Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the market faces significant hurdles due to the volatile pricing of raw materials. Manufacturers depend heavily on aluminum and steel alloys, which experience unpredictable cost fluctuations in global trade. These price variations generate instability regarding profit margins and production expenses, forcing companies to frequently adjust their pricing strategies. Consequently, this financial unpredictability disrupts the consistent planning required for sustained market growth and hampers steady financial expansion.

Market Drivers

The growing global production and sales of scooters and motorcycles act as the primary catalyst for market expansion, necessitating a parallel rise in steering assembly manufacturing. This momentum is especially visible in both the mass-market commuter segment and the growing premium category, where OEMs demand varied handlebar configurations to meet diverse ergonomic needs. Sustained demand in major regions guarantees a steady stream of orders for suppliers, evidenced by the European Association of Motorcycle Manufacturers reporting 610,757 new motorcycle registrations across five key European markets in the first half of 2024. Additionally, international trade is vital for component distribution, with the Society of Indian Automobile Manufacturers reporting exports of 3.47 million units from India in the fiscal year ending March 2024, highlighting the vast scale of global component logistics.Concurrently, the rapid uptake of electric two-wheelers is pushing manufacturers to innovate handlebar designs to meet unique technical demands. Electric mobility requires the use of lightweight materials, such as aluminum composites, to counterbalance battery weight, along with specific structural designs to accommodate digital interfaces and smart connectivity systems. This transition toward electrification is establishing a high-value niche within the component market, supported by changing consumer tastes and government incentives. According to the International Energy Agency's "Global EV Outlook 2024," electric two-wheeler sales in India neared 880,000 units in 2023, signaling a strong growth trend that compels suppliers to adjust production lines for these specialized, technology-integrated steering systems.

Market Challenges

The instability of raw material prices, specifically for aluminum and steel alloys, represents a critical obstacle to the stability of the global two-wheeler handlebars market. Because these metals constitute the primary composition of steering parts, sudden shifts in their global trade values result in unpredictable cost structures for manufacturers. This volatility directly impacts profit margins, as suppliers frequently struggle to transfer immediate cost increases to vehicle manufacturers due to pre-existing fixed contracts. Consequently, the difficulty in accurately forecasting expenses compels companies to take defensive financial positions, postponing essential capital investments in capacity expansions or facility upgrades needed to meet rising volume requirements.The consequences of this cost uncertainty are reflected in recent industry adjustments to fiscal planning. According to the Automotive Component Manufacturers Association of India (ACMA), a 4% rise in raw material costs was factored into fiscal year calculations in July 2025 to manage persistent inflationary pressures. This specifically highlights the operational challenges manufacturers encounter, where even minor fluctuations in input costs necessitate frequent pricing strategy revisions. Such financial turbulence obstructs the steady long-term planning essential for sustaining growth, leaving the market susceptible to constrained development and reduced liquidity despite robust demand for personal mobility vehicles.

Market Trends

The incorporation of digital navigation interfaces and smart connectivity is fundamentally transforming handlebar architecture, evolving steering mechanisms from basic structural parts into sophisticated digital command hubs. This shift is fueled by the widespread adoption of electric and premium two-wheelers featuring integrated TFT dashboards, which demand specialized switchgear and ergonomic mounting solutions for onboard communication, music, and navigation systems. As consumers place greater value on intelligent features, OEMs are forced to redesign steering assemblies to accommodate these complex electronic clusters without compromising durability. For instance, TVS Motor Company reported in August 2025 that electric two-wheeler sales rose by 35% to 70,000 units for the quarter, underscoring the increasing demand for tech-integrated vehicles that require these advanced, digitally enabled steering systems.Simultaneously, the adoption of clip-on handlebars within performance segments is accelerating, driven by the global growth of the entry-level premium motorcycle market. Unlike standard single-piece tubular bars, clip-on designs attach directly to the fork tubes to provide the aggressive, forward-leaning ergonomics and enhanced tactile feedback necessary for sport riding. This structural advancement requires component suppliers to employ precision machining and higher-grade alloys to satisfy the strict safety and vibration-damping standards of high-performance machines. According to Hero MotoCorp's January 2025 press release, the manufacturer realized a volume growth of 7.5% and introduced eight new models globally, generating a significant revenue stream for suppliers capable of producing these specialized, sport-oriented steering systems for the growing premium fleet.

Key Players Profiled in the Two-Wheeler Handlebars Market

- Kohli Bullet Accessories

- Renthal

- FLANDERS Inc.

- J&P Cycles

- Accell Group

- Burleigh Bars

- Dorel Industries

- Hero Cycles Ltd.

- Shimano Inc.

- SRAM LLC.

Report Scope

In this report, the Global Two-Wheeler Handlebars Market has been segmented into the following categories:Two-Wheeler Handlebars Market, by Type:

- Motorcycles

- Standard

- Cruiser

- Sports

- Off-Road

- Scooters

Two-Wheeler Handlebars Market, by Material Type:

- Steel

- Aluminum

- Alloy

Two-Wheeler Handlebars Market, by Demand Category:

- OEM

- Replacement

Two-Wheeler Handlebars Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Two-Wheeler Handlebars Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Two-Wheeler Handlebars market report include:- Kohli Bullet Accessories

- Renthal

- FLANDERS Inc.

- J&P Cycles

- Accell Group

- Burleigh Bars

- Dorel Industries

- Hero Cycles Ltd

- Shimano Inc.

- SRAM LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

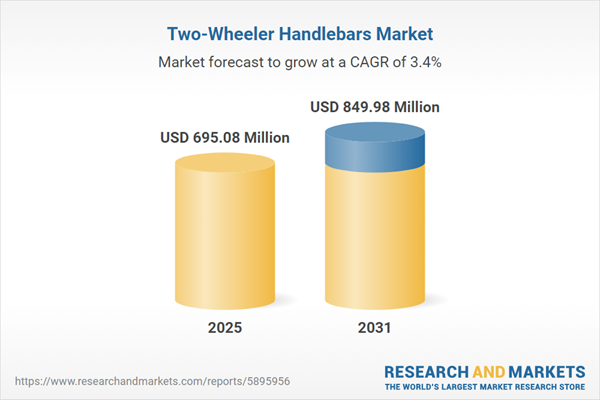

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 695.08 Million |

| Forecasted Market Value ( USD | $ 849.98 Million |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |