The marine propulsion engine market is largely fueled by the increasing need for energy-efficient solutions in the shipping sector, as nations increasingly tighten environmental regulations to limit maritime emissions. In tandem with this, the rising emphasis on minimizing carbon footprints is driving the use of green propulsion technologies like electric and hybrid systems, which provide cleaner alternatives to conventional fossil fuel-powered engines. On April 10, 2025, MAN Energy Solutions made an announcement on the selection of its MAN 175D engines for a carbon capture and storage (CCS) project at sea. The engines will be part of a system used for the capture of ships' CO2 emissions and the promotion of marine operations' environmental sustainability. This step is an indication of the increasing acceptance of cutting-edge technologies in the shipping industry for regulatory compliance and curtailing the carbon footprint of the industry. The market is witnessing a shift toward substitute fuel sources such as LNG, biofuels, and hydrogen, one of the essential marine propulsion engine market drivers that further boosts the growth momentum. The advances being made in intelligent shipping technologies as smart sensors and autonomous control systems improve engine performance and lower fuel consumption are also spurring growth.

The United States is a significant regional market, led by the growing use of environmentally friendly shipping solutions and the mounting pressure to lower maritime emissions. In line with this, advancements in green propulsion technologies such as hydrogen-powered vessels and biofuel-driven engines are contributing to the market’s expansion. Moreover, the U.S. government’s implementation of stricter environmental regulations for the shipping industry is creating a demand for more efficient and eco-friendly propulsion systems, positively impacting the. The growing marine propulsion engine market demand is also fueled by increasing international trade, which necessitates a larger fleet of container ships and bulk carriers. On March 6, 2025, U.S.-based Cummins announced that it had received DNV (Det Norske Veritas) approval in principle for its new methanol-ready marine engine. This engine is designed to support the shipping industry's transition to more sustainable fuel sources. The approval marks a significant step toward enabling global shipping fleets to reduce emissions and move toward cleaner energy alternatives in the marine sector. The growing interest in reducing operational costs by improving fuel efficiency is also acting as a driving force for the market. Besides this, the increasing focus on the global decarbonization efforts and compliance with international maritime standards is encouraging the use of alternative fuels and cleaner propulsion systems.

Marine Propulsion Engine Market Trends:

Growth in Global Trade

The rising international trade due to globalization and industrialization is significantly boosting the demand for marine propulsion engines, particularly for container ships. According to UNCTAD, global trade reached an all-time high of USD 33 Trillion in 2024, growing by 3.7% or USD 1.2 Trillion compared to the previous year. Of this increase, services were the main driver, rising by 9%, while goods trade saw a 2% increase, adding USD 500 Billion to the global trade volume. This robust growth in trade necessitates the expansion of marine transportation capabilities, especially for vessels carrying goods such as oil, natural gas, mineral ores, and consumer products-which is one of the major marine propulsion engine market growth factors,. As more goods are traded globally, there is an increasing need for larger and more efficient shipping fleets, driving the market further.Rising Demand for Energy Efficiency and Sustainable Solutions

With a growing emphasis on reducing fossil fuel consumption and improving energy efficiency, the marine industry is increasingly adopting marine electric propulsion engines. This is further evidenced by a coalition at COP 29 that called for tripling energy efficiency investments to USD 1.8 Trillion annually by 2030, with the goal of increasing improvement rates from 1% to 4%. The rising focus on energy efficiency is accelerating the adoption of sustainable propulsion technologies in the marine sector, including nuclear propulsion and liquefied natural gas (LNG) engines, which are increasingly seen as more environmentally friendly alternatives to traditional fuel-powered engines. This push for sustainability not only helps to mitigate climate change impacts but also aligns with stricter environmental regulations being enforced across the globe.Technological Advancements and Adoption of Alternative Fuels

According to the marine propulsion engine market analysis, the adoption of alternative fuels for marine propulsion engines is gaining momentum as technology continues to advance. These include fuels such as bio-methane and algal oils, which contribute to reducing exhaust gas emissions and enhancing sustainability. Furthermore, Shell's LNG Outlook 2025 projects that global LNG demand will increase by approximately 60% by 2040, reaching 630-718 Million Tonnes annually. The growing utilization of LNG, along with the push for cleaner technologies, is playing a pivotal role in transforming the marine propulsion engine market. This trend is also supported by ongoing efforts to improve the efficiency of marine propulsion engines, which enhances cargo holding capacity in next-generation tankers. As fuel alternatives like LNG become more widely used, the technology behind propulsion engines will need to evolve, integrating more advanced fuel systems and further improving fuel efficiency.Marine Propulsion Engine Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global marine propulsion engine market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on engine type, power source, power range, and vessel type.Analysis by Engine Type:

- 2-Stroke Engine

- 4- Stroke Engine

Analysis by Power Source:

- Diesel

- Gas Turbine

- Natural Gas

- Steam Turbine

- Fuel Cell

- Others

Analysis by Power Range:

- 80-750 HP

- 751-5000 HP

- 5001-10,000 HP

- 10,001-20,000 HP

- Above 20,000 HP

Analysis by Vessel Type:

- Bulk Carriers

- Container Ships

- Passenger Ships

- Support Vessels

- Tankers

- Gas Carriers

- Military Vessels

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Marine Propulsion Engine Market Analysis

The United States holds a substantial share of the North America marine propulsion engine market with around 87.80% in 2024. The market is led mainly by growing offshore oil and gas investments, which is driving demand for high-performance deep-sea propulsion systems. As per this, increasing use of LNG-powered ships to meet emission control regulations is fueling technology advancements in alternative fuel-based engines and driving the market. Likewise, expansion in naval modernization programs to improve fleet capabilities is increasing demand for advanced propulsion solutions and enhancing the market demand. The growing cruise and leisure boat market is also adding to market growth through demand for efficient, low-noise propulsion technologies. As per the Cruise Lines International Association's 2024 State of the Cruise Industry report, the United States experienced a growth of 2.7 million cruise passengers, in 2023, a 19% increase from 2019. In addition, continued investment in port infrastructure stimulating fleet renewal with engines that comply with new efficiency standards, are driving market growth. Moreover, several federal clean maritime technology incentives affecting engine selections, are promoting market demand. Furthermore, growth in commercial cargo on the Great Lakes and sea freight corridors servicing ongoing engine purchase, is driving a stimulus in the market.Europe Marine Propulsion Engine Market Analysis

The marine propulsion engine market in Europe is influenced by stricter environmental regulations. Similarly, the introduction of EU’s Fit for 55 packages, compelling shipowners to invest in compliant propulsion technologies, is also propelling market growth. Furthermore, growth in short-sea shipping, supported by EU transport policies, is augmenting market demand for efficient, low-emission engines. The expansion of offshore wind energy projects in the North Sea and Baltic Sea increasing the need for specialized vessels with advanced propulsion systems, is augmenting product sales. The Energy Ministers of the 9 North Seas countries reaffirmed plans to render Europe’s green power hub, targeting 9.5 GW turbine capacity by the end of 2025, EUR 10 billion in supply chain investments, and launching a dedicated offshore financing facility to support hybrid wind projects. Additionally, rising retrofit activities across commercial fleets driving upgrades to meet efficiency benchmarks, are encouraging higher product uptake. The region’s leadership in electric and hybrid marine propulsion is also fueling market innovation. Moreover, accelerated investment in autonomous vessels influencing engine design requirements, is enhancing market accessibility. Besides this, the resurgence of shipbuilding activity in key countries like Germany and Italy is expanding the market scope.Asia Pacific Marine Propulsion Engine Market Analysis

The market in Asia Pacific is being driven by the rapid expansion of regional seaborne trade, particularly in containerized and bulk cargo. In addition to this, favorable government-led shipbuilding initiatives, especially in China, South Korea, and India, reinforcing domestic production capabilities, are bolstering market development. Furthermore, increasing investment in coastal and inland water transport infrastructure encouraging the deployment of modern engine technologies, is fostering market expansion. The heightened push for fleet modernization across commercial and defense segments accelerating the shift toward more fuel-efficient and low-emission engines, is stimulating market appeal. Similarly, continual technological adoption in green propulsion systems, including methanol and ammonia-based engines, is gaining traction in the market. Moreover, rising regional demand for cruise tourism supporting the need for quieter, cleaner, and more efficient propulsion alternatives across newly constructed passenger vessels, is creating lucrative market opportunities. Government data shows that cruise tourism in India hit a record 4.7 lakh passengers in 2023-24, exceeding pre-pandemic levels. Domestic tourist participation rose by 85% compared to 2019-20, reflecting the increasing appeal of cruise travel within the country.Latin America Marine Propulsion Engine Market Analysis

In Latin America, the marine propulsion engine market is propelled by growing maritime trade through strategic ports along the Atlantic and Pacific coasts. Similarly, expansion of offshore oil and gas activities, particularly in Brazil, fueling investments in high-capacity engines for support vessels, is driving market growth. Brazil’s oil and gas sector is expected to receive over BRL 609 Billion (USD 122 Billion) in investments from 2025 to 2029, as per the National Agency of Petroleum, Natural Gas, and Biofuels (ANP). Nearly 90% will go on offshore projects, with BRL 347 Billion for the Santos Basin and BRL 195.8 Billion for the Campos Basin. The rising interest in renewable marine transport solutions encouraging adoption of hybrid and low-emission engines across regional fleets, is escalating market reach. Apart from this, supportive government initiatives to modernize naval and coast guard fleets are driving demand for advanced, efficient propulsion systems, thereby impelling the market.Middle East and Africa Marine Propulsion Engine Market Analysis

The market in the Middle East and Africa is advancing due to expanding maritime trade routes through the Suez Canal and the Red Sea. In accordance with this, significant investments in port development and free trade zones encouraging fleet upgrades with efficient engine systems, are stimulating market appeal. As of August 2024, investments in Saudi Arabia’s maritime sector have exceeded USD 6.7 Billion, driven by partnerships between the Saudi Ports Authority and global firms. Notable projects include Maersk’s USD 346 Million investment at Jeddah Port and 17 new logistics zones in Jeddah and Dammam. The rising adoption of LNG and dual-fuel vessels across regional shipping fleets supporting cleaner propulsion alternatives, is also expanding the market scope. Additionally, growing offshore energy exploration activities, particularly in West Africa and the Arabian Gulf, bolstering the need for reliable engines in support vessels and drilling operations, are positively influencing the market.Competitive Landscape:

The key players in the market are focusing on technological innovations, such as the development of eco-friendly propulsion systems using LNG, biofuels, and hydrogen, to meet stringent environmental regulations. They are expanding partnerships with shipbuilders and fuel suppliers to enhance product offerings and improve operational efficiency. Furthermore, companies are investing in the digitalization of their products, incorporating smart technologies like IoT and AI to optimize performance and reduce maintenance costs. As the market grows, key players are continuously expanding into emerging markets to capitalize on increasing maritime activities. These strategic moves are expected to favor the marine propulsion engine market outlook and enhance the competitive landscape.The report provides a comprehensive analysis of the competitive landscape in the marine propulsion engine market with detailed profiles of all major companies, including:

- AB Volvo

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse

- Hyundai Heavy Industries Group

- Man SE (Volkswagen Group)

- Masson Marine

- Mitsubishi Heavy Industries Ltd.

- Rolls-Royce Plc

- Wärtsilä Oyj Abp

Key Questions Answered in This Report

1. How big is the marine propulsion engine market?2. What are the key factors driving the marine propulsion engine market?

3. What is the future outlook of marine propulsion engine market?

4. Which region accounts for the largest share of the marine propulsion engine market?

5. Which are the leading companies in the global marine propulsion engine market?

Table of Contents

Companies Mentioned

- AB Volvo

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse

- Hyundai Heavy Industries Group

- Man SE (Volkswagen Group)

- Masson Marine

- Mitsubishi Heavy Industries Ltd.

- Rolls-Royce Plc

- Wärtsilä Oyj Abp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

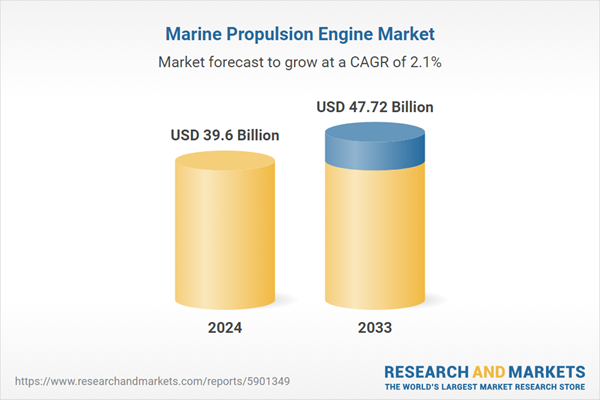

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 39.6 Billion |

| Forecasted Market Value ( USD | $ 47.72 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |