Global Medical Device Labeling Market - Key Trends & Drivers Summarized

Why Is Medical Device Labeling a Critical Pillar in Regulatory Compliance and Patient Safety?

Medical device labeling plays a fundamental role in ensuring the safe and effective use of medical technologies by providing vital information to healthcare professionals, regulators, and patients. It encompasses all printed, electronic, and graphical content displayed on a device or its packaging, including usage instructions, warnings, symbols, serial numbers, barcodes, traceability data, expiration dates, and regulatory declarations. As devices become increasingly complex and globally distributed, labeling is no longer just a regulatory formality - it is an essential tool for product identification, lifecycle traceability, and risk mitigation.In the highly regulated medical device industry, accurate and up-to-date labeling is mandated by authorities such as the U.S. FDA, the European Medicines Agency (EMA), and other regional bodies under frameworks like the EU Medical Device Regulation (MDR), In Vitro Diagnostic Regulation (IVDR), and Unique Device Identification (UDI) systems. Errors or omissions in labeling can lead to recalls, legal liabilities, patient harm, or operational disruptions. Consequently, device manufacturers are treating labeling strategy as an extension of quality assurance, product stewardship, and regulatory compliance.

How Are Digital Technologies and Regulatory Frameworks Shaping the Future of Medical Labeling?

The rise of digital health technologies and connected devices has necessitated a major evolution in medical labeling formats and content delivery methods. Traditional printed labels are being supplemented - and in some cases replaced - by electronic instructions for use (eIFU), QR-coded access to multilingual content, and cloud-based labeling repositories. These developments align with efforts to reduce paper waste, simplify inventory management, and provide real-time updates to clinicians and supply chain partners.Regulatory frameworks are also enforcing greater traceability and standardization. The UDI mandate, now in effect across the U.S., EU, China, and several other jurisdictions, requires every device to carry a globally unique identifier embedded within human-readable and machine-readable formats (e.g., barcodes, RFID). Labeling systems must now be capable of managing master data synchronization with regulatory databases such as the FDA's GUDID or the European EUDAMED. Additionally, the demand for localization and translation management - due to varying regional labeling language requirements - is pushing manufacturers toward centralized, software-driven labeling platforms with built-in workflow controls, audit trails, and version history management.

Which Device Categories and Market Regions Are Leading Labeling Complexity and Innovation?

High-risk, implantable, and reusable medical devices are subject to the most stringent labeling requirements due to their critical nature and extended lifecycle. This includes orthopedic implants, cardiovascular stents, surgical instruments, diagnostic imaging equipment, and infusion pumps. These devices often require multiple labels per unit, including sterile packaging indicators, device tracking codes, and batch traceability. In vitro diagnostics (IVDs) and combination products add further complexity by necessitating labeling integration across pharmaceutical and diagnostic domains.Geographically, the U.S. and Europe are at the forefront of regulatory stringency and labeling system sophistication. However, countries in Asia-Pacific - such as China, Japan, and South Korea - are rapidly advancing their UDI frameworks, driving regional manufacturers to upgrade their labeling capabilities. Latin America and the Middle East are also enforcing new electronic labeling norms and language-specific mandates, especially for imported devices. As global supply chains stretch across multiple jurisdictions, multinational manufacturers are adopting cloud-based, globally harmonized labeling architectures to ensure consistency, scalability, and compliance across regulatory environments.

What Is Driving Sustained Growth in the Global Medical Device Labeling Market?

The growth in the medical device labeling market is driven by a combination of regulatory enforcement, globalization of manufacturing, technological complexity of devices, and the digital transformation of healthcare systems. One major growth driver is the ongoing wave of MDR and IVDR compliance across Europe, which is compelling even legacy products to undergo labeling rework and digital enablement. Simultaneously, rising demand for home-based medical care and patient-facing devices is pushing manufacturers to adopt more user-friendly, accessible labeling strategies that enhance comprehension and minimize misuse.Another key factor is the convergence of enterprise labeling with product lifecycle management (PLM), enterprise resource planning (ERP), and quality management systems (QMS). Labeling is no longer treated as a downstream activity but is being embedded early in the product development and regulatory planning process. The use of AI in label content validation, automated translation tools, and dynamic print-on-demand labeling is also improving operational efficiency and reducing human error.

Moreover, sustainability goals are influencing label material choices, ink formulations, and packaging design. As manufacturers aim for environmental certifications and carbon reduction, the demand for recyclable labels, e-labeling solutions, and minimalistic regulatory graphics is rising. Together, these trends position medical device labeling as a high-value, mission-critical function at the intersection of regulation, technology, and patient engagement.

Report Scope

The report analyzes the Medical Device Labeling market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Label Type (Pressure Sensitive Labels, Glue Applied Labels, Sleeve Labels, In Mold Labels, Other Labels); Material Type (Paper Labels, Plastic Labels, Other Material Types); Application (Disposable Consumables Application, Monitoring & Diagnostic Equipment Application, Therapeutic Equipment Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pressure Sensitive Labels segment, which is expected to reach US$633.2 Million by 2030 with a CAGR of a 4.9%. The Glue Applied Labels segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $306.2 Million in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $292.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Device Labeling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Device Labeling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Device Labeling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Amoralia, Clarins Group, Destination Maternity Corporation, Edgewell Personal Care and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Medical Device Labeling market report include:

- 3M Company

- Amcor Limited

- AptarGroup, Inc.

- Avery Dennison Corporation

- Brady Corporation

- CCL Industries Inc.

- CleanMark Labels

- Coast Label Company

- Faubel & Co. Nachf. GmbH

- Herma GmbH

- Huhtamaki Group

- Iwata Label Co., Ltd.

- Labeltape, Inc.

- LINTEC Corporation

- Lohmann & Rauscher GmbH & Co. KG

- Multi-Color Corporation

- Resource Label Group

- Schreiner Group GmbH & Co. KG

- UPM Raflatac

- WS Packaging Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Amcor Limited

- AptarGroup, Inc.

- Avery Dennison Corporation

- Brady Corporation

- CCL Industries Inc.

- CleanMark Labels

- Coast Label Company

- Faubel & Co. Nachf. GmbH

- Herma GmbH

- Huhtamaki Group

- Iwata Label Co., Ltd.

- Labeltape, Inc.

- LINTEC Corporation

- Lohmann & Rauscher GmbH & Co. KG

- Multi-Color Corporation

- Resource Label Group

- Schreiner Group GmbH & Co. KG

- UPM Raflatac

- WS Packaging Group, Inc.

Table Information

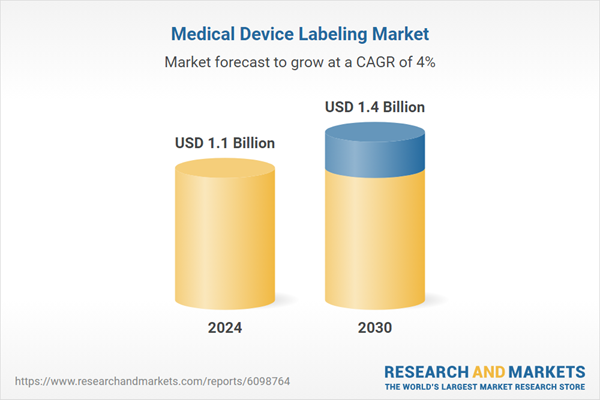

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |