Need for Replacement of Traditional HVAC Systems with Newer HVAC Systems Fuels the Middle East & Africa HVAC System Market.

A traditional HVAC system is a split system with units both inside and outside the premises. The furnace is often located in a basement or garage. The air conditioner’s condenser unit cools off the refrigerant gas that cools down the air in the evaporator within the furnace unit outside the premise. Outside units produce a lot of noise, while indoor units are mostly low on noise. These older systems have less energy efficiency, and they generate and contribute to the emission of greenhouse gases due to the use of components with old standards in the system. They also need frequent maintenance, increasing the overhead costs.

Middle East & Africa HVAC System Market Overview

The Middle East & Africa (MEA) is gradually witnessing a high growth potential for the Middle East & Africa HVAC system market. The regulations formed by the governments in Middle Eastern countries in accordance with energy efficiency and the preference for eco-friendly refrigerants which are the least detrimental to the environment increase the need for HVAC systems as these HVAC systems use eco-friendly refrigerants for energy efficiency in regions such as the South Africa, Saudi Arabia, and UAE. Extreme weather conditions, growth in infrastructure/urban development projects, increasing population are some of the few factors that will impede global as well regional players to invest in MEA Middle East & Africa HVAC system market.Middle East & Africa HVAC System Market Revenue and Forecast to 2030 (US$ Million)

Middle East & Africa HVAC System Market Segmentation

The Middle East & Africa HVAC system market is segmented based on component, type, implementation, application, and country. Based on component, the Middle East & Africa HVAC system market is segmented into thermostat, air handling units, central ACs, furnace, heat pump, compressor, and others. The central ACs segment held the largest market share in 2022.Based on type, the Middle East & Africa HVAC system market is segmented into split system, ductless system, and packaged system. The split system segment held the largest market share in 2022.

Based on application, the Europe HVAC System Market is segmented into residential, commercial, and industrial. The residential segment held the largest market share in 2022.

Based on Implementation, the Middle East & Africa HVAC System Market is segmented into new installation and retrofit. the new installation segment held a larger market share in 2022.

Based on country, the Middle East & Africa HVAC system market is segmented into South Africa, Saudi Arabia, UAE, and Rest of MEA of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa HVAC

SAFID CO LTD, Blue Star Ltd, Mitsubishi Electric Corp, Hitachi Ltd, Daikin Industries Ltd, Emerson Electric Co, Honeywell International Inc, LG Electric Inc, Carrier Global Corp, and Johnson Controls Inc are some of the leading companies operating in the Middle East & Africa HVAC system market.Table of Contents

Executive Summary

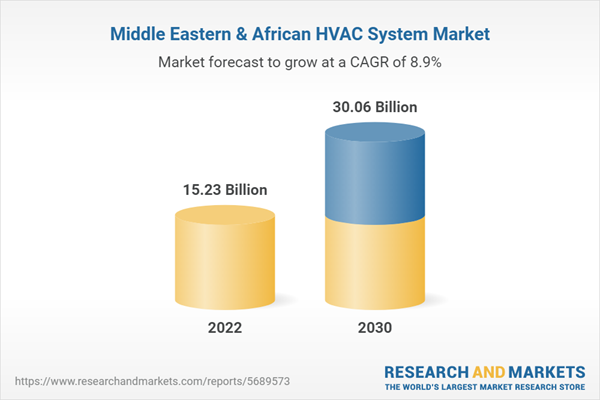

At 8.9% CAGR, the Middle East & Africa HVAC System Market is speculated to be worth US$ 30,058.55 million by 2030..According to this research, the Middle East & Africa HVAC system market was valued at US$ 15,234.42 million in 2022 and is expected to reach US$ 30,058.55 million by 2030, registering a CAGR of 8.9% from 2022 to 2030. Growth in government regulatory policies for energy saving and conservation is the critical factors attributed to the Middle East & Africa HVAC system market expansion.

Energy efficiency can be hard to monitor and improve with older HVAC systems. Generally, energy usage data is only discovered after it has been used, making it challenging to rectify or make up for. Additionally, if a system has a developing issue, it could struggle for days or weeks before failing entirely, wasting additional energy. IoT sensors installed on HVAC equipment can increase energy efficiency by monitoring usage trends and even considering weather predictions as they provide access to real-time data. The end effect is improved interior climate management with little electricity use. HVAC systems can be a significant component of IoT-enabled smart grid connectivity. IoT technology makes remote system monitoring possible, allowing users to identify issues from a distance by consulting a smartphone app or online portal. For Instance, some sensors track vital information, such as pressure, vibration, flow, temperature, humidity, on-off cycles, and fault tolerance for providing leak detection information. Technicians can easily access the insights they need to get into systems’ status and accordingly provide the solution to fix any malfunction. Most HVAC companies have a compulsory requirement for regulatory compliance, frequently requiring a field agent to inspect equipment regularly. It is challenging to accomplish and record such compliance with disconnected systems with no integration of IoT, which needs lots of paperwork and physical system checks to prove the adherence to compliance standards. Thus, the integration of IoT into HVAC systems is the key trend in the market, which is likely to boost the demand for HVAC systems.

On the contrary, lack of skilled technical workforce hurdles the growth Middle East & Africa HVAC system market.

Based on component, the Middle East & Africa HVAC system market is segmented into thermostat, air handling units, central ACs, furnace, heat pump, compressor, and others. The central ACs segment held 25.4% market share in 2022, amassing US$ 3,862.02 million. It is projected to garner US$ 8,336.20 million by 2030 to expand at 10.1% CAGR during 2022-2030.

Based on type, the Middle East & Africa HVAC system market is categorized into split system, ductless system, and packaged system. the split system segment held 46.7% share of the Middle East & Africa HVAC system market in 2022, amassing US$ 7,108.27 million. It is projected to garner US$ 14,333.22 million by 2030 to expand at 9.2% CAGR during 2022-2030.

Based on implementation, the Middle East & Africa HVAC system market is bifurcated into new installation and retrofit. the new installation segment held 60.1% share of Middle East & Africa HVAC system market in 2022, amassing US$ 9,155.86 million. It is projected to garner US$ 16,927.14 million by 2030 to expand at 8.0% CAGR during 2022-2030.

Based on application, the Middle East & Africa HVAC system market is segmented into residential, commercial, and industrial. The residential segment held 47.2% share of Middle East & Africa HVAC system market in 2022, amassing US$ 7,184.26 million. It is projected to garner US$ 13,914.22 million by 2030 to expand at 8.6% CAGR during 2022-2030.

Based on country, the Middle East & Africa HVAC system market is segmented into South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa. Saudi Arabia segment held 36.1% share of Middle East & Africa HVAC system market in 2022, amassing US$ 5,502.53 million. It is projected to garner US$ 10,409.10 million by 2030 to expand at 8.3% CAGR during 2022-2030.

Key players operating in the Middle East & Africa HVAC system market are SAFID CO LTD, Blue Star Ltd, Mitsubishi Electric Corp, Hitachi Ltd, Daikin Industries Ltd, Emerson Electric Co, Honeywell International Inc, LG Electric Inc, Carrier Global Corp, and Johnson Controls Inc among others.

In Feb 2023, Johnson Controls-Hitachi Air Conditioning introduced the new addition to the VRF lineup offered, the air365 Max. It’s designed to offer seamless comfort, energy efficiency, and easily operated features. The air365 Max is an end-to-end solution for HVAC professionals, architects, and building owners.

Companies Mentioned

- Mitsubishi Electric Corp

- Blue Star Ltd

- SAFID CO LTD

- Hitachi Ltd

- Daikin Industries Ltd

- Emerson Electric Co

- Honeywell International Inc

- LG Electric Inc

- Carrier Global Corp

- Johnson Controls Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 162 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 15.23 Billion |

| Forecasted Market Value by 2030 | 30.06 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |