Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- The material handling segment of the overall rental construction equipment accounted for the largest Italy construction equipment rental market share in 2022. In the material handling segment, aerial platforms accounted for the largest share in 2022.

- In 2022, the government announced an investment of USD 4.1 billion to upgrade water infrastructure and reduce leaks in cities and the agricultural sector. This includes checking the water supply, detecting and revamping leaks, and checking water networks of new aqueducts, reservoirs, and dams. It will also include revitalizing irrigation channels.

- The government of Italy, in 2022, invested a total of USD 3.1 billion in road and rail links across the country. The plan includes six rail infrastructure projects, three road infrastructures, two port infrastructures, two transport building works, five railway stations, one water project, one port project, and one project linked to rapid mass transport for promoting sustainable mobility.

- The construction of various infrastructure and residential projects in the country is expected to drive the demand for renting aerial platforms in the Italy construction equipment rental market. For Instance, MilanoSesto, a mixed-use development project with an investment of USD 7.3 billion- and 69-acres Union Zero is constructing seven buildings worth USD 1.4 billion in Sesto San Giovanni in Milan. Another project, Margaritaville Resort on Fort Myers Beach, will include 254 luxurious rooms and apartments.

GOVERNMENT INVESTMENT IN PUBLIC INFRASTRUCTURE

- The country’s 2021 Budget allocated USD 36.1 billion to the Ministry of Infrastructure & Sustainable Mobility (MIMIS) to expand the country’s mobility systems. The infrastructure developments will focus on energy transition and environmental sustainability.

- In Feb 2023, Webuild Construction was granted USD 354.0 million for constructing a rail bypass of 13 kilometers (km) in the Fortezza-Verona section of the high-speed railway south of the Brenner Base Tunnel. This contract is estimated to generate around 1,000 direct and indirect jobs. The contract involves the construction of a natural tunnel and includes constructing two short sections above ground alongside the existing line.

- In 2022, the Ministry of Health (MoH) Italy announced an investment of USD 151 million to upgrade and redevelop the Hospital of Cattinara in Trieste. The project is designed to develop two six-story 55m-tall hospital buildings with a 20,439 square meter area comprising 730 beds on 22.2 hectares of land. The project is scheduled to complete by 2023.

- Approximately USD 60 billion would be invested by the government to repair surface transportation nationwide. Development of the Glassboro-Camden rail line would cost approximately USD 1.6 to USD 1.8 billion and is expected to be completed in 2028. The train would stop at Glassboro, Pitman, Sewell, Mantua, Woodbury Heights, and Camden stations.

MARKET TRENDS & DRIVERS

Rental Companies Integrating Digital Technologies to Provide Safe & Secure Solutions

Rental companies are adding advanced technologies to their fleet to protect their customers from unauthorized usage of machines. For instance, Jungheinrich, a rental company, use EasyAccess in their forklifts. Through this technology, the customer can manage keyless access to forklifts, protecting the fleet against unauthorized persons. The technology also enables recording the last ten recordings in case of misuse. The company offers EasyAccess in three variants, EasyAccess Softkey, EasyAccess PinCode, and EasyAccess Transponder.Increased Investment in Renewable Energy Projects to Boost the Demand for Rental Material Handling Equipment.

In Feb 2023, the European Investment Bank (EIB) announced a loan of USD 52.9 million to Asja Ambiente Italia (Turin-based company) to construct wind and solar power plants in Campania, Sardinia, and Sicily. The combined capacity of power plants will be 238-megawatt peak (MWp) and generate some 460-gigawatt hours (GWh) of energy per year, providing for more than 190,000 households in Italy.

INDUSTRY RESTRAINTS

Skilled Labor Shortage in the Country to Hamper Construction Activities in the Region

Italy is facing an acute skilled labor shortage similar to other European countries. In 2022, the construction sector required 260,000 workers, but the Italian government only trained 3,000 workers. Moreover, it was estimated that there would be around 200,000 jobs vacant in sectors such as food & beverages, textiles, and chemicals in 2022. Additionally, in 2021, around 263,000 vacancies in the tourism sector were discontinued because of labor shortages. The pandemic added further pressure to the situation. In 2020, about 215,000 workers lost their job in the tourism sector.A Surge in Mortgage Rates to Restrict the Demand for Residential Units in the Country

The main factors hampering the housing market in Italy are rising energy prices and high mortgage rates. In June 2022, housing prices increased by 1.7%, a 4.6% rise compared to 2021. Mortgage rates became more expensive after the EIB hiked interest rates to control inflation. The average cost of buying a house in Italy is between USD 2,047.3 million and USD 2,674.5 million per square meter. In March 2022 in Milan, the average price for residential houses was recorded at USD 4,238.9 million per square meter.SEGMENTATION ANALYSIS

Segmentation by Type

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Other Construction Equipment

- Dumper

- Tipper

- Concrete Mixture

- Concrete Pump Truck

- End Users

- Construction

- Mining

- Warehouse & Logistics

- Others

VENDOR LANDSCAPE

- Prominent vendors in the Italy construction equipment rental market are Caterpillar, Volvo Construction Equipment, Liebherr, Hitachi Construction Machinery, Komatsu, Hyundai Construction Equipment, JCB, SANY & CNH Industrial.

Prominent Vendors

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr

- Hyundai Construction Equipment

- CNH Industrial

- JCB

- SANY

Other Prominent Vendors

- Kobelco

- Yanmar

- Manitou Group

- Merlo Spa

- John Deere

Rental Companies Profile

- Kiloutou

- CGT S.p.A.

- MOLO SRL

- Jungheinrich

- Loxam Piattaforme Aeree

- Federservizi

KEY QUESTIONS ANSWERED:

- How big is the Italy construction equipment rental market?

- What is the growth rate of the Italy construction equipment rental market?

- Which are the prominent rental companies in the Italy construction equipment rental market?

- What are the key trends in the Italy construction equipment rental market?

- Who are the key players in the Italy construction equipment rental market?

Table of Contents

Companies Mentioned

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr

- Hyundai Construction Equipment

- CNH Industrial

- JCB

- SANY

- Kobelco

- Yanmar

- Manitou Group

- Merlo Spa

- John Deere

- Kiloutou

- CGT S.p.A.

- MOLO SRL

- Jungheinrich

- Loxam Piattaforme Aeree

- Federservizi

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

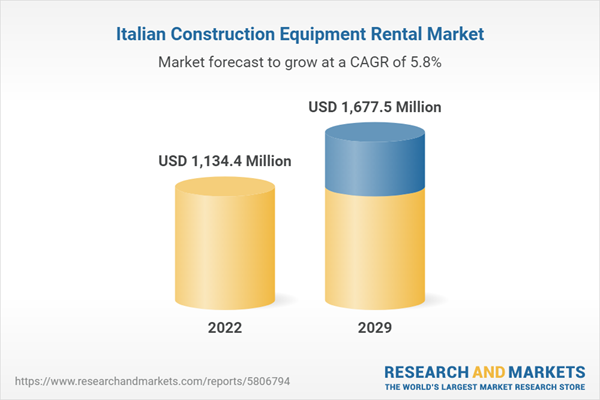

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | May 2023 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 1134.4 Million |

| Forecasted Market Value ( USD | $ 1677.5 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Italy |

| No. of Companies Mentioned | 20 |