Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Context for Mobile Operating System Evolution: Defining Scope, Trends, and Foundational Drivers Shaping the Future of Connected Devices

The proliferation of mobile operating systems has fundamentally reshaped the way individuals and enterprises interact with digital ecosystems, marking an epoch where seamless connectivity, advanced user experiences, and robust security protocols converge. As devices evolve, the software that powers them has become a critical differentiator, influencing purchasing decisions and shaping developer communities worldwide. In recent years, the rapid rollout of 5G networks has accelerated demands for operating systems capable of leveraging higher bandwidths, lower latencies, and expansive IoT integrations. Meanwhile, heightened concerns around data privacy and cybersecurity have placed rigorous demands on platform providers to deliver enhanced safeguards without compromising performance.Against this backdrop, understanding the underlying drivers of market dynamics is essential. The introduction of AI-driven features, such as on-device machine learning for personalized experiences and predictive resource management, is redefining user expectations. At the same time, pressures around sustainability and supply chain resilience are influencing development roadmaps and influencing partnerships across hardware and software domains. This introduction lays the groundwork for exploring how these foundational elements set the stage for transformative shifts and strategic imperatives that will guide the future of mobile operating system landscapes.

Exploring Radical Transformations Redefining Mobile Operating Systems Through AI Integration, 5G Expansion, Wearable Convergence, and Privacy Enhancements

Recent years have witnessed a wave of transformative shifts that are redefining the mobile operating system paradigm and raising the bar for innovation. The integration of artificial intelligence at the kernel level has enabled platforms to offer more intuitive user experiences, from adaptive battery management to real-time language translation. Concurrently, the global expansion of 5G deployments has opened new frontiers for high-speed mobile applications, catalyzing the emergence of advanced gaming, immersive multimedia, and mission-critical enterprise solutions. As devices diversify into wearables, foldable form factors, and embedded IoT modules, operating systems are evolving rapidly to support multi-device synchronization and zero-touch provisioning.Moreover, heightened regulatory scrutiny around data sovereignty and privacy has prompted platform architects to embed end-to-end encryption and granular permission controls at the core of their ecosystems. This has sparked fierce competition between closed and open models, with proprietary platforms touting tighter security guarantees and open-source distributions emphasizing flexibility and developer collaboration. At the same time, new entrants are challenging established players by localizing feature sets for regional markets and forging alliances with semiconductor manufacturers to optimize hardware-software integration. These converging forces underscore a dynamic landscape where adaptability and forward-looking innovation are paramount for sustained competitive differentiation.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Supply Chains, Component Costs, and Strategic Realignment of Mobile Operating Systems

The introduction of new tariff measures by the United States in 2025 has added a layer of complexity to the mobile operating system supply chain, exerting upward pressure on component costs and influencing strategic sourcing decisions. As levies on semiconductors, display panels, and certain assembly components take effect, hardware vendors have had to evaluate cost mitigation strategies, such as diversifying supplier networks, increasing local fabrication partnerships, and negotiating volume-based concessions. These adjustments have implications for operating system providers as well, who depend on predictable hardware roadmaps to ensure timely OS updates, security patches, and compatibility guarantees.In addition, the ripple effects of these duties have prompted a reexamination of geographic distribution models for manufacturing and logistics. Many industry participants are exploring nearshore alliances and dual-sourcing arrangements to maintain resilience against future policy shifts. At the same time, there is an emerging trend of integrating more modular hardware designs to facilitate component swapping and reduce inventory write-offs in the event of sudden tariff escalations. Throughout this period of recalibration, collaboration between platform vendors and OEMs has intensified, with joint task forces being established to align on cost-sharing frameworks and to safeguard end-user affordability without undermining long-term innovation roadmaps.

Uncovering Critical Insights Across System Types, Device Categories, Price Tiers, and End-User Verticals Driving the Mobile Operating System Landscape

Diving deeper into the market dynamics reveals nuanced insights across system types, device categories, price tiers, and end-user segments. Within the system type axis, one observes that open-source Linux-based platforms continue to dominate global volumes, benefitting from wide-ranging device compatibility and an extensive developer ecosystem, while proprietary architectures emphasize tighter integration and premium service models to command higher revenue streams. When examining device categories, smartphones remain the core growth engine, yet wearables are rapidly gaining prominence as brands seek to expand ecosystem lock-in through health monitoring, payment services, and seamless notifications. Tablets maintain a specialized niche in enterprise deployments, where larger screens and enhanced productivity suites drive corporate adoption.Price tier segmentation underscores a bifurcation in consumer behavior: sub-USD 150 offerings attract first-time users and emerging market populations through aggressive pricing and simplified feature sets, whereas flagship models priced above USD 600 focus on delivering cutting-edge camera technologies, high-refresh-rate displays, and exclusive AI services. Mid-range platforms bridge these extremes by delivering balanced performance, adequate security patches, and robust update cadences, appealing to cost-conscious yet brand-aware buyers. Finally, end-user distinctions illuminate divergent priorities: enterprises prioritize security certifications, remote device management, and compliance reporting, while individuals emphasize personalization layers, content streaming capabilities, and social media integration. Altogether, these segmentation insights form the basis for targeted product roadmaps and differentiated go-to-market strategies.

Highlighting Dynamic Regional Trends and Growth Drivers Shaping Mobile Operating System Adoption Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics further refine the strategic outlook, with the Americas market characterized by a balanced rivalry between ecosystem guardians offering premium privacy features and open-source champions advancing customization. In North America, loyalty to high-end brands is reinforced by robust carrier partnerships and stringent data protection regulations, driving incremental enhancements in security protocols. Moving south, the injection of entry-level devices accelerates digital inclusion, creating fertile ground for lightweight operating systems optimized for limited bandwidth and intermittent connectivity.In the Europe, Middle East and Africa (EMEA) corridor, regulatory frameworks around data localization and digital sovereignty exert considerable influence on platform design and cloud service integrations. Western Europe’s mature markets demand sophisticated privacy controls and seamless roaming capabilities, while select regions in the Middle East seek localized app stores and multilingual support. African markets, in turn, showcase high adoption rates of low-cost Android variants, incentivizing optimization for offline functionality and extended battery life.

Meanwhile, the Asia-Pacific region emerges as an epicenter of innovation and experimentation. China’s domestic platforms continue to gain momentum by weaving in local services and payment ecosystems, while Southeast Asia’s digital-first demographics fuel demand for social commerce and microapp integration. Across Australia and New Zealand, premium brand loyalty persists, accompanied by early uptake of new OS features such as satellite messaging and ultra-wideband proximity. These regionally tailored insights inform both global rollout plans and localized value propositions.

Examining Strategic Positioning, Innovation Roadmaps, and Competitive Differentiators of Leading Mobile Operating System Vendors in a Rapidly Evolving Ecosystem

A close examination of leading platform vendors reveals distinct strategic trajectories and competitive moats. The originator of the open-source ecosystem continues to leverage its vast partner network to drive incremental security updates, streamline API standardization, and accelerate cross-device compatibility. Conversely, the custodian of a closed environment deepens its integration between hardware, software, and services, cultivating a unified user experience that spans smartphones, tablets, wearables, and home devices.At the same time, alternative entrants with nationally focused roadmaps are forging alliances with chip designers and telecom operators to optimize performance for localized applications, establishing a firm foothold in high-volume domestic markets. Multi-brand conglomerates, meanwhile, differentiate through bespoke user interfaces and bundled content services, seeking to convert cost advantages into brand loyalty. Emerging players in the wearable segment combine lightweight kernels with energy-efficient drivers to deliver extended runtimes, meeting the distinct requirements of fitness trackers and health monitors.

Across all these initiatives, the emphasis on developer outreach remains paramount: toolchain enhancements, marketplace curation, and monetization frameworks act as critical levers for sustaining application diversity and user engagement. The convergence of these company-level strategies shapes the broader ecosystem, driving continuous innovation in performance optimization, security hardening, and cross-platform orchestration.

Delivering Actionable Recommendations for Industry Leaders to Leverage Emerging Trends, Mitigate Risks, and Capture Opportunities in Mobile Operating Systems

Industry leaders must proactively align their roadmaps with emerging technological, regulatory, and market trends to maintain competitive momentum. It is essential to invest in on-device artificial intelligence capabilities that deliver tangible user benefits such as real-time translation, adaptive power management, and predictive maintenance alerts. Organizations should also establish cross-functional task forces with supply chain partners to monitor policy developments and implement flexible sourcing strategies, thereby mitigating the impact of tariff fluctuations.Additionally, platform providers are encouraged to cultivate robust security and privacy frameworks that exceed baseline compliance, integrating zero-trust principles and continuous threat intelligence feeds. Expanding ecosystem partnerships with handset manufacturers, cloud service providers, and IoT innovators will enable differentiated experiences that drive user stickiness. Embracing modular software architectures and API-centric updates can reduce time-to-market for feature rollouts while supporting a diverse device portfolio.

Finally, market participants should maintain a pulse on regional nuances, tailoring feature sets for mid- and low-tier markets with optimized performance profiles, while preserving premium experiences in developed geographies. By balancing global scale with localized relevance, organizations can capitalize on both volume-driven segments and high-margin opportunities.

Detailing a Research Methodology Combining Secondary Intelligence, In-Depth Interviews, Data Triangulation, and Expert Review to Ensure Robust Market Insights

This research employed a multi-pronged methodology designed to ensure data accuracy and analytical depth. Secondary intelligence was gathered from a broad spectrum of public filings, regulatory disclosures, technical whitepapers, and industry press releases, providing a comprehensive view of current developments. To enrich this foundation, in-depth interviews were conducted with senior executives from platform vendors, original equipment manufacturers, and key supply chain stakeholders, offering firsthand perspectives on strategic priorities and operational challenges.Quantitative data points were triangulated across multiple sources to validate consistency and uncover discrepancies, enabling a granular understanding of component cost trajectories, software update cadences, and regional adoption curves. We applied expert review sessions to test preliminary hypotheses, refine segmentation frameworks, and stress-test scenario projections under varying policy and technology conditions. This iterative approach ensured that the final analysis reflects both empirical rigor and real-world applicability, equipping decision-makers with actionable intelligence for strategy formulation.

Concluding Insights on Market Dynamics, Technological Drivers, and Strategic Imperatives Guiding the Future Trajectory of Mobile Operating System Ecosystems

As the mobile operating system sphere continues to evolve at unprecedented speed, stakeholders must remain vigilant to the interplay of technological innovation, policy shifts, and shifting consumer preferences. The democratization of AI functionality, coupled with expanding 5G infrastructure, is creating new benchmarks for performance and user-centric design. Meanwhile, emerging tariff landscapes underscore the importance of supply chain resilience and collaborative risk management.Segmentation insights highlight the need for differentiated approaches across device classes, price tiers, and user profiles, ensuring that both enterprise and consumer demands are met with precision. Regional analyses further confirm that success hinges on nuanced localization strategies, from privacy controls in regulated markets to connectivity optimizations in bandwidth-constrained environments. Company-level evaluations underscore the strategic imperatives of fostering developer ecosystems, reinforcing security postures, and forging symbiotic partnerships with hardware and service providers.

Ultimately, the future trajectory of mobile operating systems will be defined by those who can seamlessly integrate technological advances with agile operational models, address regional and user-specific nuances, and mitigate external shocks through proactive collaboration. These collective insights form the basis for informed decision-making and sustained competitive advantage.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- System Type

- Android

- Harmony OS

- iOS

- Device Type

- Smartphones

- Smartwatches

- Tablets

- Price Range

- Budget (Less than USD 150)

- Flagship (Above USD 600)

- Mid-Range (USD 151-600)

- End-User

- Enterprises

- Individuals

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Apple Inc.

- Garmin Ltd.

- Google LLC by Alphabet Inc.

- Huawei Technologies Co., Ltd.

- Imagine Marketing Limited

- Mozilla Corporation

- Nexxbase Marketing Pvt. Ltd.

- Samsung Electronics Co., Ltd.

- Xiaomi Corporation

- Microsoft Corporation

- Jolla Oy

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mobile Operating System market report include:- Apple Inc.

- Garmin Ltd.

- Google LLC by Alphabet Inc.

- Huawei Technologies Co., Ltd.

- Imagine Marketing Limited

- Mozilla Corporation

- Nexxbase Marketing Pvt. Ltd.

- Samsung Electronics Co., Ltd.

- Xiaomi Corporation

- Microsoft Corporation

- Jolla Oy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

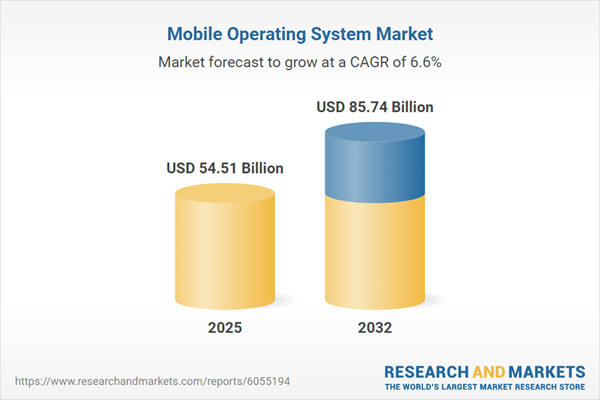

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 54.51 Billion |

| Forecasted Market Value ( USD | $ 85.74 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |