Sericulture refers to the art of rearing silkworms for the production of silk. India is currently the world’s second largest producer of raw silk and the largest consumer of raw silk and silk fabrics.

The market for silk in India is driven by both exports and a very strong domestic demand. Fabrics made up of silk are quite popular in the domestic market during ceremonies, religious rituals, weddings, festivals, etc. Silk is used as a raw material for the manufacturing of both garments such as suites, sarees, etc. as well as in products such as curtains, bed sheets, pillow covers etc. Although silk is currently regarded as a luxury item in India with its price being significantly higher than other fabrics, we expect a continuous increase in disposable incomes to increase the consumption of silk fabrics in the country.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the Indian sericulture market report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on segment, domestic production & imports and application.Breakup by Segment:

- Mulberry

- Vanya

- Tasar

- Eri

- Muga

Breakup by Domestic Production and Imports:

- Domestic Production

- Imports

Breakup by Application:

- Natural Silk Yarns, Fabrics, Made ups

- Readymade Garments

- Silk Carpets

- Others

Breakup by State:

- Mulberry Silk

- Karnataka

- Andhra Pradesh and Telangana

- West Bengal

- Tamil Nadu

- Others

- Vanya Silk

- Assam

- Jharkhand

- Meghalaya

- Nagaland

- Others

Competitive Landscape:

The competitive landscape of the market has also been examined in the report.This report provides a deep insight into the Indian sericulture market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian sericulture market in any manner.

Key Questions Answered in This Report:

- How has the Indian sericulture market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Indian sericulture market?

- What is the breakup of the Indian sericulture market on the basis of various segments?

- What is the breakup of the Indian sericulture market on the basis of domestic production and imports?

- What is the breakup of the Indian sericulture market on the basis of application?

- What is the breakup of the Indian sericulture market on the basis of various states?

- What are the various stages in the value chain of the Indian sericulture market?

- What are the key driving factors and challenges in the Indian sericulture market?

- What is the structure of the Indian sericulture market and who are the key players?

- What is the degree of competition in the Indian sericulture market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Indian Sericulture Market

5.1 Market Overview

5.2 Market Performance

5.2.1 Value Trends

5.2.2 Volume Trends

5.3 Impact of COVID-19

5.4 Market Breakup by Segment

5.5 Market Breakup by Domestic Production and Imports

5.6 Market Breakup by Application

5.7 Market Breakup by State

5.8 Market Forecast

5.9 SWOT Analysis

5.9.1 Overview

5.9.2 Strengths

5.9.3 Weaknesses

5.9.4 Opportunities

5.9.5 Threats

5.10 Value Chain Analysis

5.11 Porters Five Forces Analysis

5.11.1 Overview

5.11.2 Bargaining Power of Buyers

5.11.3 Bargaining Power of Suppliers

5.11.4 Degree of Competition

5.11.5 Threat of New Entrants

5.11.6 Threat of Substitutes

5.12 Price Analysis

5.12.1 Key Price Indicators

5.12.2 Price Structure

5.12.3 Margin Analysis

5.12.4 Price Trends

5.12.4.1 Mulberry

5.12.4.2 Tasar

5.12.4.3 Eri

5.12.4.4 Muga

6 Market Breakup by Segment

6.1 Mulberry

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Vanya

6.2.1 Market Trends

6.2.2 Market Breakup by Type

6.2.2.1 Tasar

6.2.2.1.1 Market Trends

6.2.2.1.2 Market Forecast

6.2.2.2 Eri

6.2.2.2.1 Market Trends

6.2.2.2.2 Market Forecast

6.2.2.3 Muga

6.2.2.3.1 Market Trends

6.2.2.3.2 Market Forecast

6.2.3 Market Forecast

7 Market Breakup by Domestic Production and Imports

7.1 Domestic Production

7.2 Imports

8 Market Breakup by Application

8.1 Natural Silk Yarns, Fabrics, Made ups

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Readymade Garments

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Silk Carpets

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by State

9.1 Mulberry Silk

9.1.1 Karnataka

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Andhra Pradesh and Telangana

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.1.3 West Bengal

9.1.3.1 Market Trends

9.1.3.2 Market Forecast

9.1.4 Tamil Nadu

9.1.4.1 Market Trends

9.1.4.2 Market Forecast

9.1.5 Others

9.1.5.1 Market Trends

9.1.5.2 Market Forecast

9.2 Vanya Silk

9.2.1 Assam

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Jharkhand

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 Meghalaya

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 Nagaland

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Others

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

10 Silk Manufacturing Process

10.1 Product Overview

10.2 Raw Material Requirements

10.3 Manufacturing Process

10.4 Key Success and Risk Factors

11 Competitive Landscape

List of Figures

Figure 1: India: Sericulture Market: Major Drivers and Challenges

Figure 2: India: Sericulture Market: Sales Value (in Billion INR), 2019-2024

Figure 3: India: Sericulture Market: Sales Volume (in Metric Tons), 2019-2024

Figure 4: India: Sericulture Market: Breakup by Segment (in %), 2024

Figure 5: India: Sericulture Market: Breakup by Domestic Production and Imports (in %), 2024

Figure 6: India: Sericulture Market: Breakup by Application (in %), 2024

Figure 7: India: Sericulture Market: Breakup by State (in %), 2024

Figure 8: India: Sericulture Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 9: India: Sericulture Market Forecast: Sales Volume (in Metric Tons), 2025-2033

Figure 10: Sericulture Market: Price Structure

Figure 11: India: Sericulture Market: Average Prices (in USD/Ton), 2019-2024

Figure 12: India: Sericulture Industry: SWOT Analysis

Figure 13: India: Sericulture Industry: Value Chain Analysis

Figure 14: India: Sericulture Industry: Porter’s Five Forces Analysis

Figure 15: India: Sericulture (Mulberry) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 16: India: Sericulture (Mulberry) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 17: India: Sericulture (Vanya) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 18: India: Sericulture (Vanya) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 19: India: Sericulture (Vanya) Market: Breakup by Type (in %), 2024

Figure 20: India: Vanya (Tasar) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 21: India: Vanya (Tasar) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 22: India: Vanya (Eri) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 23: India: Vanya (Eri) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 24: India: Vanya (Muga) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 25: India: Vanya (Muga) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 26: India: Sericulture (Natural Silk Yarns, Fabrics, Madeups) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 27: India: Sericulture (Natural Silk Yarns, Fabrics, Madeups) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 28: India: Sericulture (Readymade Garments) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 29: India: Sericulture (Readymade Garments) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 30: India: Sericulture (Silk Carpets) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 31: India: Sericulture (Silk Carpets) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 32: India: Sericulture (Other Applications) Market: Sales Value (in Billion INR), 2019 & 2024

Figure 33: India: Sericulture (Other Applications) Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 34: Karnataka: Mulberry Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 35: Karnataka: Mulberry Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 36: Andhra Pradesh and Telangana: Mulberry Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 37: Andhra Pradesh and Telangana: Mulberry Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 38: West Bengal: Mulberry Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 39: West Bengal: Mulberry Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 40: Tamil Nadu: Mulberry Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 41: Tamil Nadu: Mulberry Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 42: Others: Mulberry Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 43: Others: Mulberry Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 44: Assam: Vanya Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 45: Assam: Vanya Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 46: Jharkhand: Vanya Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 47: Jharkhand: Vanya Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 48: Meghalaya: Vanya Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 49: Meghalaya: Vanya Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 50: Nagaland: Vanya Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 51: Nagaland: Vanya Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 52: Others: Vanya Silk Market: Sales Value (in Billion INR), 2019 & 2024

Figure 53: Others: Vanya Silk Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 54: Silk Manufacturing: Detailed Process Flow

List of Tables

Table 1: India: Sericulture Market: Key Industry Highlights, 2024 and 2033

Table 2: India: Sericulture Market Forecast: Breakup by Segment (in Billion INR), 2025-2033

Table 3: India: Sericulture Market Forecast: Breakup by Domestic Production and Imports (in Billion INR), 2025-2033

Table 4: India: Sericulture Market Forecast: Breakup by Application (in Billion INR), 2025-2033

Table 5: India: Mulberry Silk Market Forecast: Breakup by State (in Billion INR), 2025-2033

Table 6: India: Vanya Silk Market Forecast: Breakup by State (in Billion INR), 2025-2033

Table 7: Silk: Raw Material Requirements

Table Information

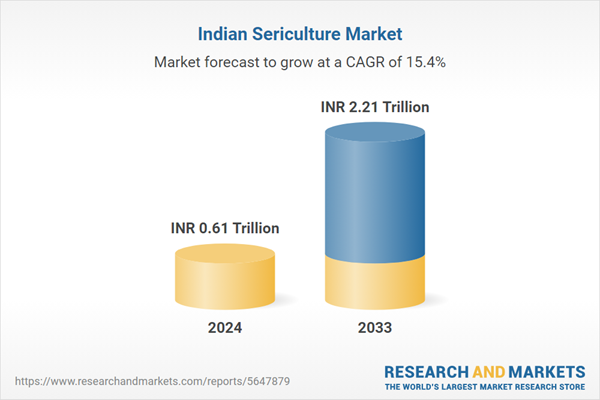

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( INR | INR 0.61 Trillion |

| Forecasted Market Value ( INR | INR 2.21 Trillion |

| Compound Annual Growth Rate | 15.4% |

| Regions Covered | India |