Global Industrial Trucks Market - Key Trends and Drivers Summarized

Why Are Industrial Trucks an Indispensable Component of Modern Industries?

Industrial trucks, a broad category that includes forklifts, pallet jacks, and order pickers, are critical equipment in warehouses, manufacturing plants, and distribution centers. The primary reason lies in their role in facilitating the efficient movement, handling, and storage of heavy materials. Industrial trucks have evolved significantly from simple hand-operated models to advanced, fully automated machines, reflecting the growing demand for efficient logistics and streamlined production processes. The first significant milestone in their development came in the early 20th century, with the introduction of powered lift trucks that could move and stack materials at varying heights. This innovation revolutionized material handling, enabling the rise of high-density warehouses and large-scale manufacturing operations. Today, these trucks come in various configurations designed to handle specific tasks, such as narrow-aisle forklifts for tight spaces or rough terrain lift trucks for outdoor use. Moreover, they are increasingly equipped with safety features like load sensors, anti-tip mechanisms, and ergonomic designs to protect operators and minimize workplace accidents.What Sets Industrial Trucks Apart in the Material Handling Equipment Market?

Industrial trucks distinguish themselves within the broader material handling equipment market through their versatility, maneuverability, and ability to adapt to a wide range of industrial tasks. Unlike fixed conveyor systems or cranes, industrial trucks can be used flexibly across different locations, making them indispensable for dynamic environments like warehouses and distribution centers. One of the defining features of industrial trucks is their capacity to operate in varied conditions, including indoor environments with smooth surfaces or outdoor settings that require rugged, all-terrain capabilities. This adaptability is further enhanced by technological advancements, such as the integration of electric drivetrains and hybrid power systems, which are replacing conventional internal combustion engines. Electric industrial trucks, for instance, are gaining popularity due to their lower emissions, quieter operation, and reduced maintenance costs, aligning with the growing emphasis on sustainability in industrial settings. Additionally, the introduction of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) represents a significant leap in the sector. These self-navigating trucks can perform repetitive tasks such as transporting goods between workstations or retrieving items from storage, thereby reducing labor costs and human error. The ability to configure trucks for specific applications, whether for handling delicate items in a cleanroom or heavy steel coils in a manufacturing plant, ensures that industrial trucks remain highly specialized yet flexible tools within the material handling landscape.How Have Shifting Industry Dynamics and Technological Advancements Shaped Industrial Truck Trends?

The industrial truck sector is undergoing rapid transformation, driven by a confluence of technological advancements and evolving industry demands. One of the most significant trends is the increasing adoption of automation and robotics, which has elevated the role of industrial trucks from simple transportation vehicles to integral components of smart, interconnected logistics systems. Companies are investing heavily in automated solutions like AGVs and AMRs to meet the rising demand for efficiency and precision in material handling. These autonomous trucks are equipped with sophisticated sensors, machine learning algorithms, and mapping capabilities, allowing them to navigate complex environments without human intervention. As industries like e-commerce, pharmaceuticals, and automotive continue to grow, the need for rapid order fulfillment and just-in-time production has driven the adoption of these advanced systems. Simultaneously, sustainability is becoming a core focus in industrial operations. The transition from diesel and gas-powered trucks to electric and hydrogen fuel cell-powered alternatives is gaining momentum as companies aim to reduce their carbon footprint and comply with stringent environmental regulations. Additionally, advancements in battery technology, such as lithium-ion and solid-state batteries, are improving the range and operational efficiency of electric trucks, making them a viable option for heavy-duty applications. Another trend is the focus on operator safety and ergonomics, with new designs incorporating features like enhanced visibility, better suspension, and automated assistance systems to reduce fatigue and minimize the risk of accidents.What Factors are Fueling the Expansion of the Industrial Trucks Market?

The growth in the industrial truck market is driven by several factors, reflecting the influence of technology, changing industrial needs, and evolving consumer demands. Firstly, the rise of automation and the increasing need for efficiency in logistics and warehousing have significantly boosted the demand for sophisticated industrial trucks. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) are transforming traditional warehouses into smart facilities capable of round-the-clock operation, reducing dependency on manual labor and increasing throughput. Secondly, the surge in e-commerce and the trend toward just-in-time manufacturing have created a pressing need for quick, reliable, and flexible material handling solutions. This has spurred the demand for versatile industrial trucks that can adapt to various applications, whether it’s handling high-density storage in distribution centers or transporting components in assembly lines. Thirdly, the ongoing shift toward sustainable operations is driving a significant change in the power systems used in these trucks. As companies seek to minimize their environmental impact, the adoption of electric-powered trucks, equipped with advanced lithium-ion batteries, and the exploration of hydrogen fuel cell technologies are gaining traction. This shift is not only reducing emissions but also enhancing operational efficiency and lowering long-term costs. Additionally, the growing emphasis on safety and operator comfort is influencing truck design, with features like real-time stability control, automated braking systems, and ergonomic cabins becoming standard. Finally, the integration of industrial trucks into broader digital ecosystems through IoT connectivity and fleet management software is optimizing fleet utilization, reducing downtime, and enabling predictive maintenance, thereby enhancing overall productivity and profitability. These factors, collectively, are driving the expansion of the industrial truck market, making it a crucial enabler of modern logistics and manufacturing success.SCOPE OF STUDY:

The report analyzes the Industrial Trucks market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Type (Counterbalanced Lift Truck, Automatic Guided Vehicle, Hand Truck, Pallet Jack, Walkie Stacker, Pallet Truck, Personnel & Burden Carrier, Platform Truck, Other Types); Power Source (Electric, Non-Electric)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Counterbalanced Lift Truck segment, which is expected to reach US$10.2 Billion by 2030 with a CAGR of a 9.2%. The Automatic Guided Vehicle segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.9 Billion in 2024, and China, forecasted to grow at an impressive 11.2% CAGR to reach $10.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anhui Heli Co. Ltd., Caterpillar, Clark Material Handling Co. Ltd., Combilift Material Handling Solutions, Crown Equipment Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Industrial Trucks market report include:

- Anhui Heli Co. Ltd.

- Caterpillar

- Clark Material Handling Co. Ltd.

- Combilift Material Handling Solutions

- Crown Equipment Corporation

- Doosan Corporation

- EP Equipment Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Hangcha Group Co. Ltd.

- Hyster-Yale Materials Handling Inc.

- Hyundai Heavy Industries Co. Ltd.

- Jungheinrich AG

- Kion Group AG

- Komatsu Ltd.

- Lonking Forklift Company Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Mitsubishi Nichiyu Forklift Co. Ltd.

- SANY Group

- Toyota Industries Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anhui Heli Co. Ltd.

- Caterpillar

- Clark Material Handling Co. Ltd.

- Combilift Material Handling Solutions

- Crown Equipment Corporation

- Doosan Corporation

- EP Equipment Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Hangcha Group Co. Ltd.

- Hyster-Yale Materials Handling Inc.

- Hyundai Heavy Industries Co. Ltd.

- Jungheinrich AG

- Kion Group AG

- Komatsu Ltd.

- Lonking Forklift Company Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Mitsubishi Nichiyu Forklift Co. Ltd.

- SANY Group

- Toyota Industries Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

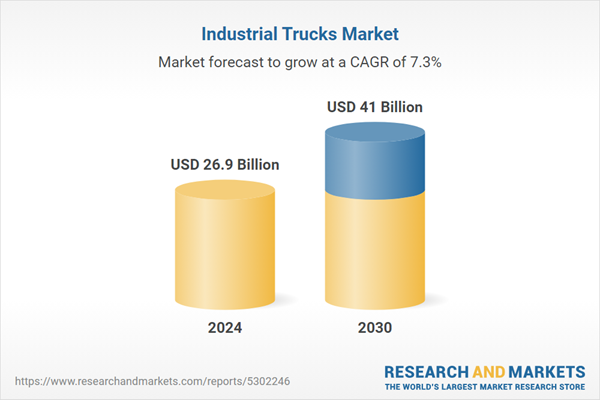

| Estimated Market Value ( USD | $ 26.9 Billion |

| Forecasted Market Value ( USD | $ 41 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |