Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A major obstacle potentially hindering market growth is the volatility of raw material costs, especially for brass and steel alloys essential for valve manufacturing. Rapid changes in global metal prices lead to instability in production costs, compelling manufacturers to frequently revise their pricing strategies. This unpredictability places pressure on profit margins and makes long-term supply agreements difficult to manage, which can slow development within the competitive landscape of cylinder valve production.

Market Drivers

The escalating use of LPG for residential cooking and heating serves as the main engine for the cylinder valve industry, particularly in emerging economies where replacing biomass is a key priority. This transition demands a parallel rise in cylinder manufacturing and a subsequent need for high-quality valves to guarantee leak-proof connections in domestic settings. As the user base expands, valve manufacturers see direct volume growth, since every new connection requires a specific assembly. Highlighting the scale of this rollout, the Press Information Bureau reported in July 2024 that the 'Pradhan Mantri Ujjwala Yojana' clean cooking scheme had reached 10.33 crore beneficiaries, demonstrating the immense volume of new hardware needed to serve these households.Furthermore, supportive government policies and subsidies for clean fuel reinforce market demand by making access more affordable for low-income consumers, thereby maintaining a recurring requirement for cylinders and maintenance parts. Financial aid from state authorities mitigates fuel costs, encouraging regular refills and extending the operational life of cylinder fleets, which necessitates routine valve inspections and replacements. As per a March 2024 Press Information Bureau release regarding the continuation of targeted subsidies, the government allocated Rs. 12,000 crore for the 2024-25 fiscal year to support these initiatives. This financial commitment ensures steady market activity, supported by broader consumption trends; the Petroleum Planning & Analysis Cell noted that India's total LPG consumption reached approximately 29.9 million metric tonnes in 2024, indicating a strong trajectory for related equipment needs.

Market Challenges

The fluctuation of raw material prices, particularly for brass and steel alloys, constitutes a critical barrier to the expansion of the Global LPG Cylinder Valve Market. Manufacturers, often operating with slim margins, depend on stable input costs to secure long-term supply contracts with gas distributors. When raw material markets undergo rapid shifts, producers must constantly adjust pricing structures, creating supply chain friction and discouraging investment in new production capacities. This instability is especially damaging in emerging economies where affordability drives LPG adoption, as even minor cost variations can disrupt the procurement of vital safety hardware.According to the International Copper Study Group, the global refined copper market was expected to see a surplus of roughly 178,000 tonnes in October 2025, emphasizing the significant imbalances affecting the primary material used in brass valves. This unpredictability complicates cost management for valve producers, frequently resulting in production delays or increased unit prices. Consequently, the difficulty in accurately forecasting manufacturing expenses impedes the industry's ability to support the scaling infrastructure necessary for the global shift toward clean cooking fuels.

Market Trends

The market is being fundamentally reshaped by the widespread adoption of IoT-enabled smart valves, which integrate digital connectivity into flow control hardware. This trend is defined by the implementation of Pay-As-You-Go (PAYG) models, where valves fitted with cellular or Bluetooth technology enable distributors to remotely track gas levels and manage access based on real-time payments. These innovations tackle affordability issues for low-income users while offering companies detailed consumption data to optimize logistics. A July 2024 Zawya article noted that a partnership between Bboxx and TotalEnergies Marketing Rwanda aims to reach 1 million people over five years by deploying cylinders featuring these proprietary Smart Cooking Valves.Simultaneously, the industry is seeing robust development in valves designed for lightweight composite cylinders, driven by the safety and ergonomic benefits of Type-IV vessels compared to traditional steel ones. These composite containers require specialized valve designs that suit their non-corrosive, explosion-proof, and translucent nature, ensuring compatibility with various pressure ratings and connection standards. Manufacturers are increasingly winning large-scale contracts to supply these advanced assemblies to major energy providers. For instance, Business Standard reported in June 2024 that Time Technoplast received a significant order worth Rs 55 crore from the Indian Oil Corporation Limited for Type-IV composite cylinders, signaling the growing commercial reliance on this modern equipment ecosystem.

Key Players Profiled in the LPG Cylinder Valve Market

- Emerson Electric Co.

- Rotarex S.A.

- Cavagna Group S.p.A.

- REGO Products, Inc.

- Kosan Crisplant A/S

- Mauria Udyog Limited

- Shanghai Qiaoyu Industrial Co., Ltd.

- Supergas India Pvt. Ltd.

- Zhejiang Jintan Valve Co., Ltd.

- ECP Industries Ltd.

Report Scope

In this report, the Global LPG Cylinder Valve Market has been segmented into the following categories:LPG Cylinder Valve Market, by Type:

- Safety Valves

- Self-closing Valves

- Forklift Valves

- Prest-O-Lite (POL) Valves

- Quick-on Valves

- Others

LPG Cylinder Valve Market, by Application:

- Industries Use

- Automotive Use

- Kitchen and Domestic Use

- Others

LPG Cylinder Valve Market, by Material:

- Brass

- Stainless Steel

- Aluminum

- Others

LPG Cylinder Valve Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global LPG Cylinder Valve Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this LPG Cylinder Valve market report include:- Emerson Electric Co.

- Rotarex S.A.

- Cavagna Group S.p.A.

- REGO Products, Inc.

- Kosan Crisplant A/S

- Mauria Udyog Limited

- Shanghai Qiaoyu Industrial Co., Ltd.

- Supergas India Pvt. Ltd.

- Zhejiang Jintan Valve Co., Ltd.

- ECP Industries Ltd.

Table Information

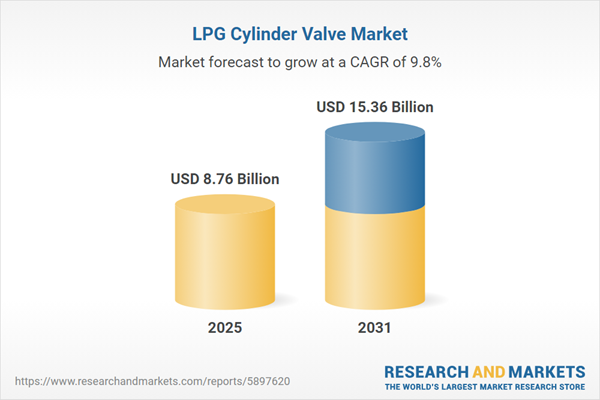

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.76 Billion |

| Forecasted Market Value ( USD | $ 15.36 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |