The integration of infrared imaging technology in the automotive and consumer electronics sectors is significantly propelling the global infrared imaging market size. In automotive manufacturing, infrared imaging is utilized for monitoring thermomechanical processes such as resistance spot welding and hot stamping, enhancing quality control and production efficiency. The heightened adoption of electric vehicles (EVs) further propels this demand. The EV market globally reached US$ 755 billion in 2024 and it is expected to grow at an annual rate of 21.5% between 2025 and 2033, reaching US$ 4.36 trillion in 2033. This growth necessitates advanced thermal management systems to ensure battery safety and efficiency, where infrared imaging plays a crucial role. In consumer electronics, the trend towards incorporating advanced sensors, including infrared imaging capabilities, into devices like smartphones and wearables is notable. This integration enhances functionalities such as facial recognition, augmented reality (AR), and health monitoring, meeting the rising consumer demand for multifunctional devices.

The growth of the infrared imaging market share in the United States is driven by several key factors, including technological advancements, increased demand across various sectors, and supportive government initiatives. Advancements in infrared imaging technologies, such as the development of high-performance sensors at reduced costs, have expanded its applications. The healthcare sector also contributes to market growth, with increasing employment of radiologic and MRI technologists. The U.S. Bureau of Labor Statistics reported a median annual wage of $83,740 for MRI technologists in May 2023, reflecting the growing demand for advanced imaging services. Government policies aimed at reducing carbon emissions further drive the adoption of infrared imaging technologies. The U.S. Energy Information Administration projects a 25% to 38% reduction in energy-related CO₂ emissions by 2030, encouraging the use of infrared imaging for energy efficiency and environmental monitoring.

Infrared Imaging Market Trends:

Rising demand for thermal imaging in defense and security applications

The increasing demand for thermal imaging in defense and security applications is a prominent trend strengthening the infrared imaging market growth. According to Deloitte, in 2024, global defense investments surged, with the aerospace and defense sector overcoming supply chain and talent shortages, while air travel demand grew 11.6% year-on-year, benefiting infrared imaging technologies through increased adoption in surveillance and aviation. Governments and military organizations worldwide are investing in advanced infrared technologies for surveillance, border control, and reconnaissance missions. The ability to detect heat signatures in low-light or obscured conditions makes infrared imaging indispensable in defense operations. In addition to this, law enforcement agencies are increasingly adopting infrared cameras for tracking suspects, monitoring large crowds, and enhancing situational awareness during night-time operations. The rising focus on national security and the need for enhanced surveillance capabilities are contributing to the market expansion.The growing integration of infrared imaging in healthcare

Another factor influencing market growth is the increasing integration of infrared imaging in healthcare, particularly for diagnostics and medical research. Infrared cameras are being used in medical settings to detect abnormal heat patterns associated with inflammation, circulatory issues, and various diseases. This non-invasive technology is gaining traction for early detection of conditions such as breast cancer, vascular disorders, and diabetic complications. The ability of infrared imaging to provide detailed thermal profiles of patients without exposure to harmful radiation is bolstering its adoption among healthcare providers. Moreover, the surging use of infrared thermography in research areas like neuroscience, where monitoring temperature fluctuations in the brain can provide insights into neurological disorders is aiding in market expansion.Increasing adoption in industrial applications

The rising product adoption across various industrial applications, particularly in predictive maintenance and quality control is providing an impetus to the market growth. Manufacturing industries are using infrared cameras to monitor the thermal performance of machinery, electrical systems, and production processes. According to reports, the rising investment in manufacturing industries, driven by the smart factories market projected to grow from USD 129.74 Billion in 2022 to USD 321.98 Billion by 2032 at a CAGR of 9.52%, is significantly boosting the adoption of infrared imaging for enhanced process efficiency, real-time monitoring, and quality control. This technology helps identify potential issues like overheating, insulation breakdowns, and mechanical wear before they lead to equipment failure. As industries aim to reduce downtime and optimize operational efficiency, the demand for infrared imaging solutions in predictive maintenance is rising. Besides this, the widespread product adoption in sectors such as automotive and electronics manufacturing, to ensure quality control by detecting defects in components and systems is impelling the market growth. Furthermore, the growing emphasis on reducing operational costs and improving product quality is positively impacting the infrared imaging market outlook.Infrared Imaging Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global infrared imaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, component, wavelength, application, and vertical.Analysis by Technology:

- Cooled Infrared Imaging

- Uncooled Infrared Imaging

Analysis by Component:

- IR Detectors

- IR Lens Systems

- IR Sensors

- Others

Analysis by Wavelength:

- Near Infrared (NIR)

- Shortwave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

- Others

Analysis by Application:

- Security and Surveillance

- Monitoring and Inspection

- Condition Monitoring

- Structural Health Monitoring

- Quality Control

- Detection

- Gas Detection

- Fire/Flare Detection

- Body Temperature Measurement

Analysis by Vertical:

- Industrial

- Automotive

- Aerospace

- Electronics & Semiconductor

- Oil & Gas

- Military and Defense

- Others

- Non-Industrial

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Infrared Imaging Market Analysis

Infrared imaging adoption is driven by advancements in defense, security, and medical applications. Increasing investments in border surveillance, homeland security, and industrial safety systems contribute to the demand for thermal cameras. For instance, in 2023, U.S. defense spending surged by USD 55 Billion to nearly 40% of global military expenditures, surpassing the next nine countries combined. This growing investment drives advancements in infrared imaging technologies, essential for enhanced military surveillance and operational efficiency. Expanding the use of imaging tools in automotive manufacturing, energy audits, and infrastructure inspection further supports growth. The region’s focus on environmental monitoring and disaster management amplifies the utility of thermal sensors in detecting temperature anomalies. With a well-developed infrastructure for research and development, innovation is accelerated, leading to enhanced product efficiency and affordability. The availability of skilled personnel and a growing inclination toward automation in industries create a favorable ecosystem for the adoption of this technology.Europe Infrared Imaging Market Analysis

The adoption of infrared imaging cabinets is rising in Europe due to advancements in automation and testing systems, particularly within the automotive sector. According to reports, the surge in EU new car sales by nearly 14%, reaching 10.5 Million units, highlights the growing automotive sector's demand for advanced technologies. This growth accelerates the adoption of infrared imaging systems, enhancing vehicle safety, driver assistance, and thermal diagnostics. The growing need for precision and enhanced quality control in manufacturing processes drives the demand for high-performance imaging solutions. These systems ensure fault detection and thermal monitoring, reducing production errors and enhancing operational efficiency. Additionally, the region’s focus on sustainability is encouraging the adoption of these technologies for energy-efficient vehicle manufacturing. Increasing investment in research and development for emerging vehicle technologies also promotes the integration of infrared imaging in materials testing and prototype evaluations. Regional expertise in engineering and robust industrial policies further strengthen the adoption of such innovations.Asia Pacific Infrared Imaging Market Analysis

The adoption of infrared imaging cabinets in this region is growing due to advancements in medical diagnostics and research applications. Expanding investments in healthcare infrastructure and a focus on precision diagnostics are enabling increased adoption of such tools. According to reports, the Indian hospital market, valued at USD 99 Billion and projected to reach USD 193 Billion by 2032, is leveraging advancements like AI, and health-tech, driving the adoption of infrared imaging for enhanced diagnostics and patient care efficiency. Additionally, regional manufacturers are integrating user-friendly technologies, making them more accessible for laboratory and clinical applications. The development of specialized imaging solutions supports industries like biotechnology, where rapid and accurate results are essential. This region's focus on modernizing medical facilities and equipping them with high-tech solutions contributes to the demand for such systems. Furthermore, increased government funding for research initiatives promotes the growth of this equipment across diverse sectors.Latin America Infrared Imaging Market Analysis

In Latin America, the expanding electronics and semiconductor industries are leveraging infrared imaging cabinets for quality assurance and performance testing. According to reports, the growing Latin American aerospace industry, projected to expand at 4.5% annually by 2034, now contributes 15% to the global fleet, surpassing Europe, while low-cost carriers capture 18.6% market share, creating a robust demand for advanced technologies like infrared imaging for enhanced aviation safety and efficiency. These technologies are used to identify thermal inconsistencies and optimize the functionality of complex electronic circuits and components. The region benefits from ongoing infrastructure growth and skilled labour that supports the development of advanced imaging systems. Moreover, the increasing emphasis on reliable testing methods for next-generation semiconductor production ensures consistent growth in the use of these solutions. Local technological initiatives and collaborative projects contribute to an environment conducive to innovation in imaging technologies.Middle East and Africa Infrared Imaging Market Analysis

The oil and gas sector in the Middle East and Africa sees increasing adoption of infrared imaging cabinets for thermal diagnostics. These systems are essential for monitoring pipelines and detecting anomalies, ensuring operational reliability in challenging environments. According to ITA, Saudi Arabia, holding 17% of global petroleum reserves and producing 13.6 Million barrels per day in 2022, drives the oil and gas sector's growth, fostering demand for infrared imaging technology to enhance operational efficiency and carbon monitoring in line with net-zero targets by 2050. The region’s focus on efficient resource management boosts demand for precision monitoring tools to minimize maintenance disruptions. Infrared imaging cabinets support predictive maintenance, reducing the likelihood of costly equipment failures. With ongoing investments in energy infrastructure, the role of advanced imaging technologies becomes pivotal for safe and efficient operations. The harsh conditions in extraction and refining processes highlight the value of reliable thermal analysis solutions.Competitive Landscape:

Leading players in the infrared imaging market are focusing on innovation, strategic partnerships, and expanding their product portfolios to maintain competitive advantages. Companies are heavily investing in research and development (R&D) to create high-resolution, cost-effective infrared sensors. These innovations target emerging applications in autonomous vehicles, smart home security, and predictive maintenance. Various strategic acquisitions and mergers are also reshaping the market landscape. Additionally, partnerships with automotive and electronics manufacturers are enabling market players to integrate infrared imaging into diverse consumer and industrial products. Manufacturers are also expanding their geographic footprint to cater to growing demand in developing regions, where adoption in manufacturing, defense, and public safety is accelerating.The report provides a comprehensive analysis of the competitive landscape in the infrared imaging market with detailed profiles of all major companies, including:

- Axis Communications

- Cox Communications

- Episensors Inc.

- FLIR Systems

- Fluke Corporation

- L3 Technologies

- Leonardo DRS

- OPGAL Optronics Industries Ltd

- Princeton Infrared Technologies Inc.

- Raptor Photonics Ltd.

- Sensors Unlimited Inc.

- Sofradir

- Tonbo Imaging Pvt. Ltd.

- XenICs

- Zhejiang Dali Technology Co. Ltd.

Key Questions Answered in This Report

1. What is infrared imaging?2. How big is the infrared imaging market?

3. What is the expected growth rate of the global infrared imaging market during 2025-2033?

4. What are the key factors driving the global infrared imaging market?

5. What is the leading segment of the global infrared imaging market based on technology?

6. What is the leading segment of the global infrared imaging market based on wavelength?

7. What is the leading segment of the global infrared imaging market based on application?

8. What is the leading segment of the global infrared imaging market based on vertical?

9. What are the key regions in the global infrared imaging market?

10. Who are the key players/companies in the global infrared imaging market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Infrared Imaging Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Technology

6.1 Cooled Infrared Imaging

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Uncooled Infrared Imaging

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Component

7.1 IR Detectors

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 IR Lens Systems

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 IR Sensors

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Wavelength

8.1 Near Infrared (NIR)

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Shortwave Infrared (SWIR)

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Mid-Wave Infrared (MWIR)

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Long-Wave Infrared (LWIR)

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Application

9.1 Security and Surveillance

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Monitoring and Inspection

9.2.1 Market Trends

9.2.2 Major Types

9.2.2.1 Condition Monitoring

9.2.2.2 Structural Health Monitoring

9.2.2.3 Quality Control

9.2.3 Market Forecast

9.3 Detection

9.3.1 Market Trends

9.3.2 Major Types

9.3.2.1 Gas Detection

9.3.2.2 Fire/Flare Detection

9.3.2.3 Body Temperature Measurement

9.3.3 Market Forecast

10 Market Breakup by Vertical

10.1 Industrial

10.1.1 Market Trends

10.1.2 Major Verticals

10.1.2.1 Automotive

10.1.2.2 Aerospace

10.1.2.3 Electronics & Semiconductor

10.1.2.4 Oil & Gas

10.1.2.5 Military and Defense

10.1.2.6 Others

10.1.3 Market Forecast

10.2 Non-Industrial

10.2.1 Market Trends

10.2.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Axis Communications

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.2 Cox Communications

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.3 Episensors Inc.

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.4 FLIR Systems

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.5 Fluke Corporation

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.6 L3 Technologies

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.7 Leonardo DRS

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.8 OPGAL Optronics Industries Ltd.

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.9 Princeton Infrared Technologies Inc.

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.10 Raptor Photonics Ltd.

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.11 Sensors Unlimited Inc.

15.3.11.1 Company Overview

15.3.11.2 Product Portfolio

15.3.12 Sofradir

15.3.12.1 Company Overview

15.3.12.2 Product Portfolio

15.3.13 Tonbo Imaging Pvt. Ltd.

15.3.13.1 Company Overview

15.3.13.2 Product Portfolio

15.3.14 XenICs

15.3.14.1 Company Overview

15.3.14.2 Product Portfolio

15.3.15 Zhejiang Dali Technology Co. Ltd.

15.3.15.1 Company Overview

15.3.15.2 Product Portfolio

List of Figures

Figure 1: Global: Infrared Imaging Market: Major Drivers and Challenges

Figure 2: Global: Infrared Imaging Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Infrared Imaging Market: Breakup by Technology (in %), 2024

Figure 4: Global: Infrared Imaging Market: Breakup by Component (in %), 2024

Figure 5: Global: Infrared Imaging Market: Breakup by Wavelength (in %), 2024

Figure 6: Global: Infrared Imaging Market: Breakup by Application (in %), 2024

Figure 7: Global: Infrared Imaging Market: Breakup by Vertical (in %), 2024

Figure 8: Global: Infrared Imaging Market: Breakup by Region (in %), 2024

Figure 9: Global: Infrared Imaging Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Infrared Imaging (Cooled Infrared Imaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Infrared Imaging (Cooled Infrared Imaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Infrared Imaging (Uncooled Infrared Imaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Infrared Imaging (Uncooled Infrared Imaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Infrared Imaging (IR Detectors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Infrared Imaging (IR Detectors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Infrared Imaging (IR Lens Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Infrared Imaging (IR Lens Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Infrared Imaging (IR Sensors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Infrared Imaging (IR Sensors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Infrared Imaging (Other Components) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Infrared Imaging (Other Components) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Infrared Imaging (Near Infrared) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Infrared Imaging (Near Infrared) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Infrared Imaging (Shortwave Infrared) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Infrared Imaging (Shortwave Infrared) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Infrared Imaging (Mid-Wave Infrared) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Infrared Imaging (Mid-Wave Infrared) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Infrared Imaging (Long-Wave Infrared) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Infrared Imaging (Long-Wave Infrared) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Infrared Imaging (Other Wavelength Ranges) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Infrared Imaging (Other Wavelength Ranges) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Infrared Imaging (Security and Surveillance) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Infrared Imaging (Security and Surveillance) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Infrared Imaging (Monitoring and Inspection) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Infrared Imaging (Monitoring and Inspection) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Infrared Imaging (Detection) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Infrared Imaging (Detection) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Infrared Imaging (Industrial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Infrared Imaging (Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Infrared Imaging (Non-Industrial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Infrared Imaging (Non-Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: North America: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: North America: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: United States: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: United States: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Canada: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Canada: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Asia Pacific: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Asia Pacific: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: China: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: China: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Japan: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Japan: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: India: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: India: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: South Korea: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: South Korea: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Australia: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Australia: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Indonesia: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Indonesia: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Others: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Others: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Europe: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Europe: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Germany: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Germany: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: France: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: France: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: United Kingdom: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: United Kingdom: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Italy: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Italy: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Spain: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Spain: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Russia: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Russia: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Others: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Others: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Latin America: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Latin America: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Brazil: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Brazil: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Mexico: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Mexico: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Others: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Others: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Middle East and Africa: Infrared Imaging Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Middle East and Africa: Infrared Imaging Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Global: Infrared Imaging Industry: SWOT Analysis

Figure 91: Global: Infrared Imaging Industry: Value Chain Analysis

Figure 92: Global: Infrared Imaging Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Infrared Imaging Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Infrared Imaging Market Forecast: Breakup by Technology (in Million USD), 2025-2033

Table 3: Global: Infrared Imaging Market Forecast: Breakup by Component (in Million USD), 2025-2033

Table 4: Global: Infrared Imaging Market Forecast: Breakup by Wavelength (in Million USD), 2025-2033

Table 5: Global: Infrared Imaging Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 6: Global: Infrared Imaging Market Forecast: Breakup by Vertical (in Million USD), 2025-2033

Table 7: Global: Infrared Imaging Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Infrared Imaging Market: Competitive Structure

Table 9: Global: Infrared Imaging Market: Key Players

Companies Mentioned

- Axis Communications

- Cox Communications

- Episensors Inc.

- FLIR Systems

- Fluke Corporation

- L3 Technologies

- Leonardo DRS

- OPGAL Optronics Industries Ltd

- Princeton Infrared Technologies Inc.

- Raptor Photonics Ltd.

- Sensors Unlimited Inc.

- Sofradir

- Tonbo Imaging Pvt. Ltd.

- XenICs and Zhejiang Dali Technology Co. Ltd.

Table Information

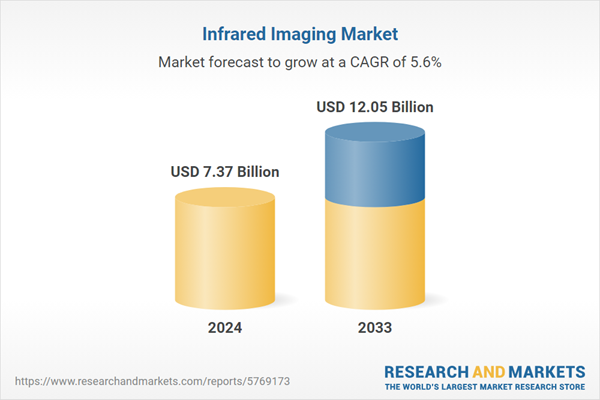

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.37 Billion |

| Forecasted Market Value ( USD | $ 12.05 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |