Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their low maintenance, ease of installation, and long service life make them an attractive alternative to metal pipes. With rapid urbanization, infrastructure growth, and expanding use in residential and commercial construction, the demand for plastic piping solutions is rising sharply. Government-led initiatives such as AMRUT and the Smart Cities Mission further support this market. Environmental awareness and technological innovation are also encouraging the use of recyclable and performance-enhanced plastic pipe variants, reinforcing their role in India’s infrastructure development.

Key Market Drivers

Rapid Urbanization and Infrastructure Development

India’s fast-paced urban expansion is creating a consistent demand for resilient and cost-effective piping solutions. As millions migrate to urban centers, there is an increasing need for reliable water supply, sewage systems, and sanitation infrastructure. Plastic pipes are ideal for these applications due to their corrosion resistance, long lifespan, and ease of transportation and installation.Projects under initiatives such as the Smart Cities Mission and AMRUT are integrating plastic pipes for municipal infrastructure upgrades, enabling quicker project completion with reduced labor costs. Their versatility in handling water, wastewater, and chemicals makes them indispensable for both public utilities and private construction projects. Furthermore, the development of residential and commercial complexes, coupled with government focus on smart water management, is propelling their adoption. With India’s urban population expected to reach 600 million by 2030, the role of plastic pipes in urban infrastructure is set to expand significantly.

Key Market Challenges

Raw Material Price Volatility and Supply Chain Constraints

The Indian plastic pipes industry faces notable challenges from fluctuating raw material prices and supply chain disruptions. Key materials such as PVC, HDPE, and CPVC are petrochemical derivatives, making them highly sensitive to changes in global crude oil prices. This volatility can lead to unpredictable production costs, affecting pricing strategies and profit margins.SMEs, in particular, find it difficult to absorb sudden cost hikes, which may deter project investments or delay deliveries. Additionally, India's dependence on imported polymer resins and additives makes the industry vulnerable to geopolitical instability and international trade issues. Events like the COVID-19 pandemic underscored these risks, leading to raw material shortages and logistic delays. The complexity of global supply networks continues to impact timely procurement and cost efficiency, compelling manufacturers to seek local alternatives or adjust operations in response to market instability.

Key Market Trends

Rising Adoption of Advanced Polymer Technologies

A significant trend shaping the India plastic pipes market is the growing use of advanced polymer-based materials for enhanced performance. Traditional PVC and HDPE pipes are increasingly being complemented by products incorporating UV-resistant polymers, antimicrobial layers, and cross-linked polyethylene (PEX) technologies. These advanced pipes are particularly suited for environments requiring greater thermal resistance, hygiene, and durability.UV-resistant pipes are gaining popularity in agricultural and outdoor applications, while antimicrobial pipes are being adopted in potable water and medical installations to ensure hygienic fluid transport. PEX pipes are preferred in plumbing and heating systems due to their flexibility and ability to withstand temperature extremes. The integration of such innovations is elevating the performance standards of plastic piping systems, offering users better longevity and application-specific benefits. As the demand for safe, reliable, and high-performance infrastructure solutions rises, advanced polymer technologies are driving product differentiation and competitive growth in the market.

Key Market Players

- Astral Poly Technik Limited

- Finolex Industries Limited

- Supreme Industries Limited

- Prince Pipes and Fittings Limited

- Jain Irrigation Systems Limited

- Ashirvad Pipes Private Limited

- Cello Pipes and Cello Group

- Kisan Mouldings Private Limited

Report Scope:

In this report, the India Plastic Pipes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Plastic Pipes Market, By Type:

- Polyvinyl Chloride Pipes

- Polyethylene Pipes

- Polypropylene Pipes

India Plastic Pipes Market, By End Use:

- Residential

- Agricultural

- Commercial

- Industrial & Infrastructure

India Plastic Pipes Market, By Diameter:

- < 50mm

- 50-100mm

- 100-200mm

- 200-400mm

- 400-700mm

- >700mm

India Plastic Pipes Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Plastic Pipes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Astral Poly Technik Limited

- Finolex Industries Limited

- Supreme Industries Limited

- Prince Pipes and Fittings Limited

- Jain Irrigation Systems Limited

- Ashirvad Pipes Private Limited

- Cello Pipes and Cello Group

- Kisan Mouldings Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | May 2025 |

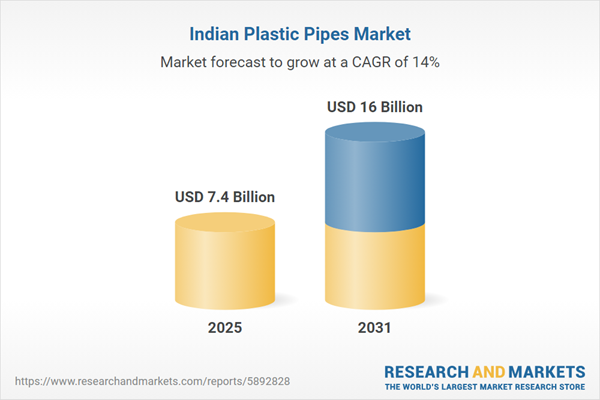

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.4 Billion |

| Forecasted Market Value ( USD | $ 16 54 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |