Global Landing String Equipment Market - Key Trends & Drivers Summarized

How Is Offshore Drilling Complexity Shaping the Evolution of Landing String Equipment?

The offshore oil and gas industry has undergone a massive technological transformation over the past two decades, with rising complexities in subsea operations significantly impacting the design and deployment of landing string equipment. Originally developed as a transitional mechanical link between the rig floor and subsea wellhead, the landing string system now plays a pivotal role in controlling well pressure, managing weight transfer, and enabling safe running and retrieval of casing strings in increasingly deep and high-pressure wells. With the global exploration trend shifting towards ultra-deepwater zones, particularly in the Gulf of Mexico, Brazil's pre-salt basins, and West Africa, the demand for high-specification landing strings with superior load-bearing and pressure-withstanding capabilities has surged. These systems are being upgraded with larger bore diameters, higher tensile strengths, and pressure ratings exceeding 15,000 psi to ensure compatibility with modern blowout preventers (BOPs) and high-capacity risers. Additionally, there's a growing integration of real-time telemetry and hydraulic control systems in landing strings to monitor dynamic loads, detect abnormalities, and enable remote interventions during critical well construction phases. This transformation underscores how offshore exploration trends are directly influencing capital equipment specifications, pushing vendors toward performance innovation.What Are the Emerging Engineering Expectations from Deepwater Exploration Projects?

The expansion of deepwater exploration programs is redefining expectations from landing string equipment, not only in terms of strength and pressure containment but also with respect to thermal resilience, fatigue resistance, and modularity. As well depths exceed 10,000 feet and operating environments approach extreme thermal gradients, landing strings are now expected to endure highly variable loading conditions without compromising mechanical integrity. This has prompted extensive use of high-strength, low-alloy steels, anti-corrosive nickel alloys, and specialized coatings that enhance fatigue life under cyclic loading. Another critical evolution is the adoption of modular string designs that allow operators to reconfigure tools rapidly depending on well geometry, pressure gradients, and rig limitations. These developments aim to reduce non-productive time and facilitate more predictable operations in deepwater and high-temperature/high-pressure (HPHT) environments. Furthermore, as oil majors increasingly pursue cost rationalization, there is a clear emphasis on multipurpose tools that can function across multiple wells and minimize rig downtime. This shift towards operational flexibility and tool longevity is compelling manufacturers to invest in precision machining, nondestructive testing, and advanced simulation modeling during the design and testing phase of landing string components.Is Automation in Equipment Handling a Disruptor or Enabler in this Market?

The global landing string equipment market is rapidly embracing automation as a core enabler for safety, consistency, and operational efficiency. With increasing scrutiny on human safety and environmental risk mitigation, automated pipe handling, torque management, and load monitoring systems have become integral to the landing string deployment process. Robotics-enabled riser running tools and torque-turn monitoring systems are being increasingly adopted to reduce manual handling and improve accuracy in makeup and breakout operations. These developments are also in sync with digital rig architecture, where central control systems integrate BOP, riser, and landing string data to deliver a synchronized well construction process. Additionally, data analytics-driven predictive maintenance is being employed to identify early signs of component fatigue or stress, allowing timely interventions without impacting drilling schedules. Vendors are also exploring smart materials and embedded sensor technologies that can relay data in real time to operators, enabling remote diagnostics and quicker turnaround decisions. While automation introduces a steep learning curve and CAPEX implications, it is proving indispensable in minimizing wellbore failure risks and enhancing rig asset utilization rates, thereby becoming a long-term value proposition for operators and rig contractors alike.The growth in the global landing string equipment market is driven by several factors…

The growth in the global landing string equipment market is driven by several factors, particularly the expanding footprint of deepwater and ultra-deepwater drilling operations across frontier basins. Rising global energy demand and the depletion of onshore hydrocarbon reserves have shifted exploration emphasis toward offshore projects, thereby necessitating advanced landing string systems that can operate at extreme depths and under challenging conditions. The uptick in high-pressure, high-temperature wells is another key driver, demanding tools with enhanced metallurgical performance, precision tolerance, and higher yield strength. Regulatory mandates focusing on well integrity and safety in offshore drilling are also encouraging the adoption of enhanced landing strings with real-time monitoring capabilities. Technological convergence between drilling automation and rig management software is facilitating demand for intelligent landing string systems that can integrate seamlessly with digital rig infrastructure. In parallel, energy transition strategies that emphasize efficiency and cost reduction are leading to a surge in demand for reusable and modular landing string components. Moreover, offshore project final investment decisions (FIDs), particularly in Brazil, Guyana, Angola, and the US Gulf, are fueling capex expansion in drilling infrastructure, ensuring long-term demand for high-spec landing string systems. Together, these trends create a robust foundation for sustained growth in this niche but indispensable oilfield equipment segment.Report Scope

The report analyzes the Landing String Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Equipment Type (Lubricator Valve Equipment Type, Retainer Valve Equipment Type, Subsea Test Tree Equipment Type, Shear Sub Equipment Type, Slick Joint Equipment Type, Other Equipment Types); Application (Shallow Water Application, Deepwater Application, Ultra Deepwater Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lubricator Valve Equipment segment, which is expected to reach US$579.4 Million by 2030 with a CAGR of a 7.1%. The Retainer Valve Equipment segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $367 Million in 2024, and China, forecasted to grow at an impressive 9.5% CAGR to reach $390.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Landing String Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Landing String Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Landing String Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Barberan S.A., Black Bros. Co., Bobst Group SA, Bruckner Maschinenbau GmbH, Comexi Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Landing String Equipment market report include:

- Aker Solutions ASA

- Cameron International Corporation

- Enovate Systems Ltd.

- ExPert E&P Companies, LLC

- Expro Group Holdings N.V.

- Hilong Holding Limited

- Interventek Subsea Engineering

- Jiangsu Wellhead Equipment Co., Ltd.

- National Oilwell Varco, Inc. (NOV)

- Optime Subsea

- Quail Tools

- Schlumberger Limited (SLB)

- Superior Energy Services, Inc.

- TechnipFMC plc

- Thyssenkrupp AG

- Vallourec S.A.

- Weatherford International plc

- Welltec A/S

- Workstrings International

- Yantai Enerserva Machinery Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker Solutions ASA

- Cameron International Corporation

- Enovate Systems Ltd.

- ExPert E&P Companies, LLC

- Expro Group Holdings N.V.

- Hilong Holding Limited

- Interventek Subsea Engineering

- Jiangsu Wellhead Equipment Co., Ltd.

- National Oilwell Varco, Inc. (NOV)

- Optime Subsea

- Quail Tools

- Schlumberger Limited (SLB)

- Superior Energy Services, Inc.

- TechnipFMC plc

- Thyssenkrupp AG

- Vallourec S.A.

- Weatherford International plc

- Welltec A/S

- Workstrings International

- Yantai Enerserva Machinery Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

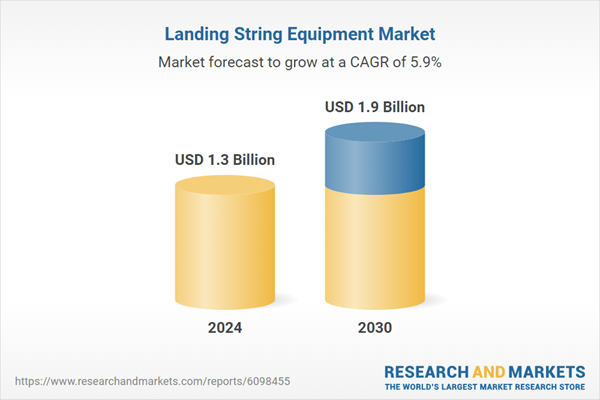

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |