Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction that frames the intersecting forces of technology, supply chain pressures, and operational priorities reshaping the large caliber ammunition ecosystem

The large caliber ammunition domain sits at the confluence of geopolitics, industrial capability, and rapid technological advancement, demanding a succinct orientation for executives and strategists. This introduction frames key forces reshaping production, procurement, and policy, establishing a shared baseline that supports deeper analysis in subsequent sections. It clarifies how constraints in materials, shifts in end-user requirements, and evolving guidance mechanisms are converging to create both pressure and opportunity across the value chain.Historical procurement patterns have prioritized scale and reliability, yet contemporary operational environments place increasing emphasis on precision, modularity, and lifecycle affordability. As a result, stakeholders are recalibrating priorities: capital investments are moving toward guided munition technologies and adaptable manufacturing approaches, while supply chain managers are seeking redundant sourcing and material substitution strategies to mitigate geopolitical and tariff-related exposures. This broader context underscores why tactical choices made today-around materials selection, production footprint, and distribution channels-will materially influence operational readiness and competitive positioning in the near term.

Transitioning from legacy practices to more agile and resilient models requires a clear articulation of risks and opportunities. Leaders must consider not only current capability gaps but also the pace of technological maturation and policy shifts that will dictate procurement windows. This introduction therefore sets the stage for the report’s deeper examination of transformative shifts, tariff impacts, segmentation insights, and tactical recommendations that follow.

A concise synthesis of the transformative technological, industrial, and policy shifts accelerating evolution in the large caliber ammunition value chain

The landscape for large caliber ammunition is undergoing transformative shifts driven by technology maturation, geopolitical realignments, and evolving operational doctrines. Advances in guidance mechanisms and materials science are elevating expectations for accuracy, lethality, and integration with networked platforms, prompting legacy suppliers and new entrants alike to adapt product roadmaps. As autonomous systems and precision strike concepts proliferate, demand patterns are migrating toward munitions that can deliver discriminating effects while reducing collateral risk and improving mission efficiency.Simultaneously, industrial strategies are shifting from monolithic mass production to modular, digitally enabled manufacturing that supports rapid reconfiguration and shorter lead times. Additive manufacturing, flexible machining centers, and digital twins are being piloted to accelerate prototype-to-production cycles and to enable decentralized manufacturing nodes closer to demand centers. This decentralization is often paired with strategic partnerships between ammunition manufacturers, material suppliers, and systems integrators, which collectively enhance resilience but require more sophisticated contract and quality assurance frameworks.

On the policy front, export controls and alliance-driven interoperability requirements are influencing certification pathways and cross-border procurement strategies. These regulatory dynamics, together with shifting doctrines that favor precision and reduced logistics footprints, are encouraging investment in guided ammunition capabilities and selective material substitution. In turn, this is reshaping supplier relationships and creating opportunities for firms that can bridge traditional manufacturing expertise with advanced sensing, guidance, and materials engineering.

An analytical review of how United States tariff measures in 2025 are reshaping sourcing strategies, supplier resilience, and procurement decision frameworks across the ammunition supply chain

The cumulative implications of U.S. tariff measures implemented in 2025 extend beyond immediate cost differentials to influence sourcing decisions, supplier diversification, and inventory strategies across the ammunition ecosystem. Tariffs affect both upstream raw materials-including metals and specialized alloys-and finished components or assemblies sourced from international suppliers, incentivizing stakeholders to reevaluate vertical integration, nearshoring, and supplier qualification timelines. In response, procurement teams are increasingly focused on trade-compliant alternates, longer-term supplier partnerships, and investment in domestic supply capacity to reduce exposure to tariff volatility.Moreover, tariffs interact with existing regulatory controls and defense procurement policies, creating a compound effect that can slow qualification of foreign-sourced components and increase lead times for systems that require tight certification standards. As a result, producers and end users are balancing the trade-offs between short-term cost mitigation and longer-term supply security. In some instances, the tariff environment has accelerated efforts to develop alternative materials or to re-engineer components to harness domestically available inputs, while in others it has required creative contractual solutions such as fixed-price agreements with tariff pass-through clauses.

The ripple effects also extend to distribution channels and secondary suppliers, where indirect sales partners and aftermarket providers must adapt pricing and logistics practices. Overall, the tariff landscape of 2025 compels a strategic reassessment of sourcing resilience and total cost of ownership, prompting organizations to pursue layered responses that combine near-term operational adjustments with longer-term industrial investment.

A detailed segmentation-driven perspective explaining how product types, caliber sizes, materials, guidance approaches, end-user categories, and distribution channels define strategic priorities and supply constraints

Segmentation insight requires understanding how distinct product, size, material, guidance, end-user, and distribution dimensions interact to shape demand profiles and technology priorities. Based on Type, the portfolio spans Air-to-Ground Munitions, Artillery Shells, Mortar Ammunition, Naval Shells, and Tank Rounds, each presenting unique performance parameters, certification pathways, and logistics demands; for example, naval and air-to-ground applications tend to prioritize corrosion resistance and integration with platform avionics while artillery and mortar rounds emphasize robustness and logistic throughput. Based on Caliber Size, distinctions among 100mm to 200mm, 40mm to 100mm, and Over 200mm categories influence propulsion system design, barrel wear considerations, and platform compatibility, with larger calibers often requiring more extensive handling infrastructure and longer qualification cycles.Based on Material, choices between Aluminum, Brass, and Steel carry implications for weight, manufacturability, cost exposure to commodity cycles, and ballistic performance; material selection also affects life-cycle maintenance and corrosion management strategies. Based on Guidance Mechanism, the division between Guided Ammunition and Non-Guided Ammunition drives differential investments in sensors, control surfaces, and integration testing, with guided systems demanding closer collaboration between munitions firms and platform software teams. Based on End User Industry, segmentation across Commercial Use, Law Enforcement, and Military reveals distinct procurement cadences and regulatory constraints: Commercial Use encompasses Firearms Manufacturers and Shooting Sports where demand is sensitive to consumer trends; Law Enforcement includes Police Forces and Special Task Forces where compliance, chain of custody, and duty-of-care drive specifications; Military end users-Air Force, Army, Coast Guard, and Navy-prioritize interoperability, lifecycle readiness, and standardized logistics.

Based on Distribution Channel, Direct Sales and Indirect Sales pathways influence margins, aftermarket support models, and intelligence flows; direct sales facilitate tighter feedback loops and long-term contracts, whereas indirect channels can broaden reach but require enhanced partner enablement and compliance oversight. Integrating these segmentation axes provides a nuanced view of product development priorities, regulatory constraints, and commercial strategies, enabling companies to align investments with the operational and procurement realities of each segment.

A regional intelligence summary describing how geographic production footprints, procurement frameworks, and geopolitical dynamics influence supply resilience and capability priorities

Regional dynamics materially shape manufacturing footprints, supply chain resilience, and procurement strategies in the large caliber ammunition domain. In the Americas, defense industrial bases benefit from integrated supply chains and proximity to major end users, which reduces logistics complexity and supports rapid response to operational needs; however, domestic capacity constraints and material concentration points still require strategic investments to avoid single-source vulnerabilities. Conversely, Europe, Middle East & Africa displays a heterogeneous landscape where alliance frameworks, varying regulatory regimes, and regional security dynamics drive collaborative procurement and cross-border industrial partnerships. These conditions foster deep engineering expertise and certification ecosystems but also necessitate careful management of export controls and interoperability standards.Asia-Pacific presents a mix of rapidly modernizing defense forces and significant industrial scaling, with countries pursuing localized production and capability development to meet regional security requirements. This growth results in competitive supplier landscapes and rising demand for advanced guidance and materials solutions. Across all regions, supply chain considerations-such as availability of specialty alloys, logistical lead times, and regulatory compliance-affect strategic choices about production location, inventory strategies, and supplier diversification. Regional procurement policies, geopolitical alignments, and domestic industrial policies therefore continue to influence where companies invest, how they structure partnerships, and which product capabilities they prioritize for regional markets.

Insights on competitive differentiation showing how engineering prowess, supplier integration, and certification capabilities determine resilience and strategic advantage in ammunition supply

Competitive dynamics among companies in the large caliber ammunition space are shaped by engineering expertise, supply chain integration, and the ability to deliver certified, mission-ready solutions under rigorous quality regimes. Leading firms tend to combine deep metallurgy and ballistics capabilities with systems engineering for guidance integration, enabling them to offer end-to-end solutions that reduce programmatic risk for end users. At the same time, specialized material suppliers and subsystem integrators play a critical role in accelerating innovation by providing advanced alloys, coatings, and electronic guidance components that can be rapidly validated and scaled.Strategic differentiation often emerges from investments in manufacturing flexibility, quality management systems, and certification track records. Collaborations between traditional manufacturers and newer technology-focused entrants have introduced hybrid business models that emphasize rapid iteration, prototype support, and platform integration services. Additionally, companies with established global distribution networks and strong aftermarket support capabilities can capture adjacent revenue streams while improving lifecycle readiness for operators. Intellectual property in guidance algorithms, fuzing technologies, and corrosion-resistant treatments remains a proprietary advantage, and firms that can protect and commercialize these assets while maintaining compliance with export controls will sustain competitive positioning.

Finally, the ability to respond to policy shifts-such as tariff changes or new certification standards-through agile sourcing, flexible contract structures, and transparent compliance processes separates resilient companies from those vulnerable to disruption. Organizational capabilities in risk management, supplier development, and cross-functional program execution therefore become differentiators in a complex and evolving market.

Actionable strategic recommendations for industry leaders to enhance supply resilience, accelerate technology integration, and align commercial practices with evolving operational needs

Industry leaders should prioritize a suite of strategic actions that enhance resilience, accelerate technology adoption, and optimize total lifecycle outcomes. First, invest in diversified sourcing strategies that combine domestic capacity expansion with vetted international partnerships; doing so reduces tariff exposure and improves response times while enabling scale during demand surges. Second, accelerate adoption of modular manufacturing techniques and digital engineering practices to shorten development cycles and enable flexible production runs that can accommodate varying caliber sizes and guidance configurations. These moves should be complemented by robust quality management systems that streamline certification across platform partners and regulatory environments.Third, pursue material strategy initiatives that include targeted alloy qualification programs and coating technologies to reduce reliance on constrained commodities. Parallel investments in material substitution research and supplier development can create optionality that shields programs from price and availability shocks. Fourth, strengthen aftermarket and distribution models by deepening direct sales relationships where feasible and enhancing partner enablement for indirect channels, thereby ensuring consistent maintenance, training, and upgrade pathways for end users. Fifth, align commercial and contractual terms to reflect tariff realities and supply uncertainties, incorporating flexible pricing mechanisms and inventory support clauses that distribute risk appropriately between suppliers and buyers.

Finally, embed a strategic talent and partnerships roadmap that brings together ballistic engineers, materials scientists, digital manufacturing experts, and regulatory specialists. This cross-disciplinary capability will enable companies to innovate responsibly, maintain compliance, and convert technological advances into field-ready advantages.

A clear and transparent description of the multi-method research approach combining primary interviews, technical synthesis, and analytical frameworks used to derive actionable ammunition sector insights

The research methodology applied for this study combines rigorous primary engagement, comprehensive secondary synthesis, and structured analytical frameworks to ensure findings are actionable and defensible. Primary inputs include structured interviews with procurement officers, manufacturing and materials engineers, supply chain managers, and policy advisers, providing qualitative depth on readiness challenges, certification obstacles, and tactical responses to tariff environments. These engagements are supplemented by plant-level visits and process-mapping exercises that clarify manufacturing constraints, quality systems, and potential scaling pathways.Secondary research integrates technical literature, public procurement documents, standards and certification guidelines, and trade policy materials to ground observations in documented frameworks and historical precedent. Data triangulation ensures that insights reflect corroborated trends rather than single-source narratives. Analytical techniques include supply chain vulnerability mapping, scenario analysis for tariff and regulatory permutations, and segmentation overlays that cross-reference product types, caliber sizes, material choices, guidance mechanisms, end-user profiles, and distribution channels to identify points of strategic leverage.

Quality assurance measures include peer review by subject-matter experts, validation of technical assumptions with laboratory and field test reports where available, and iterative feedback loops with industry stakeholders to refine interpretations. The methodology emphasizes transparency of assumptions and traceability of evidence so that decision-makers can assess the applicability of recommendations to their specific operational contexts.

A conclusive synthesis highlighting the imperative for integrated strategies that balance near-term resilience with long-term capability development across the ammunition value chain

In conclusion, the large caliber ammunition landscape is at an inflection point where technological evolution, policy shifts, and supply chain pressures are jointly redefining strategic imperatives. Precision and guidance capabilities are driving product differentiation, while materials and manufacturing flexibility determine the speed at which innovators can capture emerging opportunities. Tariff developments and regional industrial policies are further complicating procurement dynamics, necessitating deliberate sourcing strategies and more sophisticated contractual and inventory approaches.Executives and program leaders should therefore adopt an integrated perspective that aligns material strategy, manufacturing modernization, and distribution channel design with evolving end-user requirements. Cross-functional collaboration among engineering, procurement, compliance, and commercial teams will be essential to translate R&D investments into deployed capability while maintaining regulatory adherence and cost discipline. By blending near-term tactical adaptations-such as supplier diversification and tariff-aware contracting-with longer-term investments in modular manufacturing and materials qualification, organizations can build both resilience and competitive advantage.

Ultimately, the path forward emphasizes agility, informed risk-taking, and disciplined execution; stakeholders who proactively recalibrate their portfolios and industrial footprints will be better positioned to meet operational demands and to capitalize on the shifting contours of the ammunition ecosystem.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Large Caliber Ammunition Market

Companies Mentioned

The key companies profiled in this Large Caliber Ammunition market report include:- ARSENAL JSCo

- BAE Systems PLC

- Bharat Dynamics Limited

- Denel SOC Ltd.

- Diehl Stiftung & Co. KG

- Elbit Systems Ltd.

- FN Browning Group

- General Dynamics Corporation

- Global Ordnance LLC

- Hanwha Corporation by Hanwha Group

- KNDS N.V.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Nammo AS

- Northrop Grumman Corporation

- Poongsan Corporation

- Rheinmetall AG

- RTX Corporation

- RUAG International Holding AG

- Saab AB

- Singapore Technologies Engineering Ltd.

- Thales Group

- UkrOboronProm

- UNIS-GROUP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

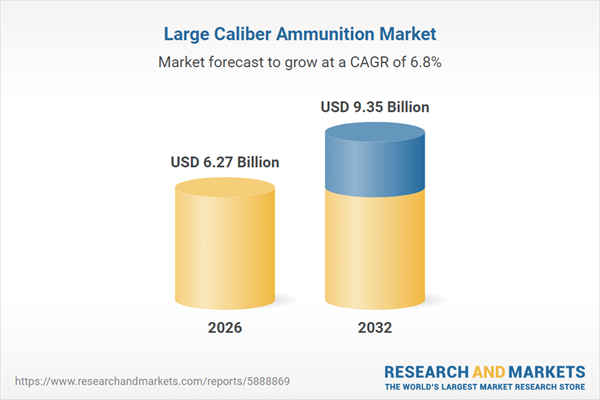

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 6.27 Billion |

| Forecasted Market Value ( USD | $ 9.35 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |