Due to COVID-19, India entered a complete lockdown scenario in late March, and economic activities started resuming slowly in early August 2020. The outbreak of COVID-19 affected domestic construction, industrial, and manufacturing activities in 2020. However, in 2021, the demand from these sectors recovered in the country and is expected to grow significantly in the coming years.

Key Highlights

- Over the short term, increasing demand from the construction industry and growing demand for electronic displays are major factors driving the growth of the market studied.

- However, the increasing cost of raw materials is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, rising installation of solar panels is likely to create lucrative growth opportunities for the global market soon.

India Flat Glass Market Trends

Annealed Glass to Dominate the Market

- Annealed glass is softer, thermally treated, and slowly cooled to release any internal stresses after the glass is formed. This process of treating the glass is known as the annealing process, deriving the name annealed glass. However, annealed glass is also commonly referred to as plate or window glass.

- Float, clear, and tinted glass are major annealed glasses commercially used for varied applications.

- Annealed glass is used in the windows of buildings. In India, several green buildings or LEED buildings focus on reducing carbon footprint in various ways. One of which is using clear glass to access natural daylight.

- According to Green Building Information Gateway, the residential complex DLF Camellias in Gurugram is India's largest LEED-certified green building with a size of 4.7 million square feet as of April 2021.

- Annealed glass can be used for further processing to obtain laminated glass, tempered glass, toughened glass, and others. Laminated glass is widely used in the automotive industry.

- Tinted glass is used in cars and other motor vehicles to avoid excess heat and to block the sun's rays. It also helps in the effective cooling of ACs installed in the vehicles. Although dark tinted glasses are banned in India, according to government guidelines vehicles can have tinted glass if the visibility for the front/rear windshield and side window is at least 70 and 50 per cent VLT respectively.

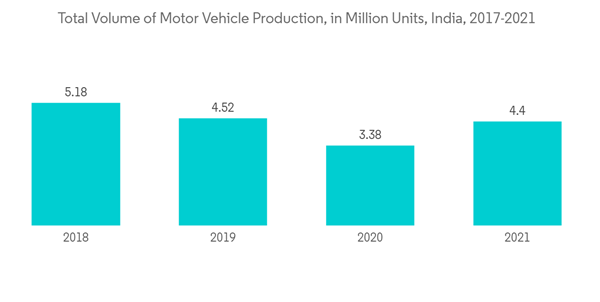

- According to the OICA, the production of motor vehicles in India accounted for 4.4 million units in 2021 with an increase of 23% from the previous year with production value of 3.38 million units.

- According to Department for Promotion of Industry and Internal Trade (India), the proposed investment value in the glass sector in India for fiscal year 2021 amounted to INR 57.12 billion (~USD 0.77 billion) as compared to the fiscal year 2020 with proposed amount of INR 5.67 billion (~USD 0.08 billion).

- Annealed glass is generally cheaper than other glass types, as no additional manufacturing process is required in production. The factor mentioned above is expected to drive the demand for annealed glass in the country.

Construction Industry to Hold the Highest Market Share

- The Indian glass industry's growth has been driven primarily by the construction sector. The construction and infrastructure industry holds the highest market share in the Indian flat glass market due to the growing demand for flat glass in residential building projects.

- 100% foreign direct investment in the construction industry in India under automatic route is permitted in completed projects for operations and management of townships, malls/shopping complexes, and business constructions.

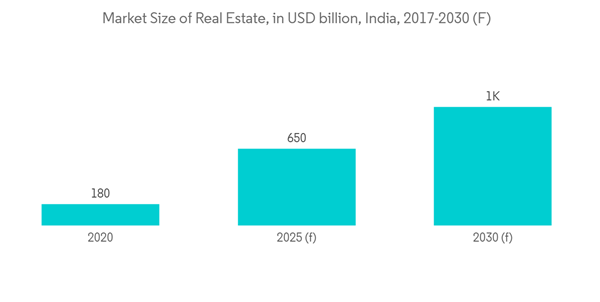

- By 2025, the Indian construction market output is expected to grow, on average, by 7.1% each year. The real estate industry in India is expected to reach USD 1 trillion by 2030.

- ICRA estimates that Indian firms are expected to raise INR 3.5 trillion (USD 48 billion) through infrastructure and real estate investment trusts in 2022, compared with raised funds worth USD 29 billion.

- According to the IBEF, In the first half of 2022, office absorption in the top seven cities stood at 27.20 million sq. ft. between July 2021-September 2021, a total of 55,907 new housing units were sold in the eight micro markets in India (59% YoY growth).

- As per the IBEF, the market size of Indian real estate for forecast year 2030 (F) is valued at USD 1,000 billion.

- In 2021-22, the commercial space was expected to record increasing investments. For instance, in October 2021, Chintels Group announced to invest INR 400 crore (USD 53.47 million) to build a new commercial project in Gurugram, covering a 9.28 lakh square feet area.

India Flat Glass Market Competitor Analysis

The Indian flat glass market is consolidated. The major players include Saint Gobain, Asahi India Glass Limited, Gujarat Guardian Limited, Gold Plus Float Glass, and Şişecam, among others (not in any particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increasing Demand from the Construction Industry

4.1.2 Growing Demand for Electronic Displays

4.2 Restraints

4.2.1 Increasing Cost of Raw Materials

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Product Type

5.1.1 Annealed Glass (Including Tinted Glass)

5.1.2 Coater Glass

5.1.3 Reflective Glass

5.1.4 Processed Glass

5.1.5 Mirrors

5.2 End-user Industry

5.2.1 Building and Construction

5.2.2 Automotive

5.2.3 Solar Glass

5.2.4 Other End-user Industries

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Asahi India Glass

6.4.2 Borosil Renewables Ltd.

6.4.3 Emerge Glass

6.4.4 G.M.GLASS WORKS

6.4.5 Gold Plus Float Glass

6.4.6 Gujarat Guardian Limited

6.4.7 Nippon Sheet Glass Co. Ltd

6.4.8 Saint-Gobain

6.4.9 SCHOTT AG

6.4.10 Şişecam

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Increasing Installation of Solar Panels

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi India Glass

- Borosil Renewables Ltd.

- Emerge Glass

- G.M.GLASS WORKS

- Gold Plus Float Glass

- Gujarat Guardian Limited

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- SCHOTT AG

- Şişecam