Global Men's Suits Market - Key Trends & Drivers Summarized

Why Are Men's Suits Evolving from Formal Attire into Style Statements of Individual Expression?

Men's suits, long symbolizing corporate professionalism and ceremonial formality, are undergoing a fundamental transformation as cultural dress norms relax and personal expression becomes central to fashion. Traditionally confined to boardrooms, weddings, and official functions, today's suits are increasingly embraced as versatile lifestyle garments adaptable to semi-formal, smart casual, and even creative streetwear settings. The modern man now views suiting as both a sartorial staple and a vehicle for personal identity - balancing tradition with innovation.This shift is driven by generational changes in fashion sensibilities, the hybridization of workspaces post-pandemic, and the democratization of tailoring through made-to-measure platforms. Globalization and exposure to international style trends via digital platforms have further pushed men toward experimenting with cuts, fabrics, and color palettes that deviate from the classic navy and charcoal archetypes. Suits are now being tailored not only to body type but also to lifestyle, climate, and cultural nuance - redefining their role in contemporary men's wardrobes across age groups and regions.

How Are Fabric Innovation, Tailoring Technology, and Sustainable Materials Reshaping the Suit Segment?

The reinvention of men's suits is being powered by material science, automation in tailoring processes, and growing consumer preference for ethical fashion. Traditional woolen and worsted fabrics are now competing with stretch blends, wrinkle-resistant synthetics, breathable linens, bamboo-derived fibers, and temperature-regulating weaves that offer greater comfort and seasonality. This has enabled suits to move beyond formal confines into all-day, multi-climate wearability - suiting the needs of modern professionals, frequent travelers, and digitally mobile consumers.Digitally enabled tailoring processes, including 3D body scanning, algorithmic pattern cutting, and virtual try-ons, are enhancing the precision and accessibility of custom-fit garments. Direct-to-consumer (DTC) brands and omnichannel retailers are leveraging these tools to deliver personalized suits without the cost and lead times of traditional bespoke tailoring. Meanwhile, sustainability is becoming a major differentiator. Eco-conscious consumers are opting for suits made from traceable wool, organic cotton, recycled polyblends, and low-impact dyes. Transparency around supply chain ethics, artisan support, and fabric sourcing is now influencing brand loyalty and purchase decisions in the mid to premium suit segments.

Which Consumer Segments and Retail Formats Are Driving Demand for Contemporary Men's Suits?

The men's suit market today serves a much broader audience than its historical business and ceremonial clientele. Young professionals, fashion-forward millennials, and Gen Z consumers are embracing slim fits, pastel tones, unstructured jackets, and broken suits (mix-and-match separates) that lend themselves to high-rotation wear. Event-driven purchases - such as destination weddings, formal parties, and networking functions - are also sustaining demand for standout occasion suits that balance flair with sophistication.Athleisure-inspired suiting (featuring drawstring waists, soft shoulders, and jersey fabrics) is gaining popularity among those seeking comfort without sacrificing polish. In emerging markets like India, Brazil, and Southeast Asia, increasing urbanization, rising disposable income, and Western fashion influence are propelling suit sales across weddings, corporate events, and religious festivities. Meanwhile, luxury buyers in the U.S., Europe, and East Asia continue to fuel demand for Italian and British handcrafted suits through department stores, luxury boutiques, and high-end e-commerce platforms.

Digital platforms are expanding access to made-to-measure and premium RTW (ready-to-wear) suits, with virtual fitting rooms, personalization interfaces, and AI-based style advisors guiding users from selection to final fit. In-store experiences, however, remain vital for tactile evaluation, expert consultation, and alteration services - especially for first-time or high-value buyers.

What Is Driving Long-Term Growth in the Men's Suit Market Despite Casualization Trends?

The growth in the men's suit market is driven by a fusion of heritage, fashion reinvention, and functional versatility. Contrary to predictions of its decline in the age of casualization, the suit is being recontextualized - adapted to new work cultures, social settings, and personal branding needs. The rising culture of personalization, increased access to tailoring, and the global appeal of “power dressing” continue to position the suit as a dynamic category that straddles classic and contemporary.As men become more experimental and conscious in their fashion choices, demand is shifting toward suits that offer comfort, individuality, and sustainability. Innovative silhouettes - such as cropped jackets, pleated trousers, and kimono-style blazers - are redefining suiting in high fashion, while modular and travel-friendly suits are gaining traction in performance wear. The influence of global fashion weeks, celebrity styling, and workplace re-dress codes is encouraging a revival in everyday suiting, especially in creative and executive environments.

Investment in digital tailoring, sustainable manufacturing, and lifestyle-driven product lines is unlocking long-term growth potential in this sector. As men continue to blend functionality with flair, the suit will remain a cornerstone of modern menswear - resilient, adaptable, and ever-evolving.

Report Scope

The report analyzes the Men's Suits market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Ready to Wear, Made to Measure); Application (Formal, Informal); Distribution Channel (Online, Specialty Stores, Retail Stores).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ready to Wear Suits segment, which is expected to reach US$11 Billion by 2030 with a CAGR of a 4.7%. The Made to Measure Suits segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Men's Suits Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Men's Suits Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Men's Suits Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 18.21 Man Made, Beiersdorf AG, Brickell Men's Products, Coty Inc., Cremo Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Men's Suits market report include:

- Armani

- Brioni

- Brooks Brothers

- Canali

- Corneliani

- Dunhill

- Ermenegildo Zegna

- Hield Bros

- Hugo Boss

- Indochino

- J.Crew

- Kiton

- Ralph Lauren

- Samuelsohn

- Savile Row Company

- Spier & Mackay

- SuitSupply

- Tailored Brands

- Thom Browne

- Tom Ford

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Armani

- Brioni

- Brooks Brothers

- Canali

- Corneliani

- Dunhill

- Ermenegildo Zegna

- Hield Bros

- Hugo Boss

- Indochino

- J.Crew

- Kiton

- Ralph Lauren

- Samuelsohn

- Savile Row Company

- Spier & Mackay

- SuitSupply

- Tailored Brands

- Thom Browne

- Tom Ford

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 374 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

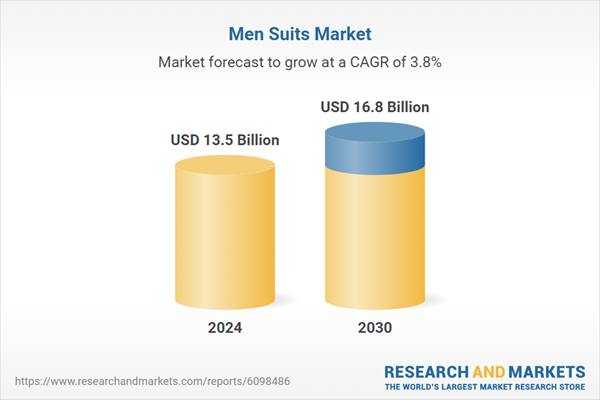

| Estimated Market Value ( USD | $ 13.5 Billion |

| Forecasted Market Value ( USD | $ 16.8 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |