Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Water Scarcity and Increasing Demand for Clean Water

One of the primary drivers of the Industrial Ceramic Filters market is the growing concern over water scarcity and the increasing demand for clean and safe drinking water worldwide. With a rising global population, access to clean water has become a critical issue. Industrial Ceramic Filters are highly effective in removing contaminants and pathogens from water sources, making them an indispensable tool for providing access to safe drinking water in both developed and developing countries. Environmental regulations aimed at reducing air and water pollution have become more stringent in recent years. Industrial Ceramic Filters are preferred in various industries for their ability to capture and filter out particulate matter, harmful gases, and pollutants. As governments worldwide tighten emission standards, the demand for Industrial Ceramic Filters in industrial applications, such as power plants and manufacturing facilities, is expected to increase significantly.Growth in the Automotive Industry

The automotive industry is a significant driver of the Industrial Ceramic Filters market, particularly in the production of catalytic converters. Catalytic converters utilize Industrial Ceramic Filters to reduce harmful emissions from vehicles, contributing to cleaner air and compliance with emissions standards. With the global automotive industry continuously expanding, the demand for Industrial Ceramic Filters in this sector is projected to grow. Advancements in ceramic filter technology have expanded their applicability across various industries. These advancements have led to improved filter efficiency, longer lifespan, and reduced maintenance requirements. Additionally, the development of nanoceramics and advanced ceramic materials has opened up new opportunities for Industrial Ceramic Filters in cutting-edge applications, further driving market growth.Increasing Awareness of Air Quality

The increasing awareness of air quality and its impact on health has driven the demand for air filtration solutions. Ceramic filters, with their ability to remove fine particles and pollutants from the air, have gained popularity in residential, commercial, and industrial settings. As individuals and organizations become more conscious of indoor air quality, the market for ceramic air filters is poised for growth. The healthcare sector is a significant consumer of ceramic filters, primarily in applications like medical gas filtration and laboratory equipment. With the expansion of healthcare infrastructure and the rising demand for healthcare services globally, the demand for Industrial Ceramic Filters used in medical applications is expected to increase.Growth in Industrial Processes

Industrial processes often require precise filtration to maintain product quality and adhere to strict quality standards. Industrial Ceramic Filters are favored in industries like pharmaceuticals, food and beverage, and chemicals for their reliability and efficiency in removing impurities. As these industries continue to expand, the demand for Industrial Ceramic Filters as a crucial component of production processes is likely to grow. The Industrial Ceramic Filters market is also benefitting from the growth of emerging markets, particularly in Asia-Pacific and Latin America. These regions are witnessing rapid industrialization and urbanization, leading to increased water and air pollution levels. As a result, there is a growing need for effective filtration solutions, driving the demand for Industrial Ceramic Filters in these areas. Research and development efforts in the Industrial Ceramic Filters sector are continually pushing the boundaries of what these filters can achieve. Innovations in filter design, materials, and manufacturing processes are helping manufacturers meet the evolving needs of various industries. This commitment to research and development ensures that Industrial Ceramic Filters remain a competitive and sustainable choice for addressing filtration challenges.Key Market Challenges

Cost of Production and Pricing Pressure

The cost of producing Industrial Ceramic Filters can be relatively high due to the specialized materials and manufacturing processes involved. This can pose a challenge in terms of pricing competitiveness, especially when compared to alternative filtration technologies. As cost-conscious consumers and industries seek economical solutions, manufacturers must strike a balance between maintaining product quality and affordability. To address this challenge, some companies are investing in process optimization and seeking ways to reduce production costs without compromising filter performance. The Industrial Ceramic Filters market faces competition from alternative filtration technologies, such as activated carbon filters, membrane filters, and sand filters. Each of these technologies has its own advantages and applications, and their adoption may vary depending on specific requirements and cost considerations. To remain competitive, ceramic filter manufacturers must continuously innovate and demonstrate the unique benefits of their products, such as durability and efficiency, compared to alternatives.Fragility and Breakage Concerns

Despite their effectiveness, Industrial Ceramic Filters are not as widely recognized as some other filtration methods. Many consumers and industries may not be aware of the benefits and applications of ceramic filters, leading to lower adoption rates. Addressing this challenge requires educational efforts and marketing campaigns to raise awareness about the advantages of ceramic filtration, especially in regions where access to clean water and air quality are significant concerns. Industrial Ceramic Filters often need to be customized to suit specific applications and industries. This customization process can be time-consuming and costly. Additionally, ensuring compatibility with existing systems and equipment can be challenging, as Industrial Ceramic Filters may require adaptations to fit seamlessly into various processes. Manufacturers and suppliers must work closely with customers to offer tailored solutions and address compatibility issues effectively. Industrial Ceramic Filters are known for their fragility compared to some alternative materials like metal or plastic. This inherent fragility can result in concerns about breakage during handling, transportation, or usage. Manufacturers need to invest in robust packaging and handling procedures to mitigate these concerns. Furthermore, efforts to develop more durable ceramic materials and coatings can help address this challenge. In water filtration applications, Industrial Ceramic Filters are susceptible to scaling and fouling over time, which can reduce their effectiveness and lifespan. Scaling occurs when minerals in the water accumulate on the filter surface, while fouling involves the buildup of organic matter, bacteria, or other contaminants. Regular maintenance and cleaning are essential to prevent scaling and fouling, but these tasks can be labor-intensive and costly. Innovative design solutions and the development of anti-scaling and anti-fouling technologies are critical to overcoming this challenge. Ceramic filtration processes, particularly in industrial applications, can consume significant energy, especially during backwashing and regeneration cycles. High energy consumption not only adds to operational costs but also contributes to carbon emissions, which may conflict with sustainability goals. To address this challenge, manufacturers are exploring energy-efficient designs and alternative filtration methods that reduce energy consumption while maintaining filtration efficiency. The disposal of ceramic filters, especially at the end of their lifecycle, can pose environmental challenges. Ceramic materials, while durable, do not biodegrade, and proper disposal methods are required to prevent environmental harm. Manufacturers are increasingly focusing on recycling and reusing ceramic filter components to minimize waste. Additionally, efforts to develop more sustainable filter materials that have minimal environmental impact are ongoing.Key Market Trends

Rising Demand for Clean Water

One of the most prominent trends in the Industrial Ceramic Filters market is the increasing demand for clean and safe drinking water. Water scarcity and contamination issues have raised awareness about the importance of effective water purification. Ceramic filters, known for their ability to remove contaminants and pathogens, are gaining traction in both developed and developing regions as a reliable solution to ensure access to clean water. This trend is likely to persist as concerns about water quality and availability continue to grow. Technological innovations are driving the Industrial Ceramic Filters market forward. Manufacturers are investing in research and development to enhance filter performance, efficiency, and durability. Nanoceramics, advanced materials, and improved manufacturing processes are enabling the development of Industrial Ceramic Filters with higher filtration rates, longer lifespans, and reduced maintenance requirements. These advancements are expanding the range of applications for Industrial Ceramic Filters and strengthening their competitive position in the filtration industry.Industrial Process Applications

The industrial sector is increasingly relying on Industrial Ceramic Filters for critical applications, such as filtration in pharmaceuticals, food and beverage production, and chemicals manufacturing. Industrial Ceramic Filters are valued for their precision and efficiency in removing impurities, ensuring product quality and compliance with stringent industry standards. As these industries continue to grow, the demand for Industrial Ceramic Filters as an integral part of production processes is set to increase. The integration of smart technology into filtration systems is a growing trend in the Industrial Ceramic Filters market. IoT (Internet of Things) technology and sensors are being incorporated to monitor filter performance, track maintenance needs, and optimize filtration processes. Smart filtration systems not only improve filter efficiency but also reduce operational costs by enabling predictive maintenance. This trend aligns with the broader Industry 4.0 movement and is poised to enhance the capabilities of Industrial Ceramic Filters in various applications. Manufacturers are increasingly offering customized ceramic filter solutions tailored to specific applications and industries. Customization ensures that filters meet the unique requirements of customers, optimizing performance and efficiency. This trend is particularly relevant in industries where precise filtration is critical, such as semiconductor manufacturing, where customized Industrial Ceramic Filters can improve yields and product quality. The Industrial Ceramic Filters market is expanding its footprint in emerging markets, particularly in Asia-Pacific and Latin America. Rapid industrialization, urbanization, and increasing concerns about water and air pollution in these regions are driving demand for effective filtration solutions. As governments and industries seek to address environmental challenges, Industrial Ceramic Filters are positioned to play a vital role in improving water and air quality.Meeting stringent regulatory standards and obtaining certifications is becoming increasingly crucial in the Industrial Ceramic Filters market, especially in applications related to water treatment and air quality control. Manufacturers are investing in research and development to ensure their products comply with evolving regulations and quality standards. Gaining certifications not only builds trust with customers but also opens doors to new markets and industries.

Segmental Insights

End User Insights

Rapid urbanization coupled with rising number of start-ups is resulting in increased demand for commercial construction globally. Growing mandates for installation of air filtration systems in commercial structures are estimated to stoke the demand for the commercial segment over the forecast period.Industrial application dominated the Industrial Ceramic Filters market in 2022. Increasing utilization of ceramic candles in households for water filtration is anticipated to escalate the growth of the segment. This method of water purification is one of the basic and most economical techniques for obtaining potable water, which is used in several African countries owing to low cost associated with it.

Product Insights

Ceramic water filter product segment dominated the market with the revenue of USD 817.5 million in 2022. The product is used in domestic, commercial, and industrial structures for multiple applications spread across diverse industries. The product applications range from filtering water for drinking to treating industrial wastewater for disposal. Furthermore, initiatives taken by governments as well as organizations such as the World Health Organization to provide potable water are poised to supplement market growth. Rising environmental concerns regarding industrial water disposal and treatment are likely to stir up the demand for ceramic water filters. In addition, they are well suited for water treatment and water disposal applications, owing to their superior inherent properties such as high cleaning capacity as compared to polymer filters. Harmful air emissions include toxic gaseous and volatile organic compounds that are emitted during industrial operations. Regulations governing gaseous air emissions and particulate matter emissions are bolstering the demand for ceramic air filters in applications across diverse industries. Moreover, government initiatives for safeguarding the environment are expected to contribute to the growth of the ceramic air filters segment. Industrial and commercial end-use industries were mandated to install these filtration systems to reduce toxic gaseous and volatile organic compounds emission into the atmosphere.Regional Insights

The Asia pacific region has established itself as the leader in the Global Industrial Ceramic Filters Market with a significant revenue share in 2022. Asia Pacific dominated the market in 2022 and is further estimated to witness a CAGR of 6.3% over the forecast period. The demand is likely to grow due to the increasing demand from end-use industries coupled with government initiatives favoring economic growth.Furthermore, growing population and water scarcity issues, especially in emerging economies of India and China, are expected to bode well for the market in the region. Additionally, the mentioned countries further face the challenge of unsafe drinking water, this is further expected to drive the use of Industrial Ceramic Filters around the region..

Report Scope:

In this report, the Global Industrial Ceramic Filters Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Industrial Ceramic Filters Market, By Length:

- 5 Inch

- 5–15-inch

- 15-20 inch

- Above 25 Inch

Global Industrial Ceramic Filters Market, By Product:

- Water Filter

- Air Filter

Global Industrial Ceramic Filters Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Ceramic Filters Market.Available Customizations:

Global Industrial Ceramic Filters Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Unifrax I LLC

- Haldor Topsoe A/S

- Doulton Ceramics

- Glosfume Ltd.

- Aquacera

- KLT Filtration

- Industrial Ceramic Filters Company, Inc.

- Global Water Ceramic Filter Manufacture Corporation

- Anguil Environmental Systems Inc.

- Tri-Mer Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

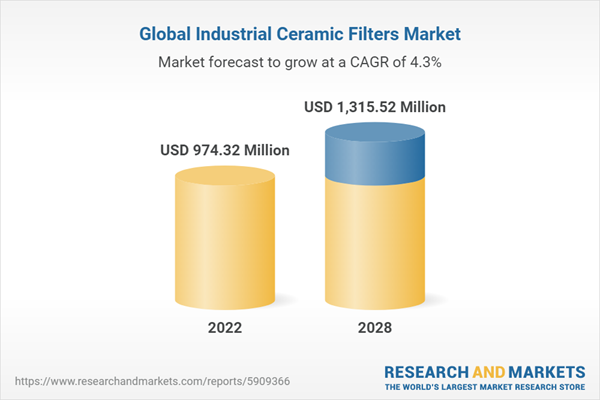

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 974.32 Million |

| Forecasted Market Value ( USD | $ 1315.52 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |