especially in price-sensitive segments. The market remains fragmented, as the demand increases for premium and segment-specialty cleaners like kitchen degreasers and glass cleaners, which is also increasing the need for innovation and supply chains.The report provides a comprehensive analysis of the competitive landscape in the India household cleaners market with detailed profiles of all major companies, including:

- Hindustan Unilever Limited (Unilever)

- Rohit Surfactants Private Limited

- Reckitt Benckiser (India) Limited (Reckitt Benckiser Group PLC)

- Procter & Gamble Hygiene and Healthcare Ltd. (Procter & Gamble)

- Jyothy Labs Limited

- Nirma Limited

- Fena (P) Limited

- Dabur India Limited

- S. C. Johnson Products Pvt. Ltd. (SC Johnson & Son Investment Ltd.)

- Pitambari Products Private Limited

Key Questions Answered in This Report

1. How big is the household cleaners market in India?2. What factors are driving the growth of India household cleaners market?

3. What is the forecast for the household cleaners market in India?

4. Which segment accounts for the largest India household cleaners product market share?

5. Who are the major players in the India household cleaners market?

Table of Contents

Companies Mentioned

- Hindustan Unilever Limited (Unilever)

- Rohit Surfactants Private Limited

- Reckitt Benckiser (India) Limited (Reckitt Benckiser Group PLC)

- Procter & Gamble Hygiene and Healthcare Ltd. (Procter & Gamble)

- Jyothy Labs Limited

- Nirma Limited

- Fena (P) Limited

- Dabur India Limited

- S. C. Johnson Products Pvt. Ltd. (SC Johnson & Son Investment Ltd.)

- Pitambari Products Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

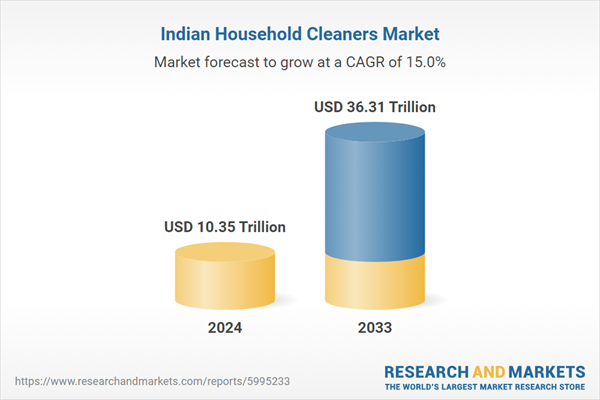

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 10.35 Trillion |

| Forecasted Market Value ( USD | $ 36.31 Trillion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |