The expansion of 5G, IoT, and cloud services generates massive amounts of data daily. Telecom operators require advanced solutions to manage bandwidth, optimize traffic flow, and prevent congestion. AI-driven analytics provide real-time insights, enabling predictive maintenance and proactive network issue resolution. Increasing connected devices compel telecom providers to enhance network monitoring and traffic management capabilities. Data-intensive applications like video streaming, gaming, and remote work drive network optimization requirements. Telecom companies are investing in scalable network management tools to accommodate growing data loads effectively. Real-time monitoring solutions improve network visibility, helping providers enhance service quality and reliability. Cybersecurity threats require robust data traffic management solutions to ensure secure data transmission. Regulatory compliance mandates encourage telecom firms to implement advanced network monitoring and security protocols. Network virtualization solutions improve scalability, enabling telecom operators to manage fluctuating data demands efficiently.

5G deployment is driving the United States telecom network management system market demand due to the increasing need for advanced monitoring solutions. Telecom operators require intelligent network management tools to handle high-speed, low latency 5G infrastructure efficiently. Real-time analytics optimize bandwidth allocation, ensuring seamless data transmission across expanding 5G networks. AI-driven automation improves network efficiency, reducing downtime and optimizing resource utilization. Rising mobile data usage necessitates scalable telecom management solutions for uninterrupted connectivity and performance. 5G-enabled IoT applications encourage telecom providers to invest in robust network monitoring and control systems. Edge computing expansion with 5G strengthens demand for real-time network analytics and security solutions. For instance, in February 2025, UScellular collaborated with Samsung to upgrade its 5G network in the Mid-Atlantic region. The deployment features Samsung’s 5G mmWave technology and virtualized Radio Access Network (vRAN) solutions. Compact Macro units, integrating baseband, radio, and antenna, enable fast installation. Operating on 28GHz and 39GHz bands, the upgrade enhances speed, latency, bandwidth, and energy efficiency. Moreover, telecom firms integrate SDN and NFV to enhance 5G network flexibility, scalability, and operational efficiency. Regulatory compliance mandates encourage telecom companies to adopt reliable 5G network management tools. Increased cybersecurity risks in 5G networks drive adoption of advanced security and threat detection solutions.

Telecom Network Management System Market Trends:

Shift towards cloud-based solutions

Telecom network management system is widely used to enhance Quality of Service (QoS) and Quality of Experience (QoE) for optimizing business operations. Broadcom reports that 64% of network teams have integrated AI-driven management tools. Cloud-based platforms enable telecom operators to manage networks remotely, reducing infrastructure costs and operational complexities. Service providers deploy cloud-based network management systems for real-time monitoring, automation, and predictive analytics. Cloud solutions support seamless integration with existing telecom infrastructure, improving efficiency and performance optimization. Increasing adoption of 5G and IoT accelerates demand for cloud-based network management tools and services. Telecom providers leverage cloud platforms for centralized data storage, improving accessibility and network security measures. Cloud-based network solutions offer real-time updates, ensuring compliance with evolving regulatory frameworks and industry standards. Additionally, rising Internet Protocol (IP) and cloud traffic worldwide also contribute to market expansion. Service providers are developing cost-effective network management system solutions for network function virtualization, broadband networks, and network orchestration.Integration of Internet of Things (IoT)

The integration of existing networks with the Internet of Things (IoT) is driving the market. The global IoT market size reached USD 1.02 trillion in 2024, highlighting its expanding influence on telecom network management systems. Telecom providers manage massive IoT device connections, requiring advanced network monitoring and optimization solutions. IoT-driven industries depend on seamless data transmission, compelling telecom operators to enhance network efficiency. Real-time IoT data requires low-latency networks, encouraging investment in advanced network management tools. AI-driven analytics optimize IoT traffic, improving bandwidth allocation and reducing network congestion. Smart cities and industrial IoT deployments demand robust telecom infrastructure with efficient network monitoring solutions. Telecom providers implement automation to manage IoT networks, ensuring seamless device connectivity and performance optimization. IoT sensors generate continuous data streams, necessitating intelligent network management for real-time processing. Predictive analytics in telecom networks helps prevent failures and ensures uninterrupted IoT device connectivity. Secure network management solutions are essential to protect IoT ecosystems from cyber threats and vulnerabilities.

Adoption of open RAN in 5G networks

Open RAN enables telecom operators to deploy vendor-neutral, interoperable network solutions, enhancing flexibility and cost-efficiency. The disaggregation of hardware and software allows for greater scalability and network optimization. AI-driven network management solutions are essential for monitoring, troubleshooting, and automating open RAN-based 5G deployments. Open RAN fosters competition among vendors, accelerating innovation in telecom network management technologies. The rise of cloud-native open RAN networks requires advanced management tools for seamless orchestration and automation. Telecom operators leverage open RAN to reduce dependency on proprietary solutions and lower capital expenditures. Network virtualization in open RAN-based 5G deployments increases the need for real-time monitoring and performance optimization. Government and regulatory support for open RAN adoption further fuels the market growth of intelligent network management solutions. Open RAN integration with edge computing enhances low-latency applications, requiring precise network control and optimization. Telecom providers require advanced security solutions to manage open RAN's distributed architecture effectively. In November 2024, Viettel introduced its in-house developed 5G Open RAN gNodeB, built in collaboration with Qualcomm. The initial rollout is active in Hanoi and Ha Nam provinces, with plans to deploy over 300 Open RAN sites by Q1 2025 and expand further across Vietnam and globally. The system leverages Qualcomm’s X100 5G RAN Accelerator Card and QRU100 5G RAN Platform, enhancing network capacity, performance, and energy efficiency.Telecom Network Management System Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global telecom network management system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, organization size, deployment type, and vertical.Analysis by Component:

- Solution

- Configuration Management

- Performance Management

- Security Management

- Fault Management

- Others

- Services

- Consulting

- Deployment and Integration

- Training, Support and Maintenance

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Analysis by Deployment Type:

- On-premises

- Cloud-based

Analysis by Vertical:

- IT and Telecom

- BFSI

- Government

- Manufacturing

- Healthcare

- Transportation and Logistics

- Retail

- Media and Communication

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Telecom Network Management System Market Analysis

The United States hold 82.80% of the market share in North America. The US telecom network management system market growth is primarily influenced by the rapid implementation of 5G technologies and the increasing need for high-speed internet. As industries like healthcare, retail, and manufacturing undergo digital transformation, the need for efficient and scalable network infrastructures grows. The shift towards cloud-based solutions enhances flexibility, scalability, and cost-efficiency, promoting their adoption. Furthermore, the US is emerging as a leader in artificial intelligence (AI), with 4,633 AI startups from 2013 to 2022, including 524 new startups in 2022 alone, attracting USD 47 billion in non-governmental funding. This growth in AI innovation is significantly impacting the telecom sector, driving the integration of AI-powered automation and predictive analytics into network management system platforms. These technologies play a crucial role in optimizing network performance, lowering operational costs, and improving service delivery. Additionally, increasing concerns over cybersecurity encourages for the creation of more robust, real-time network monitoring and management systems. As mobile data traffic continues to surge, driven by growing demand and connected devices, telecom operators are increasingly adopting advanced network management system solutions to ensure seamless connectivity, minimize downtime, and deliver superior user experiences, which further propels the growth of the network management system market in the US.Asia Pacific Telecom Network Management System Market Analysis

The Asia Pacific telecom market is expanding due to rapid technological advancements and growing telecom infrastructure. Countries like China and South Korea lead 5G adoption, with China exceeding 700 million 5G connections (41% of total) and South Korea reaching 31.3 million (48% of mobile connections), according to GSMA. Rising data traffic from IoT, smart technologies, and connected devices drives demand for network management system solutions. Governments in the region are investing heavily in digital transformation and smart city initiatives, accelerating the need for scalable, efficient telecom management. The complexity of managing multi-vendor, hybrid networks is pushing telecom operators toward AI-driven, automated network management system solutions. As 5G deployment continues, telecom providers are prioritizing real-time monitoring, predictive analytics, and network automation to optimize performance and reduce costs.Europe Telecom Network Management System Market Analysis

The European market is growing due to 5G expansion and increasing demand for efficient network management. The EU’s digital agenda, focusing on connectivity and smart city initiatives, is accelerating network management system adoption. Telecom operators are adopting AI-driven automation and cloud-based solutions to enhance efficiency, minimize downtime, and deliver personalized services. In 2021, 29% of EU enterprises used IoT devices, primarily for security, highlighting the region’s growing reliance on connected technologies. Rising mobile data traffic, driven by increased connected devices and high-speed connectivity demand, necessitates advanced network management system solutions for managing complex telecom networks. Regulatory requirements like GDPR are compelling telecom firms to implement secure and scalable network management platforms. The adoption of Network Functions Virtualization (NFV) and Software-Defined Networking (SDN) is transforming telecom operations, requiring integrated, flexible solutions for seamless network management. These factors continue to drive Europe’s market expansion, reinforcing the need for automated, AI-powered telecom solutions.Latin America Telecom Network Management System Market Analysis

The Latin America’s market for telecom network management system is expanding, driven by a rising mobile internet user base, projected to grow from 326 million (2018) to 422 million (2025). The region’s transition to 4G and 5G networks, alongside government-led digitalization initiatives, is accelerating network management system adoption. Increasing mobile data traffic is encouraging telecom operators to implement scalable, efficient, and cost-effective network management solutions. The growing need for enhanced network performance, reliability, and security further fuels market growth.Middle East and Africa Telecom Network Management System Market Analysis

The market in the Middle East and Africa is expanding due to rapid 5G adoption and increasing telecom infrastructure investments. Saudi Arabia leads the region, surpassing 11.2 million 5G subscriptions by 2022, accounting for over 25% of the mobile sector. Rising mobile data usage and the demand for improved network performance and security are accelerating the adoption of advanced network management system solutions. Governments and telecom operators are investing in digital transformation initiatives, enhancing network efficiency and reliability. The region’s growing reliance on AI-driven automation and real-time monitoring solutions further fuels market growth. As telecom networks expand, the need for scalable, cost-effective, and automated network management system platforms continue to rise.Competitive Landscape:

Key players are developing advanced solutions, integrating AI, automation, and cloud computing for seamless network performance and optimization. Companies focus on network function virtualization (NFV) and software-defined networking (SDN) to improve scalability, flexibility, and cost-effectiveness. Investment in 5G infrastructure and IoT-driven networks propels the demand for intelligent management solutions. Leading firms collaborate with telecom providers to offer customized network management services catering to specific operational requirements. Research and development (R&D) initiatives ensure continuous enhancement in security, reliability, and performance monitoring features. Expansion into emerging markets strengthens the presence of global network management solution providers. Strategic partnerships and acquisitions help companies broaden product portfolios and technological capabilities. For example, in May 2024, Dell Technologies and Ericsson have partnered strategically to support communications service providers (CSPs) in transitioning their radio access networks (RAN) to the cloud. The collaboration aims to help CSPs navigate network cloud and operations transformation, improving economics, agility, and reliability. Compliance with regulatory frameworks ensures robust network security and uninterrupted connectivity for telecom service providers.The report provides a comprehensive analysis of the competitive landscape in the telecom network management system market with detailed profiles of all major companies, including:

- BMC Software Inc. (KKR and Co. Inc.)

- CA Inc. (Broadcom Inc.)

- Cisco Systems Inc.

- Dell Technologies Inc.

- Ericsson AB

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Juniper Networks Inc.

- NETSCOUT Systems Inc.

- Nokia Oyj

- Oracle Corporation

- Paessler AG

- Riverbed Technology Inc. (Thoma Bravo LLC)

- SolarWinds Corporation (Thoma Bravo LLC and Silver Lake)

- VIAVI Solutions Inc.

- ZTE Corporation

Key Questions Answered in This Report

1. How big is the telecom network management system market?2. What is the future outlook of telecom network management system market?

3. What are the key factors driving the telecom network management system market?

4. Which region accounts for the largest telecom network management system market share?

5. Which are the leading companies in the global telecom network management system market?

Table of Contents

Companies Mentioned

- BMC Software Inc. (KKR and Co. Inc.)

- CA Inc. (Broadcom Inc.)

- Cisco Systems Inc.

- Dell Technologies Inc.

- Ericsson AB

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Juniper Networks Inc.

- NETSCOUT Systems Inc.

- Nokia Oyj

- Oracle Corporation

- Paessler AG

- Riverbed Technology Inc. (Thoma Bravo LLC)

- SolarWinds Corporation (Thoma Bravo LLC and Silver Lake)

- VIAVI Solutions Inc.

- ZTE Corporation

Table Information

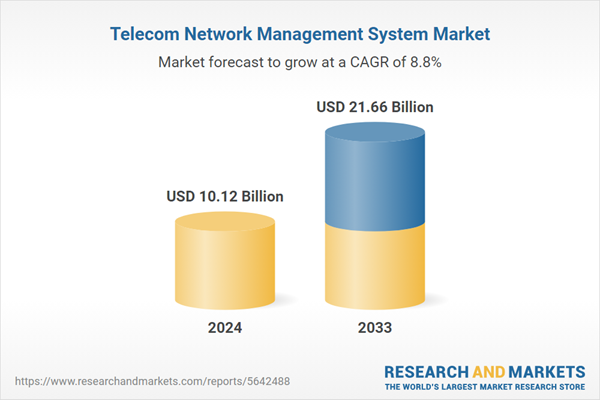

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 10.12 Billion |

| Forecasted Market Value ( USD | $ 21.66 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |