Key Highlights

- The Rail Logistics project will assist India in diverting more traffic from the road to the rail, improving the efficiency of freight transportation while lowering annual GHG emissions by millions of tonnes. Additionally, the project will encourage more private-sector investment in the railroad industry.

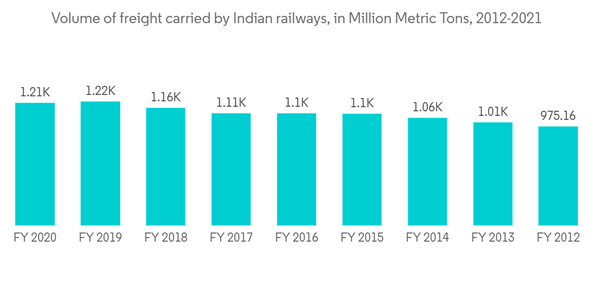

- The fourth-largest rail network in the world, Indian Railways (IR), moved 1.2 billion tonnes of freight during the fiscal year that ended in March 2020. However, just 17% of India's freight is moved by rail; 71% of it is conveyed by road. Volumes have been constrained, and shipping speeds and reliability have suffered due to IR capacity restrictions. Since trucks have been gaining market share throughout the years, IR has been losing market share; in 2017-18, its market share was 32%, down from 52% a decade earlier.

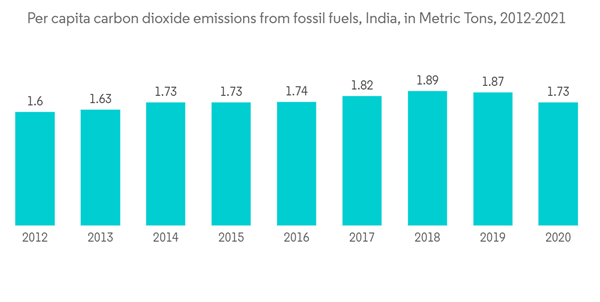

- Road freight accounts for about 95% of the freight sector's emissions, making it the biggest source of GHG emissions. Additionally, trucks were involved in 15.8% of all fatal road transport-related accidents and 12.3% of all traffic fatalities in 2018. Rail emits about one-fifth of the GHG emissions from trucks. With IR expecting to become a net-zero carbon emitter by 2030, rail has the ability to reduce 7.5 million tonnes of carbon dioxide and other greenhouse gases annually.

India Rail Freight Transport Market Trends

Digitization in Railways have increased the dependency on rail freight transport

- In the railway sector, AI has a wide range of uses, including asset management, proactive maintenance, and emergency notification. Neural networks and deep learning algorithms help schedule trains more efficiently and cut down on delays. Additionally, cutting-edge passenger information systems enhance transportation services and raise customer satisfaction.

- The Train Brain, a Swedish firm, creates AI algorithms to increase the dependability of public transportation. The startup's technology offers real-time traffic simulations, reporting, and delay forecasting. To forecast the rail network, the technology analyses data from GPS or signalling systems as well as train timetables. The Train Brain enables passengers tobetter-educateducated commute or trip plans and rail operators to make data-driven traffic planning decisions.

- Cedar AI, a US-based firm, provides artificial intelligence solutions to assist rail operators in increasing yard productivity. The startup's AI-powered technology interfaces with current software to guarantee observance of safety regulations while operating the rail yard. The platform assists rail operators in streamlining yard operations, reducing workload, and enhancing the safety of train handling. Thus, digital development provides a unique edge for railways not just to stay relevant, but also to increase their share in the overall logistics market in india.

Increasing use of decarbonization strategies is driving the market

- Governments are attempting to further decarbonize the rail industry even though trains are the most environmentally friendly mode of transportation thanks to aggressive net-zero emissions objectives. The most popular decarbonization strategies involve switching from diesel to electric, hydrogen fuel cell, or battery-powered trains. Rail operators employ electric locomotives that draw their power from renewable resources like solar or wind to further reduce CO2 emissions.

- Across industries, including railroads, Australian start-up Core Environmental Systems provides communities and end-users with energy storage solutions. The startup's Enviro Cell - Train, created expressly to meet the needs of the rail industry, addresses the standard batteries' crank power limitations. In the process, the launch decreases, and in some cases completely eliminates, financial losses for train operators while also boosting rail transportation efficiency. By optimizing train operations and giving rail a competitive edge over both road and air transport, digitization is poised to lower the climate impact of logistics. Also developed rail infrastructure has reduced distance covered by freight operations and progressively improved the india rail freight transport system.

India Rail Freight Transport Market Competitor Analysis

Increasing pressure on road transport and lower tariffs within rail transport have led to giving significant rise in competition in the India rail freight transport market. Indian Railways, OM Logistics Limited , Shiprocket, V-Xpress , Delhi Cargo Courier Services, BDG International India Pvt Ltd, Freight Mart Logistics are major market participants in India Rail Freight Transport Market. The competition amongst service providers is further heightened by the strict regulatory requirements that must be met. Businesses participate in M&A transactions to develop their product lines and expand regionally.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Indian Railways

- OM Logistics Limited

- V-Xpress

- Shiprocket

- Delhi Cargo Courier Services

- BDG International India Pvt Ltd

- Freight Mart Logistics

- Anshika Express Cargo

- Transvoy Logistics India Limited

- Speedofreight Logistics Pvt Ltd