Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Infection control apparel is gaining further traction due to advancements in material science and textile engineering, which are yielding garments with features such as breathability, fluid resistance, and antimicrobial protection - particularly vital in high-risk clinical settings. However, the market continues to face obstacles, especially the high costs tied to manufacturing and procuring advanced protective garments, which can limit adoption in cost-sensitive regions.

Key Market Drivers

Growth in Healthcare Industry

The global healthcare industry’s expansion is a primary force behind the rising demand for infection control apparel. With annual revenues exceeding USD 4 trillion, the industry comprises several major segments, including pharmaceuticals and biotechnology (USD 850 billion) and medical technology and diagnostics (USD 400 billion). As healthcare systems scale up across both developed and developing regions, the volume of clinical activities, surgical procedures, and patient admissions has also surged, leading to increased implementation of infection control measures.The prevalence of healthcare-associated infections (HAIs) further underlines the critical role of protective apparel. On average, one in ten hospitalized patients contracts an HAI, with rates significantly higher in low- and middle-income countries. Vulnerable populations, such as ICU patients, face even greater risks. In Europe, the overall burden of the six most common HAIs surpasses that of 32 other major infectious diseases combined, reinforcing the necessity for effective infection prevention strategies, including the use of high-quality protective clothing.

Key Market Challenges

Rising Cost of Advanced Materials

The rising cost of high-performance materials used in manufacturing infection control apparel is a significant hurdle in market growth. Products like surgical gowns, gloves, masks, and coveralls now incorporate specialized materials with features such as antimicrobial properties, enhanced fluid resistance, and breathability. These sophisticated fabrics - including multi-layer synthetics and coated nonwovens - are notably more expensive than traditional materials.With global safety standards becoming more rigorous, manufacturers must invest in materials that meet stringent performance and regulatory criteria. This increase in production cost elevates end-product pricing, posing financial challenges for healthcare systems - especially in regions where budget constraints impact purchasing decisions.

Key Market Trends

Growth of E-Commerce and Digital Distribution Platforms

The expansion of e-commerce and digital distribution platforms is emerging as a transformative trend in the global infection control apparel market. As demand for PPE and infection control garments grows across healthcare and industrial sectors, manufacturers and suppliers are increasingly utilizing digital channels to reach broader customer bases and streamline procurement.Notably, initiatives such as Toray Industries’ collaboration with the Guinean government underscore the growing role of digital and global outreach in supporting infectious disease prevention. Online portals now allow hospitals and healthcare professionals to place orders more efficiently, track inventory in real-time, and access regulatory documentation - offering significant advantages over traditional supply chains.

Key Market Players

- 3M Company

- DuPont de Nemours, Inc.

- Cardinal Health, Inc.

- Owens & Minor, Inc.

- Medline Industries, Inc.

- Lindström Group

- Ansell Ltd

- Delta Plus Group

- Lakeland Industries Inc.

- Protective Industrial Products, Inc.

Report Scope

In this report, the Global Infection Control Apparel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Infection Control Apparel Market, By Product:

- Isolation Gowns

- Chemotherapy Gowns

- Lab Coats

- Jackets

Infection Control Apparel Market, By End Use:

- Hospitals

- Ambulatory & Surgical Centers

- Clinics

- Research & Diagnostic Labs

- Others

Infection Control Apparel Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Infection Control Apparel Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- DuPont de Nemours, Inc.

- Cardinal Health, Inc.

- Owens & Minor, Inc.

- Medline Industries, Inc.

- Lindström Group

- Ansell Ltd

- Delta Plus Group

- Lakeland Industries Inc.

- Protective Industrial Products, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

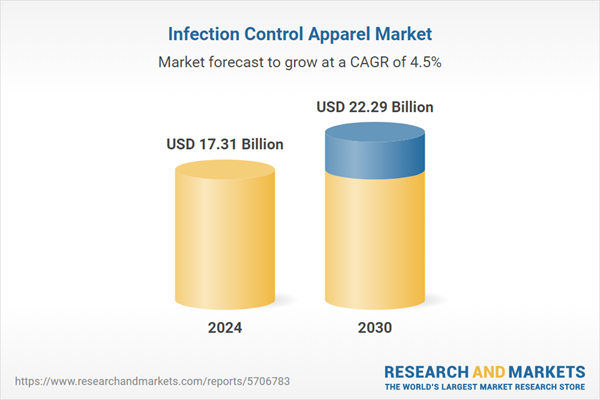

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.31 Billion |

| Forecasted Market Value ( USD | $ 22.29 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |