Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Cost concerns and low awareness among tier-2 and rural consumers are key obstacles for adoption. According to the Society of Indian Automobile Manufacturers (SIAM), India had over 30 million registered commercial vehicles as of 2023, yet smart tire penetration in this segment remains under 2%, reflecting affordability gaps and retrofit challenges. The fragmented aftermarket and absence of uniform standards for data sharing between vehicle systems and tire sensors further complicate market expansion.

As per the International Energy Agency, India's EV stock is projected to reach 10 million by 2030, which will require advanced tire technology optimized for different weight distributions and rolling resistance. Growing traction in smart fleet management, integration with AI-driven diagnostic systems, and OEM push for IoT-enabled vehicle systems present strong opportunities. Trends such as embedded RFID tags, self-inflating tire prototypes, and partnerships between tire manufacturers and tech firms are shaping future innovation pathways. Integration of smart tires into broader V2X ecosystems will further enhance their value proposition.

Market Drivers

Rise in Road Safety Regulations

The growing incidence of road accidents in India has prompted stronger safety regulations, including mandates for TPMS in vehicles. According to the Ministry of Road Transport and Highways, India recorded over 4.6 lakh accidents in 2022. Government pressure to reduce fatalities is driving automakers to integrate sensor-based smart tires capable of alerting drivers to issues like low pressure or tread wear, directly contributing to proactive maintenance and reduced breakdowns. These regulations make smart tires not only a technological upgrade but a necessity for compliance in newer vehicles, fostering rapid adoption.Key Market Challenges

High Cost of Smart Tire Systems

Smart tire systems involve embedded sensors, connectivity modules, and sometimes onboard processing units, all of which raise costs. According to the Automotive Component Manufacturers Association of India (ACMA), the cost of a TPMS unit alone can range from ₹3,000-₹10,000 per tire. In a price-sensitive market like India, this makes adoption difficult for low-cost passenger and two-wheeler segments. While benefits are clear, the upfront cost discourages many consumers and small fleet operators from transitioning to intelligent tire systems.Key Market Trends

RFID Integration for Tire Lifecycle Tracking

Smart tires with embedded RFID tags are becoming essential for lifecycle and inventory tracking, especially in commercial fleets. In 2025, Beontag and Michelin partnered to develop RFID-enabled tires to offer real-time tire data. These RFID tags enable identification, performance history, and predict wear patterns. The ability to store and communicate unique tire IDs helps manufacturers and fleet managers keep track of tire performance and automate replacement cycles. This trend aligns with the broader move toward digitized maintenance and transparent supply chain systems in India’s logistics and transport industries.Key Market Players

- Apollo Tyres Limited

- Balakrishna Industries Limited

- Bridgestone Corporation

- Continental India Ltd

- Goodyear Tire & Rubber Company

- JK Tyre and Industries

- Michelin Group

- MRF Limited

- Pirelli & C SpA

- Yokohama Rubber Company Limited

Report Scope:

In this report, the India Smart Tires Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Smart Tires Market, By Vehicle:

- Passenger Cars

- Commercial Vehicles

India Smart Tires Market, By Sensor:

- TPMS

- Accelerometer Sensor

- Strain Gauge Sensor

- RFID Chip

- Other Sensors

India Smart Tires Market, By Propulsion:

- ICE

- Electric Vehicles

India Smart Tires Market, By Distribution Channel:

- OEM

- Aftermarket

India Smart Tires Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Smart Tires Market.Available Customizations:

India Smart Tires Market report with the given market data, TechSci Research, offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Apollo Tyres Limited

- Balakrishna Industries Limited

- Bridgestone Corporation

- Continental India Ltd

- Goodyear Tire & Rubber Company

- JK Tyre and Industries

- Michelin Group

- MRF Limited

- Pirelli & C SpA

- Yokohama Rubber Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

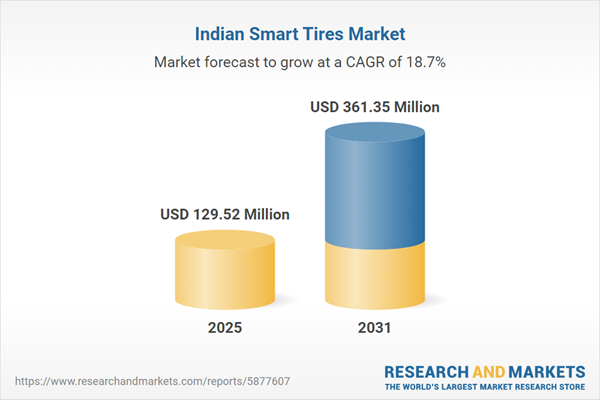

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 129.52 Million |

| Forecasted Market Value ( USD | $ 361.35 Million |

| Compound Annual Growth Rate | 18.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |