Speak directly to the analyst to clarify any post sales queries you may have.

An In-Depth Orientation to Industrial Ethernet Switch Dynamics Shaping Modern Network Infrastructures Amid the Surge in Automation and Connectivity Demands

Industrial environments are undergoing a rapid digital transformation, with connectivity infrastructure emerging as a linchpin for operational efficiency, reliability, and real-time data orchestration. In this evolving landscape, ethernet switches have transcended their traditional role as mere network endpoints to become intelligent gateways enabling deterministic communication, robust security, and seamless integration with higher-level enterprise systems. As manufacturing floors adopt advanced robotics, sensors, and control systems, the underlying network must accommodate stringent latency, bandwidth, and resilience requirements to ensure continuous production and minimal downtime.Moreover, the convergence of information technology and operational technology is setting new expectations for network infrastructure, pressing manufacturers and integrators to deploy solutions that can harmonize legacy protocols with emerging industrial ethernet standards. Against this backdrop, switches equipped with managed functionalities such as quality of service, virtual LAN segmentation, and redundancy protocols are becoming indispensable for organizations seeking to optimize performance and safeguard critical processes. At the same time, hardened unmanaged switches continue to serve niche applications where simplicity, cost-effectiveness, and plug-and-play connectivity remain paramount.

Furthermore, the ongoing proliferation of edge computing, digital twins, and machine learning applications has heightened the demand for distributed networking solutions capable of local data pre-processing and deterministic exchange. As a result, the architecture of industrial networks is evolving from centralized star topologies to more distributed designs featuring rings, meshes, and hierarchical layers that enhance fault tolerance and scalability. These architectural advancements are crucial for sectors ranging from automotive assembly lines to energy distribution networks, where reliable, high-speed connectivity underpins safety, quality assurance, and regulatory compliance.

In this executive summary, we provide an in-depth orientation to the complex, interconnected factors driving industrial ethernet switch adoption and evolution. By offering a comprehensive exploration of market dynamics, transformative trends, and actionable insights, this analysis aims to equip stakeholders with the knowledge to make informed decisions and seize emerging opportunities in a rapidly changing industrial landscape.

Transformative Shifts Redefining Industrial Ethernet Switch Markets Fueled by Edge Computing Growth, Expanding IIoT Ecosystems and Next-Generation Automation

Industrial networks are witnessing unprecedented transformation driven by the rapid integration of edge computing nodes directly on factory floors. As more processing power is deployed at the network edge, ethernet switches are expected to support enhanced distributed intelligence. In turn, this shift has accelerated the adoption of switches with advanced processing capabilities, improved software-defined networking features, and onboard analytics that reduce latency and enable real-time decision-making.Simultaneously, the proliferation of the Industrial Internet of Things (IIoT) has expanded the network footprint with thousands of sensors and actuators requiring seamless connectivity. This increased device density challenges the capacity of legacy switches and demands solutions that can manage large-scale deployments without compromising performance. Consequently, manufacturers are prioritizing devices that embed comprehensive security frameworks, ensuring that every node within the operational network can be authenticated, encrypted, and monitored for anomalous behavior.

Moreover, the drive towards Intelligent Automation has catalyzed the convergence of robotics, vision systems, and predictive maintenance applications, all of which rely on deterministic and synchronized data exchange. These requirements have propelled the transition from layer 2 to layer 3 switches in many high-demand environments, leveraging routing capabilities that optimize traffic flows and enhance resilience against potential failures. As a result, organizations are rethinking network architectures to achieve higher availability and adaptability.

Additionally, the push for sustainability and energy optimization has influenced switch design, with manufacturers introducing energy-efficient models that dynamically adjust power based on port usage and network load. These green networking solutions align with corporate environmental goals while reducing operational expenditures. As a result, the industrial ethernet switch market is evolving to prioritize holistic performance metrics that encompass not only speed and reliability but also ecological impact, signaling a more conscientious approach to network infrastructure development.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Industrial Ethernet Switch Supply Chains, Pricing Structures and Global Trade Dynamics

In 2025, newly implemented tariffs by the United States on imported industrial networking equipment have introduced significant complexities into supply chain planning and procurement strategies. Many original equipment manufacturers and integrators relied upon cost advantages offered by components and assembled switches from overseas facilities. Consequently, these import duties have led to recalibration of sourcing decisions, with several tier-one players reevaluating their vendor portfolios to mitigate margin erosion and maintain competitive pricing.Furthermore, the imposition of duties has accelerated the localization of manufacturing and assembly operations for critical components. Companies are increasingly seeking diversified manufacturing sites closer to end markets to reduce exposure to fluctuating trade policies. This trend is particularly pronounced among vendors with established footprints in North America, which are now investing in additional capacity to offset tariff-related cost increases and shorten lead times. At the same time, some organizations have turned to regional distributors and authorized partners as buffers against compliance risks and logistical constraints.

Price adjustments have also manifested downstream, as system integrators and end-users grapple with pass-through costs. In sectors such as automotive and energy where margins are tightly controlled, procurement teams are renegotiating contracts, adopting longer-term agreements, and exploring alternate suppliers to stabilize budgetary commitments. These shifts have underscored the need for greater transparency in cost structures and improved collaboration between manufacturers and buyers.

Looking ahead, market participants who proactively navigate tariff landscapes by optimizing their supply chains, adopting flexible sourcing frameworks, and enhancing forward-looking risk assessments will be better positioned to safeguard operational continuity and capitalize on evolving market opportunities.

Illuminating Segmentation Insights on How Product Variants, Hardware Configurations and Applications Shape Industrial Ethernet Switch Market Diversity

Deep segmentation analysis reveals the multifaceted nature of the industrial ethernet switch landscape. When examining by product type, the dichotomy between managed and unmanaged solutions emerges prominently. Managed switches, which encompass both layer 2 and layer 3 variants, are in high demand for applications requiring advanced traffic management features, whereas unmanaged switches continue to serve cost-sensitive installations where simplicity is paramount.Turning to hardware configurations, fixed switches provide streamlined deployments for environments with predetermined port requirements, while modular switches offer scalable architectures that can adapt to evolving connectivity needs. This distinction highlights the importance of flexibility, especially in dynamic production settings where network expansions and reconfigurations are frequent.

Protocol compatibility further refines market differentiation, as devices supporting CC-Link IE, EtherCAT, EtherNet/IP, POWERLINK, PROFINET, and SERCOS III cater to specific automation ecosystems and communication standards. Each protocol brings unique performance characteristics and interoperability considerations, influencing purchasing decisions based on existing system architectures.

Port density is another critical dimension, with options spanning fewer than eight ports, eight to twenty-four ports, and more than twenty-four ports. Low-port switches suit compact equipment clusters, mid-range port counts address general-purpose networking needs, and high-port solutions underpin complex, high-throughput installations.

Mounting preferences, including DIN rail, panel, rack, and wall installations, accommodate diverse physical environments from control cabinets to field enclosures. Application-driven segmentation underscores the role of industrial ethernet switches in manufacturing automation, security and surveillance, and smart grid deployments, each demanding tailored performance and environmental specifications. Finally, end-user segmentation covers aerospace and defense, automotive and transportation, electronics, energy and power, food and beverages, IT and telecom, mining and metals, oil and gas, and pharmaceutical and healthcare. This comprehensive view of segmentation illustrates the nuanced considerations that guide both suppliers and purchasers in aligning switch capabilities with operational requirements.

Decoding Regional Dynamics that Underscore Growth Trajectories across Americas, Europe Middle East & Africa, and Asia-Pacific Industrial Ethernet Switch Markets

Regional market dynamics for industrial ethernet switches exhibit marked variations shaped by economic priorities, regulatory frameworks, and technological maturity. In the Americas, the emphasis on reshoring and nearshoring strategies has bolstered demand for localized network solutions, particularly in automotive and energy applications. North American manufacturers are driving adoption of robust, high-performance switches capable of withstanding extreme environmental conditions, while regional integrators are integrating redundant network architectures to support mission-critical operations.In Europe, Middle East and Africa, regulatory emphasis on data sovereignty and stringent industrial safety standards has propelled the deployment of compliant ethernet switches that embed comprehensive security features. European end-users in sectors such as pharmaceuticals and renewable energy are prioritizing devices certified for functional safety and cybersecurity, fostering collaboration between local distributors and global technology vendors to ensure adherence to evolving compliance mandates.

Meanwhile, Asia-Pacific continues to lead in volume consumption, driven by rapid industrialization and investments in smart manufacturing across China, Japan, South Korea, India, and Southeast Asian nations. This region favors high-density switch configurations and protocols optimized for diverse automation platforms. In addition, governments in the region are incentivizing digital infrastructure upgrades through industry alliances and public-private partnerships, accelerating the rollout of interoperable networking standards.

Furthermore, in Africa, emerging industrial hubs are investing in energy and mining infrastructure requiring hardened switch designs, while the Middle East is focusing on smart grid and oil and gas installations that demand high-bandwidth, low-latency networking solutions. These subregional developments add complexity to the EMEA landscape, reinforcing the need for adaptable ecosystem partnerships and localized technical support.

Collectively, these regional nuances underscore the necessity of tailoring product offerings and go-to-market strategies to local market drivers, infrastructure landscapes, and end-user priorities. By leveraging region-specific insights, suppliers and system architects can refine deployment strategies and ensure that switch solutions align with both performance expectations and regulatory imperatives.

Strategic Insights into Leading Industrial Ethernet Switch Manufacturers Highlighting Competitive Approaches, Technological Innovations and Differentiators

Leading manufacturers have been deploying distinct strategies to capture value in the evolving industrial ethernet switch market. One prominent player has leveraged its extensive portfolio of networking and cybersecurity solutions to integrate advanced threat detection directly into switch firmware, offering end-users a holistic defense-in-depth approach. Another key competitor, drawing upon its automation and control expertise, has focused on embedding intelligent diagnostics and remote management capabilities, enabling predictive maintenance and reducing unplanned downtime.Strategic partnerships and acquisitions have also been instrumental in shaping competitive positioning. A major electronics conglomerate recently expanded its software-defined networking footprint through the acquisition of a boutique industrial connectivity specialist, thereby enhancing interoperability across heterogeneous automation platforms. Simultaneously, some vendors are differentiating through certified interoperability with leading industrial protocols, securing preferred supplier status in industries where specific communication standards are mandated.

In parallel, several companies have prioritized investment in high-speed 10/25/40 gigabit switch lines to accommodate bandwidth-intensive applications such as machine vision and real-time analytics. Meanwhile, those with a global presence have refined their regional go-to-market strategies, adding localized manufacturing and support centers to address emerging trade regulations and customer proximity demands.

These competitive dynamics illustrate a market where technological innovation, strategic alliances, and supply chain resilience converge to define leadership. Stakeholders evaluating partnership or procurement decisions must therefore consider not only product performance but also vendor agility, ecosystem integration, and roadmap alignment with future industrial networking trends.

Actionable Strategies Enabling Industry Leaders to Navigate Disruptions, Optimize Operations and Seize Emerging Opportunities in Industrial Ethernet Switch

To effectively navigate the complexities of the industrial ethernet switch landscape, organizations must adopt a multi-pronged strategy that balances technological innovation with operational resilience. Initially, industry leaders should conduct thorough audits of their existing network topologies, identifying bottlenecks and single points of failure. By leveraging switches that support redundancy protocols such as Rapid Spanning Tree or parallel ring, enterprises can safeguard critical processes against unexpected disruptions.In parallel, decision-makers should prioritize switches offering built-in security features, including network access control, port-level authentication, and encryption. Integrating these elements early in network design not only mitigates cyber threats but also simplifies compliance with increasingly stringent industry regulations. Additionally, selecting hardware that can accommodate multiple industrial protocols ensures interoperability and reduces the need for gateway devices, thereby lowering total cost of ownership.

Another pivotal recommendation is to embrace scalable architectures. Investing in modular switch platforms allows companies to augment port density and integrate new interface modules as production lines evolve. This future-proofs the network and aligns capital expenditures with incremental growth. At the same time, stakeholders should explore network management software that provides centralized visibility, analytics and policy enforcement, enabling remote troubleshooting and streamlined maintenance workflows.

Finally, cultivating strategic partnerships with switch vendors and system integrators enhances agility in responding to tariff changes, component shortages, and emerging protocol standards. By fostering collaborative relationships grounded in transparent communication and shared roadmaps, industry leaders can accelerate deployment timelines, optimize inventory planning, and capitalize on the full potential of their industrial ethernet infrastructure.

Comprehensive Research Methodology Detailing Primary and Secondary Data Collection, Qualitative and Quantitative Analysis, and Rigorous Validation Processes

Our research methodology integrates a rigorous combination of primary interviews and secondary data analysis to produce a comprehensive view of the industrial ethernet switch market. Initially, a series of in-depth interviews was conducted with network architects, automation engineers, procurement managers, and technology vendors across multiple regions. These conversations provided qualitative insights into deployment challenges, purchasing criteria, and emerging application requirements.Complementing these primary inputs, an exhaustive review of technical white papers, industry standards documentation, and corporate product portfolios was undertaken to map the functional capabilities, protocol support, and feature sets of leading switch solutions. Publicly available information from trade associations, regulatory bodies, and industry forums was synthesized to understand evolving compliance mandates and deployment best practices.

Quantitative analysis was performed by aggregating historical shipment data, pricing trends, and vendor rankings drawn from reputable industrial automation reports. Advanced statistical techniques were applied to identify correlations between application segments, port count preferences, and protocol adoption rates. This data-driven approach facilitated granular segmentation and scenario analysis without reliance on any single source.

Throughout the research process, findings were subjected to multiple validation rounds. Internal subject matter experts reviewed preliminary conclusions, while select industry participants provided feedback on data interpretations. This iterative validation ensures that the final insights reflect both market realities and forward-looking considerations. By combining qualitative depth with quantitative rigor, this methodology delivers robust, actionable intelligence for strategic decision-making in industrial networking environments.

Final Reflections on Industrial Ethernet Switch Market Trajectories Emphasizing Strategic Imperatives, Innovation Drivers and Future Outlook Considerations

As industrial operations continue to evolve under the twin influences of digital transformation and regulatory scrutiny, ethernet switch infrastructure remains a foundational element in ensuring connectivity, safety, and performance. The convergence of advanced protocols, edge computing capabilities, and integrated security measures has elevated expectations for network hardware, reshaping the criteria by which switch solutions are evaluated and deployed.In assessing the broader market context, it is clear that flexibility and modularity are no longer optional features but essential capabilities for accommodating shifting production demands and protocol standards. End-users now require devices that can seamlessly integrate into multi-vendor ecosystems, support dynamic traffic management, and deliver real-time diagnostics to drive continuous improvement initiatives.

Furthermore, geopolitical and trade factors, including tariff measures, underscore the importance of resilient supply chain strategies and regional partnerships. Organizations that proactively diversify sourcing, invest in localized manufacturing, and maintain transparent communication with vendors will be better positioned to navigate policy fluctuations and sustain operational continuity.

Looking forward, the success of industrial ethernet network deployments will hinge on a holistic approach that integrates hardware performance with software intelligence, cyber resilience, and effective lifecycle management. By embracing these strategic imperatives, stakeholders across industries can unlock enhanced productivity, minimize risk, and secure a competitive edge in an increasingly connected industrial landscape.

Ultimately, the interplay between technological innovation, evolving industry standards, and operational requirements will define the next phase of network modernization. Stakeholders who align their infrastructure investments with these trajectories, while fostering a culture of continuous learning and adaptation, will unlock the full potential of connected industrial ecosystems and drive sustainable growth across diverse sectors.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Industrial Ethernet Switches Market

Companies Mentioned

The key companies profiled in this Industrial Ethernet Switches market report include:- ABB Ltd.

- Advantech Co., Ltd.

- Alcatel–Lucent S.A. by Nokia Corporation

- Amphenol Corporation

- Arista Networks, Inc.

- Beckhoff Automation GmbH

- Belden Incorporated

- Broadcom Inc.

- Cisco Systems Inc.

- CommScope Holding Company, Inc.

- D-Link Systems, Inc.

- Dell Technologies Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Fiberroad Technology Co., Ltd.

- Fujitsu Limited

- General Electric Company

- HARTING Deutschland GmbH & Co. KG

- Hewlett Packard Enterprise Development LP

- Hitachi Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IDEC Corporation

- Intel Corporation

- International Business Machines Corporation

- Juniper Networks, Inc.

- Mitsubishi Electric Corporation

- Moxa Inc.

- NVIDIA Corporation

- Omron Corporation

- Patton LLC

- Perle Systems Limited

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- SALZ Automation GmbH

- Schneider Electric SE

- Siemens AG

- TE Connectivity Ltd.

- TP-Link Systems Inc.

- Weidmüller Interface GmbH & Co. KG

- Westermo Network Technologies AB by Ependion Group

- ZTE Corporation

Table Information

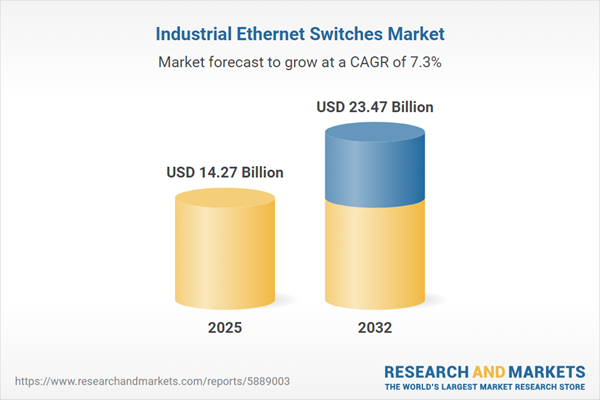

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 14.27 Billion |

| Forecasted Market Value ( USD | $ 23.47 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |