Despite economic challenges and COVID-19 restrictions, cat food sales in Latin America have continued to grow, driven by the trend of pet humanisation and increased cat ownership. The pandemic-induced home seclusion has further fuelled the demand for cat companionship. Cats are favoured for their low maintenance compared to dogs, making them suitable for urban living and less time-consuming for busy owners. Research highlights the emotional benefits of owning cats, which contributes to the growing trend of treating pets like family members thus, driving the Latin America cat food market.

This evolving pet ownership landscape is reshaping the pet food market in Latin America. Consumers are increasingly seeking natural and organic pet food options, reflecting broader preferences for healthier lifestyles. The rise of e-commerce has further transformed the market dynamics, offering convenient access to diverse pet food products.

Another key driver is the emphasis on pet health and wellness, driving demand for premium pet food with high-quality ingredients. This trend towards premiumization aligns with pet owners' focus on holistic pet nutrition.

Leading pet food manufacturers are capitalizing on these trends by investing in new production technologies to develop innovative pet food varieties that cater to diverse flavour, texture, and nutrition preferences.

Overall, the Latin America cat food market development is expected to be fuelled by the convergence of factors including pet humanisation, demand for natural and organic options, the impact of e-commerce, and the growing emphasis on pet health and wellness. The market's evolution towards premiumisation and innovation underscores the changing dynamics of pet ownership in the region.

Market Segmentation

Latin America Cat Food Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Dry Cat Food

- Cat Treats

- Wet Cat Food

Market Breakup by Ingredient Type

- Animal Derived

- Plant Derived

Market Breakup by Price Category

- Premium Products

- Mass Products

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Market Breakup by Country

- Brazil

- Mexico

- Argentina

- Others

Competitive Landscape

Key players in the cat food market in Latin America manufacture and offer nutritionally enhanced products to support the end users in the market.- Nestlé S.A.

- Mars, Incorporated

- Schell & Kampeter, Inc.

- Colgate-Palmolive Company

- General Mills, Inc.

- Wellness Pet Company, Inc.

- The J.M. Smucker Company

- Nueva Tecnología en Alimentación S.A. de C.V.

- M.I. Industries, Incorporated (Instinct Pet Food)

- Tiki Pets

- Fit Formula

- Bravery Pet Food

- Alinatur Petfood SLU

- Others

Table of Contents

Companies Mentioned

- Nestlé S.A.

- Mars, Incorporated

- Schell & Kampeter, Inc.

- Colgate-Palmolive Company

- General Mills, Inc.

- Wellness Pet Company, Inc.

- The J.M. Smucker Company

- Nueva Tecnología en Alimentación S.A. de C.V.

- M.I. Industries, Incorporated (Instinct Pet Food)

- Tiki Pets

- Fit Formula

- Bravery Pet Food

- Alinatur Petfood SLU

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | May 2025 |

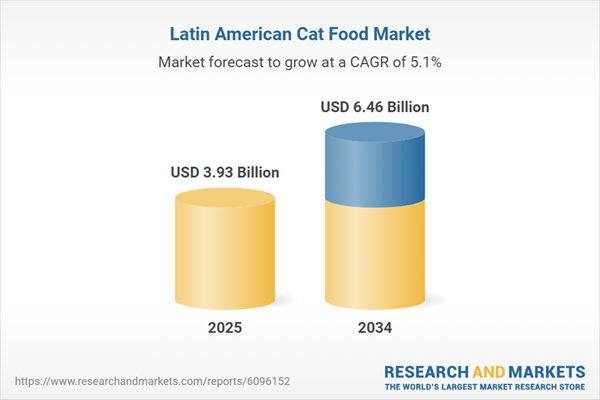

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.93 Billion |

| Forecasted Market Value ( USD | $ 6.46 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 13 |